Radio host Tom Joyner says he'll pay $10K debt owed by Ypsilanti woman on her deceased son's student loan

After an Ypsilanti woman put out an online plea to major lending corporations to forgive the student loan debt owed by her deceased son, nationally syndicated radio host Tom Joyner stepped up to help.

On his morning show Tuesday, Joyner and co-host Jacque Reid brought Ella Edwards, 61, of Ypsilanti, on-air during the “Inside Her Story” segment to share her plight:

Ella Edwards is still emotionally shaken and depressed by the loss of her only son, 24-year-old Jermaine Edwards, who died unexpectedly in March 2009 of natural causes.

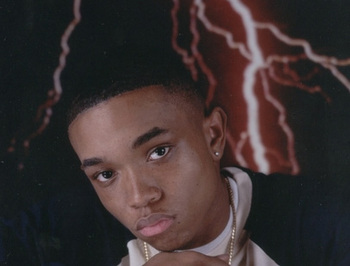

Jermaine Edwards

Courtesy Change.org

“They kept calling me for the money,” Edwards said in an interview with AnnArbor.com. “And I had to get up and go to work to pay for this student loan because I just can’t stand for them to call me. … It doesn’t make sense to pay for something I can’t use.”

The debt forced Edwards out of retirement and back to work sewing truck covers to make the payments.

After listening to Edwards, Joyner announced on his radio show that he would pay the remainder of the debt owed on Jermaine Edwards’ student loan. In Southeast Michigan, the radio show airs on 105.9 Kiss FM.

Joyner is known for making his radio show a platform for action and change. He has raised more than $60 million with the Tom Joyner Foundation to help keep students in historically black colleges and universities.

Tom Joyner

Courtesy of the Tom Joyner Foundation

This October, Edwards started a Change.org petition online.

So far, about 203,000 people have signed the Change.org petition since it went live on the site. Entering information online generates an emailed message to the companies named.

The high level of response to Edward’s Change.org petition may have limited the number of emails actually sent to the company so their servers didn’t crash, said William Winters, senior campaigner for Change.org.

The petition would have remained online at Change.org until there was a resolution to the situation, Winters said.

Representatives from American Education Services and First Marblehead Corporation could not speak to the case of Jermaine Edwards specifically, citing federal privacy laws.

However, both companies named in the Change.org petition state they have no control to change the policy.

After graduating from Willow Run High School, Jermaine Edwards had shipped off to Full Sail Performing Arts School in Orlando, Fla., where he earned his associate degree.

Edwards said her son was inspired by Dr. Dre and wanted to get into the music business. After a couple failed attempts at breaking into the scene - first at Wayne State University and later in Atlanta, Jermaine was faced with the challenge of supporting his girlfriend and newborn son. He dropped his dreams of being a rapper and picked up a job with the Norfolk-Southern Railroad in Georgia.

After a long day of work and a ritualized phone call to his mother, Jermaine went to sleep. He didn’t wake up the next morning.

Authorities ruled that Jermaine died of natural causes, his mother said.

Jermaine had three student loans with the federal government and one with a private loan company.

Federal student loans are forgiven upon the death of the individual. But when it comes to student loans obtained through private lenders, policies vary by company.

“Private loans are more relatable to a consumer bank loan or car loan,” said Keith New, spokesman for American Educational Services. “It’s borrowed money and each loan has a different set of contractual terms.”

In the case of American Educational Services -- the company working to collect the payments on Jermaine's student loans - they weren’t the actual owners of the loan in the first place.

American Educational Services contracts with a number of lending organizations, including First Marblehead Corporation, to service loans; meaning they sign up individuals and collect payments.

“As an awareness piece, we’re always encouraging comparative shopping to make sure (customers) are best served,” New said. “Each loan product is different.”

Edwards said she had no idea she would be responsible for paying off her son's loan after he died -- and would never choose to sign up for a private loan again.

