City income tax revenues can be volatile, unreliable during recession, Grand Rapids shows

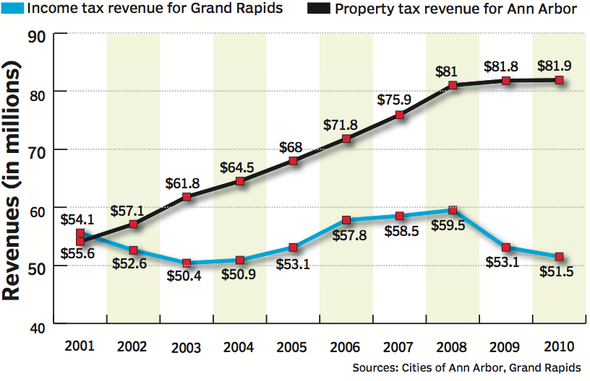

When the national economy turned south in 2001, the city of Grand Rapids — for the first time in its history — saw city income tax receipts start to spiral downward.

Over three years, revenues fell from $56.4 million to $50.4 million before stabilizing. By 2008, those numbers climbed back to $59.5 million as conditions improved.

But in the last two years, as the economy took another turn, income tax receipts plummeted to $51.5 million — an $8 million or 13.4 percent drop.

Tom Crawford, Ann Arbor's chief financial officer, has asked City Council members to weigh the option of a city income tax to help with the city's budget shortfalls.

Ryan J. Stanton | AnnArbor.com

As Ann Arbor officials consider a city income tax as a possible cure to the city's budget woes, Grand Rapids might be the best case study on how such a tax — directly tied to individual and corporate earnings — can fluctuate wildly with changes in the economy.

Under its current tax structure, Ann Arbor has been able to rely on steady growth in property tax revenues over the last decade. Total property tax collections grew every single year — by 51.4 percent overall — from 2001 to 2010, going from $54.1 million to $81.9 million, city records show.

"There's no doubt the property tax is more stable," said Tom Crawford, Ann Arbor's chief financial officer, who is weighing the city's revenue options right now. "The question is: Do we want to fund our government primarily off of property taxes, which is a relatively stable source, or do you consider restructuring the way government is funded and reduce your property taxes and implement an income tax?"

Ann Arbor officials are faced with a $2.4 million budget shortfall for the fiscal year starting July 1. After years of cutting services and reducing the number of employees, city officials fear further cuts could be draconian.

At a budget retreat earlier this month, Crawford asked Ann Arbor City Council members: Is it time to reconsider a city income tax?

Grand Rapids: a case study

As Grand Rapids saw its income tax revenues plummet over the last two years, Ann Arbor saw its property tax collections tick up by almost $929,000.

With revenues down, Grand Rapids voters went to the polls last year to approve an increase in the income tax rate to help avoid painful cuts to police and fire services.

The rate for residents and corporations rose from 1.3 percent to 1.5 percent, while the rate for non-residents went from 0.65 percent to 0.75 percent. With those increases, the city is now expecting to take in $61.2 million in income tax receipts this year.

"We don't regret it because without the income tax, we wouldn't have been able to do what we've done over the years," VanderWest said of the city's reliance on an income tax. "Grand Rapids, I think, has been very successful with the income tax. Obviously, it's volatile. It can go down in bad times, and it's now in the process of increasing our revenue."

In Ann Arbor, property taxes are the primary source of revenue, making up about 60 percent of the general fund budget. State funds, fees for services and other income make up the rest.

Because of its income tax, Grand Rapids has been able to keep property taxes relatively low. The city levies a total of 8.37 mills, including an operating millage of 2.86 mills.

That compares to Ann Arbor's 16.8 mills, including an operating millage of 6.17 mills.

Under Ann Arbor's city charter, if an income tax is approved by voters and adopted, the operating millage must be eliminated. That means most residents would see their property taxes — when also considering non-city taxes — come down by about 13.6 percent.

Ann Arbor officials estimate an income tax could bring in up to $12 million in additional net revenue annually. Following state law, the leading idea is to tax residents and corporations at a rate of 1 percent of income and non-residents at half that.

VanderWest, who now works part-time as a senior auditor for Grand Rapids after retiring from his higher post, said Ann Arbor officials should strongly consider the idea.

RELATED CONTENT

By that, VanderWest means Ann Arbor could tap into a currently untaxed population: The tens of thousands of people who commute to work in the city every day, including a majority of the 39,462 employees working for the University of Michigan.

Due to land occupied by U-M and other tax-exempt entities, about 40 percent of all property in Ann Arbor is off the tax rolls. It's been a sore point over the years as U-M reaps the benefits of city services like police and fire protection, and its employees drive daily on city streets and bridges, yet they don't pay any taxes to the city of Ann Arbor.

"We've got a large non-taxpaying entity in town, and that entity has significant economic activity going on," Crawford said. "As we're trying to manage a city government that serves our residents, considering an income tax where we're able to get some revenue from a chunk of the property that is not paying taxes may be an appropriate way for the government to be funded."

Various reports have estimated the number of non-residents who commute to work in Ann Arbor at anywhere from 50,000 to more than 75,000.

According to a July 2009 study prepared for the city by a consultant, Ann Arbor residents share about 76 percent of the city's tax burden under the current operating millage system, while corporations share 24 percent. Under an income tax system, non-residents for the first time in the city's history could potentially share about one-third of the tax burden.

Weighing the options

At this month's budget retreat, Crawford provided council members with three options for increasing tax revenues: A city income tax and two variations of a Headlee override.

The Headlee override has drawn less attention, but some city officials think it's the better choice given the uncertainties of a city income tax.

Council Member Mike Anglin, D-5th Ward, said too many unanswered questions remain about how a city income tax would work in Ann Arbor. He said he still hasn't seen solid figures on administrative costs or how many people the city would collect taxes from.

"We don't know the numbers exactly, so before even making a judgment on it, I want to make sure we have all the information," he said. "Generally, I'm leaning against it."

The 1978 Headlee Amendment to the state Constitution limits the growth of tax revenues to the rate of inflation. Steadily over the years, the combined effects of Headlee and Proposal A have whittled Ann Arbor's 7.5-mill operating millage down to 6.17 mills.

Most Ann Arbor City Council members have mixed feelings about an income tax. Council Member Mike Anglin, D-5th Ward, says he's generally leaning against the idea.

Ryan J. Stanton | AnnArbor.com

Council Member Sabra Briere, D-1st Ward, said she prefers the Headlee option because she sees it as a modest across-the-board tax increase. And she's still not convinced a city income tax makes economic sense for Ann Arbor.

But before going to voters and asking for more money, Briere said the city needs to make every effort to renegotiate contracts with its labor unions in good faith.

"Has the city shown that it's done everything it can to cut costs, to be frugal, to manage its money in the most rational way?" Briere said. "I think until the time comes that we've managed to convince the unions to renegotiate in good faith that we can't say that."

Ann Arbor's biggest budget challenge appears to be the constant escalation of employee costs coupled with declines in state revenue sharing. The city's revenue sharing payments have fallen from a high of more than $14 million a decade ago to just above $9 million last year.

And even as the city has slashed its workforce from 1,005 to 736 full-time employees over the last decade, the costs of pay and benefits in Ann Arbor city government — including retiree pensions — have risen from $86.7 million to $115.9 million since 2002.

The city's spending in other areas also has grown. For fiscal year 2010-11, Ann Arbor's total expenditure budget is $345.5 million, including the $81.5 million general fund.

Council Member Christopher Taylor, D-3rd Ward, is part of a working group of Ann Arbor officials considering the city's revenue options. Taylor said it's a real possibility the City Council could place an income tax or Headlee override question on the November ballot.

"My own view is that the residents of the city — the voters of the city — should have a say in the sort of city services they receive," he said. "They should have a say in what sort of funding the city has at its disposal to provide services."

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529.

Comments

John Q

Thu, Feb 3, 2011 : 10:14 p.m.

"Authors of the Snyder report have acknowledged it compared public sector workers with all private sector workers, including part-time workers and those earning minimum wage." "It's essentially impossible to do a job-by-job comparison for every public sector and private sector job," Anderson said. Another AlphaAlpha claim dies when exposed to the light of day. How many people here are willing to put their own wages and benefits up against those for part-time and minimum wage workers as comparison for whether they are fairly compensated or not?

Edward R Murrow's Ghost

Thu, Feb 3, 2011 : 4:58 p.m.

