Tax-dollar tug of war: Proposed city ordinance changes would place new limits on Ann Arbor DDA

Downtown Ann Arbor's Main Street as it looked on a summer night last year. Ann Arbor Downtown Development Authority officials argue the success of the DDA is visible in the success of the downtown, which they consider the best in the state.

Ryan J. Stanton | AnnArbor.com

With private investments being made throughout downtown and new high-rise apartments popping up left and right, the amount of taxes being captured annually by the DDA is expected to grow by about $1 million over the next two years, according to new estimates.

At least two members of the Ann Arbor City Council want to see that growth curbed, and they're co-sponsoring ordinance changes on Monday night's council agenda that could result in the return of roughly $1 million a year in captured taxes from the DDA to various taxing units.

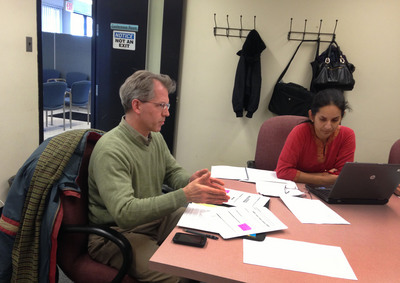

City Council Members Stephen Kunselman and Sumi Kailasapathy, shown here at a city audit committee meeting this past week, are co-sponsoring a set of ordinance changes that would place new limits on the Ann Arbor DDA.

Ryan J. Stanton | AnnArbor.com

"I don't think the DDA needs another $1 million on top of the $3.7 million they already have because the city has needs of its own," Kunselman said. "And so do the other taxing units."

The taxing units the DDA takes revenue from include the city of Ann Arbor, Ann Arbor Transportation Authority, Washtenaw County, Washtenaw Community College, and the Ann Arbor District Library.

Kunselman said the ordinance changes are worded in such a way that the DDA wouldn't see a reduction in revenue from current levels.

Other proposed changes limit who can serve on the DDA's governing board and for how long.

"My purpose of bringing these forth is not to vilify the DDA, but to try to improve the institution," Kunselman said at a recent meeting, quickly adding: "Because it's easy to vilify the DDA ...."

DDA board members were quick to jump on Kunselman's remarks at their last meeting. They took turns criticizing what's being proposed while speaking proudly of the DDA.

DDA board member Sandi Smith, a downtown resident and business owner, said Kunselman demonstrates a lack of understanding of how TIF funding works.

The revenue netted by the DDA within the bounds of the downtown district — unchanged since its creation by the city in 1982 — are what's known as "tax-increment financing" or TIF funds.

The fact that the DDA's revenue capture is growing means the downtown tax base is growing, Smith said, adding that means the DDA is doing its job.

"The investment we make in infrastructure, from the DDA's perspective, actually brings the whole downtown up and brings more money to the general fund. It brings more money to all of the taxing authorities, so an increase in value of downtown properties helps everybody," she said.

DDA Chairwoman Leah Gunn, who would be term-limited off the board under the proposal, said the DDA seems to be working well for everybody right now.

"They really ought not to mess with something that works well," she said. "We have been very good stewards of the city's infrastructure."

A tiff over TIF dollars

The DDA has used TIF revenue over the years to fund streetscape improvements, new LED streetlights throughout downtown, solar panels at the Farmers Market, repairs and upgrades to Liberty Plaza, Sculpture Plaza and the Kempf House museum, and many other projects.

Additionally, the DDA has spent millions of TIF dollars in the downtown on city infrastructure, including new water mains, public trash cans, alley repairs and miles of sidewalk repairs. The DDA also contributed $8.2 million to the city's new municipal center.

Former county administrator Bob Guenzel said he's observed a strong commitment to fiscal stability since he's been on the DDA board the last few years. "It's now proposed that we change the rules about that, about how we capture the TIF. Frankly, I hear no reason for that."

Ryan J. Stanton | AnnArbor.com

Additionally, it included $276,036 that would have gone to the Ann Arbor Transportation Authority, $772,229 that would have gone to Washtenaw County, $499,120 that would have gone to Washtenaw Community College, and $208,101 that would have gone to the Ann Arbor District Library.

To put that into context, the DDA captured about 17 percent of the $22 million in total taxes paid by downtown property owners last year.

No money is being diverted from K-12 public schools or Ann Arbor SPARK, which also levy taxes on downtown properties.

If the ordinance changes are enacted as proposed, the city's treasurer estimates the DDA would have to refund a total of $713,221 to the different taxing units in the 2013-14 fiscal year.

Kunselman said he's going to take it a step further and propose pushing the refund up to roughly $1 million for each of the next two years.

In the first year, that would return $613,919 to the city, $213,583 to the county, $134,757 to Washtenaw Community College and $57,421 to the library. About 12.5 percent of the city's share is a pass-through to AATA.

Even with those refunds, the DDA still would collect nearly $3.7 million in the next fiscal year, which starts July 1, and nearly $3.8 million in 2014-15, according to city estimates.

Kunselman and Kailasapathy both said the ordinance changes they're proposing aren't politically motivated and shouldn't be viewed as an attack on the DDA.

"That's the misconception I think that's floating around," Kailasapathy said. "I'm a CPA and we do auditing and we do compliance and taxes, so for me it's more of an issue of doing it right."

Given that the DDA is a component unit of the city, she said, the city owes it to other taxing units to make sure the TIF capture is handled fairly and no excess funds are kept by the DDA.

"If you see the TIF capture ... it's growing at a tremendous rate," she said. "We're just saying it might slow the growth a little bit."

DDA term limits?

Another proposed change would prohibit Mayor John Hieftje and any future mayor of Ann Arbor from serving on the DDA board after the November 2014 election.

As mayor, Hieftje is in charge of appointing all of the DDA's board members, and for several years has served on the board himself.

The Ann Arbor DDA board at its most recent meeting.

Ryan J. Stanton | AnnArbor.com

Additionally, no other elected public officials of any kind could serve on the DDA board under the proposal.

"I think that's the kind of thing we need to remove to instill trust and confidence into the institution, so that's the purpose of that," Kunselman said. "It's not to target any particular elected official."

Term limits also would be placed on DDA board members, so no one could serve more than two consecutive four-year terms, or eight years total.

"The term limit is important because we have one member who has been serving for over 20 years, and I think that kind of indicates the DDA is getting maybe a little set in their ways and isn't open to change," Kunselman said. "They're unwilling to look at new ideas."

DDA board member Keith Orr, a downtown business owner for more than 20 years and a resident of Ann Arbor since 1976, said he's proud of the work the DDA does.

"We're doing something which very few other government entities are doing: focusing on infrastructure," he said. "We hear the news about our crumbling infrastructure across the nation, but very few entities are doing anything about it."

Part of the reason the DDA works so well, Orr said, is because it's not an elected body where its members are preoccupied with getting re-elected.

"This is the reason the DDA is a de facto parking authority," he said. "City Council abdicated their responsibility to maintain the parking system they owned and operated many years ago. They still own the parking system, but now it is maintained and run in a manner the envy of most cities."

Former county administrator Bob Guenzel said he's observed a strong commitment to fiscal stability since he's been on the DDA board the last few years.