“Please know what you’re signing before you sign it,” she said. “People need to know what’s going to happen.”

New said the company was aware of the Change.org petition, but when it comes to affecting policy, it’s misdirected: American Educational Services does not have the power to make decisions regarding student loans, and has to abide by the terms of the contract it has with a loan company.

In the case of Jermaine Edwards, that company is First Marblehead Corporation.

“First and foremost, we’re saddened by Mr. Edward’s death and extend our condolences to the family,” said Gary Santo, managing director of First Marblehead.

First Marblehead is not a lender, Santo said. The company creates and facilitates student loan programs on behalf of third party lenders, which can be banks or universities.

“The terms and conditions of each program are set by the lenders,” Santo said.

Santo declined to comment on the educational institutions with whom First Marblehead contracts.

Santo said the terms and conditions of each loan are made available to individuals before the promissory note is signed. He declined to comment if the terms and conditions included information regarding who would be responsible for a loan in the occasion of a death.

Citing federal privacy laws, Santo said the company is not able to comment on the specifics of the Edwards case without their permission. The story that Change.org campaigners attribute to petitions like Ella Edwards’ is Ryan Bryski’s campaign to get Key Bank to forgive the loan of his deceased brother, Christopher Bryski.

“After several weeks of campaigning, Key Bank gave in,” Winters said.

In the aftermath of a campaign that was posted in the spring, a number of people targeted their lending organizations to request that the student loans of their dead relatives be forgiven, Winters said.

Ryan Bryski is now trying to pass Christopher’s Law at the federal level, which would require student lenders to disclose the policy regarding discharging the remaining student debt when the primary borrower dies or is disabled. Consideration of the law has been pushed into the 2013 Congressional session.

Amy Biolchini covers Washtenaw County, health and environmental issues for AnnArbor.com. Reach her at (734) 623-2552, amybiolchini@annarbor.com or on Twitter.

Comments

A2centsworth

Sun, Dec 9, 2012 : 4:35 a.m.

From what i gathered from this article, the young man finished school, Therefore the loan was used for its purpose. Ms. Edwards cosigned the loan, making her legally responsible for it. Her sons' unfortunate death does not relinquish her from this obligation. If you have a mortgage on your house, and it burns down, you still have to pay the bank the money. I doubt Mr. Joyner would have jumped in to help if this was not a black family.

Nick Danger

Fri, Dec 7, 2012 : 7:34 p.m.

Mr Joyner you are a class act

Christiana Jones

Fri, Dec 7, 2012 : 3:55 p.m.

Good job, Mr. Joyner. But this is not something uncommon. There are many who are suffering from this. We have hardly any option to help them.

David Dallasite

Fri, Dec 7, 2012 : 3:46 p.m.

Tom is also a great friend to the Alzheimer's cause, volunteering to help host one of the Alzheimer's Memory Walks in Dallas. On his syndicated radio show, he has brought good attention to this 6th leading cause of death that impacts African Americans and Hispanics at almost 3X the rate it affects Caucasions. Tom is Dallas-based, but for years did a morning show here and then flew to Chicago everyday to do an afternoon drive time show before returning home to Dallas that evening. Tireless worker and advocate for those in need.

cook1888

Fri, Dec 7, 2012 : 3:01 p.m.

Ms. Edwards - I am so sorry for the loss of your only child. I hope the generous offer brings you some measure of peace.

ThinkingOne

Fri, Dec 7, 2012 : 2:53 p.m.

