New report: Eliminating personal property tax would deal $43M blow to Washtenaw County

Local governments and schools in Washtenaw County stand to lose about $43 million if Michigan's personal property tax is eliminated without providing replacement revenue.

That's according to a new report from Raman Patel, the county's equalization director, who says Washtenaw County government alone stands to lose $5.6 million.

Patel's analysis looks at the potential impact on the county, cities, townships, villages, schools, community colleges and other taxing authorities if state-level talks of eliminating the personal property tax — the tax businesses pay on equipment — pan out.

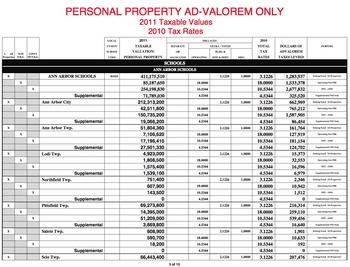

A screen shot of the county's new report on personal property taxes.

About $4.1 million would be chalked up as a loss for state education, while libraries could lose $1.58 million and local school districts stand to lose $14.6 million.

Washtenaw Community College stands to lose another $3.5 million, and the Washtenaw Intermediate School District stands to lose $3.62 million.

According to the report, townships in Washtenaw County stand to lose a collective $1.57 million, with the biggest hit being to Pittsfield Township at $658,825.

The city of Ann Arbor's general fund currently takes in about $78 million a year in revenue, and personal property taxes account for about 4.6 percent of that. Cutting that much from the budget would be about the equivalent of 35 full-time police and fire positions.

All six lawmakers representing Washtenaw County in the state Legislature agreed at a forum last week that eliminating the personal property tax is worth considering, but they all stressed they don't want to deal another blow to local governments by not providing replacement revenue. Most agreed it should be a dollar-for-dollar replacement.

"I think it's important to mention that, when we talk about local governments depending on this revenue, that means public safety," said state Rep. Jeff Irwin, D-Ann Arbor.

Republicans characterize the elimination of the personal property tax as the second phase of a two-part overhaul of the state's business tax structure. That started earlier this year with the elimination of the Michigan Business Tax.

Gov. Rick Snyder told AnnArbor.com in an interview last month it could take up to a decade for the state to tackle personal property tax reform, though.

The Michigan Municipal League is among the groups that have come out in opposition of eliminating the personal property tax without replacement revenue. The MML calls the tax one of the last stable sources of revenue left for local governments and public schools.

The MML did its own analysis recently showing the potential impact of eliminating the personal property tax as a percentage of local government budgets.

Leah Gunn

"We would not be able to maintain the mandated services we are required by state statute to do, so county government would essentially disappear," she said. "We are the ultimate safety net for the community, and I would hate to think of the consequences."

Saline Mayor Gretchen Driskell said it also could have devastating consequences in her city, which she said relies on personal property taxes for 17 percent of its revenue. She said elimination of the tax would mean the city would have to cut entire departments.

"It's a huge issue," she said. "It's very worrisome when we've already been cutting over the last 10 years. That's something we're going to have to be seriously looking at."

Driskell said 43 states have personal property taxes, so she's wondering why there's such strong emphases on eliminating it in Michigan.

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's e-mail newsletters.

Comments

Sallyxyz

Wed, Oct 19, 2011 : 1:44 p.m.

Don't worry, they will just raise the property taxes to make up for any losses in the personal property taxes. They will get the money from somewhere. We will all pay more if this tax is eliminated under Ricky.

bobfromaccttemps

Thu, Oct 20, 2011 : 12:42 p.m.

When taxes are passed through we have the choice to purchase the product or not. Directly taxed we do not have that choice. We already pay for the programs with our real estate taxes by the way.

Mike

Wed, Oct 19, 2011 : 3:08 p.m.

You want the benefits you should pay for them directly then you'll understand how much you pay in hidden taxes passed through from businesses. Why put it on businesses who could be spending their time trying to create jobs instead of meeting regulatory requirements? We don't pay taxes we just pass them through to consumers so you pay anyway. Can't people grasp that concept?

BigMike

Wed, Oct 19, 2011 : 8:45 a.m.

Eliminate the personal property tax! It ranks among the most absurd and anti-success forms of taxation. Let's see, my business pays tax on personal property that we already paid for - and paid sales tax on - and often have fully depreciated. So we're penalized for buying equipment that's used to run or improve our business. And on top of that we pay big bucks for our accountant to figure out what we should pay each year. Hate it!

bobfromaccttemps

Wed, Oct 19, 2011 : 6:18 p.m.

