Tough budget decisions lie ahead for Ann Arbor City Council

Ann Arbor City Council members are going into a Monday night budget session knowing that Michigan's slumping economy is battering and bruising the city's finances - just as it has other cities across the state.

The tough decisions council members must make in the next three months became clearer this weekend as they received detailed reports from city administrators. A series of budget impact sheets outline more than $5.2 million in newly proposed cuts, on top of millions already trimmed from the budget.

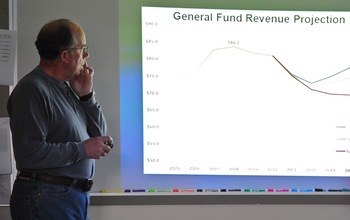

City Administrator Roger Fraser offered a grim outlook on the city's revenue predictions at a budget retreat in December. The full impact of the cuts that need to be made became clearer this weekend in new reports from city staff.

Ryan J. Stanton | Ann Arbor.com

Nearly half of the proposed cuts would impact public safety services. On the chopping block are 20 positions in the fire department and 17 in the police department.

"The city’s revenue projections are grim, but our constituents rightly demand that we focus on public safety," said Council Member Christopher Taylor, D-3rd Ward. "I will study the administrator’s sobering proposals to determine how the city will provide high-quality safety services if these cuts go into effect."

The reports sent to council members Friday night come as the City Council prepares for another budget working session expected to last from 6 p.m. to 9 p.m. Monday night in city hall.

The city's budget has seen revenues drop sharply over the last two years - from what started as an $89.2 million balanced budget in fiscal year 2008-09 to a projected $76.1 million budget for the fiscal year starting in July.

At its current rate of spending, the city is on pace to go into next year with $81.3 million in expenses to account for. If the city can't cut costs or raise revenues, it would dig itself a $5.2 million hole in 2010-11.

The budget impact reports now in the hands of the City Council reflect city staff's plans for trimming 7.5 percent from the budgets of every service area in the city. Public safety is no exception.

The 17 positions in the police department that face elimination would trim $1.98 million from what was projected to be a $26.5 million budget in the next fiscal year. That includes laying off nine sworn police officers, seven positions within the community standards division and one management assistant.

The fire department has a $13.3 million projected budget for the next fiscal year, after having made $677,678 in cuts already this year.

The much-debated layoff of 13 firefighters and elimination of one vacant position are still scheduled to take effect in July, which will save nearly $1.4 million. In addition, another six firefighters were added to the possible layoffs - for a total elimination of 20 firefighter positions in July. The additional cuts would save another $997,445.

"This will result in the closing of fire substations, resulting in increased response times due to crews responding from the remaining fire districts," the budget sheet prepared by city staff reads. "Service reduction may impact regional response agreement talks and may void response agreement draft with Ypsilanti."

Mayor John Hieftje said no one wants to cut further into police and fire, and all options will be exhausted before that happens.

"I think you'll see us do everything we can to preserve public safety," he said. "And you'll also see us bargaining with our employees and doing everything we can to cut expenses. And I hope that those bargaining units will work with us."

Just three weeks ago, the firefighters union voted to approve a new contract that included a voluntary 4 percent reduction in compensation. Firefighters, who were hoping to avoid layoffs, say they're disheartened to see the city now proposing even more staffing cuts than before.

According to a staff analysis, additional cuts to the fire department would take daily staffing levels below national standards to effectively and safely fight an average-sized house fire and may raise insurance rates.

In parks and recreation, $285,961 in new cuts are proposed, on top of $328,982 already planned. Staff is recommending keeping Mack Pool and the Senior Center open, but implementing a series of cuts and revenue enhancement options that were identified by special task forces.

The city is proposing raising user fees at some facilities, including the Fuller and Olson athletic fields, outdoor pools, hockey rinks at Buhr and Veterans Ice Arena and Fuller Pool. The city also could increase fees for canoe rentals and institute parking at Allmendinger and Frisinger parks during University of Michigan football Saturdays.