"Adding $3632 to the $103,769 from above gets the average total compensation of an Ann Arbor city employee to $107,401 per year." Indeed it does. Now what, exactly, do we think this means? It certainly does not mean that this is what every city employee receives. This is simply a talking point bereft of any real meaning. But at least there is a factual basis to it. That's a refreshing change. Now, let's take the next step, shall we? An earlier A2.com piece lays out the average pay (i.e., what shows up on one's W2) and cost of employment (e.g., benefits, employer payroll tax, etc...) for some city employees by their job category. That chart can be found at: <a href="http://www.annarbor.com/news/controlling-employee-costs-may-be-ann-arbors-biggest-challenge/">http://www.annarbor.com/news/controlling-employee-costs-may-be-ann-arbors-biggest-challenge/</a> So rather than discuss a meaningless average that lumps everyone together no matter their skills, education, and experience, it seems the table at the above link is a useful place to start. Those who think that Ann Arbor city employees are over-compensated ought then make their case using private sector comparisons to this table given similar levels of skills, education, and experience. And if they cannot make that comparison or are unwilling to do so, one can only conclude that they cannot make their case. I won't be holding my breath while I wait. Good Night and Good Luck

AlphaAlpha

Thu, Feb 3, 2011 : 2:51 a.m.

"Adding $3632 to the $103,769 from above gets the average total compensation of an Ann Arbor city employee to $107,401 per year." This brings new meaning to the phrase "Cool 107". The Cool 107 Club. Where human service contributions are 'too expensive'.

John Q

Thu, Feb 3, 2011 : 12:06 a.m.

"The idea is: equal pay for equal tasks, not equal pay for all tasks." Funny comment coming from you since you've never made any effort to determine which employees are getting under or over paid for their tasks. Proof of that is your claim that all employees are getting paid overtime, a claim that has no basis in fact. Yet another failed attempt to spread disinformation.

AlphaAlpha

Wed, Feb 2, 2011 : 2:36 a.m.

"AlphaAlpha's solution is to pay every worker in the city the same wage, no matter what ..." Either another diversionary debate tactic, or you are thinking of another pro-fairness commenter. The idea is: equal pay for equal tasks, not equal pay for all tasks. Diverting attention away from the fact that Ann Arbor city worker 2011 total compensation cost is $103,769? Par. Oh, but wait. There is more: we should include the cherished overtime pay, averaging $3,632 last year. Applying that number to this year's cost, a reasonable expectation, brings likely total compensation cost to a whopping $107, 401. As asked on another thread tonight, is $107,401 per year appropriate? Many believe not.

John Q

Tue, Feb 1, 2011 : 5:44 p.m.

Shifting to a 401k-style retirement will move the liability for pension costs off the city's books long-term. But the transition to such a plan actually costs the city more in the short-term to make that change.

John

Tue, Feb 1, 2011 : 2:53 p.m.

Let's stop figuring out ways to cut services, or raise citizen's taxes. Cut your salary and benefit packages, and go to a 401k like the rest of the working world.

John Q

Tue, Feb 1, 2011 : 1:37 p.m.

AlphaAlpha's solution is to pay every worker in the city the same wage, no matter what their experience, education or time with the city? The city manager's wage = the firefighter's wage = the pool lifeguard's wage. Interesting that the solution from our conservative friends is straight out of Soviet Comrade. Good day to you comrade.

John Q

Tue, Feb 1, 2011 : 1:35 p.m.

"Why are all the nice houses in Portage, not Kalamazoo? I suspect because people there are not interested in paying another tax." What tax is that? Kalamazoo doesn't levy an income tax. Now what do we blame the houses in Portage on?

Edward R Murrow's Ghost

Tue, Feb 1, 2011 : 1:23 p.m.

alphaalpha wrote: "Captain Casper wants us to know: $104K city worker cost is 46K above the 58K US private worker cost. 46K X 760 = 35M." As usual, bogus numbers topped by rude tone. But, this is what we've come to expect. The $104K you cite for city workers is for pay and benefits. The $58K you cite for private sector workers is for pay only. Moreover, as I KNOW you KNOW (after all, we've been over this ground before, haven't we, alphaalpha), the BLS website from which you draw this data says that the data cannot be used in the manner you do. The BLS web page makes clear that comparing pubic to private is comparing apples to raisins. But I'll let the BLS website tell the story. Quoting the BLS website at <a href="http://www.bls.gov/news.release/ecec.tn.htm" rel='nofollow'>http://www.bls.gov/news.release/ecec.tn.htm</a>: "Compensation cost levels in state and local government should not be directly compared with levels in private industry. Differences between these sectors stem from factors such as variation in work activities and occupational structures. Manufacturing and sales, for example, make up a large part of private industry work activities but are rare in state and local government. Management, professional, and administrative support occupations (including teachers) account for two-thirds of the state and local government workforce, compared with two-fifths of private industry." To put it differently, the pay of a hamburger flipper at McDonalds has nothing whatsoever to do with the pay of a police officer, and vice versa, which is what your simplistic little averaging exercise insists ought be the case. In other words, once again, as is almost always the case, your numbers are bogus. But thanks for letting me make that clear to people in this discussion strand. Good Night and Good Luck

Edward R Murrow's Ghost

Tue, Feb 1, 2011 : 2:27 a.m.

Nice reply, Eyeheart. I appreciate your thoughtfulness and, unlike some others, your willingness to work with facts and logic. Indeed, you and I aren't that far apart. You ask why I live in the township. It had nothing to do with taxes. Simply put, I could purchase more house for less money. That is still the case, I am quite certain. That tells me that despite A2's higher property taxes, the demand for housing in A2 keeps its per square foot housing prices higher than in the townships. If that is the case, I cannot imagine an income tax changing that picture because the property tax should go down more than the increase in income tax. Again, I don't see the income tax as desirable. But I think it might be the least worst solution. Good Night and Good Luck

AlphaAlpha

Tue, Feb 1, 2011 : 2:04 a.m.

"The question that needs to be asked is this: what is the quality of life in Ann Arbor worth? What is it that consistently lands this city in the list of best cities in the US in which to live? What will happen to that quality of life and to property values if parks turn to weed-infested fields, if Huron Hills becomes a condo complex, if insurance rates go up because fire and police protection fall below certain levels?" Good news: Lower compensation costs for city employees will allow more employees to be hired, which will improve services and lower unemployment; and there can be money returned to the taxpayers as well, raising their living standard. Win-win.

EyeHeartA2

Tue, Feb 1, 2011 : 1:57 a.m.

..and now, part II Why the budget problems? I suspect a lot has to do with the "bucket" fiasco we have going on. We sell things (like buying empty land in Webster Township) with dedicated millages. It only seems like a little bit (x for an $x,000,000 home), - sort of like charging "just a little bit" on your credit card, but pretty soon all those little bits add up to a bunch and people say "no more" to the next one. Add this to the highly publicized and very visual spending of dubious value we have taken on lately, and yes you do have a challenge. We sell our taxes at the margin, but the bill is due in total. An income tax is just kicking the problem down the road though and will ultimately lead to lower property values and lower income people living in Ann Arbor. At which point, the solution will, of course, be to ask for higher income tax rates and higher property tax rates, like they have in Detroit. Then the cycle repeats. Not sure why you live in the township, but with most people, one of the first things they mention is the taxes. That or wanting some space – usually followed by "plus the taxes are lower". Anyway, that's my take.

AlphaAlpha

Tue, Feb 1, 2011 : 1:55 a.m.

Mr. Stanton - Hopefully you will soon report on the newly published Citizen's Guide to Michigan's Financial Health? Thank you.

Ryan J. Stanton

Tue, Feb 1, 2011 : 10:41 p.m.

I wanted to do a report on that yesterday but got bogged down with the release of the county per diem report and a City Council work session. Hopefully you were able to read some of the news on the report that we aggregated on our site. There's a lot of information to glean from it, and it could seep into future stories.

EyeHeartA2

Tue, Feb 1, 2011 : 1:55 a.m.

ERM; Well, I think we agree, but for different reasons. I feel that income taxes on a city level are indeed correlated to poor quality of life within the city. Not overnight, but longer term lower income people will migrate to the city and higher income people will leave. Houses just outside the city limit will command more of a premium today than they have in the past. The big winners will be Scio and Pittsfield township, to a lesser extent Ann Arbor township. I feel that people who will be punished are those that live well below their means. People that are not house poor and didn't mortgage to the hilt, live modestly but have decent income (tenets I wish our city government ascribed to). Twenty five years ago, when we were looking for our starter house or a few years later when we were looking for our second house, an income tax would have sent us to the developments just south of I94 or Fleming Creek. As this scenario get repeated over and over again, the income you sought to tax will not be there and you will find yourself worse off than ever. We think UM won't move, but might the hospital? Might a technology park be conveniently located by the airport? UM may not move, but the professors and staff sure can. At which point, the person who moves into their house has a lower income than the professor that left. How about the Detroit Lions? Why is their practice facility in Allen Park/Dearborn? I suspect at least in part due to not wanting to pay the income tax in Detroit. Why are all the nice houses in Portage, not Kalamazoo? I suspect because people there are not interested in paying another tax.