Yeah I could be productive like Mike and play on the internet instead of taking my advice and looking at the return and seeing I could save some money by doing it myself.

Mike

Wed, Oct 19, 2011 : 3:05 p.m.

I'm with you big Mike, Bob like paperwork and is probably an accountant who doesn't want it to go away otherwise he'd have to do something productive with his time

bobfromaccttemps

Wed, Oct 19, 2011 : 12:54 p.m.

Quit paying the big bucks to the accountant. If it takes you more than 15 minutes to file that return I would be very surprised. For the most part you are just copying the prior year return and adding new purchases and subtracting disposals.

djacks24

Tue, Oct 18, 2011 : 10:44 p.m.

Nobody seems to realize a tax based on property values is a joke. It used to be property was the one thing nearly guaranteed to gain or hold equity. Why should we pay nearly the same amount of money (or more) for the services that are being hacked away, while our property values diminish daily? At least when our property values remained at or above a certain level it was a win win. Now it's well established over events of the last few years that it's not at all fair to tax payers. Nobody is talking about eliminating revenue altogether, but we sorely need a state and federal tax structure based on today's circumstances and not circumstances of the 19th century. The entire system is broken and needs a 21st century overhaul and not more kicking the can down the road.

Mike

Tue, Oct 18, 2011 : 8:48 p.m.

It's a pain in the rear to fill out the paperwork to pay the personal property taxes. Maybe there's a better way to tax businesses that doesn't require any paperwork. Maybe just tax them for having a business or something that would actually be a lot more palatable instead of having another tax to deal with and paying someone to process and check it. Non-business owners just think it's no big deaL, money grows on trees when you're in business and you have nothing to do but sit around and fill out paperwork. Many businesses are actaully punished by growing larger because the regulatory burden increases once they get over a certain number of employees - solution is to stay small and not grow. We eliminated our 401K plan and health care plan due to increasing regulations and requirements to contribute 3% of payroll to every employee's retirement. That was the final nail in the coffin for our 401K plan, now nobody can take advantage of it. But I'm not worried because the government has said they're going to take care of me cradle to grave so I don't have to worry; and besides once the "rich" pay their fair share all will be good.

Mike

Wed, Oct 19, 2011 : 3:04 p.m.

@bob - you must be one of those paper pusher types - good for you - enjoy while other people do productive things Just one of many forms that need to be filed every year/quarter, etc. Eliminate them all. I waste way too many hours every year on government mandated forms to fill out. What a waste of time. I have no desire to grow my business, it just means larger government regulatory burdens. I have enough already and don't have departments with employees to fill out all of the paperwork like a large company. Non-business owners don't get it......

bobfromaccttemps

Wed, Oct 19, 2011 : 12:51 p.m.

If it takes you more than 15 minutes to file that return I would be very surprised. For the most part you are just copying the prior year return and adding new purchases and subtracting disposals.

weberg

Tue, Oct 18, 2011 : 8:28 p.m.

How about portraying the numbers with a different lens, such as..... "Cutting that much from the budget would be about the equivalent of 5 city hall art sculpture installations."

Stephen Lange Ranzini

Tue, Oct 18, 2011 : 10:47 p.m.

Despite tons of virtual ink spilled about the sculpture, the fact is that "it" doesn't actually have a name, which is a shame since "we" spent $750,000 on it. I propose that the *citizens* christen the sculpture and give it a name! In that spirit, University Bank has announced a new online poll to name the Dreiseitl water sculpture in front of City Hall. Join in the fun and please click here: <a href="https://www.surveymonkey.com/s/W333K58" rel='nofollow'>https://www.surveymonkey.com/s/W333K58</a> to take the poll and to see the current proposed list of names! We'll announce the initial results of the poll when the sculpture is finally working!

Top Cat

Tue, Oct 18, 2011 : 8:09 p.m.

How about replacing it with an income tax surcharge on all people who identify themselves as "Progressives"?

clownfish

Wed, Oct 19, 2011 : 2:11 p.m.

Why? Don't you use the roads too? Or do you have a magic carpet you ride to work?

Joe_Citizen

Tue, Oct 18, 2011 : 8 p.m.

