Washtenaw County retiree pension and benefit plans underfunded by nearly $240M

The county has 1,010 active members and 740 retirees/beneficiaries under the Washtenaw County Employees Retirement System, a defined benefit pension plan started in 1948.

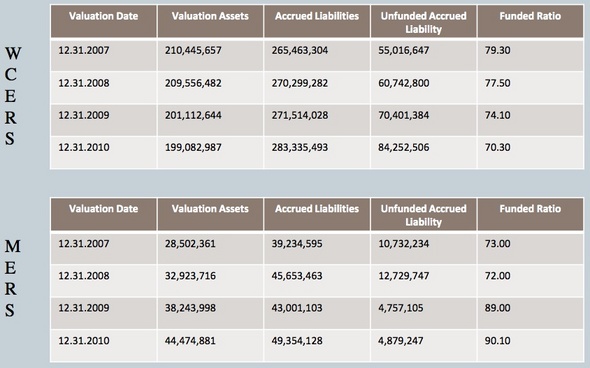

With accrued liabilities totaling $283.3 million and assets valued at $199.1 million, the WCERS plan is $84.3 million underfunded (or 70.3 percent funded). At the end of 2007, it was 79.3 percent funded, so the trend in recent years has been downward.

The county has another 286 active members and 21 retirees/beneficiaries under the Municipal Employees Retirement System, a separate defined benefit pension plan run by the state for Washtenaw County Sheriff's Office employees.

With accrued liabilities totaling $49.4 million and assets valued at $44.5 million, the MERS plan is $4.9 million underfunded (or 90.1 percent funded). At the end of 2007, the plan was 73 percent funded, so the trend in recent years has been upward.

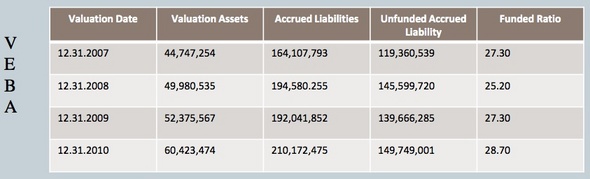

Additionally, the county has 1,303 active members and 726 retirees/beneficiaries in its Voluntary Employees Beneficiary Association, a trust that funds retiree health care.

With accrued liabilities totaling $210.2 million and assets valued at $60.4 million, the VEBA is $149.7 million underfunded (or 28.7 percent funded). At the end of 2007, it was 27.3 percent funded, so not much has changed with the funded ratio in recent years.

- Download the full report here.

County Administrator Verna McDaniel noted the county was ahead of the curve in establishing a VEBA trust in 1996 to fund health benefits for future retirees. It wasn't until 2004 that the national Governmental Accounting Standards Board issued new guidelines for governments to account for future retiree benefits while employees are still working and earning the benefits.

Verna McDaniel

McDaniel said the county is working collaboratively with its labor unions to bring costs down. But she said the fact that the county has the burden of those future liabilities isn't anything to be ashamed of — the county is proud to invest in its employees' futures and provide the kind of benefits they deserve.

The Washtenaw County Board of Commissioners is expected to meet at 4 p.m. today to ratify a new labor agreement with its largest union, AFSCME Local 2733, which represents 644 employees. McDaniel said the union's members have agreed to pay more toward the cost of both their health care and pensions.

More details are expected to be disclosed later today.

The county is faced with an estimated $17.5 million budget deficit over the next two years and county officials are aiming for $8 million in employee concessions to help close the gap. McDaniel said on Monday the same concessions achieved with AFSCME Local 2733 are expected to be imposed on the county's nonunion employees.

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's e-mail newsletters.

Comments

pgagreg

Fri, Sep 16, 2011 : 9:59 a.m.

It's all the little things that add up to create such a large liability for future generations. For example take the Pierce Lake golf course. The county parks dept. has been operating it a loss of $250,000 per year for several years. It's not only the waste of taxpayers operating this money losing entity but it is all the employees of this money losing operation that will be drawing from the generous retirement that the county offers.

thegreenhornet

Thu, Sep 15, 2011 : 4:05 p.m.

It wasn't that long ago that the Board of Commissioners changed the retirement plan from a defined contribution plan to a defined benefit plan. While a defined benefit plan is socially desirable it is not economically sustainable. When most other governments where switching to a defined contribution plan, Washtenaw County was doing the opposite, and at great expense. It would be nice to know who on the Board spearheaded the effort.

snapshot

Thu, Sep 15, 2011 : 4:55 a.m.