AlphaAlpha

Tue, Feb 1, 2011 : 1:48 a.m.

Captain Casper wants us to know: $104K city worker cost is 46K above the 58K US private worker cost. 46K X 760 = 35M.

AlphaAlpha

Tue, Feb 1, 2011 : 1:40 a.m.

Mr. Bean - Your call for another 20% drop in RE is likely correct, and, in fact, conservative. You likely know that RE prices (most assets in fact), following credit manias, do not simply revert to the mean, they overshoot the mean, then get back to the mean. The magnitude of the overshoot phenomena is hard to gage, but easy to predict. Best models predict a bottom in 2016-2021, based on manias of recent times. It will play out in slow motion; few yet call it what it is: a depression. All- Regrettably, our property, and all, tax systems, 'assume' prices only rise. Rearranging taxes, as with an income tax, is no solution. Costs must be reduced; most cost is labor; labor cost must drop. We can do it, or have it done for us; it will happen.

AlphaAlpha

Tue, Feb 1, 2011 : 1:01 a.m.

Uh oh. New data. The public sector - private sector pay disparity is worse than we thought. From the new report Citizen's Guide to Michigan's Financial Health: "FIGURE 8: Average State Employee Compensation is Twice Average Private Sector Worker, 2009"

Ryan J. Stanton

Mon, Jan 31, 2011 : 8:27 p.m.

A reader e-mailed me this comment in defense of a city income tax for Ann Arbor. Expecting that it furthers the discussion around the issue, I'll post it here: Those analyses are fair. But I still this it works because: 1. I believe Ann Arbor is one of those "smaller" cities where it will work. I think the stability and nature of the stationery workforce -- not the city's population -- defines whether it will work. Our workforce is even more stable than Lansing's State government workforce because ours continually grows -- and will do so for the foreseeable future, whereas State government is shrinking -- and our wages are higher. 2. Sure incomes rise and fall more than property taxes, especially under Proposal A which stabilizes property tax revenue. So what? Good leaders will plan for that by not over-spending the bounty of new cash, and instead (a) investing in one-time capital projects and (b) stashing away cash to cover those days when incomes fall. Moreover, I am confident that the data will show that Ann Arbor's income is more stable than the State average, i.e., we didn't fall as much or as fast as statewide income fell. 3. We'd still have a property tax, but it would be 10 mills instead of 16 mills. 4. Ultimately, it's all about one thing: tax the commuters. They pay nothing. Time to start paying.

Steve Bean

Mon, Jan 31, 2011 : 8 p.m.

Interesting that the property tax revenue numbers for Ann Arbor don't (yet) reflect the partial bursting of the housing bubble--or the full loss of the former Pfizer property. Home prices have another 20% to fall to get in line with historical trend line for value. Some prognosticators anticipate values to drop another 80% or more. Are our property taxes out of line with the economic system that supports them? Is Grand Rapids dealing with economic reality due to its taxation system in a way that we are not? In other words, is our apparent relative prosperity an illusion?

Edward R Murrow's Ghost

Mon, Jan 31, 2011 : 6:30 p.m.

"Locally, Albert Berriz of McKinley Associates previously vowed to move his company's headquarters out of Ann Arbor if a city income tax passed." Well, then!!! Nuff said!!! If the unelected Lord of Ann Arbor says not to do it, it better not happen!! Wonder if he'll move all of his slummy apartment complexes, too? Good Night and Good Luck

Edward R Murrow's Ghost

Mon, Jan 31, 2011 : 6:28 p.m.

Eyeheart: To be honest, I'd hope the city can avoid it. Given the way the city charter reads, the losers on this will be the city's working class, many of whom live in structures they don't own. Property owners likely will see a decreased tax bill as their property taxes will drop more than the income tax they will pay. But those who live in apartments, etc.... likely will not see the savings (the landlords will absorb it) yet they will pay increased income taxes. I have no problem taxing those who live outside the city (me, by the way) for the services they use (e.g., road maintenance) or for the services that are there if needed (e.g., fire protection) and for the other things (e.g., parks) that make the larger community a pleasant place to live. The question that needs to be asked is this: what is the quality of life in Ann Arbor worth? What is it that consistently lands this city in the list of best cities in the US in which to live? What will happen to that quality of life and to property values if parks turn to weed-infested fields, if Huron Hills becomes a condo complex, if insurance rates go up because fire and police protection fall below certain levels? These are complex and important questions that those who simply wish to cut taxes and/or cut spending seem not to understand. In the end, we will pay. The only question is when and how. Good Night and Good Luck

Roadman

Mon, Jan 31, 2011 : 5:23 p.m.

A city income tax is supported primarily in Michigan cities where there are not a whole lot of people working i.e. retirees, welfare recipients, and the unemployed. If anyone has ever driven to Flint in recent years, it is a virtual ghost town with the downtown areas having multiple abandoned buildings. In Jackson, the two biggest employers are the local hospital and Jackson prison. I can recall a nine-story office building in downtown Jackson being purchased for $125,000. Those are examples of cities where a city income tax would depress and already depressed economy. Locally, Albert Berriz of McKinley Associates previously vowed to move his company's headquarters out of Ann Arbor if a city income tax passed. An income tax would be an incentive for other existing businesses to leave. These are two salient reasons why a city income tax is inappropriate in A2.

EyeHeartA2

Mon, Jan 31, 2011 : 4:17 p.m.

ERM: So, are you in favor of income taxes for Ann Arbor? or just like playing debate coach? Regarding poor assumptions - can you trot out some latin from your high school debate club about putting words into peoples mouth? You could, as they say, look it up. I don't remember mentioning a cause/effect relationship between one causing the other. It does however, seem a a great way for the city to increase spending on some of thier great projects we have seen over the past year or so - underground garage, art for the police station.

Edward R Murrow's Ghost

Mon, Jan 31, 2011 : 7:02 p.m.

Eyeheart--I guess I misunderstood your point when you listed all of those fine cities that had income taxes. The implication seemed clear. I, apparently, was wrong. My mistake. So, for us mentally challenged folks, what, exactly, was your point? Good Night and Good Luck

Stan Hyne

Mon, Jan 31, 2011 : 3:43 p.m.

A city income tax is like two foxes and a chicken voting on what they are going to have for dinner. The city should do what the residents are doing at this time, trying to live within our income.

Edward R Murrow's Ghost

Mon, Jan 31, 2011 : 2:48 p.m.

"ERM, Yep, those were the smaller communities I mentioned I left off the list. " Indeed, but they argue against your point, which is to imply that income taxes are the destroyer of communities. The fact of the matter is that Ann Arbor is far different--either in size, or in economic circumstance, or in quality of life, or in the status of its primary industry, or in all of the above--from any of the communities in the state that have income taxes, and it is therefore a false analogy to say "Because Highland Park . . . . therefore Ann Arbor". As I said-- post hoc ergo propter hoc logic error. Good Night and Good Luck

John Q

Mon, Jan 31, 2011 : 2:13 p.m.

"However, renters may deduct a portion of their rent that goes toward property taxes from their state taxes, so you're hitting them with increased state tax liability (lower property taxes=smaller portion of rent is deductible from state taxes) at the same time taking money from them on an income tax. " The renters deduction is based on the amount of rent you pay, not on the property taxes paid by the owner so this statement is not true.

rusty shackelford

Mon, Jan 31, 2011 : 2:07 p.m.

An income tax is absolutely unacceptable. It just slams renters from all sides, and keep in mind that renters will likely be lower-income than homeowners in this town. It lowers costs for property owners, but you'd have to be pretty daffy to think that will result in a decrease in rent. However, renters may deduct a portion of their rent that goes toward property taxes from their state taxes, so you're hitting them with increased state tax liability (lower property taxes=smaller portion of rent is deductible from state taxes) at the same time taking money from them on an income tax. It is absolutely wrong to increase taxes on the working classes while giving away freebies to those who are wealthy enough to own investment properties--this may not be the intent, but it is a clearly foreseeable result.

aanonliberal

Mon, Jan 31, 2011 : 1:52 p.m.