"We're on the cusp of redevelopment in the downtown for businesses, and we also hope for residences," said DDA Chairwoman Leah Gunn, the longest-serving member of the board. "We have a number of new apartment buildings that are in progress and some that are planned. So my feeling is the DDA has been careful, it has been prudent."

Ryan J. Stanton | AnnArbor.com

Guenzel and other board members said the DDA's success is visible in the success of the downtown, and in a well-maintained parking system.

"I think it's the best downtown in the state of Michigan, and I think the DDA deserves a lot of credit for that, and I wouldn't mess with it," he said.

"We're on the cusp of redevelopment in the downtown for businesses, and we also hope for residences," Gunn added. "We have a number of new apartment buildings that are in progress and some that are planned. So my feeling is the DDA has been careful, it has been prudent."

DDA board member Russ Collins, executive director of the Michigan Theater, said the people serving on the DDA board are all community volunteers with a vested interest in the downtown.

"Is everything perfect? I don't think so," he said. "I get mad at parking meters. I get mad at ice and snow being where you might not want it to be.

"But in terms of good use of taxpayer dollars by volunteers who are committed to the city, who work and live in the downtown and who care, that's what you have on this board," he said. "And to have it be a political punching bag for the sake of political aspiration doesn't seem to be good use of the volunteers who are here out of their bottom-line concern for a place that they love."

'Us versus them'

Kunselman and Kailasapathy continued to air their concerns about the DDA at a meeting of the City Council's audit committee this past week.

Kunselman raised concerns that the DDA's latest audit from the last fiscal year shows more than $4 million was transferred from the TIF fund to the DDA's parking fund. That's because the DDA is using TIF revenue to help finance the new underground parking garage built on Fifth Avenue.

Kunselman said it just seems odd that TIF dollars are being used to subsidize the parking fund at the same time the city's general fund is getting 17 percent of the DDA's parking revenues.

The DDA's audit shows the TIF fund balance dropped by nearly $1.4 million last year — from more than $6.1 million to just under $4.8 million. However, the parking fund, which was on the verge of deficit at one point, rebuilt a $2.1 million fund balance.

The DDA's overall cash reserves went up from $8.2 million to $8.6 million. Parking revenues totaled about $17.1 million, and overall revenues totaled about $21.1 million — $20.6 million of which was spent last year, the audit shows.

Council Member Sally Hart Petersen, another member of the audit committee, suggested there's been too much "us versus them" in the dialogue about the DDA.

"I think it's a good reminder that 'them' is us," she said, pointing out that the DDA is a component of the city government and the city owns the DDA's assets.

But Kunselman argued it's an important distinction that the DDA receives tax revenues from other taxing units aside from the city.

He also thinks the DDA, a four-employee operation, has gotten a free pass while other departments have had to cut their budgets.

"The DDA is the only agency, so to speak, within the city that has been increasing its budget since 2002 as we've been decreasing our budget, cutting FTEs, cutting services," he said.

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's email newsletters.

Comments

Carolyn

Wed, Mar 20, 2013 : 2:20 p.m.

In general, DDAs are entities set up to help spur development in struggling downtown areas. Ann Arbor's downtown is hardly struggling. The DDA here has done a lot of adminrable things, and they have done tons of studies on the parking system so it is run very efficiently. That said, with the city's revenues down and services being sut so dramatically (think leaf pick up, tree trimming, park maintenance, police and fire layoffs, etc. etc.), it may well be time to use those TIF revenues for city-wide services.

Real Life

Wed, Mar 20, 2013 : 2:54 a.m.

Given the successes of the DDA and the meager accomplishments of the council, I'd suggest putting the DDA in charge of the city's finances and can the council.

RUKiddingMe

Tue, Mar 19, 2013 : 10:40 a.m.

Why is the DDA fixing sidewalks? We just passed a millage for the city to do that. Too much crossover, too much staff being paid to do the same thing with our money, too much money being spread around with no real direct good being done. Time to END the DDA and time to END SPARK. Hey SPARK; what have you done with all the money you're getting? Why do you get to receive tax money and not have to show what you're doing with it?! What are you doing with it??!!

Arno B

Tue, Mar 19, 2013 : 1:01 a.m.

"Four million transferred to the DDA parking fund"? "Using TIF revenue to help finance the new garage on 5th Avenue"? I thought the "black hole" (new garage) was to be financed by the $50 Megabuck bond issue? I do not think that it will be too far in the future that we'll be hearing about the garage not getting enough revenue to pay off the bond requirements. Then what?

Brad

Tue, Mar 19, 2013 : 11:43 a.m.

Then what? Then the taxpayers are on the hook.

Veracity

Tue, Mar 19, 2013 : 3:44 a.m.

It has been happening already, Arno B. Just look at the deficit budgets listed for the last three fiscal years on the DDA website. Servicing the underground garage bond issue costs the DDA $3 million a year. And it is not the only debt that the DDA has to service.

JRW

Tue, Mar 19, 2013 : 12:16 a.m.

20 years? I don't think so. Term limits immediately!

Karen

Mon, Mar 18, 2013 : 11:36 p.m.

My taxes have gone up enough - I would like the DDA to be disbanded. I thought that the city council was supposed to be elected to do this kind of of long term planning, not a non-elected incestuous cabal.

tosviol8or

Mon, Mar 18, 2013 : 10:36 p.m.

"The DDA district and T.I.F. HAD to be approved initially by each taxing body prior to its implementation. If the taxing units don't like it now, they have only themselves to blame." G-Man, any hope you had of convincing people you are well-versed in the intricacies of PA 197 went out the window with that statement, which is 100% false. The ability of taxing jurisdictions to opt out of having their taxes captured was not implemented until 1996.

Vivienne Armentrout

Mon, Mar 18, 2013 : 10:53 p.m.

And also, when the DDA charter was up for renewal in 2003, they carefully kept the old district boundaries, which prevented taxing jurisdictions from protesting. I know because I was on the BOC and inquired about this with our Treasurer.

Steve Bean

Mon, Mar 18, 2013 : 9:33 p.m.

The DDA's web site—"DDA: On a Mission to Strengthen Downtown"—offers no information about the organization's goals, only a budget and projects. How will it know when it has succeeded? At what point will downtown be sufficiently revitalized and renewed? If it has no goals, directing it to develop them (and metrics to measure progress) would be a reasonable option for council at this point, along with whatever other changes they'd like made.

nickcarraweigh

Mon, Mar 18, 2013 : 8:49 p.m.

The DDA sounds like Dante's Ninth Circle, some vast conspiracy like Skull and Bones, the Trilateral Commission, the Masons, drinking water fluoridation and the Loyal Order of Raccoons. Do they have a secret handshake, too?

LXIX

Mon, Mar 18, 2013 : 9:37 p.m.

The DDA does have a secret handshake - it's called the 'Shakedown'. However, after reading the article and comments it should be obvious that it is no longer a secret.

LXIX

Mon, Mar 18, 2013 : 8:28 p.m.