Hieftje said he's getting feedback from residents that it could be time to consider increasing revenues instead of cutting so deep. He expects the council to consider asking voters to approve an income tax, which could add $7.6 million annually in new net revenues to the city.

City officials who favor an income tax have argued the average property owner in Ann Arbor won't feel the impact of the tax because, in conjunction with the new tax, property taxes would come down by about 15 percent. The 75,000-plus people who commute to Ann Arbor for work would bear the brunt of the shift in tax burden, according to proponents of the income tax.

"I've never been a fan of the income tax," Hiefte said. "But it may be a decision that we'll have to face."

City Administrator Roger Fraser didn't mince words this past week when he told City Council members it's time to set aside politics and be willing to make bold - and perhaps unpopular - budget decisions.

"I understand that these are politically difficult things to talk about," Fraser said. "I understand that we have elections every year. I understand that six of you are up for election this year. But I also understand that we've got some major issues that need to be resolved in terms of our budget, and something's got to give."

Ryan J. Stanton covers government for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529.

Comments

AlphaAlpha

Thu, Feb 11, 2010 : 11:55 p.m.

Corrected values (thanks to JohnQ for helping with the facts): Recap: All government workers average: $82,846.40 All civilian workers average: $57,179.20 Ann Arbor workers average: $116,858.34 $26 million per year can be saved via competitive city wages.

AlphaAlpha

Wed, Feb 10, 2010 : 7:30 p.m.

Who among us will earn $150,000 in total compensation this year? Upon rechecking the 2010 Budget Book, and recalculating 2010 city employee compensation, the numbers below are indeed correct. (Perhaps Mr. Fraser can supply the additional data needed for calculating median incomes; for now, average values are accurate enough to understand the magnitude of this issue.) The 2010 Budget Book, page 117 lines 1 and 2, in the 2010 column, shows: $55,519,965 requested for pay; $59,426,234 requested for benefits; totaling $114,946,199 in compensation for 766 employees, which averages to $150,060.31 for each employee for 2010. $150,060.31 per year average total compensation. Hello? Is that reasonable? Median income level of U.S. workers over 25: $32,140 Median income level of U.S. workers over 25 with bachelor's degree or above: $56,078 Source: US Census Bureau, 2006; income statistics for the year 2005

AAresident

Tue, Feb 9, 2010 : 3:51 a.m.

I attended the Council work session where the income tax was discussed some months ago. Although I don't recall the exact figures, one of the problems of the proposed tax is that it is expensive to implement. The overhead for managing the tax is I think around 3 million each year. Combine that with the reduction in business tax revenue of 7 million, add millions more for lack of compliance, also add something for the cost to business and individuals for accounting and other compliance, and you get a tax that has a lot of overhead for a relatively small amount of money collected. At that work session, Council was not all that enthusiastic about the tax. They also recognized that it would be unpopular. I think if residents realized how expensive it will be to manage, they would be less interested than they are now.

AlphaAlpha

Mon, Feb 8, 2010 : 4:42 p.m.

What is the average total annual compensation paid to a city employee?

Awakened

Mon, Feb 8, 2010 : 3:34 p.m.

Thanks for the Link to the Budget Proposals, Ryan. I note that the reduction of 9 police officers and 6 more firefighters don't have the consequent reductions in supervisors. Civilian staff, including Community Services Officers, do have this reduction. Other than the planned reduction of several positions (eliminated with the buyout) the Sgts and Lts in both services remain to service the reduced number of employees. Give then proportion of supervisors in the PD at least 3 should be demoted because they no longer have anyone to supervise. They could co back on the streets to reduce impact. But maybe they are the bosses buddies so we get to keep payin gto keep them behind a desk and waiting for someone to show up after we call 911.......

veritasA2

Mon, Feb 8, 2010 : 11:24 a.m.