The one thing that Grand Rapids does not have that is not going to pick up and move is.......................U of M. That is the problem they stress the city resources and pay nothing for them. Their students, faculty, visitors and employees coming and going to and from campus or the hospital. A city income tax will tap into that U of M payroll (and they are not going to move away). That's the flaw with the study. U of M is NOT moving from Ann Arbor

EyeHeartA2

Mon, Jan 31, 2011 : 3:02 a.m.

ERM, Yep, those were the smaller communities I mentioned I left off the list. You can, as they say, look it up.

1bit

Mon, Jan 31, 2011 : 1:49 a.m.

Why would we want to spend within our means?

AA

Mon, Jan 31, 2011 : 1:44 a.m.

How much more of your income does any government agency need. How much? How long?

Edward R Murrow's Ghost

Mon, Jan 31, 2011 : 1:36 a.m.

But, of course, eyeheart, that's not the "rest of the pack". The complete list is: Detroit, Highland Park, Grand Rapids, Saginaw, Albion, Battle Creek, Big Rapids, Flint, Grayling, Hamtramck, Hudson, Ionia, Jackson, Lansing, Lapeer, Muskegon, Muskegon Heights, Pontiac, Port Huron, Portland, Springfield and Walker. There are numerous very nice communities on this list. Moreover, implying that as you do that income taxes are the reason for Detroit's (and other's) problems is a classic post hoc ergo propter hoc logic error. You can, as they say, look it up. Good Night and Good Luck

Justavoice

Mon, Jan 31, 2011 : 1:36 a.m.

I get really tired of the constant bickering that UofM is stealing city services. One has to ask who supports more city businesses than UofM and UofM employees? What about parking fees? Don't those generate revenue for the city? Doesn't that generate profit for businesses which in turn pay property taxes? Maybe it's about time UofM employees call a boycott of city businesses and see how well that impacts profit margins and revenues to pay those city taxes.

YpsiLivin

Mon, Jan 31, 2011 : 1:20 a.m.

The median home price in Ann Arbor is $220,000. The median household income in Ann Arbor is $87,061. A Headlee override for the median house in Ann Arbor would cost the owner $146.30 in additional property taxes each year. An income tax on the median household income would cost the household earner(s) $870.61 per year. Just sayin...

EyeHeartA2

Mon, Jan 31, 2011 : 1:05 a.m.

I agree with you, Ghost, why compare to Grand Rapids? I suspect because if you are selling the idea of an income tax, Grand Rapids is a lot more palatable then the rest of the pack: Flint, Jackson Lansing, Muskegon, Muskegon Heights Pontiac Port Huron, Highland Park Saginaw ..and a few very much smaller municipalities and of course the poster child for a well run city: Detroit Maybe when Kwami gets out of prison, he can consult on this issue.

Edward R Murrow's Ghost

Mon, Jan 31, 2011 : 12:21 a.m.

"Why does a donkey react differently to the last straw than the first?" I guess that this is what passes for a logical and fact-based analysis to a serious question? Apparently. Still waiting, alphaalpha, for you to explain where $35 million in cuts in a $100 million budget can be found. Guess talking about donkeys and straws is easier? Good Night and Good Luck

A2K

Mon, Jan 31, 2011 : 12:10 a.m.

So, if I'm reading this correctly...and override of the Headlee amendment would be an uncapping of the amount our property taxes could be raised in a given year - so instead of the steady 3% increase year after year, we could have an increase of 8% "just because they could"? What am I missing here? I guess my department is an odd UM department (according to the article) as only 1-2 people I can think of work outside of town/don't currently pay A2 property taxes *raises eyebrow*

AlphaAlpha

Sun, Jan 30, 2011 : 11:48 p.m.

"Why aren't all the businesses and high income residents moving to Salem?" Why does a donkey react differently to the last straw than the first?

dotdash

Sun, Jan 30, 2011 : 10:46 p.m.

Is it possible that a city income tax would convince people who work for the U to move back into Ann Arbor? Property tax rates will be lowered by this move, apparently, so they might as well take advantage of it. We could have a "welcome" party for anyone who moves in from a surrounding township or town.

John Q

Sun, Jan 30, 2011 : 8:43 p.m.

I'll ask a question I've asked before. If all of these residents and businesses are so tax-sensitive that they'll leave town when an income tax arrives, why aren't they all located out in Salem Township? Residents can still be in the Ann Arbor School District and businesses can enjoy the benefits of being located in a township that levies no local property tax. It's a tax haven in Washtenaw County. Why aren't all the businesses and high income residents moving to Salem?

Vivienne Armentrout

Sun, Jan 30, 2011 : 8:31 p.m.

Pardon me, I meant to say that FY 2010 *began* on July 1, 2009.

Vivienne Armentrout

Sun, Jan 30, 2011 : 8:28 p.m.

The graph is misleading and the information is incomplete. First, the comparison between Grand Rapids and Ann Arbor is misleading, as many commenters have already noted, because the economies and circumstances of the two cities are so different. But also, what years are we really comparing? Note that Ann Arbor's property tax collection is shown as having leveled off between 2007 and 2010. But do those figures represent the Fiscal Year 2010 or the calendar year? Ann Arbor's accounting system is set up in Fiscal Years that extend from July 1 to July 1. FY 2010 ended July 1, 2009. City council is currently working on the budget for FY 2012. We are now in FY 2011. Property taxes collected in July, 2010 actually relate to FY 2011, not reflected on the graph. If I am not mistaken, the city was still collecting some taxes from the Pfizer property as of FY2010. That was one of the largest taxpayers in the city until it was purchased by UM. But taxes are not collected on property related to assessment of property in one calendar year until the next year. Thus, we will all be paying taxes in (calendar year) 2012 on the assessed value of our property as declared this spring - (calendar year) 2011. Yet that will be from the city's viewpoint, FY 2013. So the figure for "2010" likely relates to assessed value from early 2008. I think there were some changes in real estate value, income, investment capital and many other economic factors between early 2008 and the end of calendar 2010. (I have also explained some of this in my first blog post of a series, <a href="http://localannarbor.wordpress.com/2011/01/09/ann-arbors-budget-the-case-for-a-city-income-tax/.)" rel='nofollow'>http://localannarbor.wordpress.com/2011/01/09/ann-arbors-budget-the-case-for-a-city-income-tax/.)</a>

G. Orwell

Sun, Jan 30, 2011 : 8:27 p.m.

My two cents since that is all I have after paying taxes. The FAIR thing to do, after cutting expenses (get rid of unnecessay departments and reduce expenses), would be to impose a city income tax. I say this only because U of M continues to expand gobbling up taxable property and its employees use all the benefits of the city for free. This is subsidized by property owners in AA. Not fair. I think it is a simple matter of fairness. Plus, property taxes in AA is ridiculous. If this happens, I may consider living downtown.

Macabre Sunset

Sun, Jan 30, 2011 : 8:26 p.m.

Have you ever noticed that the people who demand that others pay their "fair share" of taxes are either billionaires or people who are amongst the 50% who don't pay income tax because they don't make enough money to tax under the current system?

EyeHeartA2

Sun, Jan 30, 2011 : 7:24 p.m.

"They can reduce their property taxes down so their residents are at a break-even point, and the gain then is the non-resident tax collections." ....and how can you tell when a politician is lying? They promise you break even on taxes.

bugjuice

Sun, Jan 30, 2011 : 7:20 p.m.

The UM ain't goin' nowhere. Ann Arbor offers a lot as the host city to one of the wealthiest publicly owned universities anywhere. It's a symbiotic relationship, Can't be one without the other, so spare us the "Ann Arbor wouldn't be what is is today if..." It's a non argument. A city income tax has, more than once been suggested as a way, via UM employee paychecks, to get the U to contribute their fair monetary share to the operating costs of their host city. This tells us that many people recognize that the U needs to and should be a better corporate partner. So why take a back door route to that end? Instead of an income tax that would most likely cause some businesses to locate and relocate outside the city, end up taxing more than a few people at the middle and lower tax brackets, an income tax that might well follow the Grand Rapids example etc... Why doesn't council and the city administrator and our overpaid city attorney's office just get some spine and seriously take the necessary and feasible action to get a few million annually from the U? They'll never miss it.

KJMClark

Mon, Jan 31, 2011 : 3:19 a.m.