These City planners had a radical city plan for 2020. In 1967 they established a green belt fund. One of the nation's first. In 1971 voters narrowly missed setting a legal population limit for the city. Many feared the city would reach the end of its precious land supply and beauty due to overpopulation and development. Intercity traffic to jobs also began to add to local congestion. In 1997 City Council contemplated reducing the potential number of new jobs created in the city . With its "Comprehensive Rezoning Proposal," inside its greenbelt, the city would reduce the ultimate number of new jobs created to 15,000-20,000 by o Purchasing commercial land to prevent further commercial development; o Rezoning more commercial land for residential use o Change zoning ordinances to reduce the allowed size and density of new development The city has no DDA. The city is Ann Arbor's top "model" city Boulder Colorado. Population 98,389. Maximum in 2020 140,000. Source info http://www.agoregon.org/page61.htm

Vivienne Armentrout

Mon, Mar 18, 2013 : 5:48 p.m.

A point not often made is that the DDA also captures special millages that voters approved toward a particular purpose. This includes parks and roads millages, and special county, WCC, and AADL millages as well. If the Library bond had been approved, the DDA would have captured those dollars (that other properties pay within the DDA district for the millage). When voters approve a special millage for a particular purpose, I don't think they are often aware that some of the most high-value properties in the city are bypassed. This has become an issue in other communities http://www.detroitnews.com/apps/pbcs.dll/article?AID=/201303150946/METRO/303150379 where there are objections to TIF extraction of millages meant to aid the DIA and the Detroit Zoo. We have many purposes that we would like to direct tax funds toward. The DDA may be one of them, but they should not have an unlimited exemption from all other specially directed taxes.

tosviol8or

Tue, Mar 19, 2013 : 1:36 a.m.

There are bills being written, even as we read and write, to exempt the zoo and arts taxes from capture in the Oakland/Wayne/Macomb area where they are levied. They will pass, but with some opposition. After they pass, every library, park district, veteran's home, senior center and public safety department with a dedicated millage will come out of the woodwork to say, "If them, why not us?" And they should. The problem with TIF is its perpetual nature. TIF plans should have an expiration date that is non-renewable. After 20 or 30 years,if the DDA wants to continue to capture taxes, they should be required to reset the base value so the growth from the original plan goes back to the taxing jurisdictions. That was the original intent of TIF--that the tax base would grow to benefit the taxing jurisdictions, and not the DDA in perpetuity. Another way to allow TIF plans to co-exist is to limit capture to 50% of the growth (Ann Arbor is actually one of the better DDAs in that regard, not cannibalizing every single dollar of taxable value growth). That way, taxing jurisdictions with their skin in the game get to have an immediate and continuous return instead of the DDA keeping it all. TIF is a good concept, but DDAs have evolved into a bunch of greedy (redacted to preclude deletion). They shouldn't be exempt from the same budgetary limits as other departments (although as a component unit they aren't completely congruent to a department) are.

Vivienne Armentrout

Mon, Mar 18, 2013 : 5:32 p.m.

Some useful calculations and comments on this can be found in an earlier piece in the Ann Arbor Chronicle http://annarborchronicle.com/2013/03/03/column-lets-get-dda-tax-capture-right/

st.julian

Mon, Mar 18, 2013 : 5:03 p.m.

Be nice tok limit the amount of revenue that they could keep as well as how the money could be used. They may have been created by an ill informed government, as shown by their recent action, but they've been adopted by the developers who micromanaged their myopic intellect

Greg

Mon, Mar 18, 2013 : 4:43 p.m.

Badmouthing Synder for the DDA as LXIX is doing is pretty laughable. One only has to ask if he was even in state government at the time "DDA's were State "authorized"? Answer, of course not. DDA may be a bad joke on taxpayers, but Synder had nothing to do with it.

LXIX

Mon, Mar 18, 2013 : 5:42 p.m.

Agreed, a Snyder-run DDA would be also laughable. The point was that MI voters denounced Snyder's unelected Emergency Managers. They said NO. So he ignored the voters and re-legalized EMs under new legislation anyway. So much for representative democracy. Is the DDA becoming just another Snyder mini-me? An unelected EM with no accountability? That is not such a funny one to me.

glenn thompson

Mon, Mar 18, 2013 : 3:43 p.m.

When the DDA promotes development and then captures the taxes from the development this means the services to the new development must be paid for from the pre-development tax base. This is not sustainable over the long term. The Kunselman/Kailasapathy resolution seems a reasonable way to return some of the DDA captured taxes back to the general fund to provide services to all, including those in the new developments.

LXIX

Mon, Mar 18, 2013 : 3:14 p.m.

The DDA and SPARK are anything but just another "component of government" Ms. Peterson. These are privately managed self-serving entities allowed by government to tax and spend without due representation. A very seriously-held American value. DDA's were State "authorized" to operate outside of the "poor and dumb" voter-entangled financial urban decay in the seventies. Downtown business given the freedom to govern themselves in a desperate effort to save the citites. Similar to Snyder's current State Emergency Management "solution". Exact same issue of rescuing corrupted cities unable to manage their own finances. Unlike Snyder's EM teams, however,, when voters call for disolution then City Council should be discussing how to terminate the DDA . Or the Council should be removed by their boss - the public - before they become another corporate-run Snyder mini-me. Putting up a big show like Kunselman to make the DDA share a little of what is not their's to begin with is lame. Claiming like Smith that the DDA is just "doing its job" is even more insulting. Dump the DDA. And that little SPARKY too. You want corporate socialism move to China Inc..

Ryan J. Stanton

Mon, Mar 18, 2013 : 9:46 p.m.

Petersen wasn't talking about SPARK. She was talking about the DDA, which is a public entity and a component unit of the city government. Very much public. All its meetings are open to the public and so are its records. FOIA the city's payroll list and you'll find the four DDA employees on it. So it's not accurate to say it's privately managed. Of course, the DDA does contract out day-to-day management of the parking system to Republic Parking, which is a private company.

Jack Eaton

Mon, Mar 18, 2013 : 2:46 p.m.

Ryan, the article says: "Kunselman and Kailasapathy continued to air their concerns about the DDA at a meeting of the City Council's audit committee this past week." It was my understanding that members of the audit committee had raised concerns about the DDA's audit report and whether the DDA had complied with its own rule that it report the status of the TIF account in compliance with the requirements of Section 15(3) of the State of Michigan Downtown Development Authority Act. The concerns raised by the audit committee seem significant to me. It is my understanding that the DDA's chief financial officer is currently unavailable to answer questions and the DDA's auditors did not attend the Audit Committee's meeting, as requested. I was not at the audit committee meeting but I understand that you were. I look forward to your reporting on the concerns raised and the difficulty the audit committee is having getting answers.

Vince Caruso

Mon, Mar 18, 2013 : 2:37 p.m.

Support this change. DDA needs to be checked on the position that bigger is always better (for them yes higher TIF, but may not be for the community). Small cities work better than large ones and are more in human scale. DDA should not be cover for those on Council who don't want to take heat for an unpopular position.

Veracity

Mon, Mar 18, 2013 : 2:27 p.m.

Ryan, Can you clarify how the DDA's overall cash reserves are at $8.6 million now when a previous article of yours reported that the 2010-2011 audit of the DDA finances showed a reduction of the reserve fund to $2.7 million? Where did the DDA find an additional $6.0 million in the following 20 months? (from http://www.annarbor.com/news/ann-arbor-downtown-development-authority-audit-report/)

Ryan J. Stanton

Mon, Mar 18, 2013 : 2:46 p.m.