I think it is a very nice thing for Mr Joyner to pay off the loan. I am shocked at some of the responses here though. First is the lack of financial knowledge about loans. Many people apparently think that co-signing a loan is just a kind of 'Yes I think you should make this loan' thing with no financial obligation. Think about the words: co-SIGNER; like the SIGNER of the loan. What would possibly be the reason the lending agency wants you to SIGN the loan if not to give them another option for collecting? While I cannot disagree that is unpleasant to have to do so under these circumstances, and I have no idea if the number or tone of the calls were inappropriate, the fact remains that it was agreed upon up front that there was a possibility she would have to pay. Second is the idea that since she is not benefiting from the loan she should not have to pay. Of course she is not benefiting - if the loan were for her benefit she would be the primary SIGNER, not the co-SIGNER. Regardless, she is still obligated because she signed the loan. Third is the tone by some that somehow it is even more insulting that she is 'SEWING TRUCK COVERS'. In the first place, there is absolutely nothing inherently wrong or insulting about doing this for a living. Additionally, the article states: '...out of retirement and back to work sewing truck covers...'. The wording seems to imply that this was a former career, so it would be a natural thing to do when returning to the labor force. Again, there may have been an issue with the nature or frequency of the calls. There are laws to regulate that. The fact that a co-SIGNER is expected to pay under these unfortunate circumstances is - well, unfortunate. But it is to be expected.

leaguebus

Fri, Dec 7, 2012 : 6:55 a.m.

And the rich get richer and the poor, poorer. Sounds a lot like all the predatory loans that crashed the economy in 2008.

racerx

Fri, Dec 7, 2012 : 3:17 a.m.

I listen to the TJMS every morning on local radio station WMDK 105.9 and shed a tear of both sorrow and joy after Tom informed Ms. Edwards that he would pay the complete loan. To the uninformed, and especially A2.com that might not be aware, Tom Joyner has been doing these deeds for years. His annual fund raising to support tradition African American colleges and providing scholarships to college students is just one of many contributions that Tom has been doing most of his adult life. As he always says, "...what do I know, I'm just a deejay..." Apparently a lot. Oh, and by the way, President Obama called Tom Joyner yesterday morning to chat about the fiscal cliff. When Tom's sidekick, Sybil, asked our president about the "gifts" Mr. Obama had no reply. Yup. Even a DJ can go far in life! Congrats to the TJMS (Tom Joyner Morning Show)!

OLDTIMER3

Thu, Dec 6, 2012 : 11:33 p.m.

Cosign to go to school to be a RAPPER, why not to a school for some real work like enineering or something.

kalamityjane

Fri, Dec 7, 2012 : 2:59 p.m.

It says he was inspired by rappers and that was a goal. I'd gather if he was in school he wasn't going to "learn to be a rapper" which is something one cannot learn. Perhaps he had the talent but knew if he wanted to get anywhere in the performing arts getting an education and learning the logistics of music would be a better gateway to becoming a future performer. This was a kid trying to do the right thing and go to school while chasing a dream why is he being admonished posthumously for that?

EyeHeartA2

Fri, Dec 7, 2012 : 1:53 p.m.

@ Susan; I think he did.

a2susan

Fri, Dec 7, 2012 : 3 a.m.

@oldtimer3 -seems very judgmental. I'd like to know what your idea of "something" is.

Roger Dodger

Fri, Dec 7, 2012 : 1:18 a.m.

What, music degrees don't count anymore?

pvitaly

Thu, Dec 6, 2012 : 11:57 p.m.

Or english composition...

lorayn

Thu, Dec 6, 2012 : 10:57 p.m.

this is a sad tale, but also symptomatic of the lack of financial literacy in this country. When people die their heirs are responsible for paying off any debts. Loans, credit card debts, mortgages, etc are not forgiven.

Unusual Suspect

Fri, Dec 7, 2012 : 2:35 a.m.

"When people die their heirs are responsible for paying off any debts. Loans, credit card debts, mortgages, etc are not forgiven." That is not true, and it's not what happened in this case. This was not a situation of inheritance, she made herself responsible for the loan. Mileage may vary for husband/wife situations. Roger Dodger is correct. Collection companies called me when a family member died asking if I would like to make arrangements to pay off his debts. They did not actually tell me I was responsible o do so, they just asked me if I would like to make arrangements to do so. If you find yourself in this situation, just tell them not to call you again and they must stop.

