Ann Arbor Public Schools Educational Foundation spent more on overhead than on giving grants, tax records show

The Ann Arbor Public Schools Educational Foundation spent more money on overhead than it supplied to the Ann Arbor school district in each of the last two years, tax records show.

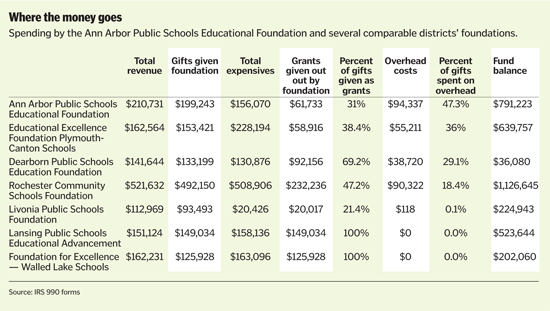

Last school year, the foundation spent just over 47 percent of the money it raised from donors on overhead - which includes items like staff salaries, printing and postage. It spent 31 percent on grants, and the rest went to the foundation's fund balance.

“If you want to have a professionally run non-profit foundation, you have to hire professional people to run it or you get a hockey association,” foundation Executive Director Wendy Correll said, referring to the recent embezzlement case involving a part-time bookkeeper who stole nearly $1 million from the Ann Arbor Amateur Hockey Association. “We know the Michigan non-profit association recommends you spend about 20 percent on overhead. We’re not there yet, but we're going to get there (soon).”

The foundation - a 501c3 nonprofit organization run separately from the school district it supports - has experienced rapid growth in recent years, both in how much money it raises and in how much money it gives away. It is in the midst of transistioning from an organization that primarily gave away small amounts of money to an organization that underwrites large scale initiatives designed to help offset some of the Ann Arbor school district's budget struggles.

The foundation, which was formed in 1991, is in the midst of a campaign to raise $1 million to help the district. And in that campaign, the foundation has pledged to spend just 12 percent to 20 percent on overhead costs.

The Ann Arbor foundation gave out $61,733 in grants for various programs in the Ann Arbor school district in the fiscal year that ran from July 1, 2008, to June 30, 2009, while spending $94,337 on overhead costs, the foundation's 990 tax form shows.

Correll said the amount spent in grants last school year, while accurate to the tax forms, is misleading because the foundation had approved spending $25,000 for the elementary enrichment coordinator program - but that money wasn't spent that year because the program was delayed.

It’s not unusual for foundations to approach the 50 percent mark on overhead costs, said Rob Collier, the president and CEO of the Council of Michigan Foundations.

“As a general rule, you don’t want to get over 50 percent,” he said. “It’s even better if you can keep it to under one-third.”

Other foundations of comparable size that support school districts have a range of overhead costs.

Ann Arbor has the highest overhead costs of the seven foundations analyzed by AnnArbor.com. Walled Lake, at zero percent, is the lowest - giving out all the money it raised. That was possible because the district contributed the cost of the director, something that’s changed since those numbers were reported due to district budget cuts, Executive Director Sandy Richards of the Walled Lake foundation said. She said Walled Lake aims to give out at least 50 percent of what it receives and uses the rest for overhead and savings.

Experts said it's common for districts to pay for foundation staffs.

“It’s certainly not unusual to have school districts provide administrative support and space,” Collier said. “That’s why overhead costs for many school foundations are down compared to (Ann Arbor).”

The district that came closest to Ann Arbor in overhead costs was Rochester at $90,332 - although Rochester also far outpaced the other foundations in total revenue. The number dipped from there, with the third highest in overhead costs attributed to the Plymouth-Canton foundation at $58,916.

In a publication for foundations, the Michigan Nonprofit Association suggests non-profits give out at least 65 percent of what they raise and use between 20 percent and 35 percent on overhead.

Raising moneyAfter Washtenaw County voters turned down a countywide enhancement millage last fall, foundation officials launched the push for a $1 million campaign - which surveys and studies told them was possible to reach.

“After the countywide millage was defeated last fall, as a board we decided it was time to take bold action,” said board chairwoman Christy Perros. “As a group, we believe that strong public schools make for strong communities."

The board commissioned a feasibility study several years ago that showed the organization should be in a position to raise $750,000 to $1 million by this year, Perros said. After the millage defeat, a foundation survey of community donors and non-donors indicated the community would be willing to support a larger fundraising campaign than the non-profit initially planned for this year, Perros said.

Wendy Correll, executive director of the Ann Arbor Public Schools Educational Foundation

"We were ready - they were ready,” she said of the ramped up campaign.

Vicki Haviland, a parent of students at Dicken Elementary School, is among those ready to give more. She recently held a house party that raised about $2,500 for the fund.

“I support the 1 Million Reasons campaign because I think it's a great way to capture the dedication that thousands of A2 citizens feel for the public school system," she said. "Although the county millage didn't pass this fall, it did get the majority of votes in Ann Arbor, so we all know that there is interest in financially supporting our schools ... Donating at this time especially is a great way to give back at the end of the school year to the school system and teachers who have done so much for our kids.”

The goal of the new campaign is to help the district keep its excellent programs, Correll and Perros said.

“We hope that funds raised through this campaign will help keep the Ann Arbor Public Schools innovative and excellent,” Perros said. “We hope that the funds raised through this campaign will find their way to each and every student in the district. One of our guiding principles is all students, all schools. We believe the funds from this campaign will help us reach more students in the district than ever before.”

The board will decide what projects it will fund with the money after the campaign ends June 30. To date, more than $135,000 has been raised in the campaign, which began in April, with more gifts in the pipeline. Ninety percent of those giving have never donated to the foundation before, Correll said.

“We’ve created so much awareness,” Correll said. “We’ve already tripled what we normally get through our letter campaign.”

Even before the $1 million campaign was launched, the foundation’s fundraising efforts were on the top end compared to similar-sized school districts and the foundations that support them. The bulk of Ann Arbor's gifts came from letter campaigns, not from events, although the foundation has several annual events.

The only one to raise more money in 2008 was the Rochester Community Schools Foundation at more than $490,000. Most of the other schools raised between $125,000 and $150,000.

Spending moneyFor much of its life, the Ann Arbor foundation focused on giving out small grants to teachers for classroom projects, but that's changed in the last few years.

The foundation board decided it should also provide broader support for the district and began to fundraise more and support district-wide projects like specialized literacy software.

The foundation still provides teacher grants. This spring, it awarded about $15,000 in projects, all designed to enrich students’ classroom experiences. The projects included minority student scholar programs at the high schools, gardens at various elementary schools and a sixth-grade transition boot camp at Scarlett Middle School.

However, the foundation recently has been focusing on larger grants to the district for programs that help all students, not just one classroom. For example, this year the foundation paid for enrichment coordinators to work with the schools to focus on increasing opportunities outside the classroom for students.