The Michigan Supreme Court just ruled that health care benefits was not a guaranteed obligation as are pensions. All you government folks should start thinking about supporting a good plain and simple national healthcare plan.

snapshot

Thu, Sep 15, 2011 : 4:49 a.m.

Thanks Annarbor.com, now we can see that "frivilous" negotiations will no longer pass muster. Our "union" influenced officials need to quit giving tazpayers money away to these minority unions. A very small number of government workers account for huge budget shortfalls because of the undue influence they have on elected officials. The state of Michigan is short 54 Billion dollars in it's pension funds.

Brenda Kerr

Wed, Sep 14, 2011 : 10:57 a.m.

Up until 2007 all new County employees were in 401k plans. Many years ago (15 - 20?) the County made this change. I don't know if all current employees were left in the pension or if some were moved out of the pension into 401k plans, but the pension still existed. As time went on the pension was supporting more and more retirees while being funded by fewer and fewer employees and the County was having to make large payments into the fund. The County decided to bring all employees back into the pension (along with all their 401k money). At the time the decision was made the pension would have been more than fully funded, but the economy crashed and the 401k money was 30% less than planned by the time it rolled into the pension. County employees have always contributed to the pension and are contributing more now. Many people inside and outside the County said it was fiscally irresponsible to go back to a pension. Now the County and its employees are working to make up all the money that was lost, just like everyone else who lost money in the market crash.

dlb

Tue, Sep 13, 2011 : 10:44 p.m.

The commissioners raided this fund which was running a huge surplus as recently as 5-10 years ago. Retirees should not have to pay the price of this - they are not the bad guys!

Woman in Ypsilanti

Tue, Sep 13, 2011 : 8:31 p.m.

It seems like the obvious solution is to fund the darn pension funds. I don't like the idea of having public employers go to something like the 401(k) because I would rather see a trend away from such things although like everyone else in the private sector I am jealous as heck of the benefits public employees get. But what always gets me is why so many others in the same situation decide that the solution should be to take away things from public employees rather than work to get the same kinds of benefits in the private sector.

KeepingItReal

Tue, Sep 13, 2011 : 7:35 p.m.

I hope this is not a set up for a tax millage to fund the county's pension fund, especially after I visited a county office and observed an employee playing solitaire on a county computer and was too busy playing the game to provide me with the customer service the county likes to claim it provides..

Macabre Sunset

Tue, Sep 13, 2011 : 7:26 p.m.

This is part of the economic nuclear bomb that already adds up to tens of trillions of dollars in America. When it explodes, we will face a serious devaluation of our currency, rendering those nest-eggs much less valuable. If we don't act now, our children won't have much of a future.

Bill

Tue, Sep 13, 2011 : 7:14 p.m.

Is unfunded liability like how much would be owed if no more income ever came in? You never hear about unfunded liability about anything else. What's your unfunded liability for utilities? Assume you never work again and have no income in the future, it sounds pretty big.

snoper

Tue, Sep 13, 2011 : 6:49 p.m.

Headline says $240M, but your chart says $84M. Neither one is good news, but a "journalist" might be interested in which one is the right number.

Ryan J. Stanton

Tue, Sep 13, 2011 : 6:57 p.m.

Go back and take another look. There are three different unfunded liabilities that are added together to come up with the larger number. The $84M is only one part of it.

Townie

Tue, Sep 13, 2011 : 5:58 p.m.

lumberg48198: OK, is any of this audited by anyone outside of SPARK? Or are these the 'self reported' numbers from SPARK (nice when you get to evaluate yourself)? So can you release all the SPARK audits? Perhaps you can explain why not? Was your information directly from the SPARK annual reports or somewhere else? If so, where? Job creation numbers, real numbers are what I want and not the usual '60 companies were assisted', '62 companies received business acceleration services', etc. So the SPARK number for jobs created (not audited or verified) is 1,425? And their budget is what? Can you divide their budget by the number of jobs created for us and post it? Blind is describing the way SPARK wants us to be, not me. I'm obsessed by wasted money, secrecy and a total and utter lack of transparency. If you're so big on them then please - allow us taxpayers to see the audits and have someone independent verify their job creation numbers for us. Fairly simple request wouldn't you agree?

lumberg48108

Wed, Sep 14, 2011 : 12:59 p.m.