Roger Dodger

Fri, Dec 7, 2012 : 1:17 a.m.

It's very important that people understand that you are only responsible for debt that you personally have incurred. Co-signing a loan counts for that. But any debt that you have not specifically agreed to take on. Don't let the credit agencies fool you. I've read stories where people start paying on a debt that doesn't belong to them, and that MADE them liable. Always ask for a letter of debt validation when a new collection agency comes calling: http://www.creditinfocenter.com/rebuild/debt_validation.shtml

WalkingJoe

Thu, Dec 6, 2012 : 11:05 p.m.

If the deceased left no money or property they are not, unless they co-signed for any of the things you mentioned. As I posted earlier we consulted an attorney and was advised about this.

Geez

Thu, Dec 6, 2012 : 9:58 p.m.

I am sorry for this family's loss, but I do have issue with " He has raised more than $60 million with the Tom Joyner Foundation to help keep students in historically black colleges and universities." This would not be allowed if someone was trying to do this to any college for white students. And seats must be left open to fill quotas for minorities and black students even if there are better qualified students available (meaning grades and attendance). I never did get a response to my scholarship application to the NAACP. Are there scholarships available that are strictly for any other races?

Geez

Fri, Dec 7, 2012 : 9:04 p.m.

@ Lorayn Those schools you speak of only let in the students they choose. They do not have a quota that other institutions must follow. Go to a campus and see for yourself. @ Angry The cival rights act prevents this. Plus there would be a media frenzy and Jesse would be all over it.

lorayn

Thu, Dec 6, 2012 : 11 p.m.

The scholarships are for students attending historically black colleges and universities. These schools were founded because Black students could not attend the majority of colleges and universities in the US. Students who attend these schools can be of any race. So, you have your facts wrong in terms of the Joyner foundation.

Angry Moderate

Thu, Dec 6, 2012 : 10:31 p.m.

I am not aware of any law that would prevent you from starting a scholarship fund for white students only.

Elaine F. Owsley

Thu, Dec 6, 2012 : 9:34 p.m.

First rule - avoid co-signing.

dancinginmysoul

Thu, Dec 6, 2012 : 9:14 p.m.

I can't believe some of the comments here. This woman cosigned a student loan so her son could attend college. She didn't take out a personal loan to buy a bunch of crap with no intention of ever paying it back. Her son died. He died! And now, despite coming out of retirement to go back to work SEWING TRUCK COVERS to pay it back, she still gets slack for being irresponsible. I certainly hope none of the people making comments like this ever find yourself in a financial crisis because you can't pay the loans you took. Hopefully none of you ever loose your job, or have a medical emergency that keeps you from working. Or have your partner die. I'm glad that you have the rest of your life planned out perfectly so no surprises ever pop up. And you'll always be able to pay your bills. Good for you for having the foresight to know you'll never be in a situation where money is tight.

Unusual Suspect

Fri, Dec 7, 2012 : 2:30 a.m.

"Stupid Hick" said, "I hope they do, so they will get what they deserve." The shoe fits.

Stupid Hick

Fri, Dec 7, 2012 : 1:18 a.m.

"I certainly hope none of the people making comments like this ever find yourself in a financial crisis..." I hope they do, so they will get what they deserve.

Craig Lounsbury

Thu, Dec 6, 2012 : 9:41 p.m.

Not one person in here said she was irresponsible that I can see. But by her own admission she was caught by surprise at her obligation. I think that is a lesson for all to embrace. I am a cosigner on a school loan for a daughter. She is now married and a mother and the loan is mostly paid off. But I am fully aware if she were to tragically die, or stop paying the responsibility falls on me, not her husband. He didn't cosign I did.

djacks24

Thu, Dec 6, 2012 : 9:38 p.m.

There is something called a life insurance policy which covers things like debt when someone dies. Look into it.