"They fund programs that align with our strategic plan and that we feel are needed for our students, but because of the tight financial times, we're unable to pay for," Ann Arbor Superintendent Todd Roberts said. "We're certainly grateful for all their help."

The foundation has decided to only spend the money it has on hand, Correll said. That’s why no specific projects are earmarked for the $1 million campaign. The board will see how much money it has, then prioritize with the district on how to best spend it.

That process will likely follow the current procedures for larger gifts - the school district develops programs to help students and pitches them to the foundation board committee, highlighting the educational research supporting each initiative and how it will be monitored.

To raise money, the foundation has a small staff.

Correll is a ¾-employee, a bookkeeper works a few hours a week and a clerk works a few hours a week.

Correll said the foundation is committed to making sure its finances are in order and that played into the overhead costs.

“We had a CPA signing checks for a while,” she said. “We didn’t need to pay for that.”

The bookkeeper does that task now, under the supervision of a certified public accountant firm.

From the $1 million campaign, the foundation has decided of the first $250,000 raised, 20 percent will go to overhead; for the dollars between $250,000 and $500,000, 15 percent will go to overhead, and from the dollars between $500,000 and $1 million, 12 percent will go to overhead.

Those are lower percentages than currently go to overhead.

Of the $94,337 paid in fiscal year 2008 for overhead costs, $68,564 went to professional fees and payments to independent contractors, the group’s required non-profit 990 form shows.

At the same time, the foundation gave $61,733 in grants, down from $83,222 in fiscal year 2007, tax forms show.

Despite more money being awarded in the 2007 fiscal year, overhead costs also were higher that year.

The group reduced its spending on overhead from fiscal years 2007 to 2008. Tax forms show the foundation paid $118,800 on overhead - including more than $65,000 in compensation - in the year that ended June 30, 2008. That compares to $94,337 in total overhead in the year that ended June 30, 2009. Correll said the the compensation figure is for more than a 12-month period.

“For several years, the foundation was run on a strictly volunteer basis,” Perros said. “As we committed to growing so that we could raise more money to give back to the district (more than teacher grants), we knew there would be associated costs to fund capacity building. The board knew that we had to make an initial investment to reach our new goals. It is our ultimate goal to reduce overhead costs as much as possible so that more of donors' dollars go to programs in the schools."

Perros said the plan in the coming fiscal year is to start talking about the process of growing the endowment so that ultimately, all funds received from donors would go directly to programs in the schools, and overhead would be covered by income from the endowment.

“We’re cognizant of our costs and want to keep them as low as possible," Cornell said. "We want to put as many dollars as possible back into the district to make sure the students keep receiving the excellent education they’ve been getting here in Ann Arbor.”

David Jesse covers K-12 education for AnnArbor.com. He can be reached at davidjesse@annarbor.com or at 734-623-2534.

Comments

Karen Chassin Goldbaum

Thu, Jun 24, 2010 : 2:27 p.m.

I agree with commenters who remind us that the Foundation's overhead-to-grant ratios will improve as its work to raise awareness and funds gains momentum. I applaud their efforts and also agree that sometimes small grants can make a big difference. If you supported the millage, as my husband and I did, please join us in donating dollars equalling the amount of the small tax increase we would have experienced (plus a few dollars for those who might not be in a position to do so) to the AAPSEF. We'd been meaning to do it and now this article has inspired us to back up our convictions with a check. It's a great organization with a hardworking staff pursuing an important mission. I'm grateful for our two grown sons' experiences in A2 schools, and the paid and volunteer staff who enriched their lives.

space cowboy

Wed, Jun 23, 2010 : 1:28 p.m.

Wendy Correll should spend more time raising money and managing the busienss of AAPSEF and less time checking her headlines and comments on this blog. 5 posts in 2 days.... Secondly, are you really suprised at how inefficient these organizations are when it comes to managing and distributing money. Classic "big government" organization. Real good at selling a make sense idea and concept to help people out; real bad on executing the business details efficiently. Third point is if you think this is inefficient, wait and see how Obama and his cronies "manage" the $20 Billion from BP intended to help those harmed by the oil spill. I know the rhetoric will be awesome, but I am suspect as to the efficiency and placement of the funds. Finally, where are all the contributions from you well intentioned voters who supported the millage and wanted to see extra funding goingto the schools?

Joel A. Levitt

Tue, Jun 22, 2010 : 12:31 p.m.

Mr. Norton What do the troglodytes in Lansing have to do with whether to contribute through the Foundation or directly to the AAPS?

Steve Norton, MIPFS

Tue, Jun 22, 2010 : 10:51 a.m.

Mr. Levitt, I think you'll find that many, even most, of the people willing to donate through the AAPSEF (especially large donors who are only now being convinced to direct their generosity to our schools) would not do so if the only route was to give directly to the district. Most contributions currently go to PTOs, which are likewise independent charities not under public control. We do not currently have substantial amounts of money being offered to the district in the form of private giving. Who is able to solicit such funds and make the case for donating? Surely the district would find it hard to earmark its precious funds for such a task. That's what the AAPSEF does, and what the overhead is for. They are carrying the message to the broader community, and it does not cost the district a dime since the EF is self supporting. The EF has not displaced private giving directly to AAPS, since there was virtually none. What it has done is to encourage our community to actively support our schools. Direct giving to AAPS has not and probably will not generate enough funding to affect the budget crunch greatly. In that case, we are left depending on action in Lansing to change the resources we have available. That's why I'd rather have an active Educational Foundation than be totally at the mercy of the machinations at the state Capitol.

Joel A. Levitt

Tue, Jun 22, 2010 : 7:21 a.m.

Mr. Norton What do the troglodytes in Lansing have to do with whether to contribute through the Foundation or directly to the AAPS?

Steve Norton, MIPFS

Tue, Jun 22, 2010 : 12:07 a.m.

glacialerratic wrote: "We need to find a way to fund our schools but to do so in way that maintains public accountability and public control." In fact, we already know how; there are multiple proposals on the table right now. However, our state lawmakers are collectively unwilling to take steps that increase revenue for schools (or anything else). While I work every day to change this situation, I do not expect dramatic change in the near future. Actually, I expect the situation to get more difficult after the November elections. As to local options, our one alternative to raise revenue for general school operations (the county millage) was defeated after ferocious opposition from some quarters and general resentment against any tax increases. One of the main goals of Michigan Parents for Schools is to change the public discourse about education, and to remind citizens why support for public education is a critical part of our success as a society. However, until we are able to make a great deal more headway in Lansing, I will continue to welcome the work of the AAPSEF to underline the value of our schools and to fund initiatives which would not otherwise exist.

glacialerratic

Mon, Jun 21, 2010 : 10 p.m.