You said basically the same thing above, in a lot fewer words, and the answer is the same. They *can't* charge the U a dime. It's illegal. There aren't any "necessary and feasible" actions they can take, unless they first change the state Constitution. Every time we have this discussion the folks at the U tell us very politely to go jump in a lake and if we want any of their money, we should implement an income tax.

bugjuice

Mon, Jan 31, 2011 : 12:29 a.m.

The UM PD is not the first responder if you dial 911. I don't know where you get the info that UM provides police, fire and trans for Ann Arbor.

bugjuice

Mon, Jan 31, 2011 : 12:27 a.m.

??? As state taxpayers we already pay for UM PD as well as local, county and state police. UM get its fire service from the city, not the other way around. UM transportation is of limited use for users other than students. Even if I could, I'd have to walk 3/4 of a mile to use a UM bus to go pretty much nowhere I need to go.

MjC

Sun, Jan 30, 2011 : 8:17 p.m.

I'd imagine if the UM had to give a "few million" to the city, the city would then have to turn around and pay for the UM's police, fire, and transportation services, right? Or don't those UM services count as a contribution to Ann Arbor city operations?

Stuart Brown

Sun, Jan 30, 2011 : 7:18 p.m.

Another bad idea from the Hieftje machine. Tax people who can't say no; reminds me of frat boys who use roofies(the date rape drug) on their dates. And just with roofies, the approach relies on the victim having no memory of the attack. I saw the figures for the city's employee compensation; they've gone from $86K/year per employee to over $150K/year per employee in 8 years with a rate of increase of almost 8%/year at a time when inflation is about 3%/year. Not mentioned in the article is the explosion of "consultants" used by the city and the creative accounting techniques used by Mr. Crawford to shift money around the sundry funds (aka "buckets") the city maintains. BTW, Fraiser (the Ann Arbor City Manager) does not nor never has lived in the city despite moving since he first came here. This to me indicates that the cost of city government is so high, many high income folks choose to live in the burbs surrounding Ann Arbor; a trend I would expect to accelerate if an income tax goes through. A city income tax is a bad idea because the citizens of this town would simply be feeding a bloated, dysfunctional political machine run by our current Mayor, Mr. Hieftje. Almost none of the major towns in Michigan who have an income tax are vibrant places people are moving to; Ann Arbor's population has been flat for the last 10 years and the last thing this town needs is an income tax.

Jim Peters

Sun, Jan 30, 2011 : 7:11 p.m.

I'm more than a little concerned that city counsel members think that a "modest" tax is OK. We the resident of Ann Arbor are already one of the highest taxed taxpayers in the state. I think a city income tax is long overdue. It's about time the 75,000 people that work in the city pay their way with a "modest" 0.5 income tax. Regarding, the $2.4M deficit, how about a 5% across the board budget cut for all departments, including HR and payroll. That would save over $4M annually with money to spare. We need to stop spending money we don't have and stop blaming our annual budget woes on the police and firefighting. All city departments need to look in the mirror.

dotdash

Sun, Jan 30, 2011 : 6:42 p.m.

The whole city-income-tax issue seems to provide cover for tax increases. We need to separate the two ideas. 1) do we need more money? and 2) on what basis should we be taxing people? I'm not necessarily against tax increases, by the way, but a lot of people are. Let's just be clear about what we are trying to do and why.

a2citizen

Sun, Jan 30, 2011 : 6:17 p.m.

Tom Whitaker: The University of Michigan alone employs over 30,000 people. The federal government has close to 5,000 employees. I think once you add in Briarwood employees, and all the offices, shops and stores around the city, you could reasonably approach 50,000-75,000. The university employees grid lock Eisenhower & State every night when leaving the city. I'd like to see the police park there every afternoon at 4:30 for some revenue generation. And traffic IS bad in the morning. One reason traffic may not seem as heavy as football Saturday's is because the parking is disbursed throughout the entire city, not concentrated in one area. I wonder how many people the UofM laid off during The Great Recession. Probably zero. The taxes from the income of university employees would be steadier than the income of the private corporations in Grand Rapids. And university employees are very well compensated. But I also think there should be salary cuts and caps for city employees. Police officers making $100,000+ is ridiculous. Nonresidents use our roads. Are they paying to repair the potholes? The bridge reconstruction (Stadium & State, if that ever finishes)? How much does the University contribute towards fire protection? Towards road improvements? I think the city should finish projects it has started before spending money on new projects but the University swallows up property (the Pfizer labs). Is the U of M going to pay property taxes on that real estate? I don't know. But if their expansion continues to creep into the city tax foundation I think it would be reasonable to tax university employees. <a href="http://en.wikipedia.org/wiki/University_of_Michigan_Health_System" rel='nofollow'>http://en.wikipedia.org/wiki/University_of_Michigan_Health_System</a> <a href="http://www.hoovers.com/company/The_University_of_Michigan/cfcsci-1.html" rel='nofollow'>http://www.hoovers.com/company/The_University_of_Michigan/cfcsci-1.html</a> <a href="http://www.few.org/docs/legislative/map/Michigan.pdf" rel='nofollow'>http://www.few.org/docs/legislative/map/Michigan.pdf</a>

Tom Whitaker

Mon, Jan 31, 2011 : 6:48 p.m.

My point was, and remains, that there is no hard data to support any number of commuters because no one is asking the question or doing the research. See my follow up reply under my original post.

Macabre Sunset

Sun, Jan 30, 2011 : 6:03 p.m.

It seems narrow-minded to pillory the University for tax issues in Ann Arbor. All that separates Ann Arbor from being another Pontiac is the University and the people it draws into town. The University brings far more wealth into town than Ann Arbor could raise using that land for other purposes. I'm sure the surrounding townships would be absolutely delighted if Ann Arbor implemented an income tax. Land values for the parcels in commercial areas just outside city limits would double in value.

aes

Sun, Jan 30, 2011 : 5:46 p.m.

How about throwing another money-raising idea into the mix? Last year, Oakland CA voters backed an initiative, Proposition F, which establishes a 1.8 per cent tax on medical marijuana sales and, according to an article in the August 9, 2010 "New Yorker" (page 23), will bring that cash-strapped city a million dollars a year. We know that Oakland has had plenty of marijuana dispensaries since the drug was legalized in 1996, and two years ago the city decided to permit large-scale indoor marijuana plantations, as well. Okay, granted that Oakland has about 4 times the population of Ann Arbor, but there seem to be quite a few out-of-towners wandering into our town to buy mj supplies.

Stephen Landes

Sun, Jan 30, 2011 : 5:18 p.m.

The problem in Ann Arbor is not that we are taxed too little; it is that the City spends too much. We obviously are paying far too much in wages and benefits to employees of City government. We also engage in far too many projects that are beyond our means like fountains to nowhere and the ugliest City Hall in captivity. We are simply spending beyond our means and it has to stop...NOW.

Macabre Sunset

Sun, Jan 30, 2011 : 9:15 p.m.

So, Johnny, the increased taxes that go into paying off a new bond and the interest from that bond are zero. Terrific budget lesson. I think it's the same one Obama and the state of Illinois are currently teaching.

johnnya2

Sun, Jan 30, 2011 : 6:14 p.m.

The fountains and city hall and every other projects is NOT part of the budget discussion. I know this is hard to understand, but a capital investment is not an expense. It has NOTHING to do with operating budgets. If you want to involve yourself in the argument, it would be better to educate yourself on how things work.

Dog Guy

Sun, Jan 30, 2011 : 5:17 p.m.

Politicians playing reluctant to raise taxes is good theatre.

John Q

Sun, Jan 30, 2011 : 4:52 p.m.

Perhaps Ryan can make a connection between the behavior of local income taxes during a recession and what happens to corporate income taxes in the same economic environment. Rick Synder's push for a corporate income tax is going to return Michigan to the days of wild revenue swings in boom and bust economies that led to the adoption of the SBT. Our Governor Accountant should learn something from economic history in Michigan.

Cash

Sun, Jan 30, 2011 : 4:36 p.m.

A valid study would be looking at medium size cities that are home to major universities with historic aging buildings and thousands of resident students. I can think of Columbus Ohio and State College, Pa as two that levy an income tax. Has that tax relived the burden of property owners or increased it? Has that tax relieved the general fund budget of the related municipalities? Has that tax had an impact on Penn State or Ohio State University? Has that tax impacted the ability to attract faculty.staff and students to the area? Etc......

Gorc

Sun, Jan 30, 2011 : 4:35 p.m.

Jay Allen - Outback Steakhouse on Ann Arbor-Saline Road is actually Pittsfield Township.

Matthew

Sun, Jan 30, 2011 : 4:21 p.m.