We need to focus on the real issue and dig deeper. Read the union contracts between the City and its SEVEN unions. All these union's negotiated "juicy" contracts years before today's leadership team. Management efforts to realign these contracts to today's realities have been fruitless to say the least. To appease council and the public the salaried employees take reductions in wages and benefits (with no representation) leading people to believe that the union's are equally impacted, not. What's impacting the bottom line are the compensation packages these union folks are receiving annually, a sum far above the private industry. In fact, the City provided all employees a Total Compensation Summary for FY 2009. You might be surprised how much an administrative support specialist is making. Consider all the fringes such as uniforms/clothing, paid training, overtime/comptime, paid time off, promotional and progession/step increases, etc. Take a closer look and get informed before choosing layoffs, a city tax, outsourcing, closing parks/facilities. Stand behind the City's leadership team by forcing these union to re-open their contracts and take real concessions that impact the bottom line! 1. International Association of Fire Fighters Local 693 2. Command Officers Association of Michigan A2 Police Sergeants/Lieutenants 3. A2 Police Officers Association for Community Services Assistants/Professional Service Assistants 4. Teamsters Local 214 - PD Professional Assistants 5. Teamsters Local 214 - Police Deputy Chiefs Unit 6. AFSCME Local 369 - 7. Teamsters Local 214 - Civilian Supervisors

Ryan J. Stanton

Mon, Feb 8, 2010 : 10:59 a.m.

@bornblu I believe snapshot is merely pointing out that the city's charter stipulates that, if an income tax is ever implemented, the city's operating millage must be eliminated, which would bring property taxes down by about 15 percent. As far as what that would do to home values, we might need to ask the experts. In the meantime, for all questions related to the income tax, I'd point you to the city's income tax study and FAQ sheet, which were released last July when talks of an income tax were gaining momentum. It's worth pointing out that the amount of additional revenue raised would depend upon whatever exemption level is approved. A feasibility report prepared by Plante Moran has several scenarios which could be considered ranging from $7.6 million to $14.2 million.

bornblu

Mon, Feb 8, 2010 : 10:29 a.m.

@ Snapshot I am somewhat confused and admit have much trouble with math. If, as you indicate, you pay a.5% income tax and "property values will increase because property taxes will decrease", doesn't make sense to me. I was always under the impression that, all else remaining the same, as property values increase your property taxes do also! Whether you want a city income tax, or not, is a legitemate question, your logic is not.

YpsiLivin

Mon, Feb 8, 2010 : 10:02 a.m.

TAG, I think the way Michigan law is structured, a city cannot impose an income tax on residents only. The tax is on income generated within the city, regardless of where the earner lives.

TAG

Mon, Feb 8, 2010 : 9:01 a.m.

I don't understand the strong dislike of an income tax many people have. If the income tax replaces property taxes then on average people will not be paying more but the income tax is potentially more equitable - you make more then you pay more. It is not necessary to charge an income tax to people who work but do not live here - I don't think those folks actually use that much in city services to justify the tax because the businesses they work for should be paying a tax to the city - perhaps an exception would be those who work for the U as the U doesn't pay its fair share and charging the U employees a tax wouldn't cause them or the U to leave town

Tim Darton

Mon, Feb 8, 2010 : 8:05 a.m.

Seems to me that Ann Arbor is doing better than other Michigan cities even though the city lost Pfizer and has so much land off the tax roles. The fact that the city owns a lot of it just means they have a lot of park land to take care of but the voters mandated that. Logo makes several good points but in his (her?) last post the question was posed, are all the cities in Michigan mismanaged or are you just running a campaign here?

Jim Johnson

Mon, Feb 8, 2010 : 1:53 a.m.

I forgot one thing on my last post. If silo-busting and pork-project busting isn't enough, I have two words: "Privatize everything." Before cutting services drastically, you need to ask if you can outsource and get somebody else to provide the same services at a cheaper price than what we can directly provide it for. If something isn't within your core competencies, you get somebody else to do it. That's business strategy 101.