Here's a link to the DDA's latest audit: http://www.annarbor.com/Ann_Arbor_DDA_audit_2011-12.pdf The story you just cited states: "That dropped the DDA's overall fund balance by $2.7 million" "by" not "to" The DDA started the last fiscal year on July 1, 2011 with an $8.18 million fund balance. That's now up to $8.6 million.

Dog Guy

Mon, Mar 18, 2013 : 2:20 p.m.

Money collected for parking on public property is a tax.. Which founding father said taxation without representation is tyranny? All of them.

tosviol8or

Tue, Mar 19, 2013 : 1:44 a.m.

No, it isn't. A tax is levied without regard to benefits received. When you pay a parking fee, you receive a benefit. Whether your benefit is worth the fee you pay is one of microeconomics, not public finance.

UpperDecker

Mon, Mar 18, 2013 : 2:33 p.m.

Just park in a nearby neighborhood and walk. That will teach them.

Arboriginal

Mon, Mar 18, 2013 : 2:20 p.m.

Is it time to disband the DDA? Take this flash poll!

Left is Right

Tue, Mar 19, 2013 : 2:51 a.m.

Disband. See what happens.

Arboriginal

Mon, Mar 18, 2013 : 7:02 p.m.

Disband = thumbs up.

Goober

Mon, Mar 18, 2013 : 2:12 p.m.

Wow! Many seem to be violating AA.com comment guidelines. Go figure!

Itchy

Mon, Mar 18, 2013 : 2:14 p.m.

I agree with you Goob. Interesting that when a topic hits the public hot button, many comments are censored. Yes - go figure!

Brad

Mon, Mar 18, 2013 : 1:56 p.m.

One other thing - they should never, ever be allowed to "manage" a project like the Garage Mahal again. The awful schedule overrun inconvenienced thousands of people a day for months longer than planned, not to mention the damage it did to local businesses. Who thought they knew enough to do this in the first place?

Tom Whitaker

Mon, Mar 18, 2013 : 4:03 p.m.

Still waiting for a final cost analysis of that project and the Fifth/Division improvements project. Both were funded by the same bond issue.

fjord

Mon, Mar 18, 2013 : 1:56 p.m.

The level of arrogance shown in the quotes from the DDA members is breathtaking. $1 million would pay for how many firefighters? Police officers? Road repairs? Cough it up, DDA.

Goober

Mon, Mar 18, 2013 : 2:17 p.m.

I would venture a guess that being arrogant is one of the personality traits to being appointed on the DDA. The voters need to step up and pressure city council to make changes if they do not like the DDA, how it runs and how it is managed.

Brad

Mon, Mar 18, 2013 : 2:08 p.m.

Were there any quotes from Ms. Lowenstein? She really has a way with words.

Townspeak

Mon, Mar 18, 2013 : 1:48 p.m.

I believe the DDA should be made into a City commission, like the Parks one. This tax/parking money should go to the City, not the DDA. If the DDA is so great why do we have vacant storefronts, too high of rents, pan handlers galore, no ice rink or anything to do downtown for kids and families. The DDA is simply a waste as a separate and distinct tax collecting entity. Give them a budget, yet, but not power to tax and spend like an unelected mini city gov.

DJBudSonic

Mon, Mar 18, 2013 : 1:45 p.m.

Thanks for the attention to this audit. The DDA is rightly freaking out over this audit, heaven forbid that we who pay their way get to see exactly how our money is being spent. There is nothing wrong with establishing term limits in this case, either. I would think term limits would be supported by the Mayor, jockeying for appointments helps fill the old war chest,right? While you are at it find out if there is any way to keep SPARK 's hands out of the tax collection bag.

a2grateful

Mon, Mar 18, 2013 : 1:40 p.m.

Thank you to council representatives Kailasapathy and Kunselman for considering this examination of fiduciary accountability and responsibility for Ann Arbor tax dollars. Historical context question, Mr. Stanton: What major, successful projects has the DDA actually developed since its inception? Have they developed anything notable?

Skyjockey43

Mon, Mar 18, 2013 : 5:44 p.m.

Thank you 1st ward voters for voting in a voice of reason and common sense fiscal responsibility that has been sorely lacking in ths city council for far too long

Ryan J. Stanton

Mon, Mar 18, 2013 : 3 p.m.

Aside from some of the projects I mentioned in this story, the DDA seems particularly proud of its improvements to the downtown parking system. The "parking improvements" section of the report I just provided notes the construction of the Ann/Ashley parking garage (paid for entirely using TIF), Liberty Square parking garage (paid for entirely using TIF), Fourth and Washington, Forest and Library Lane garages (substantial amount paid for using TIF), and then the Maynard garage was completely renovated, and the Fourth and William garage was completely renovated with an additional floor added. Now the First and Washington garage is expected to be completed by April. The report also notes the Kline Lot on Ashley Street was entirely paid for using TIF funds. There's a lot more in the report, not just parking improvements, but that gives you an idea.

Ryan J. Stanton

Mon, Mar 18, 2013 : 2:52 p.m.

The DDA outlines its history of projects it has funded in this document: http://www.annarbor.com/DDA_info_2013.pdf

mendez

Mon, Mar 18, 2013 : 1:40 p.m.

The first step to fixing the DDA is removing the mayor from power and creating an appointee and board review committee. This board would be seated by half of the council members one from each ward. One elected official from each ward sits on the council the other on the appointee board. Crazy? Not really.... we would then be able to justify cutting all their salaries in half , even the Mayor. The DDA would then be under the purview (not control) of a board of elected officials. In defense of the non political members of the DDA Board, I'm sorry you are puppets for a few truly power hungry people, but deep down you know this needs to change. Im not tea party or conservative i am moderate liberal. As a voter My concern is that the DDA is a political/ financial instrument that benefits politicians and thier friends. Something that was created to fight urban blight, job well done. Today however, the DDA is a tax instrument without representation and politically and legally indestructable. The DDA is oligarchic in nature and behavior it most typically highlights how all Heijfte appointees are far to comfortable with their absolute power. Ann Arbor needs to take back their city from group of people who are not honest enough to see the problems they have created.

Left is Right

Tue, Mar 19, 2013 : 2:48 a.m.

The first step to fixing the DDA is maybe to disband it. In my opinion downtown will flourish without it. It served its purpose but that time has passed. Let's see what happens without it.

Patricia Lesko

Mon, Mar 18, 2013 : 1:39 p.m.