A recently posted contribution acknowledges that the education foundation is under the guidance of respected members of the community and business leaders, but stops short of recognizing the significance of this admissionthat the foundation will accelerate the loss of public control and public accountability for our schools and place greater leverage in the hands of an unelected board that will have disproportionate influence on priorities and policies. In whose interests will such a board act? The ruthless attempts to discredit public institutions and to delegitimate them have spurred the antitax extremists who threaten our shared responsibilities to educate our children. To interpret these comments as coming from an antitax perspective is perhaps ironic, but very wide of the mark. We need to find a way to fund our schools but to do so in way that maintains public accountability and public control. Such a foundation, despite all good intentions, is not a publically-held trust. It is nave, or perhaps disingenuous, to claim otherwise.

DagnyJ

Mon, Jun 21, 2010 : 9:50 p.m.

Most foundations that give grants to educational organizations have an evaluation process to determine whether the grantmaking led to the hoped-for outcomes. Does AAPSEF evaluate the effect of its grants? How does the board know that its grants have an effect on student learning, or whatever is the desired goal of the grant? BTW, what IS the goal of the foundation, anyway? There is much talk of "supporting" education in Ann Arbor Public Schools, but what does that mean exactly? Giving a few teachers $500 for pet projects? Or something else? Seeing that disadvantaged students close achievement gaps? Making sure all students have equal access to classes, activities, excellent teachers? I don't know for sure from reading this article or the foundation website.

Andrew Thomas

Mon, Jun 21, 2010 : 9:35 p.m.

DonBee and Joel Before I respond to your questions/comments, I would like to clarify that I am doing so as a private citizen, and not in my official capacity as a BOE Trustee. You do raise an interesting point, one which has many facets. In a perfect world, I would tend to agree with you: Donating money directly to the District would eliminate the middle man, might be more cost effective (although that is debatable), and would prevent an outside organization from exerting undue influence over decisions made by the District. We do not, however, live in a perfect world. First, I think an external foundation has much greater potential for fund-raising than the District. If the District were to devote a significant amount of resources to fundraising, I would imagine there would be howls of protest over this waste of taxpayers money. An independent foundation has more flexibility in its ability to raise money, and will probably be more effective. By way of example, the various PTOs and PTSOs, which are independent of the District, are very successful at raising money for their individual schools. Second, I agree with Steve that many (if not most) donors to AAPSEF like the feeling that their gifts will go to directed, separately identifiable initiatives, not just dumped into the black hole of the Districts general fund. In this sense, AAPSEF is similar to the various booster groups for sports, band, etc. Football boosters are willing to work long and hard to raise money to support the football team; I doubt they would work as hard if all their efforts just went into the general fund. Finally, I think the danger of having a source of funding that is controlled by an independent board rather than by the Board of Education is not nearly as great as you fear. The Board of the Ed Foundation is composed of community representatives (including a BOE Trustee and senior administrators from the District). Also, even if AAPSEF is successful at raising $1 million this year (and each subsequent year) and uses all this money to fund programs through the District, this still amounts to no more than of one percent of the Districts operating budget. Not likely that this will influence decisions made by the BOE one way or another. Thank you for your constructive comments.

Steve Norton, MIPFS

Mon, Jun 21, 2010 : 8:32 p.m.

DonBee and others, I'm not an expert in this area, but I'll give it a shot in case no one from the Foundation is reading now. First off, I'm not sure how gifts directly to the district are treated for taxation; donations to the AAPSEF, as a 501(c)(3) charity, are fully tax deductible. Second, most donors show a preference for having some control over how their funds are being used. My impression is that gifts to the district cannot be earmarked, and simply go into the general fund. You may have noticed that specific gift items, like cars or pianos, which cannot be spread across all schools, have to be formally accepted by a vote of the board of education. That's a cumbersome process. In contrast, the Educational Foundation, through its board and grant-making process, can spark new initiatives, encourage small-scale experimentation, and fund items that would be hard to carve out of the general fund budget. And it can do so under the guidance of respected members of the community and business leaders. I agree - I do not wish the California model on us. However, thanks to Proposal A, we are already well on our way to being there. I prefer giving our community a way to support our schools, even if we are unable to do so through the public route of taxation. If people are concerned about the erosion of public control, I suggest that they become active in supporting changes in how public schools are funded in Michigan, call on the Legislature to find durable ways to increase and stabilize revenues for schools, and perhaps even support local measures such as a county-wide millage. But since many of the people complaining about a loss of public control have also been critical of other efforts to increase revenues to schools, especially the last millage, I find it hard to take those protestations at face value.

DonBee

Mon, Jun 21, 2010 : 6:30 p.m.

Mr Norton, Ms. Correll, and Mr Thomas - Mr Levitt poses an interesting question. Why not send the money directly to AAPS? What benefits does having the AAPSEF have over direct contribution to AAPS? For the schools and the contributors? Thank you in advance for your answers.

JackieL

Mon, Jun 21, 2010 : 5:50 p.m.

Every new business has start up costs. I think the goals of this organization are great. If they raise the money and keep expenses close to current ones, then all will be in order. Personally, I place a high value on trips and outside of school experiences. Many students do not learn well from books. Some of the schools/classes are taking their students on spectacular field trips. It would be great if all of the schools were able to participate. I believe this foundation has also paid for private music lessons for some students. People might not realize that there is no way students will be good enough to get into the advanced orchestras in high school unless they have private lessons --- a lot of them! So, this seems to be a good program and I plan to donate.

mike from saline

Mon, Jun 21, 2010 : 4:23 p.m.

I'm curious, Is AAPSEF required to follow the rules [laws] of the Michigan Civil Rights Initiative, in regards to "minority student scholar programs"?

Joel A. Levitt

Mon, Jun 21, 2010 : 2:12 p.m.

Corrected Text --- I agree with the previous commenter, glacialerratic. As they raise more money, the Ann Arbor Public Schools Foundation will more and more dilute the electorate's influence on Board of Ed members. Certainly, the schools need more money, but is the benefit provided by the high-overhead Foundation worth the price? The tasks performed by the foundation are: communicating with the public, accounting and allocating donations. The school system already has mature organizations for performing these functions, particularly, allocating funds is the task of the elected Board of Ed and of the administration. Don't contribute through the Foundation. Send your contributions to the schools directly, at: Ann Arbor Public Schools 2555 So. State Street Ann Arbor, MI 48104

Joel A. Levitt

Mon, Jun 21, 2010 : 1:57 p.m.