Jim Johnson

Mon, Feb 8, 2010 : 1:34 a.m.

The gravy train has to stop. Stop the $50,000,000 underground parking garage now. Stop the multi-million AATA tear-down of a 20-year-old facility now. Stop the construction of the Fuller Intermodal Facility (parking garage) now. Sell the old abandoned city facilities (washington and n. main) now. Take the money and give it to the operating fund. I don't care about "fiscal silos". Tear them down now. Pass whatever laws are necessaary now. Any company acting like this would go bankrupt. If you can't do it, I'm voting for somebody else in November. Or maybe running myself.

logo

Sun, Feb 7, 2010 : 11:25 p.m.

So, most of the cities in the state are in the same or worse shape. Are they mismanaged too? Or are you just running your campaigns against the city on the blogs. Half of you don't even live here of course you don't want to pay an income tax. Are Ypsi., Kazoo, Bay City, Lansing, Grand Rapids, Troy, etc. all mismanaged? None of these cities could take on a project like the Stadium Bridges on their own but A2 is going to replace them starting next fall. Looking around the state, A2 is way ahead of other cities.

snapshot

Sun, Feb 7, 2010 : 6:08 p.m.

Let's get an income tax on the ballet now and quit stalling. Oakapple is wrong! Businesses won't move, people won't quit their jobs because they have to pay.5% income tax, property values will increase because property taxes will decrease making rents more reasonable which will attract new tenants. Sell ALL the golf courses or shut them down. Get the unions back to the bargaining table.To Craig Ferris, it's the unions that are beating the crap out of the taxpayer with that union baseball bat. You gave up 4%, that's nothing so quit whining and give up another 15%. The gravy train is over! We can't afford you anymore. I'm not sure what you have to negotiate? It's not like the fire department down the street is going to be able to pay any better! Get real about the budget crisis. What part of "crisis" don't the unions get? You think everybody's lying about not having any money? The fact that you think you did the taxpayer a "favor" by making a measley 4% concession is an attitude that needs changing. It amazes me that you make such a big deal out of a 4% decreaseto help keep fellow employees on the payroll. Let's start charging non residents park access fees and let's get that income tax going so we can charge folks for the privilege of "working" in our city like residents get charged for the privilege of "living" here.

voiceofreason

Sun, Feb 7, 2010 : 5:16 p.m.

I am glad there doesn't seem to be great support for an income tax. It should be obvious to residents that fiscal mismanagement will cause any corresponding drop in property tax to be short lived. There are far too many long-term negatives associated with an income tax to justify adopting one as a "short term budget fix".

newsboy

Sun, Feb 7, 2010 : 4:18 p.m.

Lets let the residents vote on this issue! Its time for the residents of Ann Arbor to stand up and make these tough decisions. This decision cannot and should not be made by the major, city council, or the residents of other cities and townships.

Ryan J. Stanton

Sun, Feb 7, 2010 : 3:53 p.m.

Here's a link to the documents (with a lot more information) that will be the subject of discussion at Monday night's working session: http://a2docs.org/doc/151/

YpsiLivin

Sun, Feb 7, 2010 : 3:28 p.m.

"Now, ask yourself honestly - would you move to any of them?" Hudson is a nice small town actually. Not that you would have a clue. Lol. My question wasn't whether or not it was a nice town. The question was, would you move there? Why would anyone move to a city with an income tax when they can live in a neighboring township and save themselves the annoyance and hassle?

brad

Sun, Feb 7, 2010 : 2:49 p.m.

An income tax isnt the issue. The city will adopt the budget before a public vote. That said, heres my take. The top 9 property taxpayers (no Pfizer) will benefit by $1.5 million/year with no operating millage [Source: the 2009 CAFR...their taxable value totaled $235m]. Renters and wage earners will pick up the slack. Also, I have concerns about key assumptions in the consultant report and the administrative overhead, among others.

a2grateful

Sun, Feb 7, 2010 : 2:31 p.m.