With a couple of exceptions, the DDA Board members are routinely criticized on AA.com as arrogant, out-of-touch cronies who thumb their noses at taxpayers. Ellie Serras, who headed the "Our New Downtown Library" committee told AA.com after the proposed millage went down in flames, "I think there were implications that the library was involved with the DDA (Downtown Development Authority) in some way…and the community responded." We need the DDA to keep parking revenues healthy? Um, nope. DDA Board member Roger Hewitt recently crowed about DDA's revenue per parking space: $784. Bringing in $784 in annual revenue per parking space is something to write about, because it's 98 percent below the national per parking space average, according to the most recent data compiled by the National Parking Association (http://www.a2politico.com/2013/01/high-overhead-debt-load-push-dda-parking-revenues-98-percent-below-national-average/). Prior to 2001, the city's parking system employed a unionized workforce, and parking cost .75 cents/hr. After John Hieftje took office, he pushed to have the DDA control parking. Hieftje and his unelected DDA Board friends broke the union. Now parking costs $1.50 per hour. Under the terms of Republic Parking's current contract the company is paid a $150,000 management fee, plus the $50,000 "performance-based" fee which DDA Board members—starting with Leah Gunn—have repeatedly referred to as a "tip" (http://www.mlive.com/opinion/ann-arbor/index.ssf/2009/03/other_voices_taxpayers_shouldn.html). This resolution is long overdue. Let's see who on Council will defend cronyism, and oppose these sensible checks and balances. Defending the DDA and its current Board could, perhaps, be a more serious political mistake than supporting the Percent for Art Program, and parkland for parking, as did Stephen Rapundalo and Tony Derezinski is their failed bids for re-election.

a2grateful

Mon, Mar 18, 2013 : 1:25 p.m.

Is a2 on the cusp? Do we continue to blindly trust leaders to represent "their interests," as we write blank checks with no questions asked? If yes, the status quo reigns: no cusp. Or, do we assert our voices so that leaders represent "our interests," establishing civic priority, while defining service level expectation and accountability? If yes, maybe the established guard is on the cusp. Curious. The established guard is not the old guard. The established guard is the self-serving new guard. The old guard is akin to former mayor Belcher's service philosophy, as recently posted here. This old guard is responsible for a2's greatness today. Some might contend that a2's durability has survived the new Hieftje regime. However, the cusp is upon us: Ann Arbor's durability as a great city may be in question. The new guard: Dwindling public safety resources. Crumbling infrastructure by choice, even though it has been fully funded. Parklands threatened and neglected. Pensions and healthcare unfunded. Planned major expansion of long-term debt for folly projects. Neighborhoods deconstructed. "Ignore the torpedoes: Full speed ahead." Is the current DDA structure part of the new or old guard? How do you want it to be? Please let your councilperson know! Keep it free reigning or reel it in? A very interesting discussion and vote are pending.

Stephen Lange Ranzini

Mon, Mar 18, 2013 : 1:19 p.m.

@G-man: I wrote "when property taxes rise" and what I *meant* by that was "when values and the actually taxable amount of assessments rise and as a result property taxes paid rise", which is quite the mouthful. I was not and did not refer to additional millage rate rises. We are both correct, but your description is more detailed as to the actual mechanism with respect to how and when increased property tax revenue falls into the DDA's "bucket". @Ryan Stanton's post at 8:51am and his first reply to his post provide the rest of the nitty gritty details. In my comments I generally assume some level of basic knowledge as to how things in municipal government work or whatever the topic is (and am happy to answer detailed questions on my comments like yours), because otherwise if I explain every detail my comments get way too long and fewer people read them, as I have found out in the past. I am always trying to find the happy medium between being too detailed and being too verbose, and sounding like a bad, boring, pedantic teacher!

Stephen Lange Ranzini

Mon, Mar 18, 2013 : 2:16 p.m.

@Veracity: Sorry, about that. I generally only repost a comment I make in a reply to a comment in the main thread if posts from that same thread are reposed by someone else in the main thread as happened in this case by @G-man. In this case especially it was needed because my comment was criticized by name. I do this because many people don't read the replies to comments, but just the comments. For careful readers like you I apologize in advance since it is repetitive!

Veracity

Mon, Mar 18, 2013 : 2:06 p.m.

Deja vu --- repetitious of a previous posting. Please do not assault the readers!

Sam S Smith

Mon, Mar 18, 2013 : 1:40 p.m.

I'd read it. If the posts are not a way of giving more info about something perhaps it should be reported as news.

G-Man

Mon, Mar 18, 2013 : 1:02 p.m.

The DDA was created by the State Legislature under Public Act 197 in 1975. It gives the authority for setting up the District and the local DDA can then set up the tax increment financing. Public Hearings had to be held at the time the District was created. The local taxing authorities had to approve. The money must be used for Public improvements within the district. Surplus monies received which are over and above monies to be expended in implementation of the plan must be returned to the local taxing authorities. Mr. Ranzini is not quite correct in his depiction of the DDA. The Tax Increment Financing is based on the taxes collected on the increase of assessed value of the real and personal property within the district over and above the base assessment year. It doesn't have anything to do with rising property taxes. For example, if the beginning base assessment for property in the district was $1,000,000 and the next year the assessed value for the same property went up to $1,200,000, the captured money by the DDA would be the amount of taxes that each taxing authority would collect on the $200,000 of assessed value increase. As the assessed value increases, subsequently the TIF funds increase. I think the parking structures are a separate issue from TIF. If the City has "turned over" administration of the parking system to the DDA, then that was their prerogative. If that is not working out, then the City should look at that decision and if they want to "take over" the parking structures on the City budget then that is what they would have to determine.

Left is Right

Tue, Mar 19, 2013 : 2:39 a.m.

Well Government Man,I've had no real opinion of DDA performance / usefullness one way or the other but your continuing rabid defense urges me to re-examine that. Somehow claiming any credit for the present success of downtown / campus doesn't jibe with my reality of what's happened there in the last 30 years. It would have happened DDA or not--and maybe it would have been more successful without!

Veracity

Mon, Mar 18, 2013 : 2:05 p.m.

Deja vu --- Entire statement is repeated from earlier. Please do not assault the readers!

Ryan J. Stanton

Mon, Mar 18, 2013 : 12:51 p.m.

Here's some extra background for those interested in the nitty-gritty details of all this: There's a portion of the city code from 1982 that states if the value of downtown property grows at a faster rate than anticipated in the DDA's TIF plan, at least 50 percent of the excess TIF capture must be given back to the taxing units. The code further states if the value grows at a rate more than double that anticipated in the plan, all the excess TIF funds must be given back to the taxing units. The DDA in 2011 interpreted the law to mean the DDA can't just collect excess TIF dollars and sit on them. The DDA's attorney said as long as the DDA has debt to pay on capital projects like parking garage improvements, the DDA's first obligation is to pay off the bonds, and as long as the TIF is being spent, the DDA isn't required to refund any TIF money to the taxing units. The changes being proposed attempt to clarify how to calculate whether a TIF refund is due from the DDA to taxing units. That includes a clarification that the calculation must include real and personal property taxable values, that the calculation must use the tax base growth estimates in the DDA's TIF plan that are labeled "realistic" instead of "optimistic," and lastly that the calculation no longer can consider an allocation of TIF revenues to debt service as a "disqualifying condition" or cause to avoid giving the refunds to the different taxing units. The changes being proposed also state any TIF money used by the DDA must be specifically allowed under the 1975 state law that created DDAs and must directly benefit properties within the DDA district. Lastly, the changes make it clear the DDA is required to submit an annual TIF report to the city before the first regular meeting of the City Council each January.

jcj

Mon, Mar 18, 2013 : 1:03 p.m.