I say give tax incentive to the companies, and count it as "per 100 employees" or something like that. If they have employees paying taxes, then they don't have too. So say they have to pay some $50,000 for taxes, if they have enough employees that are already paying their taxes, then allow it to be deducted from the companies, or something like that.

Joe_Citizen

Tue, Oct 18, 2011 : 7:52 p.m.

No matter how it goes, it's going to be paid by us anyway.

John Q

Tue, Oct 18, 2011 : 10:38 p.m.

"Who's the "us" you're talking about? Would that be the 50% who pay no income taxes or the 50% that do?" I love when conservatives parrot their talking points, even when they don't apply. In Michigan, we have a flat income tax. Everyone who earns income pays it. Thanks to Snyder and the Republicans, the working poor and the elderly saw their deductions and credits reduced or eliminated so that even the people at the low-end of the income scale are being forced to pay more to fund the business tax break.

TC

Tue, Oct 18, 2011 : 9:56 p.m.

Most likely, it will be paid by the poor, the elderly and the school children. Just look at the record.

Mike

Tue, Oct 18, 2011 : 8:50 p.m.

Who's the "us" you're talking about? Would that be the 50% who pay no income taxes or the 50% that do?

leaguebus

Tue, Oct 18, 2011 : 7:40 p.m.

@JSA There was a story yesterday about this, Snyder and his crew want to eliminate this tax because it stops job creation by business. As I said yesterday, all the auto plants built elsewhere in the country were given huge incentives by the states that got them and now some of the lower tax states are in trouble because of these incentives and the low taxes that they levy. It takes money to run a state and if the elected officials keep cutting taxes, whether it is business tax or individual taxes, things like education, public safety, roads, and bridges will not get funded adequately. Snyder and his Republican intellectuals think by cutting business taxes that companies will magically build plants here. The truth is that it takes money to make money, so if the state does not have money to give larger incentives than other states, which we don't, we won't get the plants and jobs. Cutting taxes makes no sense at this juncture, as all it does is deprive the state of capital to lure businesses to the state. Plus companies look for an educated workforce and our level of education is falling fast as revenue falls. It is a vicious circle.

Mike

Tue, Oct 18, 2011 : 8:46 p.m.

"The truth is that it takes money to make money, so if the state does not have money to give larger incentives than other states, which we don't, we won't get the plants and jobs. Cutting taxes makes no sense at this juncture, as all it does is deprive the state of capital to lure businesses to the state." - So your answer is to take money from businesses so the state can give it to other businesses so they can pay taxes to give to other businesses and so on. Did I get that correctly?

JSA

Tue, Oct 18, 2011 : 8:30 p.m.

Thanks for letting me know. I missed that one.

JSA

Tue, Oct 18, 2011 : 7:18 p.m.

Did I miss something. I don't see where any bill has been drafted much less introduced. This sounds like people floating an idea for future consideration.

Lori Cash

Thu, Oct 20, 2011 : 1:27 p.m.

Currently 2 bills have been submitted to eliminate personal property taxes.

EyeHeartA2

Tue, Oct 18, 2011 : 7:13 p.m.

HEADLINE: "Eliminating personal property tax would deal $43M blow to Washtenaw County" Waaaaaaay down in the story: "Most agreed it should be a dollar-for-dollar replacement." I thought you were better than that, Ryan.

TC

Tue, Oct 18, 2011 : 9:54 p.m.

That's exactly the problem. There are no replacement dollars. Everyone agrees that there should be, but do you really think that the Tea Party types are going to let that happen? If Snyder wants to end one tax he needs to replace it with another. Share the sacrifice? I doubt it.

lumberg48108

Tue, Oct 18, 2011 : 8:39 p.m.

OMG --- this graph should be in the lead (for context) -- instead its "below the fold" in newspaper speak "All six lawmakers representing Washtenaw County in the state Legislature agreed at a forum last week that eliminating the personal property tax is worth considering, but they all stressed they don't want to deal another blow to local governments by not providing replacement revenue. Most agreed it should be a dollar-for-dollar replacement."

Lolly

Tue, Oct 18, 2011 : 8:37 p.m.

I don't see any conflict in what you are pointing out. If the tax were eliminated, it would mean $43M less for the county. The fact that people agree it "should" be replaced doesn't mean much when they haven't identified a source for replacing it. Do you think it should be eliminated and then we go looking for alternative funds?