The city's tax sales tax revenue has increased from 54 million to 81 million over 10 years. It looks like the city has a spending problem, not a revenue problem.

Ryan J. Stanton

Sun, Jan 30, 2011 : 5:36 p.m.

You mean property tax revenue.

Gorc

Sun, Jan 30, 2011 : 4:36 p.m.

That's true at all levels of government.

Jaime

Sun, Jan 30, 2011 : 4:17 p.m.

So despite the lose of property tax revenue from the departure of Pfhizer the city has seen its revenue increase by 51% over the last ten years yet they can't balance their budget. Doesn't say much for they way they operate.

Jay Allen

Sun, Jan 30, 2011 : 3:41 p.m.

There are a few good points that have been presented. The math that has been broken down by a few is key. GR does more with less. If someone would like to debate that we can. Next, is the U of M. Folks, we ALL need to realize just how good we have it with UM here. Don't start bashing UM and it's take breaks. This would be an example of cutting your nose off to spite your face. Do you REALLY think the QUALITY of life would be the same w/o the U here? This is really simple. Seriously elementary. Just add a 1% sales tax within the A^2 city limits. Now you reap the benefits of 110K folks 8 times per year. Plus those who just come to watch. Now you see benefits from everyone coming to town. So when my family of (4) goes to Outback for a Friday night dinner and the bill is 70.00, I pay an extra .70. Something to consider.

Edward R Murrow's Ghost

Mon, Jan 31, 2011 : 10:08 p.m.

"LOL! Outback is in Pittsfield." Yes, indeed it is. Doesn't change the larger point. Good Night and Good Luck

Jay Allen

Mon, Jan 31, 2011 : 12:30 a.m.

basic bob. While if you look at the map it would appear Outback is in Pittsfield, then go look at the voter districts. It becomes a grey line. I "thought" south of AA-Saline was the Twp and to the North of AA-Saline was the city. What I find even more funny is the lack of regard to the subject at hand. Instead of showing some insight to a much larger issue, you want to play "Are you smarter than a 5th grader" on Geography. This is exactly the type of behavior that will complain no matter what tax goes into effect because all of your energy is spent being disruptive.

Basic Bob

Mon, Jan 31, 2011 : 12:02 a.m.

LOL! Outback is in Pittsfield.

Edward R Murrow's Ghost

Sun, Jan 30, 2011 : 6:26 p.m.

Jay, I don't think there is anything that would prevent the tax you propose--an entertainment tax, per se. Wayne County and Detroit have them, as do most large metropolitan areas. Good Night and Good Luck

Jay Allen

Sun, Jan 30, 2011 : 5:32 p.m.

Ryan and ERM. OK, I get it now. On the sales tax. So why couldn't AA impose a "restaurant" tax and a "hotel" tax? I was unaware of the links you 2 have provided me/us with. Thanks.

Jay Allen

Sun, Jan 30, 2011 : 5:29 p.m.

ERM. I understand fully that UM cannot be taxed. I get that. What I mean is do you really think the fine eating places, hotels, shopping, etc would exist if UM did not? There is no reason that a small AA Sales tax could be implemented and then everyone carries the torch a little bit. Stunsif. Dude, we eat at Outback 6-7 times per month. They know us there on a first name basis. When my daughter is in town, it is under 70, every time. We do not drink alcohol, my wife and daugther drink water, and the majority of time my wife and i split a 13.99 steak because the 5.99 appetizer has filled us up.

Ryan J. Stanton

Sun, Jan 30, 2011 : 4:54 p.m.

Here's a look at local sales tax rates in the Phoenix area: <a href="http://phoenix.about.com/od/govtoff/a/salestax.htm" rel='nofollow'>http://phoenix.about.com/od/govtoff/a/salestax.htm</a>

Ryan J. Stanton

Sun, Jan 30, 2011 : 4:49 p.m.

Having lived in a state (Arizona) where certain cities have been able to generate additional revenue and flourish because of city sales taxes added on top of the state sales taxes, I know firsthand how a city can benefit from tapping into the sales activity of its retail sector, and how far those extra dollars can go in meeting unmet needs in a community. However, as the latest report from the Citizens Research Council of Michigan indicates, we don't have that option here in Michigan right now. "Some might prefer a local-option sales tax, but the state Constitution dictates the maximum sales tax rate and the dedication of sales tax revenues," CRC's report states. "Without the ability to go above the current six percent rate, it is not likely that a local-option sales tax could be authorized without the state ceding some of the tax it currently levies or a constitutional amendment, which would require voter approval in a statewide election. The local option income tax, therefore, is the revenue option immediately available to cities."

stunhsif

Sun, Jan 30, 2011 : 4:09 p.m.

Good luck spending only 70 dollars for dinner for 4 at Outback Jay. Good Day No Luck Needed

Edward R Murrow's Ghost

Sun, Jan 30, 2011 : 4:08 p.m.

Under Michigan law there can be no local sales tax. <a href="http://www.michigan.gov/taxes/0,1607,7-238-43529-155505--,00.html" rel='nofollow'>http://www.michigan.gov/taxes/0,1607,7-238-43529-155505--,00.html</a> Good Night and Good Luck

Jay Allen

Sun, Jan 30, 2011 : 3:42 p.m.

take = tax

bugjuice

Sun, Jan 30, 2011 : 3:40 p.m.

And not a single word on leaning harder on the 800 pound gorilla in the room... The University of Michigan. There's been LOTS OF TALK over the years to get the U to pay their fair share, instead we go after working people, many who live from paycheck to paycheck.

Tom

Mon, Jan 31, 2011 : 3:39 a.m.

Mick - I mean exactly that. The thousands of employees of U-M use Ann Arbor city services on a daily basis and somehow don't think they need to pay into the system. They drive in on our roads or use our bus system (which they still don't adequately reimburse AATA for), they use our water system, wastewater system. Don't lie and say you never use any city services, now THAT is a joke. Also, about your hypothetical situations where U-M police respond to incidents in the city... well it goes both ways. And who does U-M call when they need extra help on gamedays? Oh, the city police force. By the way, not one dollar of sales tax goes to the city... everything goes to the state.

KJMClark

Mon, Jan 31, 2011 : 3:13 a.m.

Yeah, because every time someone brings the topic up, there's talk until people realize it's not possible. The state Constitution makes the University part of the State itself. Ann Arbor isn't allowed to tax the state government. So if you want to tax the U, you have to change the state Constitution. You go try to make that change, and let us know how it turns out, OK?

Mick52

Mon, Jan 31, 2011 : 2:28 a.m.

Tom, please explain what you mean by stealing city services? What a joke. Most cities in Michigan do not have a city income tax, they get along fine without it. I worked at UM, 28 years I cant recall ever using city services other than the streets to get back and forth. I never pay for using any other city's street when I go anywhere. If the sidewalks along the major streets in the campus area need plowing UM employees plow them. Those streets belong to the city. When a crime occurs on campus, the UM police respond. Also, when an collision happens on streets owned by the city, the UM police respond and police the accident. They can do that because the law that gives university's police authority extended the authority to streets adjacent to university owned property. Authority, not ownership. So who is stealing a service in those regards? UM personnel empty the trash cans. Is the city going to do that, even on campus grounds? Why not? Any city resident can walk across campus and put trash in a UM trash can. If the city empties trash on Main St, then under your position, all services the city renders should be extended to UM property too, since UM employees would be paying the same tax as non residents who work in the city. UM employees do not use city services nearly as much as other people who work in Ann Arbor since the UM performs those services. I hope that if the city goes ahead with this the UM will get equal services. Perhaps they should also tell the city they will have to start paying rent on Fire station five. UM employees put more money into city coffers than they "steal" by being in the city in the form of sales taxes and purchases made at city businesses. The problem is what others have pointed out here. AA just spends too much and always has. Look at it this way. The police and fire chiefs are proposing that with less personnel, they can provide the save services. If so, why so many more previously?

Tom

Sun, Jan 30, 2011 : 6:21 p.m.

This is exactly what will get U-M to at least begin to pay their fair share, as they pay nothing in property taxes. At least their thousands of employees who use city services on a daily basis will be held partly accountable with a city income tax. The non-residents who have the luxury of commuting into Ann Arbor and working here and using its services need to contribute to the system from which they are currently just stealing.

Edward R Murrow's Ghost

Sun, Jan 30, 2011 : 3:29 p.m.