DDA came out with its legal interpretation that it didn't have to do that. There in lies one of the problems! The DDA is running city hall.

Ryan J. Stanton

Mon, Mar 18, 2013 : 12:53 p.m.

The DDA's TIF income has grown substantially over the last several years due to new developments downtown. According to the DDA's own calculations in 2011, nearly $1.2 million in excess TIF money had been captured since 2004. About $711,767 of that was owed to the city, but the City Council voted in May 2011 to forgive the DDA, citing other financial support the city has received from the DDA over the years. Meanwhile, the DDA agreed in May 2011 to return about $473,000 to three taxing units: Washtenaw County, Washtenaw Community College and the Ann Arbor District Library. The checks already had gone out to those three units to repay them for the excess captures before the DDA came out with its legal interpretation that it didn't have to do that.

Nicholas Urfe

Mon, Mar 18, 2013 : 12:49 p.m.

The DDA is more like a cabal, or a club, than an organization accountable to the residents of this town. They have frequently demonstrated how they force their own agenda, while trying to project the appearance of accepting public input - so long as your input matches their goal. These changes will help reign in the DDA, and constrain their power.

Left is Right

Tue, Mar 19, 2013 : 3:10 a.m.

Maybe G-man's got the Kwame with the DDA

Sam S Smith

Mon, Mar 18, 2013 : 1:56 p.m.

G-Man why wouldn't you want someone to look into audits, etc. ? DDA is a public entity not a private one.

Sam S Smith

Mon, Mar 18, 2013 : 1:48 p.m.

Does Public Act 197 give DDA free reign to do what it only wants?

G-Man

Mon, Mar 18, 2013 : 1:07 p.m.

Obviously you are not familiar with Public Act 197

Sam S Smith

Mon, Mar 18, 2013 : 12:49 p.m.

Thank you S. Kailasapathy and S. Kunselman!

Sam S Smith

Mon, Mar 18, 2013 : 1:37 p.m.

And how is this illegal G-Man? Please explain in detail.

G-Man

Mon, Mar 18, 2013 : 1:09 p.m.

Thanks for something they cannot legally do.

yohan

Mon, Mar 18, 2013 : 12:47 p.m.

Why are there no public restrooms in downtown AA? Almost all other cities of decent size have them. Why are there no workers to clean the sidewalks on a daily or at least biweekly basis (i.e. barf patrol)? These are the kind of improvements that many except from the DDA. Not catering to the interest of out of town developers.

a2miguy

Mon, Mar 18, 2013 : 4:53 p.m.

Easy... because no one in this town would ever be able to agree on where to put them.

UpperDecker

Mon, Mar 18, 2013 : 2:31 p.m.

Public bathrooms would be ideal, even Detroit has them in some areas. I do see people cleaning the sidewalks around maynard area, but I don't know if they are working for the city or a local business.

yohan

Mon, Mar 18, 2013 : 1:51 p.m.

G-man, Yeah, I thought about attending a DDA meeting and voicing my concerns but looking at the experience of others that have done so, I am sure that I would be ignored, if not made fun of.

G-Man

Mon, Mar 18, 2013 : 1:11 p.m.

Have you ever attended a DDA meeting? Perhaps it would be helpful to take the time to show up and make your concerns known?

yohan

Mon, Mar 18, 2013 : 12:49 p.m.

OOPs, that's expect

Linda Peck

Mon, Mar 18, 2013 : 12:41 p.m.

Limitations or elimination of the DDA are happily anticipated by many citizens of Ann Arbor. We need now to ensure that the people who live in Ann Arbor and pay property taxes do not continue to be overtaxed, and have decent police and fire departments, and good roads, as well as a nice downtown place for visitors from out of town. Yes, we are vibrant, but I don't agree that it is because of the existence of the DDA. As in all government, term limits should be the standard. The power of the DDA is excessive. It reminds me of these same issues at the State and Federal levels that have yet to be solved.

G-Man

Mon, Mar 18, 2013 : 1:14 p.m.

DDA doesn't have anything to do with the amount of taxes you pay. Please read the Act, get informed, attend a DDA meeting. If you are "overtaxed" now, you should be talking to the taxing bodies that are implementing the taxes (such as City Council, Schools, County, ISD, etc, etc)

Jim Osborn

Mon, Mar 18, 2013 : 12:12 p.m.

"It's now proposed that we change the rules about that, about how we capture the TIF. Frankly, I hear no reason for that," he said. It appears that all of the DDA members actually think of the money that the DDA collects via taxes or parking fees as their money to spend as however they see fit, accountable to no one else. Stephan Ranzini said it very well that "any working capital on hand above the prioritized strategic needs of any entity owned by the City of Ann Arbor ought to be returned immediately to the General Fund." Council members Kunselman and Kailasapathy are correct to question the DDA and want to divert some of this city owned money back to the city back to the control of the city before it is spent on a lesser project instead of core city responsibilities. After all, it is our money, not the DDA's money, and we can use it instead of being asked to pay ever higher taxes

Jim Osborn

Mon, Mar 18, 2013 : 1:51 p.m.

I lived in California 31 years ago when the council passed the DDA resolution. I have friends and neighbors who were preschoolers when this was passed, were they, too, supposed to have talked to the council 30 years ago or forever kept quiet? I'd bet a majority voters did not live in Ann Arbor 30 years ago and were over 18. No, it is not the DDA's money, it is taxpayer money that we, via our elected officials allow the DDA to have and collect, then spend. When we, as taxpayers via our elected officials decide to change the arrangement, we can and should. The time has come. It is not their money.

G-Man

Mon, Mar 18, 2013 : 1:21 p.m.

Jim, Apparently you did not make this sentiment known to City Council when they held the Public Hearing to approve the implementation of the DDA. You are incorrect in assuming that the legally obtained money that the DDA has acquired through the T.I.F. plan is not "theirs" to use according to their lawfully adopted plan. If they are collecting surplus monies above and beyond the plan, then that surplus must be returned to the taxing units. Mr. Ranzini is not 100% correct in his assertions. There are laws....

G-Man

Mon, Mar 18, 2013 : 12:11 p.m.

Sandi's got it right! Steve needs to take a class in DDA..... I suggest you check the Public Act for guidance. I don't know of anything that states a local unit of government can do what Steve K is proposing "I don't think the DDA needs another $1 million on top of the $3.7 million they already have because the city has needs of its own," Kunselman said. "And so do the other taxing units." It's not about "Need" Steve, it's about what the law is. It does not say that once a DDA "Gets too much" that you can take some away from it! The DDA district and T.I.F. HAD to be approved initially by each taxing body prior to its implementation. If the taxing units don't like it now, they have only themselves to blame. Apparently you just see a "cash cow" and can't stand it that you can't get your fingers on it. I suggest better spending your time on legal ways to reduce spending and lower taxes if you want to increase revenues.

Arboriginal

Mon, Mar 18, 2013 : 2:18 p.m.

Take that class Steve! G-Man knows, and you don't. Hee Haw!

Jeffersonian

Mon, Mar 18, 2013 : 11:45 a.m.