I agree with the previous commenter, glacialerratic. As they raise more money, the Ann Arbor Public Schools Foundation will more and more dilute the electorates influence on Board of Ed members. Certainly, the schools need more money, but is the benefit provided by the high-overhead Foundation worth the price? The tasks performed by the foundation are: communicating with the public, accounting and allocation of donations. The school system alreadily has mature organizations for performing these functions, particulary, allocation is the task of the Board of Ed and of the administration. Don't contribute through the Foundation. Send your contibutions to the schools directly at: Ann Arbor Public Schools 2555 So. State Street Ann Arbor, MI 48104

glacialerratic

Mon, Jun 21, 2010 : 1:16 p.m.

This foundation, if it meets its goal of becoming as large and well-funded as that in Irvine, California, will increase the influence of non-elected individuals who are not accountable to the public. Well-funded education foundations bring money and clout into decision-making about public education. What influence will this foundation have when critical decisions need to be made, such as another round of redistricting or consolidation of schools? What happens when its priorities diverge from those of the Superintendent or the School Board? When redistricting took place in the late 90s, disruption was most profoundly felt in schools where parents had less political and personal influence on decision-makers. Schools with parents who had the resources and relationships to affect the outcome were untouched. What happens when the District again faces a decision such as this? How will the leaders of the Foundation choose to act? In whose interests? Efforts to delegitimate public institutions at all levels have fueled the tax revolts that have weakened public schools and other fundamental public services and infrastructure. The goals of the AAPSEFto improve and support underfunded public schoolsare all well and good. Yet it stands to further erode public decision-making and accountability and to further enhance the power of non-public interests to shape and set priorities.

glacialerratic

Mon, Jun 21, 2010 : 1:11 p.m.

This foundation, if it meets its goal of becoming as large and well-funded as that in Irvine, California, will increase the influence of non-elected individuals who are not accountable to the public. Well-funded education foundations bring money and clout into decision-making about public education. What influence will this foundation have when critical decisions need to be made, such as another round of redistricting or consolidation of schools? What happens when its priorities diverge from those of the Superintendent or the School Board? When redistricting took place in the late 90s, disruption was most profoundly felt in schools where parents had less political and personal influence on decision-makers. Schools with parents who had the resources and relationships to affect the outcome were untouched. What happens when the District again faces a decision such as this? How will the leaders of the Foundation choose to act? In whose interests? Efforts to delegitimate public institutions at all levels have fueled the tax revolts that have weakened public schools and other fundamental public services and infrastructure. The goals of the AAPSEFto improve and support underfunded public schoolsare all well and good. Yet it stands to further erode public decision-making and accountability and to further enhance the power of non-public interests to shape and set priorities.

braggslaw

Mon, Jun 21, 2010 : 10:30 a.m.

If people want to donate the money they earned to employ people at the AAPSEF, they are free to do so. I would like my money used more efficiently so I would never donate money to an organization with such poor output.

Jeffersonian

Mon, Jun 21, 2010 : 6:44 a.m.

I agree with Bethy. Every program doesn't have to come with a big price tag. How about getting such a program started with volunteers until it becomes to big and needs professional management.

Steve Pepple

Mon, Jun 21, 2010 : 6:06 a.m.

A comment was removed because it contained a personal attack against another commenter along with unsubstantiated allegations about other issues.

Steve Norton, MIPFS

Mon, Jun 21, 2010 : 12:37 a.m.

"Voice", Wow. Your summary judgment of the schools and the AAPSEF is not justified by any of the facts as presented. And the conspiracy theory aspect is rather sad. I do not "accept failure;" I see the AAPSEF as a success that has the potential to get even better with time. Nothing in David Jesse's story leads me to change my opinion. I do hope that, as they grow, the AAPSEF will meet their stated goal of keeping overhead well within the range of best practices. Ms. Correll has been a tireless advocate of our schools and the role private giving can play in keeping them excellent. I'm sure that her compensation does not begin to match the time and energy she has put into the Foundation in the last few years. The Foundation has already made a huge difference in the district, and I very much hope they will raise the funds to do more. The critique of Randy Friedman is ironic, since I believe he was originally elected as a fiscally conservative critic of the schools. That makes his past support for this administration and the financial steps they have taken all the more notable. I sincerely doubt that his votes on the school board, whatever they might have been, have much to do with the business activities of a national pharmaceutical distributor. I have seen you make these accusations before on this site, but I have yet to see any evidence at all presented. As for me, I am a parent and the co-founder of an independent group of parents and citizens who place a priority on properly funded public schools in Michigan. I have no financial relationship with either the school district or the teachers' union. But I have worked with and respect the leadership of both organizations. I write here, in the press, on my organization's web site, and speak publicly on these issues. I also sign my name. What's yours?

A Voice of Reason

Sun, Jun 20, 2010 : 11:38 p.m.

I am glad I never and will never give a penny to the AAPS Foundation. Steven Norton--do you ever have any standards on anything? Every comment is pro-school distict and frankly, we expect better from our investment in our schools. You expect status quo, and accept failure. Please explain your relationship with the school district and teacher's union. I am guessing there is some type of financial arrangement and it is only fair that you disclose the truth so we understand your true motivation. Randy Friedman voted for every single request the MEA wanted and the Harvard Drug group was given generous MEA and UAW contracts because of it. He voted to irresponsibly spend our tax money, protect ineffective teachers and sold our children's future for his own personal gain. Steve, I hope you will be honest and let us know why you are supporting a failing, ineffective foundation that's only purpose seems to be to paying Wendy's salary.

A Voice of Reason

Sun, Jun 20, 2010 : 11:20 p.m.

That should be the end of the AAPS foundation. Not successful and an embarrassing failure. Time to close it down. (will our board be leaders for once? or are they happy with this kind of success?) Actually, this is a scandal and should make the national news.

Klayton

Sun, Jun 20, 2010 : 10:35 p.m.

Wow! I used to teach in Ohio and our school district's foundation was run by a great group of parent volunteers. They had little to no overhead costs so every penny could go toward grants. Sad that a district such as Ann arbor could not take more advantage of the intelligent, resourceful parents who are willing and excited to volunteer for school causes such as the grant foundation.

YpsiLivin

Sun, Jun 20, 2010 : 7:02 p.m.

Wendy, I'm not entirely sure what your explanation means, but in 2007, the 990 lists the foundation's purpose as "educational enrichment" but the only foundation "accomplishments" listed on the 990 were scholarship payouts totaling $7,034. (Sounds more like "individual enrichment" to me.) The rest of the payouts/expenses were for salaries, accounting fees, legal fees, supplies, printing, depreciation, administrative fees, "outside services" and two additional fundraising expenses. If your donors accept the funding of scholarships as "educational enrichment" then more power to you, but in the absence of any other "enrichment" activities, the 2007 990 makes the foundation look like it chewed up a lot of money on administrative expenses and didn't generate much (any?) benefit for the AAPS as a whole. Just sayin'...

braggslaw

Sun, Jun 20, 2010 : 6:03 p.m.

Typical... an institution that raises money solely to justify their existance and pay salaries.