Logo: "These budget cuts are hitting all Michigan cities hard and Ann Arbor starts out with 42% of the real estate off the tax roles." The largest holder of non-taxable land in the City of Ann Arbor is.... Drum roll, please.... More drum roll.... The City of Ann Arbor.... What? The City of Ann Arbor owns more non-taxable land in the City limits than U of M? Yes! Why doesn't the City ever mention this fact? Maybe it would cloud their lobbying efforts for new taxes, as it is far more convenient to blame big, bad U of M as the source of all of their problems of lack of taxable land base. More drum roll.... And the City is still buying more land.... But what about U of M? Well, U of M is a regional economic engine.... U of M provides jobs.... U of M provides medical services and training.... U of M is a renowned educational facility.... U of M brings research grants from all corners of the earth.... What is the City? An out-of-control spending machine! They are known for being the home for U of M. However, they can't even afford to mow their own grass. Holy fountains of phenomenal folly, team Hieftje! Let's ignore the economics and bridge collapses. Threaten more cuts, perpetually raise taxes and service fees. Build unneeded and unwanted construction that puts local business at risk. What is City government's best product, aside from compost and recyclables? FEAR, of course! How about voter apathy? Only August will tell!

Gill

Sun, Feb 7, 2010 : 2:02 p.m.

What ever happened to the discussion at the State about eliminating townships to free up money for the cities and the counties?

belboz

Sun, Feb 7, 2010 : 1:41 p.m.

The East Stadium Bridges are a perfect example of why the city does not need more money - they need more efficient and effective spending. Why do I say that? Because they have a $22 million project, with no source of funds. The state has rejected the funds, so they are pinning their hopes on a Tiger Grant. Well, there have $56 billion in applications for Tiger Grants, but only $1.5 will be awarded. Looks like a very long shot. What is worse, is that for $12 million less, they could just put in an at grade road. The average cost of a 4 lane road - as referenced by various Departments of Transportation - is $6 million. With this economy, I'd expect less than that. Plus, we are only talking about 1/2 mile of road. So, add the cost to remove the dirt and bridge (what hasn't fallen down already) and you have what I would expect to be less than $10 million. But, our council and administrator chose the $22 million project. The city owns the same amount of property as the Packard and Stadium intersection, room enough for center turn lanes on both roads. So, when the city cannot prioritize spending - when wasteful projects persist - then they can leave the taxes where they are at. Frankly, they should lower them to help stimulate spending. The budget is excessive already....

YpsiLivin

Sun, Feb 7, 2010 : 1:17 p.m.

"The cities mentioned are not in trouble because of an income tax, they're in trouble because of the decline of the auto industry in our State." Imposing a city income tax didn't solve their problems though, did it? Once you put an income tax in place, where do you think the City will turn the next time it runs out of money? Well... your 1% income tax will go up to 2% or 2.5%. Will you still feel like it's the answer to your problems? All this talk about how many "city services" non-residents use is rubbish. These "city services" are services the city needs to provide for its residents, regardless of how many non-residents are in town at the moment. Do Ann Arbor residents compensate other municipalities for their "use" of services when they visit? No, of course not! What's next? Taxing visitors to the Big House on football Saturdays? A special tax for Art Fair visitors? The last time this issue came up, studies were done that showed that businesses currently in the city would relocate outside the city limits were an income tax imposed. An income tax isn't the right way to go about solving the city's financial problems. If Ann Arborites want to live large that's fine, but let them pay for it on their own. Non-residents should not be expected to subsidize Ann Arbor's extravagance. For the record, an income tax in Ann Arbor would not impact my household one iota, as neither my spouse or I live/work in the city. Cities that have imposed income taxes haven't gotten the bang they were hoping for from income taxes to residents; they're still in deep financial trouble. Cure the basic problems of municipal overspending/misspending first, and stop hoping that extra school taxes and greenbelt millages will insulate your property values from the economic realities of the marketplace.

logo

Sun, Feb 7, 2010 : 12:05 p.m.