I become scared when appointed authorities think that they have an unconditional mandate to operate independently and unbiased- usually there is motivation that is sometimes hidden even to members themselves. Remember "what's good for GM is good for America?" If you were a GM board member you wouldn't have seen anything wrong with the statement. And even GM board members are elected. Of course there should be oversight to projects and plans for healthy growth. But remember that investors have risk, board members spending public funds not so much. Further, when elements of social engineering and favoritism creep into the agenda, as they have in the past, then bad decisions often follow.

G-Man

Mon, Mar 18, 2013 : 1:24 p.m.

The DDA was created by Public Act 197, 1975, it's not something just made up. I suggest overturning the Public Act if you are not in favor of it.

Technojunkie

Mon, Mar 18, 2013 : 11 a.m.

So part of the city agrees to charge itself extra taxes to pay for infrastructure, does a relatively good job of managing that with minimal bureaucracy, and city council wants a piece of the action? Sure looks like a money grab to me. Also a lesson in why governing should be done at the most local level possible, to the extent it happens at all.

dancinginmysoul

Mon, Mar 18, 2013 : 11:22 a.m.

Pretty much everything you just said is inaccurate.

dancinginmysoul

Mon, Mar 18, 2013 : 10:59 a.m.

Oh please please please! Downtown Ann Arbor needs the DDA reigned in, as well as regulated. Also I cannot attribute the downtown vibrancy to the DDA. The success should be recognized as a joint effort between the businesses and members of the community. Loyalty to shopping and eating downtown - despite the ridiculous parking fees, road closures and construction- is why we still have such a unique area filled with locally owned independently owne

Tom Whitaker

Mon, Mar 18, 2013 : 3:52 p.m.

"Parking is a $1.20 an hour." Or any fraction thereof...

UpperDecker

Mon, Mar 18, 2013 : 3:49 p.m.

I hear those complaint as well and I wasn't trying to be rude, I am just used to paying so much more for parking that it seems wild to me that people get so riled up over it! I would definitely prefer to NOT pay for parking when going to work lol.

dancinginmysoul

Mon, Mar 18, 2013 : 3:29 p.m.

Upper: I never asked you to feel sorry for me. I grew up in downtown Ann Arbor and have worked here in downtown Ann Arbor the majority of my life. The biggest complaint I hear from people who live, work, and shop downtown is the parking.

DeeAA

Mon, Mar 18, 2013 : 3:17 p.m.

I used to work downtown in the 70's. The current monthly parking rates are about the same, after adjusting for today's dollars. $100 per month, $25 per week is only $5 per day in today's dollars.

UpperDecker

Mon, Mar 18, 2013 : 3:11 p.m.

Plus assuming you work a 5 day work week, paying $100 for a month would be much cheaper than paying out every day by the hour.

UpperDecker

Mon, Mar 18, 2013 : 3:09 p.m.

Meh sorry I can't feel bad for you. I moved here from Chicago and I am used to paying to park in a city. If you don't like paying for the luxury of parking downtown then you can park in the nearby neighborhoods and walk like I see lots of people doing every day. There is even the lot across from the Y that is like $5 all day.

dancinginmysoul

Mon, Mar 18, 2013 : 2:36 p.m.

Yes, parking is 1.20 an hour. Which is no big deal if you're downtown 2-3 hours a week. And what of those individuals who work downtown. If I park in a structure for a "normal" work day, I'm looking at $10.80 a day just to park. Not to mention the parking tickets handed out freely. Monthly passes cost more then $100 a month. Maybe you'd like to pay my parking fees then, since you believe they aren't excessive. Completely ridiculous.

UpperDecker

Mon, Mar 18, 2013 : 2:28 p.m.

Parking is a $1.20 an hour. Not Ridiculous At All

G-Man

Mon, Mar 18, 2013 : 1:26 p.m.

The DDA is regulated by its creating legislation, PA 197, 1975. They are bound to act according to law. Perhaps you should try to get on the Board and perhaps you will gain insight into how the DDA has to operate.

dancinginmysoul

Mon, Mar 18, 2013 : 11:02 a.m.

oops...*local, independently owned shops and restaurants.

Stephen Lange Ranzini

Mon, Mar 18, 2013 : 10:53 a.m.

As a basic principle, any working capital on hand above the prioritized strategic needs of any entity owned by the City of Ann Arbor ought to be returned immediately to the General Fund. Those needs should prioritized by city council with help from the city administrator by importance across all city funds (also known as separate accounts or "buckets"). For the city of Ann Arbor, the government's first priority MUST be the health and safety of it's citizens, but in this key area we are falling short. We should set the following top objectives: a police car in front of any address in two minutes, a fire truck in four minutes, waste pick up every week with a sanitary disposal methodology, clean water, waste water and flood water management, road repair, etc. Extra money piling up in separate funds and buckets like the DDA burn holes in their pockets and result in boondoggle spending like "The DDA also contributed $8.2 million to the city's new municipal center [Rog Mahal]. It is time to drain the buckets to fund the priorities!

jondhall

Tue, Mar 19, 2013 : 5:34 p.m.

What country you from?? Are they accepting immigrants

BobbyJohn

Mon, Mar 18, 2013 : 3:32 p.m.

Seriously, if Mr. Ranzini runs for mayor, I will support and campaign for him. Stephen, thanks for caring so much for our town!

Stephen Lange Ranzini

Mon, Mar 18, 2013 : 2:08 p.m.

@G-man: wrote "does PA 197 allow Cities to "slow the growth" of captured dollars?" The Act empowers a city to establish a DDA and set certain parameters on its future operation. As @Ryan Stanton notes: "There's a portion of the city code [establishing the DDA] from 1982 that states if the value of downtown property grows at a faster rate than anticipated in the DDA's TIF plan, at least 50 percent of the excess TIF capture must be given back to the taxing units. The code further states if the value grows at a rate more than double that anticipated in the plan, all the excess TIF funds must be given back to the taxing units." So, the answer to your question is "yes".

G-Man

Mon, Mar 18, 2013 : 1:36 p.m.

Thanks, Stephen, but does PA 197 allow Cities to "slow the growth" of captured dollars? I have been led to believe that the Act was created to encourage the growth the properties ( and assessed values) within the District, thereby enhancing the District. Beside, the DDA is not taking away money from the taxing authorities on these new projects, it's just revenue that the units do not receive.

Stephen Lange Ranzini

Mon, Mar 18, 2013 : 1:11 p.m.

@G-man: Please see @Ryan Stanton's post at 8:51am and his first reply to his post. The details of this proposal are a creative and legal mechanism to slow the growth of the TIF taxes being captured by the DDA and increasing the general fund property taxes flowing to the City, County, Washtenaw Community College, Ann Arbor District Library and AATA. These taxes are being generated from new buildings being built in the huge surge in downtown tall building construction.

Stephen Lange Ranzini

Mon, Mar 18, 2013 : 12:26 p.m.

@G-Man: There is nothing in the Act that requires the city to hand over the profits from the downtown parking system to the DDA. The parking system was given to the DDA by a resolution of City Council and that resolution can be revoked or modified. Many restrictions on funds trapped in the 58 separate funds of the city ("buckets"), are trapped there ONLY because of a past resolution of city council, which can be revoked or modified. There is over $100 million of such funds lying about in the city government, overall according to the city's annual audit report (CAFR). There are many legal options to Drain The Buckets and all it takes is a little hard work and outside the box thinking. As a top priority the city manager, mayor and city council ought to be working on finding all those strategies!