Amy Biolchini

Thu, Dec 6, 2012 : 9:05 p.m.

Though Ella Edwards was surprised that she had to pay back the private loan once her son died, she is actively paying it back. The point of the petition was to press the companies involved to change their policies, and she's going to keep the petition up to raise awareness. What do you think of Christopher's Law?

Unusual Suspect

Thu, Dec 6, 2012 : 8:53 p.m.

This is a nice gesture. But I hope people will still learn the lesson that if you can't afford to pay back a loan yourself, don't become a co-signer on it.

Unusual Suspect

Fri, Dec 7, 2012 : 2:28 a.m.

No, ghost, I didn't say that.

MDavid

Thu, Dec 6, 2012 : 9:30 p.m.

@Ghost: Re-read Unusual Suspects comment. He/she was talking about the co-signer, not the primary applicant. Bravo for the person who helped her, but she was responsible for paying this money and there is no shame in working to pay a debt. The fact that she doesn't directly benefit from it has no relevance. Her comment "It doesn't make sense to pay for something I can't use." is very telling.

Ghost of Tom Joad

Thu, Dec 6, 2012 : 9:13 p.m.

the idea that everyone who takes out a student loan already has the means to pay it back defeats the entire purpose of the loans' existence. People who take these loans out are doing so with the assumption that the investment in the education will provide the ability to pay it back later through gainful employment. These are the false promises that our higher education system is founded on. When anyone goes to college, the fact that they are poor shouldn't be what prevents them from going. You've essentially said that, unless you're already well off and don't need money, don't borrow it.

Homeland Conspiracy

Thu, Dec 6, 2012 : 8:50 p.m.

Remember Corporations are people too....blood sucking, black hearted & soulless people. END Corporate personhood now!

dancinginmysoul

Thu, Dec 6, 2012 : 8:42 p.m.

Restoring my faith in humanity. And compassion. Well done!

WalkingJoe

Thu, Dec 6, 2012 : 8:20 p.m.

i can feel for Ms. Edwards. After our daughter was murdered loan companies and collection agencies hounded us too. We consulted an attorney and was told we were not responsible for her debts unless we co-signed on any of them, which we had not. That didn't stop them from calling all the time. One thoughtless person, I not writing what I really think of them, asked me if I didn't want to clear my daughters name. I said " I'll make you a deal, give me my daughter back and I'll pay you what she owes". He told me I was being unreasonable.

Cash

Thu, Dec 6, 2012 : 11:26 p.m.

I'm very sorry Walking Joe.

Michiganian

Thu, Dec 6, 2012 : 8:05 p.m.

Why would you ever sign on a loan and assume that you're not obligated to pay it in some fashion? If you weren't obligated, there would be no reason for you to sign. I'm sorry, but the lender did nothing wrong here. Ms. Edwards should've known better. Nothing to be outraged about here.

Geez

Fri, Dec 7, 2012 : 8:57 p.m.

@ ANGRY That is the way all loans work. Regardless of what the loans are for. If there is only one peron on the loan the loan is either forgiven or paid back by the estate. If the loan has two signers the second is responsible. This is the same for home and auto loans. If a husband and wife get a house loan and the husband dies, the wife is then responsible for the payments.

dancinginmysoul

Thu, Dec 6, 2012 : 9:09 p.m.

Usual, if you read what I wrote I stated "it's not like she took the loan and just decided to not pay it." Obviously she cosigned the loan, and I never stated she didn't. Perhaps I wasn't clear. What I meant to say is that it's not like she took a loan with no intention of ever paying it back. She went back to work to pay it back.

Angry Moderate

Thu, Dec 6, 2012 : 9:04 p.m.

These contracts could be changed so that the lender, not the co-signer, assumes the risk of the student dying. The lender would then be able to spread out the costs over all borrowers--like a built in life insurance policy that pays off the loan if the debtor dies. I believe this is how federal student loans work.