Speechless

Sun, Jun 20, 2010 : 5:23 p.m.

Assuming that both Ann Arbor and Rochester calculate overhead costs similarly (with district contributions being the wild card factor), how about comparing the history of the two foundations? It might bring a clearer perspective if we look at the Ann Arbor numbers for the previous two fiscal years along with figures from the initial growth years of the Rochester foundation. Early on, did Rochester briefly experience a comparable high overhead percentage, or were they keeping it below 30% even when annual revenue was much lower? Similar growing pains, or not? Upon re-reading the start of the article, the first four sentences up through the hockey quote are quite the slam! bang! pow! opening to the story. AAPSEF = Ouch. That said, the larger issue and bigger scandal by far remains the lack of adequate funding for public education from county, state and federal revenue sources.

Wendy Correll

Sun, Jun 20, 2010 : 4:35 p.m.

No general contributions are used for scholarships. AAPSEF holds several endowed scholarship funds for graduating AAPS students; awards are made from these funds. It has been the practice of AAPSEF in the past few years to encourage donors interested in establishing scholarships to do so for students while they are in the AAPS. Two such scholarships have been established in the past two years.

YpsiLivin

Sun, Jun 20, 2010 : 3:35 p.m.

When I look at the 990 for the AAPSEF for 2007, it appears as though all but $358 of the fund's $42,000+ revenue that year was spent, mostly on overhead and scholarships ($7,000+) presumably for graduating students. There are many tuition assistance/grant/scholarship programs that exist for college students who can demonstrate financial need. I would suggest that since the mission of the foundation is to support the AAPS, the foundation (if it has not already done so), should stop providing college tuition assistance to students who have exited the AAPS and refocus its spending priorities on programs that benefit enrolled students. If I donated to the AAPSEF with the intention of having my gift fund school programs, and later found out that my gift was used to support individuals, meaning that no benefit was seen by enrolled students, I'd be a very disappointed donor indeed.

Steve Norton, MIPFS

Sun, Jun 20, 2010 : 3 p.m.

DagnyJ says: "Ridiculous. $500 here, $1000 there for one-shot, nifty little projects." Sometimes, $500 or $1000 is all it takes for a teacher or parent group to get the ball rolling with something that will change the lives of students. Everyone is afraid to spend precious resources on new things, and the AAPSEF's small grant program helps spark innovation around the district. Small things can have a big impact. But this comment also misses the larger efforts the AAPSEF has supported, including funds for professional development so that educational software is used effectively, support for other technology initiatives, support for an elementary enrichment coordinator who can assist all schools, and so on. Until the EF reliably has the funds to support such large programs, however, people will be reluctant to launch initiatives which may die on the vine. That is why the One Million Reasons campaign is so important.

Steve Norton, MIPFS

Sun, Jun 20, 2010 : 2:50 p.m.

As a supporter of our schools, I feel I really need to comment here. I agree with Andy Thomas - both Ann Arbor Parents for Schools and I personally support the mission and work of the AAPS Educational Foundation. We have worked extensively with AAPSEF executive director Wendy Correll and board chair Christy Perros, and I admire both their commitment and professionalism. They have worked very hard to bring the EF into the 21st century and to ramp the organization up to meet the needs we face given the anemic funding available for our schools. With tiny exceptions, the people of the Ann Arbor area cannot directly choose to spend more on school operations; the AAPSEF gives us all an opportunity to preserve and extend the programming that makes AAPS a top notch school system. Even more important, the AAPSEF is playing a central role in ensuring that innovative programming is available for "all schools" and "all students." There is already considerable inequality within our school district, based on which PTOs are able to raise enough funds to hold on to programming formerly supported by the district and which cannot. My own children's school PTO was one of the first to make a direct contribution of our funds to the EF's Village Fund Initiative, and I encourage all other PTOs who have the means to do the same whenever possible. It should surprise no one that, when dramatically expanding the mission of an organization, many of the startup costs come before the revenue starts to flow. Anyone who has been involved in nonprofits that grow beyond the initial "all volunteer" stage recognize that the time comes when a professional staff and other similar expenses are an integral part of the organization "growing up." But neither is it fair to compare this small local organization with international organizations that have huge economies of scale. I'm sad that so many commentators here feel that anything connected with our schools must be wasteful and rotten. I also find it ironic that the same people who mistrust the school district with taxpayer funds are critical of an independent nonprofit whose board - made up of business and community leaders along with educators - seeks to make sure donors get the most bang for their buck. Take a look at the whole 990; the "professional services and contractors" line clearly includes all staff pay. In addition to postage, there are thousands in advertising and other fundsraising expenses. Unlike some of the other area foundations, the school district does not pick up anyone's salary. Lastly, the 990 shows that the EF's investments suffered an unrealized loss of $111,000 last year. Anyone surprised that this slowed down disbursements, or prompted them to shift a bit more to build up the fund balance? I'm supporting the "One Million Reasons" campaign, and I encourage everyone who cares about our schools to do so as well. If you have questions, check out their web site or ask Ms. Correll or contact their board. These are dedicated people who are happy to talk about what they are trying to do for our schools.

DagnyJ

Sun, Jun 20, 2010 : 2:30 p.m.

Go look at the list of grants awarded by the AAPSEF. http://www.aapsef.org/initiatives/initiatives.html On the right, downloadable spreadsheets. Ridiculous. $500 here, $1000 there for one-shot, nifty little projects. I'm sure there were some swell photo ops and teachers made nice with foundation bigshots. But these nickel and dime handouts will do nothing to improve education for AAPS students overall. If your kid has a teacher who doesn't choose to apply, you get zero benefit from the foundation. If your kid needs a long-term, sustainable to program to help him overcome some educational challenge, the foundation won't help you there. But hey, if you want an organic garden next to the playground, this the organization for you. And 47% overhead is indeed a travesty.

glacialerratic

Sun, Jun 20, 2010 : 2:26 p.m.

Ms. Correll has not addressed the fact that the board of the foundation is not accountable to the public, but only to itself. This is a highly dubious enterprise if it weakens public governance, responsibility and accountability for funding of public schools. Where does the $250,000 that has been raised come from? Who will be making decisions about how it will be spent? What mechanism exists to ensure accountability for the effective and equitable use of these funds? A foundation, because of its inherent institutional character, is not accountable to the public--the public does not choose the board or set its priorities. This is a disturbing trend that comes from California, a state that long ago ceded it reputation for progressive ideas when it passed Proposal 13.

Jonas Dainius Berzanskis

Sun, Jun 20, 2010 : 2:15 p.m.

Anyone that is interested should look at Rotary International Foundation and their bylaws governing the percentage allowed for administrative costs. To me 30% is usurious, 40% is criminal. The donors are being fleeced. Check out what Rotary has done and the funds they have raised

DonBee

Sun, Jun 20, 2010 : 1:53 p.m.