I love the comparisons to Grand Rapids. Anyone here want to move to Grand Rapids and its collapsing industrial base? Its city parks that are strewn with garbage. Its west and south sides that look more like slums than livable neighborhoods (and its near east side looking little better)? Yes, there are, apparently, people in A2 who aspire for their town to become Grand Rapids. Here's hoping you fail. Good Night and Good Luck

johnnya2

Sun, Jan 30, 2011 : 6:12 p.m.

"most folks in GRR think of Ypsilanti as part of Ann Arbor, being seperated only by US-23. " I think that says more about the lack of education in Grand Rapids than it does about the reality of the budget situation. Having lived in GR for two years, I never heard anybody confusing Ann Arbor with Ypsilanti. Of course, I do know people who confuse EAST GRAND RAPIDS with Grand Rapids proper. One is a wealthy enclave, the other not so much. I will also point out if GR is so great, their latest jobless figure was 8.9%. Ann Arbor was at 6.6%. Median income for individuals, per family, per household are all significantly higher in Ann Arbor. Median household values are also higher. By ANY reasonable measuring stick, Ann Arbor has outperformed Grand Rapids. If GR wants to cut services and make their city a low income. low housing value, but low tax haven, say let them go for it. Higher taxes generally lead to higher incomes. What do you think the average person in California, or New York make versus an employee in Florida. Do the math, it aint that hard.

a2citizen

Sun, Jan 30, 2011 : 6:06 p.m.

Stun, I worked in GR for several months last year. You don't want A2 devolving into that. A coworker was confronted by police downtown while trying to enter a facility. The police were just doing their job but they assumed he was a drug dealer. Your community has to have sunk pretty low for that assumption to become part of the police SOP.

Ryan J. Stanton

Sun, Jan 30, 2011 : 4:38 p.m.

The folks over in Grand Rapids I talked with indicated there have been some major manufacturers in the city that have significantly downsized and reduced their footprints in the last few years. And data I've reviewed from DELEG indicate manufacturing is on a downward trend in Grand Rapids.

Edward R Murrow's Ghost

Sun, Jan 30, 2011 : 4:28 p.m.

Jay: But that is EXACTLY the comparison. The services a city provides directly relates to quality of life, which directly relates to property values, which directly relates to revenue, . . . and the circle goes on. Flint and Detroit are great examples of the downward spiral. Grand Rapids is on the precipice of being there. Stun: GR's industrial base is growing? That would be news to the folks who lost their jobs when the 2 GM plants there closed, to those who lost there jobs when the Electrolux Plant closed, and to the workers at the last Steelcase factory in GR whose closing was just announced. Once again, you are wishing for something that just isn't true. After all, if GR had an expanding industrial base, it would not be facing falling revenues, would it? Good Night and Good Luck

stunhsif

Sun, Jan 30, 2011 : 3:46 p.m.

" "Anyone here want to move to Grand Rapids and its collapsing industrial base? Its city parks that are strewn with garbage. Its west and south sides that look more like slums than livable neighborhoods (and its near east side looking little better)?" What a ridiculous paragraph, full of falsehoods and generalizations. Grand Rapid's industrial base is growing , not shrinking. And BTW, most folks in GRR think of Ypsilanti as part of Ann Arbor, being seperated only by US-23. Good Day No Luck Needed

Jay Allen

Sun, Jan 30, 2011 : 3:46 p.m.

I don't believe that folks here sir are directly comparing the quality of life in AA vs GR sir. I think the comparisons (IMHO) are more they have cut less services than AA and have maintained their budget vs a budget here in AA that has grown based on the tax revenues presented. But something to consider, numbers lie, liars use numbers. So help me out here ERM!

blahblahblah

Sun, Jan 30, 2011 : 2:20 p.m.

I agree with Tom Whitaker's comments regarding the city's growing debt load. The current building spree (old Y purchase, new police/court building, Library lot underground parking and proposed Fuller Garage) have placed a substantial financial burden on Ann Arbor taxpayers. City council has borrowed money for all of those projects which now require millions in annual interest and principal payments. Now council has the audacity to consider asking the taxpayers for even more money to continue this insane building spree (they now want to borrow $10 million for the Fuller Garage).

xmo

Sun, Jan 30, 2011 : 2:18 p.m.

Why not have both property tax and income tax? This way the city can double the revenue and bring more wonderful things to us residents! It's a joke, why not start making tough decisions and reduce the size of our city government to the size it was in 1960? Do we really need all of these extra services? NO! We need Fire, Police some zone and building code people but the rest is overhead.

KJMClark

Mon, Jan 31, 2011 : 3:08 a.m.

They can't have an operating millage and and income tax at the same time. It's forbidden by the City Charter. If they adopt an income tax, they drop the operating millage.

Tom

Sun, Jan 30, 2011 : 6:15 p.m.

Fire and police are exactly the services they are trying not to cut. You are a bit naive if you think the city could operate with just that and nothing more.

BroncoJoe

Sun, Jan 30, 2011 : 2:09 p.m.

@dconkey - Good question. Relative size of cities by population versus budget, based on comments in article. Pop Tax Rev Part of Gen Gen Op Op Budget Budget GR 193K $51.5M 50% $103M AA 113K $81.9M 60% $136.5M So, it would look like GR is about 71% larger but AA has a Gen Op budget 32% larger.

gsorter

Sun, Jan 30, 2011 : 2:09 p.m.

So, let me get this straight. Grand Rapids is a city with 193,700 and Ann Arbor is a city with 114,000 residents, according to Wikipedia. Grand Rapids gets about half its revenue from the income tax, and that is $51.5 million, so its total revenue is about $103 Million. Ann Arbor's total is about $82 million. If you do the math, that means Grand Rapids gets by with with about $532 per resident, and we get by with $718. How is it Grand Rapids is so much more efficient. And how is it that our city needs 51% more than 2001? We certainly don't have that many more people, and inflation in the past 10 years has been low. What am I missing?

Joan Lowenstein

Sun, Jan 30, 2011 : 6:02 p.m.

In addition to what Ryan has responded, last year Grand Rapids' mayor reported to the legislature that he was considering declaring the city bankrupt and that it was $20 million in the hole. Compare that with Ann Arbor's current problem of $2 million. Grand Rapids laid off 175 employees, including 44 police officers and is considering privatizing its water system.

Ryan J. Stanton

Sun, Jan 30, 2011 : 5:15 p.m.

You also have to consider the total budgets of each city and what they're able to bring in from state and federal sources, fees for services, investment income, etc. From the last annual audits of both cities, Ann Arbor's total primary government expenses were $154.6 million and Grand Rapids showed $287.7 million. That amounts to a cost of city government in Ann Arbor at $1,366 per resident (though we have to point out not all of that money is coming directly from residents). And in Grand Rapids, that amounts to $1,490 per resident (or $1,143 per person if you factor in the 58,530 non-residents who pay taxes to the city). When you start to look at it that way (which I still don't think is a complete picture or the best possible analysis), the difference starts to shrink.

Ryan J. Stanton

Sun, Jan 30, 2011 : 3:27 p.m.

You're extending ratios I gave for the general fund budgets to the entire city budgets. I believe the comparison you're looking for is this: Grand Rapids brought in $91.2 million in total from property and income taxes in 2010. Ann Arbor brought in $81.9 million from property taxes. Census data from 2006 showed Grand Rapids' population at 193,083 and Ann Arbor at 113,206. Using your methods, that puts tax collections at $472 per resident in Grand Rapids and $723 per resident in Ann Arbor. But that's still a flawed analysis because it doesn't account for a wide range of variables and doesn't look at what ratio of the taxes in each city are being paid by corporations. Also, you have to consider that Grand Rapids taxed the incomes of 58,530 non-residents in 2010. Using your methods, with those people added to the population count, that changes the calculation to $362 per person in Grand Rapids. But even that is still flawed. It'd take a lot more work to get at what you're getting at, but I see your point. Thanks for adding to the conversation.

David Cahill

Sun, Jan 30, 2011 : 1:59 p.m.

I'm intrigued by the "working group" that Stanton has uncovered. The City Council has an official Budget Committee, which would seem to be the right body to consider the city's revenue options. But that committee is not the "working group". Apparently the "working group" consists of three Councli members, CFO Crawford, and City Administrator Fraser. This group was not appointed by City Council, and its existence has never been publicly reported. It had at least one meeting before Christmas at a local restaurant. No, it's not a violation of the Open Meetings Act for such a group to form and start meeting, as long as a majority of Council members are not part of the group. But this kind of behind-the-scenes activity is not very appetizing, either.

Ryan J. Stanton

Sun, Jan 30, 2011 : 2:23 p.m.