Unusual Suspect

Thu, Dec 6, 2012 : 8:58 p.m.

dancing, it's not like she's a victim of circumstance. She willfully signed her name the loan, which is an agreement to pay it. So, yes, she actually did take out a loan.

Craig Lounsbury

Thu, Dec 6, 2012 : 8:56 p.m.

when someone dies the only thing that changes is the loan falls on the cosigner.

dancinginmysoul

Thu, Dec 6, 2012 : 8:41 p.m.

It's not like she took out a loan and just decided to not pay it back. When someone dies, it actually changes things. I'm sure you've never done anything you "should've known better" not to do. Especially when it comes to your family.

Linda Peck

Thu, Dec 6, 2012 : 7:57 p.m.

That is a very sweet thing to do, Mr Joyner!

Cash

Thu, Dec 6, 2012 : 7:50 p.m.

Hooray for Mr Joyner. And might I add, almost NO one can pass the buck like a lending institution.

FaithInYpsi

Fri, Dec 7, 2012 : 3:54 a.m.

Don't quite agree Cash...I am sorry for the situation but the obligation still remains.

Cash

Thu, Dec 6, 2012 : 11:24 p.m.

djacks24, I'm betting that he did not intend to die at that young age either. Nor did his mom expect it. Shame on you.

djacks24

Thu, Dec 6, 2012 : 9:32 p.m.

Don't intent to repay, then don't borrow or cosign. Pretty simple.

EyeHeartA2

Thu, Dec 6, 2012 : 7:47 p.m.

Nice of Mr. Joyner to do this. A reminder to everyone not to co-sign any loan you are not willing to re-pay. Especially for a friend of any type. (which I realize was not the case here) Co-signing means they will come after you if the first person skips out for any reason. They may not even try to hard to get the first person to pay if there is a co-signer. You are on the hook if you co-sign. Period.

Unusual Suspect

Fri, Dec 7, 2012 : 2:26 a.m.

Dancing, he said "Especially for a friend of any type. (which I realize was not the case here)."

dancinginmysoul

Thu, Dec 6, 2012 : 9:07 p.m.

I'm sorry, but it appears by EyeHeartsA2's comments that he is making reference to cosigning for a friend. She was cosigning a student loan for her son. There's a HUGE difference between the two. Obviously it's not a very smart decision to cosign financial documents for a friend. But your son? Really? Maybe he couldn't have gone to school with her cosigning. It clearly states in the article that she went back to work to pay the loan. I don't think I'm out of line at all. IMO the above comment was totally unnecessary to the story.

Craig Lounsbury

Thu, Dec 6, 2012 : 8:55 p.m.

dancinginmysoul, the point made by Eyeheart is completely valid. One could argue a main point to the story is to know what your obligations are when signing a legal document. Evidently Ella Edwards wasn't aware when she signed that she was taking on the responsibility. I'm glad it worked out and someone with the means was willing to help. But your out of line with your comment. IMO.

dancinginmysoul

Thu, Dec 6, 2012 : 8:39 p.m.

This was her son. Not her friend. Her son. Way to miss the point of the story.

Ghost of Tom Joad

Thu, Dec 6, 2012 : 7:45 p.m.

It's getting dusty in here. Bravo Mr. Joyner.

Honest Abe

Thu, Dec 6, 2012 : 7:35 p.m.

Bittersweet story. Very nice act though, Mr Joyner.

getyourstorystraightfirst

Thu, Dec 6, 2012 : 7:33 p.m.

This is a testament that there ARE wonderful, thoughtful, selfless, warm-hearted people still out there!! Shame on that collection agency that forced this grief stricken woman back to work after her retirement & sons death. Hopefully she can try to enjoy her retired life now.

mkm17

Thu, Dec 6, 2012 : 8:38 p.m.

I disagree. The mother co-signed the loan and therefore was responsible for repaying it. The collection agency did nothing wrong.