If the overhead next year is $100,000 and the grants are $900,000 (which equals the million they want to raise), then the overhead will be 10 percent of funds raised. That is a total I could really get behind. But, if the overhead or fund raising expenses rise significantly, then I have a real problem with the whole thing. Given their fund balance in the table above, it looks like they gave about 9 percent of what they had available to grant. If they are trying to build an endowment like the UofM and have millions in the bank, this is about the right amount to give out. Otherwise, I would expect to see a lot more of the fund balance used in the year it is contributed. I think we need a follow-up piece in 6 or 12 months.

Wendy Correll

Sun, Jun 20, 2010 : 1:45 p.m.

To Holly Owens and all, indeed my comment was flip and should not have been made, certainly not to a reporter. I in no way intended to diminish the work of hard working volunteers and professionals doing important work every day for hundreds of organizations in this community, many of which support programs for young people. My sincere apologies to all for that error. I know that the hockey association has worked diligently to overcome negative publicity and my flip comment did not help.

Kafkaland

Sun, Jun 20, 2010 : 1:09 p.m.

This doesn't really seem to be a problem of absolute overhead costs, but of scale. Why can't we have one organization for all of SE Michigan, with the office and paid professional staff to oversee accounting etc., which shouldn't cost much more than the AA office costs now, plus local unpaid coordinators to make things happen and have authority over what happens in the respective school districts? That would save a ton of money that could go to the kids and still ensure proper management and oversight.

Holly Owens

Sun, Jun 20, 2010 : 1:07 p.m.

Note to Wendy Correll: you sure didn't help yourself or your organization by taking a cheap swipe at the AA Hockey Association with your comment, "If you want to have a professionally run non-profit foundation, you have to hire professional people to run it or you get a hockey association". That's doing a terrible disservice to all the many volunteers who work for nothing at non-profits every day, and do an extraordinary job. You also seem to imply that you have to bribe someone with a salary in order to keep them from stealing from you. White collar professionals are not exempt from embezzling, as we all know too well. Finally, you came off as elitist and superior. With that one comment, I'm afraid you succeeded in doing the exact opposite of what I'm sure is your goal; the AA Public Schools Educational Foundation may well see diminished contributions in the future from all the people you ticked off with that careless statement.

jns131

Sun, Jun 20, 2010 : 12:54 p.m.

Happened to Willow Run a few years back. Had something to do with a grant and small classrooms. Come to find out they used it to pay bills with. Same thing Ann Arbor has done. No big surprise here. Students get nothing and teachers get their paychecks.

Wendy Correll

Sun, Jun 20, 2010 : 12:52 p.m.

The selection process for large grants funded by AAPSEF is modeled after the agreement between the Irvine Public Schools Foundation and the Irvine Unified School District. The Irvine Public Schools Foundation is highly successful and works collaboratively with the school district. The process here is as follows: the AAPS Superintendent submits a variety of grant applications to the board of the AAPSEF in the early spring of each year. All applications for funding must be aligned with the strategic plan of the district and are typically presented by the administrator overseeing the content area. Presented in this way, the board of AAPSEF is assured that the programs are educationally sound. A subcommittee of the board of AAPSEF, composed of AAPSEF board members, parents, retired teachers and community members then conducts further review of each and every application. Programs recommended for funding by the committee represent the intersection of donor interest (gauged through surveys and donor directed gifts) and AAPS needs. The full board votes on which programs to fund and at what dollar amount. At the time that grants are awarded, reporting measurements are put in place to provide feedback on the progress and efficacy of the programs. Education foundations across the country operate in ways that work for their community; some tell the districts what they want them to spend the money on without seeking input from the school district, some foundations exist within the school district and fund programs decided upon by the school district without community or donor input. The program evaluation and selection process used by AAPSEF supports the wishes of contributors to support needed programs in the schools and to have independent oversight over the funding. This year, due to significant budget cuts and uncertainty until the end of June as to just what will be reduced, the process has been delayed. In addition, the One Million Reasons Campaign ends July 31st. We will not know until that time how much funding will be available for programs in the 2010-2011 academic year. Decisions will be made in August.

Orangecrush2000

Sun, Jun 20, 2010 : 12:35 p.m.

"Its not unusual for foundations to approach the 50 percent mark on overhead costs, said Rob Collier, the president and CEO of the Council of Michigan Foundations." Why is this? I thought that OH was suppose to be about 25%?

Stephen Landes

Sun, Jun 20, 2010 : 12:02 p.m.

The Foundation had best look to Walled Lake, Lansing, and Livonia to figure out how to do its job more efficiently. I would not give to an organization with overhead at 47%; that is simply ridiculous. Charitable organizations are looked at critically when their overhead exceeds 10% and that is the threshold I would expect the A2 Foundation to not cross.

Wendy Correll

Sun, Jun 20, 2010 : 12:02 p.m.

No funding from the One Million Reasons Campaign will be used to build a fund balance. That was stated in our literature.

Speechless

Sun, Jun 20, 2010 : noon

To follow up on something briefly noted earlier, the real issue here is the failure of local, county, state and federal tax structures to adequately fund the costs of public education. The question that screams out is why school districts have education foundations in the first place. The very existence of entities like AAPSEF illustrates how dysfunctional the funding systems have become. The top priority should be to render their purpose obsolete by fixing public funding, and then disband them quickly. The slow pace of AAPSEF fundraising is of interest, but only as a side issue. These operations exist as a desperate hack created to fill a serious money gap — an undemocratic hack at that, as previously noted. Not directly accountable to voters, yet they make funding decisions involving public education. At very best, they offer a financial band-aid which allows us to delay implementing genuine solutions. For now, the most immediate remedy at hand is another millage increase referendum. Beyond that, an increase in (or reinstatement of) federal and state financing for public education will help limit millage increases and also provide balance by supporting districts with a poorer tax base. A deeper, longer-term fix is eventual adoption of a graduated state income tax, which will raise state revenue levels — including state aid to schools — without additional burden on the middle class. With improved funding under a more rational tax framework, districts would also have greater ability to distribute money adequately between individual schools. The quality of available activities should not depend on whether the PTO has a sufficiently large base well-off parents willing to pay costs (or whether other local PTOs will voluntarily share these costs).

Basic Bob

Sun, Jun 20, 2010 : 10:53 a.m.

Thanks for the story. I just saw one of the "Million Reasons" campaign signs up close and was curious what the AAPSEF planned to do with the money they raise. It seems that they don't have any plan for the money except to pay overhead and build a fund balance. While I support their goals, they have not succeeded in execution.

Steve Norton, MIPFS

Sun, Jun 20, 2010 : 10:48 a.m.