David, I had not heard about this group myself until I started poking around for this story. It's my understanding the group has met only once so far, which may be the meeting you reference. Taylor said the group is planning a process to more aggressively investigate the income tax and Headlee override options, and that will include a public input component. "Once we come to those conclusions and we see how the process goes, if folks on council agree it's a question suitable for voters' consideration, then there'll be a vote to put the issue on the ballot," he said.

Chase Ingersoll

Sun, Jan 30, 2011 : 1:50 p.m.

The problem is that the representatives have not sincerely put an effort into discussing where they can cut budgets, because it is essentially asking a one party state to reduce the size of their party. And who is the party? - The public employee sector is that party. Ergo - they can't philosophically or logically make the cuts. They are going to drown in deficit budgets even while they flail for enhancement of existing tax bases and creating new ones. What they don't realize in "the party" of the public sector is that tax payers are "fungible" in that the same work ethic and initiative that enabled them to become the high income producers will be the work ethic an initiative that these tax paying "producers" in society use to migrate to those pockets of any state or county that has the lowest tax rate.

johnnya2

Sun, Jan 30, 2011 : 5:58 p.m.

The big lie that people move to the lowest tax rate, or that lower taxes is GOOD for the economy. Nevada, Florida have a ZERO income tax rate. Florida is also a "right to work" state. Tell me how that is doing for their job creation. Worse unemployment than Michigan. Look at the largest companies, and where they are located. New York City (Chase Bank), Chicago (Boeing, United AIrlines), California (Google, Apple). I guess lower taxes are NOT what motivates people to live someplace or operate their business. I will also point out that Ann Arbor has the lowest unemployment rate of any metro area in Michigan, lower than it has been in two years, and LOWER than any area in Ohio, or Indiana except Bloomington Indiana. I know facts are a hard thing for the right wing to deal with. They prefer their "beliefs" versus what ACTUALLY happens in the real world.

Edward R Murrow's Ghost

Sun, Jan 30, 2011 : 3:22 p.m.

"The problem is that the representatives have not sincerely put an effort into discussing where they can cut budgets" Really?? Evidence to support this absurd statement? Didn't think so. Good Night and Good Luck

YpsiLivin

Sun, Jan 30, 2011 : 1:49 p.m.

And when all else fails, push the burden of the City's profligate spending habits off on non-residents who have no say in the matter, so they can subsidize the Ann Arbor lifestyle.

Tom

Sun, Jan 30, 2011 : 6:10 p.m.

It's better than having all of those non-residents stealing city services every day. It's about time they pay their fair share.

Jim Mulchay

Sun, Jan 30, 2011 : 1:37 p.m.

The question seems to be the amount of property available to tax and the pool of income available to tax. I'm not familiar with tax codes, but I believe most (if not all) U-M property is exempt from local property taxes - along with religious properties. I would assume all U-M employees would have their income taxed. I believe the U-M/U-M Hospitals are the largest employers in Ann Arbor.

Tom Whitaker

Sun, Jan 30, 2011 : 1:32 p.m.

"Various reports have estimated the number of non-residents who commute to work in Ann Arbor at anywhere from 50,000 to more than 75,000." Sources? These numbers seem wildly, wildly exaggerated to me. If this were true, we'd have traffic not too unlike football game days, every morning and evening, but we don't. Surely there is a way to accurately collect this data before deciding an income tax is even worth discussing. Property tax collections have increased steadily over the last 10 years. Unfortunately, so has the City's debt load from major capital projects, yet this Council is still rushing head first into yet another parking structure, a conference center, and what all else? In addition to labor costs, when will the growth areas of the City budget be addressed and cut (capital projects, IT, city attorney, and administrator's office)? Let's see some real cuts in these areas before discussing an income tax or Headlee override.

Tom Whitaker

Mon, Jan 31, 2011 : 11:40 p.m.

@Steve: Didn't forget the bus riders. That's why I said that 75,000 commuters would result in 65,000 cars. I think 10,000 bus and bike riders and carpoolers from outside the city limits is a very generous figure. The percentage is probably far less. @ERMG: I see no flaws in my analogy. But I see others focusing on that anecdotal comparison instead of the main point, which was that there is no hard data to support the idea that there are 75,000 daily commuters coming to Ann Arbor. I think it is absurd. Where is your data to refute me?

Edward R Murrow's Ghost

Mon, Jan 31, 2011 : 10:07 p.m.

"I stand by the football game analogy, though it is beside the point." Of course you do, despite its obvious flaws. And, if it's beside the point, why the analogy in the first place, much less defend it when its flaws are made manifest? Good Night and Good Luck

Steve Bean

Mon, Jan 31, 2011 : 7:38 p.m.

Tom, you might be forgetting that some commuters ride the bus (and a few bike) from Ypsi and elsewhere.

Tom Whitaker

Mon, Jan 31, 2011 : 6:41 p.m.

The real point of my post was that the City constantly makes major financial decisions without collecting hard data or using hard data that already exists. Examples: --A new downtown parking structure despite data that showed that the system had plenty of capacity (and more recent data shows parking demand declining). --Spending money on future trains with no idea of the numbers of commuters who might reasonably be served by the proposed routes. --Partnering in a new hotel and conference center without any study of the feasibility or how these ideas have fared in other cities (answer: very poorly!). --Proposing a new parking structure for UM in Fuller Park without studying better locations (former Kresge research site) or alternative transportation options. Why not put those millions into the train that is supposed to negate the need for cars? (No data perhaps?) I'm glad UM confirmed that they have 20,000 non-resident employees but are they really commuters to Ann Arbor? How many work inside the Ann Arbor City limits? UM has multiple facilities all over SE Michigan. If I lived in Milan, but I worked for UM ITCom on Plymouth Road, which is outside the City limits, would I be taxed? I stand by the football game analogy, though it is beside the point. If one claims 75,000 daily commuters in to Ann Arbor, I think this would actually result in MORE car traffic than football. Commuters usually drive alone. Football fans walk, take shuttles and charters, or they drive in groups. I honestly believe that 75,000 commuters would equate to 65,000 cars, while 120,000 football fans and workers probably equate to 30,000 cars. (Who has hard data?) Football fans have the stadium as the ultimate destination, but they also descend on satellite areas where most hotels, restaurants and shopping are located. Commuters are likely concentrated in downtown and central campus, but also around the perimeter.

johnnya2

Sun, Jan 30, 2011 : 5:51 p.m.

At a UM home game the traffic all descends on ONE place AND the time the people need to be there is the same. I would also say that 50,000 people is more than HALF the volume of an average UM football game, so to even think that it is a comparison is ridiculous. How about the traffic for the busiest basketball game being 20k people. If you have ever been on Washtenaw going toward Ann Arbor, or on US 23 headed out of town on a Friday at 5 pm, I think your anecdotal analysis won't stand up to reality.

Edward R Murrow's Ghost

Sun, Jan 30, 2011 : 3:21 p.m.

Unlike UM football gamedays, they're not all going to the same place (the intersection of Main and Stadium) at the same time. Good Night and Good Luck

Ryan J. Stanton

Sun, Jan 30, 2011 : 2:19 p.m.

Tom, I've seen a mix of analytical data out of city hall and from its consultant's report from July 2009 that were based on either SEMCOG figures or Census data or a combination of both. It's still being debated what the actual number is, but there seems to be some general agreement it's in that range. Like the story points out, we start with more than 20,000 non-resident commuters right off the bat with U-M, which I was able to have confirmed by the U.

aataxpayer

Sun, Jan 30, 2011 : 1:29 p.m.

Every time this bad idea get proposed businesses and persons with high income consider moving to the townships. This tax will make it harder to recruit workers and the tax involves added paperwork for businesses. I doubt that my business would renew its lease if this passes.

KJMClark

Mon, Jan 31, 2011 : 3:05 a.m.

You do realize that you're already paying property taxes that would be lowered, right? The Charter requires that the city drop the operating millage if there were an income tax. Your lease would go down by the millage amount.

Tom

Sun, Jan 30, 2011 : 6:01 p.m.

Well... See ya! Enjoy living in the middle of nowhere. I'm sure you'll do great business there too.

jlb314159

Sun, Jan 30, 2011 : 12:56 p.m.

So, they've had a 51% increase in tax property revenues since 2001, and they still can't balance their budget! I'm a "non-resident" because I couldn't afford the property taxes, but I still shop primarily in AA, sending my dollars to the businesses there. Sounds like tazation without representation to me.

johnnya2

Sun, Jan 30, 2011 : 1:35 p.m.