Jim Osborn

Mon, Mar 18, 2013 : 12:17 p.m.

Very well said. I will add that we need to divert the flow that fills these buckets before the DDA hatches another BIG DIG spending project.

G-Man

Mon, Mar 18, 2013 : 12:16 p.m.

What you suggest is not the way the Public Act is written, Stephen. If there is something in the Public Act that allows "draining" the lawfully acquired money by the DDA, then by all means, please point it out.

Bcar

Mon, Mar 18, 2013 : 10:51 a.m.

downtown works juuuuust fine on its own. We dont need a DDA!!

Bcar

Mon, Mar 18, 2013 : 2:01 p.m.

oh yes G-man, Capitalism, supply-and-demand never work without big smarter-than-you government...

G-Man

Mon, Mar 18, 2013 : 12:16 p.m.

It wouldn't work so fine without the DDA influence

Alan Goldsmith

Mon, Mar 18, 2013 : 10:50 a.m.

Kunselman and Kailasapathy deserve kudos for bringing up this issue for discussion. What about other Council members? They need to step up to the plate. Not surprised the Greek chorus of Mayoral Appointees are fine with diverting tax dollars from the rest of the City for their own special interests. And can't believe you bring up Sandi Smith and fail to mention she was one of the Mayor's rubber stamps on City Council. I, for one, want the DDA abolished but the changes offered by Kunselman and Kailasapathy are a good compromise and a step in the right direction. Ryan, can we get a list of DDA salaries posted to this article? Thank you.

Bob W

Mon, Mar 18, 2013 : 10:43 a.m.

Why is there this separate entity in the first place? Why is it so independent from city government? Can anyone enlighten me on the history behind this?

Real Life

Wed, Mar 20, 2013 : 2:57 a.m.

The DDA accomplishes things, city council? Not so much.

LXIX

Mon, Mar 18, 2013 : 4:52 p.m.

If one doesn't know their history they are bound to repeat it. Some from the seventies 1. Baby boom families needed more 60's housing. The new hosuing was built in outlying suburbs. People moved out and took their shopping carts with them. Malls stripped downtowns of their historic businesses. 2, Mostly poor people were stuck downtown with a decaying infrastructure and set taxes. Unions were powerful and corrupt. Random young crime was prevalent. New York was renowned for its cronyism, strikes, huge trash piles, and daily muggings. 3. Nixon and the growing protest over the Vietnam not-a-war led to disrespect for governance and its ability to manage. The same mistrust was held for large corporations. They were broken up. 4. Peak Oil arrived in the U.S. where crude production began to drop - rapidly. That and war between Israel and its neighbors realized what oil embargos could do to the Western economy. The first time economically threatened by outsiders there was an oil shock. Coupled with large government expenses for "War" led to large economic instabilities which further eroded government's credibility. Smaller and more local control was safer. 5. By the late seventies the voters (including impatient boomers) demanded change they could believe in. So new legislation was written. Removing downtown controls from the "ineffective" government led to the DDA. Business allowed to serve its own interest free of governance to spur economic renewal for .

Stephen Lange Ranzini

Mon, Mar 18, 2013 : 12:44 p.m.

@G-man: I wrote "when property taxes rise" and what I meant by that was "when values and the taxable amount of assessments rise and as a result property taxes paid rise", which is quite the mouthful. I was not referring to additional millage rate rises. We are both correct, but your description is more detailed as to the actual mechanism with respect to how and when increased property tax revenue falls into the DDA's "bucket". In my comments I generally assume some level of basic knowledge as to how things in municipal government work or whatever the topic is (and am happy to answer detailed questions on my comments like yours), because otherwise if I explain every detail my comments get way too long and fewer people read them, as I have found out in the past. I am always trying to find the happy medium between being too detailed and being too verbose, and sounding like a boring and pedantic teacher!

G-Man

Mon, Mar 18, 2013 : 12:31 p.m.

The DDA was created by the State Legislature under a Public Act in the early 1980's. It gives the authority for setting up the District and the local DDA can then set up the tax increment financing. The money must be used for Public improvements within the district. Mr. Ranzini is not quite correct in his depiction of the DDA. The Tax Increment Financing is based on the taxes collected on the increase of assessed value of the real and personal property within the district over and above the base assessment year. It doesn't have anything to do with rising property taxes. For example, if the beginning base assessment for property in the district was $1,000,000 and the next year the assessed value for the same property went up to $1,200,000, the captured money by the DDA would be the amount of taxes that each taxing authority would collect on the $200,000 of assessed value increase. As the assessed value increases, subsequently the TIF funds increase. I think the parking structures are a separate issue from TIF. If the City has "turned over" administration of the parking system to the DDA, then that was their prerogative. If that is not working out, then the City should look at that decision and if they want to "take over" the parking structures on the City budget then that is what they would have to determine.

Bob Needham

Mon, Mar 18, 2013 : 12:29 p.m.

Bob W, the state government initially set up the DDA mechanism as a way to revive struggling downtown districts. I'm not sure they are really any more independent from the rest of their cities than any other appointed board or commission; they're just higher profile and have more money to work with.

Stephen Lange Ranzini

Mon, Mar 18, 2013 : 11:40 a.m.

@Bob W: In addition to tax increment financing (TIF) property tax capture when property taxes rise in the DDA area, the major funding source of the DDA is from the parking structures. Before the downtown parking system was handed over to the DDA, city council failed to properly manage the downtown parking structures. Too little funding for maintenance was provided and the structures were mismanaged and neglected. For example, road salt was allowed to damage one structure to the point that it corroded and later had to be torn down. Councilwoman (later State Senator) Liz Brater was elected Mayor of Ann Arbor on a platform attacking the mismanagement of the parking structures.

Steve Hendel

Mon, Mar 18, 2013 : 10:47 a.m.

Because that's how the City Council set it up, back when.

Carole

Mon, Mar 18, 2013 : 10:39 a.m.

Frankly, I believe that all of the tax dollars collected should as well as the parking fees should go to the city. Then if they wish, provide a reasonable budget to DDA (personally I think they should be shut down. And, they would have to stay within the budget limits. It has been my understanding that frequently they have gone why over budget and the city bails them out. Hmmm. No way, in fact just shut them down.

Alum

Mon, Mar 18, 2013 : 10:34 a.m.

YES, YES, YES. Finally some control over this agency. I'v always gotten the impression that this group has been too independent. Some of their decisions make me wonder who their working for. Certainly not for the electorate of AA. The city and citizens need more say in all their decisions.

LXIX

Mon, Mar 18, 2013 : 3:36 p.m.

G-Man that is a misleading statement. While abolishing the State Act is a thought, hmmm, it only allows municipalities to create and dissolve their own DDA's. Ann Arbor voters can "instruct" their City Council to do the later at any time.

G-Man

Mon, Mar 18, 2013 : 12:57 p.m.

The DDA is founded by Public Act 197 of 1975, the Public Act by the State cannot be arbitrarily altered by the City. Look at the Act for enlightenment