AMOC: I will comment more later, but let me note this: what you are describing is the Village Fund Initiative, and it is the creation of a number of far-sighted individuals and is run by the... AAPS Educational Foundation. This is one of many programs that help to implement their mission to support "all schools, all students."

jcj

Sun, Jun 20, 2010 : 10:40 a.m.

Are there inaccuracies in the story? If so point them out! If not defend the expenditures but don't kill the messenger!

jcj

Sun, Jun 20, 2010 : 10:30 a.m.

@ Alan Bernard While you would have us believe that every story has an ulterior motive you might do well to direct your comments towards the person that penned the story David Jesse not Tony. And if AAPSEF has nothing to be ashamed of then a little transparency should not hurt! All might do well to take a look at this link http://www.charitywatch.org/tips.html "AIPs Charity Rating Guide recommends that in most cases 60% or more of your charitable donation should go to program services. In AIPs view, 60% or greater is reasonable for most charities. The remaining percentage is spent on fundraising and general administration. Less than 40% should be spent on general administration and fundraising costs. Note: A 60% program percentage typically indicates a satisfactory or C range rating. Most highly efficient charities are able to spend 75% or more on programs."

say it plain

Sun, Jun 20, 2010 : 10:28 a.m.

Ugh, @Alan Benard and especially @Edward R Murrow's Ghost make some important points here. What a non-story this is; it has got to count against the publishers as a sort of phishing operation at this point really to stir up the old reliable debates, very sad and tiresome. This 'story' doesn't tell one properly, non-profits need to actually hire a responsible person or two run the thing lol, and when accounts are low, hiring a person or two at very reasonable wages even will seem to eat a lot of the income, no? The charts of comparison should have been the starting point for some real journalism. Why the differences among the school systems in their affiliated non-profits? *First* go and investigate these, *then* submit the piece. Is it that we have moved to the equivalent of blogging now, so that instead of a full piece of investigative or policy-debate journalism we get provocation to the community? Can aa.com please attempt to move us beyond the sound-byte stuff we get all over? Why do we need one more forum for hints and implications to provoke shallow thinking and negative spinning? @Glacialerratic brings up yet one more interesting issue that could be explored, if that were something desirable but perhaps thinking is discouraged here lol...are we comfortable with the idea that a 'private' group can decide where to spend money on public education in this particular way? I would love to see less sensationalist destructive sound-byte-y pieces that seem so specifically tailored to nastiness and more *analysis*, but I'm losing hope here.

AMOC

Sun, Jun 20, 2010 : 10:23 a.m.

With all due respect to Wendy Correll's "professionalism", she is dead wrong. A non-profit with substantial revenue can be very effectively managed by volunteers, and will experience minimal risk of embezzlement if they also have an effective auditing policy. Unlike the hockey association or Safe House, what's needed is a policy which prevents having a single trusted individual who signs off on financial reports for some years before anyone else examines the books in detail. The AAPSEF could free up approximately 75% of their overhead expenses for grant making by having a CPA or other paid professional audit their books and prepare their IRS filings, but otherwise return to operating as a volunteer organization. While it's true that 47% is not an unusually high overhead rate among major fund raising organizations, that says much more about the sorry state of our tax laws and the profit potential in working with non-profit organizations than it does about how well or poorly managed AAPSEF might be. Their very high fund-raising expenses and overhead levels (compared to the United Foundation and the AAPS PTOs) are what has been and will continue to keep me from contributing to AAPSEF. That, and the fact that I have vastly different personal priorities regarding which AAPS programs which deserve my voluntary support in addition to the taxes I am required to pay. Those community members concerned about equity among school PTOs should consider making a contribution earmarked for the PTO Council's Equity Fund (Whole Village Fund?, it's operated under several names the last few years) by which those schools whose PTOs raise a lot of money share funds with AAPS schools where the PTO has less ability to raise large amounts of money. All of this process is managed by committed volunteers with appropriate checks and balances to prevent malfeasance. PTO Council took note of the hockey association, and strongly suggested having individual school PTO's financial records reviewed by 2 or more individuals, or even professionally audited.

DagnyJ

Sun, Jun 20, 2010 : 10:22 a.m.

Great story, David Jesse! This foundation does not have a focused plan for giving to improve student learning. It gives out "happy" grants for little projects in individual classrooms. And the high overhead is another indication of its directionless activity.

Alan Benard

Sun, Jun 20, 2010 : 9:54 a.m.

The assignment of this non-story jibes with annarbor.com's anti-teacher/schools bias, and it certainly is fuel for the page-view fire, as Mr. Murrow's Ghost pointed out. Well done, Tony! You get to serve both your advertisers and your right-wing publisher simultaneously. But Tony, don't you feel a little bit of shame with these tabloid-esque headlines?

jcj

Sun, Jun 20, 2010 : 9:49 a.m.

@ gild Did not say " no paid staff" Said If a "non-profit" is spending that PERCENTAGE on overhead then I refuse to call them a non-profit! OK I will remove Walled Lake from the equation. Does not take away from the fact that AAPSEF is spending $94,337 on overhead costs while granting $61,733 to its "cause" If some do not see something wrong with this equation then give all you want to the administrators.

glacialerratic

Sun, Jun 20, 2010 : 9:43 a.m.

Public schools are under-funded and public confidence in their effectiveness has been under-mined from many directions. Nevertheless, the intrusion of a non-profit foundation into decision-making for public education must raise concerns. The AAPSEF board decides which projects it funds. The foundation board is not selected by public ballot and is not accountable to anyone but the organization itself. School boards are accountable to the public through the ballot for financial and management decisions they make. Foundation boards are not. Who sits at the table when decisions that affect schools across the district are made? How are priorities set? How is equity across the district ensured? How is the effectiveness of grant-making measured and reported, and how does it contribute to sustainable improvement of all schools rather than small, localized projects? Notwithstanding the participation of AAPS administrators, the AAPSEF introduces private decision-making into the most important public investment of any community. This starts to shift responsibility for public schools to private hands and may not be in the interest of the District and of the community.

michaywe

Sun, Jun 20, 2010 : 9:43 a.m.

Good Morning and Happy Day to our Father's! "If a "non-profit" is spending that percentage on overhead then I refuse to call them a non-profit! Obviously someone is making a profit from these donated funds!" jcj Story doesn't accuse AAPSEF of making a profit. Are you confusing profit with what most non-profits, IMO, are guilty of - replacing the IRS gift of no tax/no owner(s) ROI with jobs, studies and consultants?

gild

Sun, Jun 20, 2010 : 9:31 a.m.

@jcj: You must be kidding. In order for you to deem it a nonprofit, an organization must have no paid staff? As far as Walled Lake goes, did you miss the part where it says the foundation does have a paid director, but the position is being funded by the school district?

sbbuilder

Sun, Jun 20, 2010 : 9:21 a.m.

