Residential property values climbing in 2012 in Washtenaw County

Initial assessment changes in Washtenaw County show overall value increases for residential property in eight communities in 2012, the most since the recession.

File photo

Washtenaw County's Equalization Department showed projected value increases for eight communities after assessment changes this year: Ann Arbor (2.5 percent), Ann Arbor Township (4.7), Dexter Township (2.2), Lodi Township (3.1), Lyndon Township (0.2), Salem Township (5.6), Saline Township (1.6) and Scio Township (1.2).

Those percentages were based on reports completed before each municipality's board of review met to rule on appeals made by homeowners on the initial 2012 assessments.

Municipalities have been providing updated figures to the equalization department over recent weeks, said Director Raman Patel.

Now the county's board of commissioners expects a final report - with updated numbers - at Wednesday's meeting.

In 2011, the county saw its first signs of value stabilization as four communities saw value increases.

Going back to 2009, 14 communities saw double-digit value drops. By the initial 2012 numbers, only one is above a 10 percent value loss: Milan, which is at -11.4 percent.

The valuations are done on "arms length" transactions, not short sales or foreclosures. However, real estate experts said, the pressures in the market caused by both types of under-market sales resulted in widespread value drops in county.

Here's a look at Washtenaw County's changes in residential property values, based on the initial numbers provided to the county. Positive numbers are bolded.

Cities

- Ann Arbor 2.5

- Chelsea -1.8

- Milan -11.4

- Saline -0.6

- Ypsilanti -8.0

- Ann Arbor 4.7

- Augusta -1.9

- Bridgewater -4.6

- Dexter 2.2

- Freedom -3.3

- Lima -3.3

- Lodi 3.1

- Lyndon 0.2

- Manchester -4.8

- Northfield -5.7

- Pittsfield -1.1

- Salem 5.6

- Saline 1.6

- Scio 1.2

- Sharon -6.5

- Superior -0.8

- Sylvan -3.0

- Webster -3.3

- York -2.9

- Ypsilanti -4.5

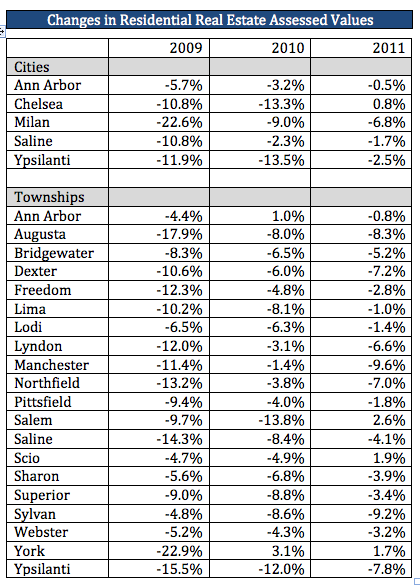

Below are numbers from 2009-2011:

Comments

u812

Tue, Apr 17, 2012 : 1:23 p.m.

With all this inflation someone is getting a raise! if not the middle class, then it's the RICH .

cinnabar7071

Tue, Apr 17, 2012 : 12:39 p.m.

Are property value increasing, or is the value of the dollar slipping? I used to be able to eat at Mcdonalds for $5, now it costs about $8, that doesn't mean the Big Mac is worth anymore. Paula how does the dollar value figure into your story?

sellers

Tue, Apr 17, 2012 : 1:36 a.m.

One other thing - my assessment increased for the first time in 2 years and I'm in Saline proper? What gives ? (and no - I'm not a victim of PropA/1994. My last sale was post 2000)

Indymama

Tue, Apr 17, 2012 : 4:07 a.m.

You are not alone!! My assessment also went up considerably, but the actual value of the house decreased. Ann Arbor City publicity indicated that tax assessments would hold steady with just a few exeption. Everyone I have talked to from various parts of the City have had an increase in their assessment and so have their neighbors!! So....another falsehood told by our corrupt city officials.

sellers

Tue, Apr 17, 2012 : 1:35 a.m.

Interesting to see the farther out you go from Ann Arbor, the higher the drops (in general). Could this be another sign of a resurgence of urbanism ? I do feel bad for those in Milan and Ypsilanti City proper that have taken a hit. (Dexter, Barton Hills, and Manchester villages are included in township reports I presume).

DonBee

Tue, Apr 17, 2012 : 2:26 a.m.

Sellers - I think you need to put the numbers on a map and look again. I think you that the answer is not so easy. I also suspect if you used zip+4 you would get a very interesting picture, which shows areas far out in the county with increasing value and some close with negative value.

Paula Gardner

Tue, Apr 17, 2012 : 12:16 a.m.

Sheriff's deeds sold in the first quarter of 2012 total 217, compared to 289 at the first quarter in 2011. Not all will become foreclosures, as owners get a chance to redeem them. But initial indications suggest that foreclosures are dropping across this county, if not across the state.

DonBee

Tue, Apr 17, 2012 : 2:23 a.m.

Paula - Given the slow down in foreclosures for Robo-signing and other issues, I doubt we are over the hump. A good number to find would be the number of homes that are 90 days or more behind on mortgage payments.

say it plain

Mon, Apr 16, 2012 : 11:58 p.m.

Ah, yes, and since these numbers DO NOT include foreclosures and short sales lol... yet as the mlive site shows with their article from a couple of days ago about how Michigan is still the 7th in the nation for foreclosures (I think Ann Arbor has a bunch as well, as much as we'd like to pretend it doesn't happen here)... http://www.mlive.com/business/index.ssf/2012/04/michigans_foreclosure_filings.html this "news" is more of the "values climbing..." misleading/cheerleading we have come to expect perhaps?

zeeba

Tue, Apr 17, 2012 : 3:34 a.m.

If it doesn't include short sales and foreclosures, then these are the values people are getting for non-distressed home sales. So I wouldn't regard that as misleading, since those non-distressed prices are already affected by foreclosures.

say it plain

Tue, Apr 17, 2012 : 3:06 a.m.

wait, why can't I post links?! http://www.mlive.com/business/index.ssf/2012/04/michigans_foreclosure_filings.html

say it plain

Tue, Apr 17, 2012 : 3:05 a.m.

sorry, here's the full link: http://www.mlive.com/business/index.ssf/2012/04/michigans_foreclosure_filings.html