Social Security: Is it a giant Ponzi scheme?

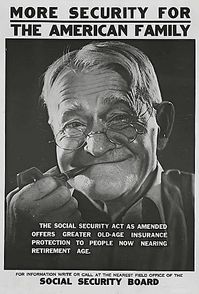

Social Security promotional poster used in the 1930s to build interest in the federal program.

Image from Wikimedia Commons

Editor's note: This post is part of a series by Dr. Baker on Our Values about core American values. This week, Dr. Baker is discussing Social Security and the public's reaction to the possibility that it may be in crisis.

Is Social Security just a giant Ponzi scheme? A grand federal fraud?

In the Republican presidential debates last week, candidate Rick Perry said it is, repeating the charge he made in his 2010 book, "Fed Up!" Here’s a similar remark, made on the campaign trail in Iowa: “It is a Ponzi scheme for these young people. The idea that they’re working and paying into Social Security today, that the current program is going to be there for them, is a lie. It is a monstrous lie on this generation, and we can’t do that to them.”

Perry isn’t the first to make this claim. The idea that Social Security is a Ponzi scheme goes back at least to Paul Samuelson in 1967, a Nobel laureate in economics.

But he meant it in a positive way: “It stems from the fact that the national product is growing at a compound interest rate and can be expected to do so for as far ahead as the eye cannot see. Always there are more youths than old folks in a growing population.”

Perry’s worry is that Samuelson’s assumptions — a growing economy and more young than old — are no longer accurate.

So, the Ponzi-fraud charge is not new. It has been made many times. In fact, whenever a new Ponzi scheme is uncovered, like Bernie Madoff’s, someone will liken Social Security to it.

What I find particularly interesting this time around is that’s it’s a presidential candidate who made the claim. And it’s set off a spirited debate among politicians, pundits and the media, with one group saying “No, it isn’t!” and other saying “Yes, it is!”

Social Security is one of the federal government’s most popular programs. It’s also one that is in need of repair. This week on OurValues.org, we’ll look at various facets of the program and charges against it. For today, here’s how the Securities and Exchange Commission defines a Ponzi scheme:

“A Ponzi scheme is an investment fraud that involves the payment of purported returns to existing investors from funds contributed by new investors. Ponzi scheme organizers often solicit new investors by promising to invest funds in opportunities claimed to generate high returns with little or no risk. In many Ponzi schemes, the fraudsters focus on attracting new money to make promised payments to earlier-stage investors and to use for personal expenses, instead of engaging in any legitimate investment activity.”

Was Ida May Fuller part of a scam?

Who was Ida May Fuller? She was the first beneficiary of recurring Social Security payments, and her story has become legendary among critics of the Social Security system.

Ida was born on September 6, 1874, on a farm in Vermont. She went to school in Rutland, Vermont, where Calvin Coolidge was one of her school mates. Ida led a quiet life as a schoolteacher, retiring as a legal secretary. She never married and had no children. Ida lived alone most of her life.

She would be lost to history if it weren’t for the fact that she was the very first American to collect retirement benefits from Social Security. Her story was chronicled by the office of the historian at the Social Security Administration, which is the source of the facts presented here.

Ida spent most of her life working before Social Security existed. She filed for retirement claims in 1939, just about three years after she began making contributions. Her payroll tax contributions accumulated to a grand total of $24.75. (You can see a record of her contributions here.)

She started collecting benefits in January 1940 when she was 65 years old. Her first check, in the amount of $22.54, was number 00-000-001. Ida lived to 100. She collected benefits for over three decades. These amounted to a total of $22,888.92.

She paid $24.75. She got $22,888.92. This is why Ida is the poster child for critics of Social Security who argue that early participants got the benefits at the expense of late participants —just like a Ponzi scheme. Though a Ponzi scheme is entirely fraudulent, it is true that in this type of scheme the early investors make money and the late investors lose money.

Generalizing from the Ida story, critics say the same is happening now. Boomers, for example, will increasingly collect all the benefits to which they are entitled, but at the expense of younger Americans, who won’t. Presidential Rick Perry is one such critic, as we discussed yesterday. But others say the leap from Ida’s experience to the present is a logical fallacy.

Do you think Social Security is a Ponzi scheme?

Do you think Perry has a point — or is he off base?

What does Ida’s story say to you?

Does it contain a lesson about Social Security?

Dr. Wayne E. Baker is a sociologist on the faculty of the University of Michigan Ross School of Business. Baker blogs daily at Our Values and can be reached at ourvaluesproject@gmail.com or on Facebook.