Obviously, you missed the point - which was YOU claim they do not share information about their results - when they do - with everyone (it was a press release and on its website) I make no claims nor do i care about the accuracy of the numbers - I was simply pointing out that what you claimed (they don't release numbers of econ impact ) is a falsehood. I am not for or against SPARK (and you sometimes make good points) but next time you rant - rant about the numbers posted instead of claiming they do not post numbers.

Will Warner

Tue, Sep 13, 2011 : 5:31 p.m.

Government couldn't very well force paternalistic employment practices upon the private sector without engaging in them itself. But the era of the pension is over. I'm not saying the county can walk away from obligations. But employers need to stop making promises they can't keep, and employees need to stop thinking of their employers as their daddies. Everybody needs to take responsibility for his life, including his retirement.

tommy_t

Tue, Sep 13, 2011 : 5:28 p.m.

The setup for the raid and mayhem starts. Look out retirees they're a comin' for ya.

Townie

Tue, Sep 13, 2011 : 5 p.m.

First thing is to stop wasting our County money on SPARK and put it toward fully funded our commitments rather than wasting it on a secretive organization that is unable to demonstrate real results. Re the health benefits -- do retirees get Medicare? If so, why is the county paying for health insurance? This is a result of our casino stock market and our health insurance mess. We let Wall Street gamble and when they lost (if there had been a profit they would have kept it) we ended up making them whole. Health insurance: we are paying for a lot of waste in the system yet no one, esp. Republicans - remember the 'death panels' stuff when there was a sensible proposal to review treatments that don't work? - wants to look at the waste and deal with it. For example, ever wondered who pays for all those gazillions of pharmaceutical ads on TV ('ask your doctor for XXX')? We do. And most of those expensive drugs are only marginally effective and rarely better than generics. Billions and billions added to health care costs and they end up with this as the result.

lumberg48108

Tue, Sep 13, 2011 : 5:22 p.m.

@townie --- I am starting to think you are blind because you continue to fuel your obsession with SPARK and I continue to post the info you say is lacking... its comical -- 2010 results follow •1,425 new jobs committed through employers. •1,300 jobs posted on Ann Arbor SPARK's talent portal, by 400 companies. •Over 4,000 job seekers assisted with employment searches. •New talent initiatives included MichAGAIN, an effort to attract talent back to Michigan, and the continuation of popular programs, including Hot Shots and Mingle and Match. •62 companies received business acceleration services, including business planning, marketing, patent and intellectual property acquisition, business introductions and funding preparation services. •60 companies were assisted as incubator tenants at Ann Arbor SPARK's Regional Incubator Network, including SPARK Central and East locations as well as the Michigan Life Science and Innovation Center. •42 companies received funding through the Michigan Pre-Seed Capital Fund and the Michigan Microloan Fund Program, both administered by Ann Arbor SPARK. The combined total invested through the funds administered by Ann Arbor SPARK was $3,752,000. In 2010, Ann Arbor SPARK's business attraction, expansion and retention efforts resulted in the following companies choosing to locate or expand in the region: •Aeroflex Manufacturing •Amcor Rigid Plastics •Arbor Networks •Biotectix LLC •BoroPharm, Inc. •Bosch •The Crowley Company •Delphinus Medical Technologies, Inc. •Edwards Brothers, Inc. •Fastener Advance Product Co. •Ford Rawsonville Plant •Frame Hardwoods •Grand River, Inc. •Heron Wind Manufacturing LLC •HistoSonics Inc. •Hygieia, Inc. •i3D Technologies Inc. •InTouch Health •Integrated Sensing Systems, Inc. (ISSYS) •JAC Products, Inc. •KnowledgeWatch •Masco Cabinetry LLC •NanoBio Corporation •Quantum Signal LLC •RetroSense Therapeutics LLC •Saline Lectronics, Inc. •Scientific Consulting LLC •Sheridan Books, Inc. and others ...

annarboral

Tue, Sep 13, 2011 : 4:44 p.m.

240 Million underfunded! There are only two ways to deal with that. # 1 is to raise taxes to pay for these outrageous benefits. # 2 is to elect responsible commisioners and totally change the pension to a defined contribution or simply eliminat the pensions entirely. Want to guess how the Democrats will attack this problem?

cinnabar7071

Tue, Sep 13, 2011 : 6:05 p.m.

The county just went from a defined contribution plan to the one we have here, why was that? Just a few years ago the majority of the workers were in a defined contribution plan and the county allowed them all to move back into the WCERS plan. Why did the Commissioners OK this?