So Christy, you seem to know the cause of A2's budget problems but if so many, many cities in the state are in the same boat and they don't have 40% of their real estate off the tax roles, then what is the problem in those cities. Do the mayor's and councils in Ypsi, Grand Rapids, Troy, Saginaw, Bay City, etc. need to be impeached? Or, is this all because Michigan is suffering more than any other state and all the $$ are going away for everybody?

DagnyJ

Sun, Feb 7, 2010 : 11:09 a.m.

It's hilarious that the city and a lot of commentors here are going with the "Hey, let's get all those other guys to pay for our stuff!" alternative. It won't work. The assumptions are based on hypothetical numbers that even the consultants say are just guesses. What if the guesses about out of town workers are wrong? What if there are more unemployed people in the city than they've guessed? What if we implement an income tax, and then find out it's not enough? How about we just to learn to live within our means, and start negotiating PILOT with UM? An income tax is a bad idea. It won't work. And in a year we'll be even more screwed than we are now.

racerx

Sun, Feb 7, 2010 : 10:59 a.m.

Will city employees who also commute into the city have to pay an income tax? Despite the higher salary employees who might be able to take the income tax hit what about those who don't fare as well? A lot of city employees can't afford to live in the city in which they work. Will McCormick, Fraser, Barnett, Hupy all have to pay this tax? Or, will there be an "exception" put into the code for those few who work for the city? An income tax isn't the answer, especially since pools and senior centers are suggested to remain open despite these not being "essential" city services. When FD staff are being cut and has the potential to impact peoples lives and property how is "staff" suggesting these sites remain open?! WTF? Oh, I'd rather have my property burned to the ground or lose a family member just so a few, A FEW people can enjoy a dip in the pool. Probably over dramatic, but come on people, council, Mayor, Fraser, see the light. Oh, but for to long they've been in the dark, why would I expect that to change now.

Awakened

Sun, Feb 7, 2010 : 10:56 a.m.

The difference between A2 and most communities is that its single largest industry, the University of Michigan, is tax exempt. Taxing out of town workers makes sense because of this. I do feel for the folks in small businesses who must employ out of town workers at minimum wage. It is already difficult to get good help because of the lack of parking for workers. But businesses will get a net reduction. Perhaps they could compensate their workers. A 1% tax for a $40,000/yr worker is $400 pre-tax; $300 (at most) post-tax. This will be most difficult for small business. I'm not sure how short the fire department is over the last few years but this is a 20% reduction. The police department will have been reduced 43% over the last decade. I hope we have suffered the same losses in supevisors and administrators. But I doubt it.

scole

Sun, Feb 7, 2010 : 10:53 a.m.

So let's see if this makes sense. Ann Arbor is having a tough time, like a lot of cities in the state.. So, to fix it, we're going to tax non-residents (who couldn't afford AA taxes, that's why they don't live there) who already pay taxes to support their own ever-shrinking public safety departments. Yes, there are services in AA that I get when I'm there, paid for by the residents. But they are also paid by the money I spend at business while I'm there. And AA residents sometimes leave their city limits once in a while I understand. How about we just put up toll gates at each city limits, and we can pay for "police protection" before we enter a new city/township?

Lifelong A2

Sun, Feb 7, 2010 : 10:34 a.m.

The statistics prove thet oakapple is wrong: businesses located inside the City would enjoy a net reduction in tax burden under an income tax proposal because of the significant reduction in property taxes. Again, I hope people will carefully the study the facts before reaching conclusions. I'm always amazed how little people actually know about the income tax proposal, and how quickly they become supporters after they learn the facts.

Lifelong A2

Sun, Feb 7, 2010 : 10:32 a.m.

Excellent points raised by mmggttnn and logo: the vast majority of our property tax dollars in Ann Arbor do not go to the City. They go to the schools, County, Library, etc. An income tax is a great idea, but *not* just because it will generate new revenues. The best reason for an income tax is that it will re-distribute the tax burden away from Ann Arbor residents and onto people who work -- but don't live -- in A2. In fact, property taxes would drop significantly for Ann Arbor residents. Furthermore, most retirement income is exempt from the income tax. Due to these factors, many Ann Arbor residents -- particularly seniors on a fixed income -- would see a net reduction in their total tax bill. It's time to get this community discussion going so people can learn the facts. When they do, they usually end up supporting an income tax.

oakapple

Sun, Feb 7, 2010 : 10:29 a.m.

Although I'm retired now I onced owned a local business that employed 70+ people. Many of them lived in surrounding townships. If the city had an income tax it would have made it more difficult for me to hire the best people if my business was located within the city limit. The net result of a city income tax will be that new businesses will start outside the city limit and businesses already located within the city will consider moving, especially as they grow and need more space. Office rent levels will have to go down within the city to attract or keep these businesses. So property values and property taxes will also go down. Restaurants and other service businesses within the city will also suffer reduced patronage. So be very careful about imposing a city income tax.

logo

Sun, Feb 7, 2010 : 10:12 a.m.

BTW, Grand Rapids is a great place to live. I have been in Grayling, Port Huron, Battle Creek and Big Rapids in the last few years and they are all nice cities, no problem. The mayor has been against an income tax for a long time but he's wrong. In A2 the millage would drop by 6 mills. The millage rate for all the governments and schools on our tax bills would go down 15% but the city portion is only 28% of that, so it would go down 36%. Most residents would break even on an income tax, a lot of seniors and lower income workers would make money, higher incomes would pay more but everyone would get to live, work and recreate in a great city that did not have to make these cuts.

logo

Sun, Feb 7, 2010 : 9:59 a.m.

These budget cuts are hitting all Michigan cities hard and Ann Arbor starts out with 42% of the real estate off the tax roles. Taxes are high but so much goes to the schools. The city only gets 28% of what we pay and the city's millage rate is down from what it was 12 years ago. A2 has an expensive Cadillac park system (but I love it), the city's hands are tied in union negotiations by Act 312 and then add in the loss of 5% of the property tax revenue from Pfizer going to UM and you have a greater understanding of the problem.

mmggttnn

Sun, Feb 7, 2010 : 9:18 a.m.

The cities mentioned are not in trouble because of an income tax, they're in trouble because of the decline of the auto industry in our State. Ann Arbor has not been dependent on the auto industry which is why we're in better shape. But the nation's economic distress, the State's financial decline, and Pfizer's leaving has put us in the hole. The income tax coupled with a property tax reduction will not cost city taxpayers much of anything. We will get revenue from workers who live outside the city but work in the city and use our services. Cities decline because their quality of life declines. Let's not let that happen to Ann Arbor. Support a city income tax!

Grover1

Sun, Feb 7, 2010 : 8:34 a.m.

Additional taxes on our already burdened citizens should always be considered last after budget cuts. Higher taxes and fees just drive the tax base away. Running a city's budget, should be no different than running a business, right? In a bad economy can businesses raise prices to its customers, or should it look to eliminate waste?

YpsiLivin

Sun, Feb 7, 2010 : 8:13 a.m.

If you think that imposing an income tax is the answer, look at the Michigan cities that already impose an income tax: Albion, Battle Creek, Big Rapids, Detroit, Flint, Grand Rapids, Grayling, Hamtramck, Highland Park, Hudson, Ionia, Jackson, Lansing, Lapeer, Muskegon, Muskegon Heights, Pontiac, Port Huron, Portland, Saginaw, Springfield and Walker Now, ask yourself honestly - would you move to any of them?

Raggety Andy

Sun, Feb 7, 2010 : 7:39 a.m.

If an income tax will save jobs and get the budget out of the red then by all means let's do it.