And, without trying to veer of into another discussion, I'm wondering what 'teapartyers' have to do with this article? This was allowed in two separate posts, so I'm assuming the censors have deemed it relevant. Mr Ghost, could you provide us with the connection please? Good riddance, and Good Morning

jcj

Sun, Jun 20, 2010 : 8:36 a.m.

@ Edward R Murrow's Ghost You seem to take a great deal of interest in these A2.com non- stories! You Said "The problem is not the overhead. That overhead likely would be the same whatever the amount of money coming in. The problem is that there is not very much money coming in--hence the high percentage." I say Sorry the problem is with your logic. If a "non-profit" is spending that percentage on overhead then I refuse to call them a non-profit! Obviously someone is making a profit from these donated funds! You only have to look at the chart to see how REAL non-profits are run! Look at the overhead cost for Lansing, Walled Lake and Livonia! Wendy Correll was off base taking a swipe at the AAAHA with her comment!

Elizabeth Nelson

Sun, Jun 20, 2010 : 8:15 a.m.

I had the opposite reaction to one poster re: this headline. In this online version (I haven't seen the printed paper), this headline spins overly negative, I thought. I gasped when I read it, there was shock value that disappeared after I read the article (particularly looking at the small figures in the chart). I'm disappointed that anyone would interpret these numbers to mean that somehow the Foundation is not worth supporting or is somehow inefficient in its work. The actual amounts spent on overhead are peanuts, it's the $$ coming in that obviously needs to increase. The headline made me gasp but reading the numbers made me want to pledge money and volunteer my time. The goal of supporting equity between different schools (and ideally offering more funds to those schools that DON'T have wealthy PTOs) is something all of us should be able to get behind.

Andrew Thomas

Sun, Jun 20, 2010 : 8:13 a.m.

I strongly support the goals of the Ann Arbor Public Schools Educational Foundation, and commend Ms. Correll and the rest of its leadership. As the District struggles with declining revenues while simultaneously maintaining and expanding the quality of public education, private donations will become increasingly important. In terms of absolute dollars, the administrative cost of running AAPSEF is not excessive. As noted in the article, it is common for a school district to support the cost of the directors salary, something we have not been able to do. In a period where AAPSEF is attempting to build up its endowment through attracting new donors, it is not surprising that some start-up costs are associated with this effort. I look forward to the day when AAPSEFs endowment is sufficient to generate enough investment income to cover all administrative costs so that current donations can be directed toward the current needs of our schools. Over the years, I have personally put my money where my mouth is in terms of supporting AAPSEF. I am currently donating my entire stipend as a Board of Education Trustee to AAPSEF, and I know that a number of my fellow Trustees are doing the same. I urge all members of our community to support our childrens future by contributing to this very worthwhile organization.

Christy Perros

Sun, Jun 20, 2010 : 8:10 a.m.

@ Craig Lounsbury: As Immediate Past Chair of the Foundation I feel I must provide some additional information that speaks to your comment of the Foundation being 19 years old. While founded in 1991, AAPSEF reorganized in 2007 in order to expand and provide greater support for programs in the AAPS. That reorganization was based upon knowledge that it would take time and money to achieve wide scale community support. A feasibility study conducted by Martz and Lundy was the basis for the reorganization. This growth has required an investment in staff and infrastructure that is now paying off. I encourage anyone that still questions our overhead expenditure to visit this page on our website http://aapsef.org/about_us/financial_review.html

Craig Lounsbury

Sun, Jun 20, 2010 : 7:58 a.m.

"The problem is not the overhead. That overhead likely would be the same whatever the amount of money coming in. The problem is that there is not very much money coming in--hence the high percentage." You are incorrect Mr Ghost, the problem is the overhead. The foundation was formed in 1991. After nearly 20 years in existence they should be doing much better with their money than 47% overhead and 31% to grants. It would be understandable if they were an upstart charity but they aren't. They are 19 plus years old.

aamom

Sun, Jun 20, 2010 : 7:51 a.m.

@Jeffersonian I understand and agree with your point that 100% of money could be spent on kids if given directly to the PTO. My concern is that some of our elementaries are able to raise extreme amounts of money due to attendance boundary demographics and others can't raise much at all. Since PTOs now almost exclusively pay for field trips and all other "enrichment" opportunities, the opportunities at our schools would differ even more than they currently do. That is why I like the idea of the AAPSEF but I hope they actually do lower their overhead.

The Picker

Sun, Jun 20, 2010 : 7:20 a.m.

Not very critical reporting of this gouging by a non profit. 47% Really! How about a breakdown of these "Total Expensives" and Total overhead And why is it that governments and non profits are always using comparable worth studies to hop scotch their way to higher salaries? For profits can't get away with this. This shows that a donation "For the children" often doesn't benefit them!

Jeffersonian

Sun, Jun 20, 2010 : 7:07 a.m.

I accuse no one of wrong doing. It is note worthy to point out that "professionalism" means that the administrative people involved are being paid as hired agents and not volunteers. I'm sure the people who donate could contribute their funds directly to a thousand different programs within the local school system with nearly 100 percent finding its way directly to the students. No need for a middle man to decide how to spend the money when the schools are busting at the seams with needs of every kind. I don't think there is a teacher or a principle that would turn down a contribution to better the educational effort.

Brian Bundesen

Sun, Jun 20, 2010 : 7:03 a.m.

So the justification for the grossly disproportionate administrative costs are because of the hockey association embezzler? That statement asks us to believe that non-profits are forced to overpay it's leaders, and demonstrates a disconnect to those who are served by the non-profit. Disgraceful. IMO, non-profit leaders should be thankful for the opportunity to serve and be humble, not have an air of superiority, especially in light of the other organizations who seem to be doing fine with reasonable admin costs.

stunhsif

Sun, Jun 20, 2010 : 6:43 a.m.

No suprise here! And it is supposed to be about the kids they say, yeah right. Let's watch the defenders spin this one. Business as usual, nothing more or less.

Wendy Correll

Sun, Jun 20, 2010 : 5:16 a.m.

The board and staff of the AAPSEF take seriously its mission to support innovation and excellence in the Ann Arbor Public Schools. A review of AAPSEF 990s does not give a full picture of the work of our organization, nor most nonprofits. It doesnt reflect the fact that the board allocated additional funds for grants that were not distributed because the program did not launch as early as anticipated. We didnt pay for a program that wasnt delivered. The funds were placed back into reserves to be reallocated at another time. Further, the 990s dont show that AAPSEF was a collaborator in bringing additional resources to programs in the schools that didnt involve cash exchanges; field trips for classrooms that would not otherwise have been taken, tickets to UMS events, volunteers, etc. For more information, visit: http://aapsef.org/about_us/financial_review.html. The AAPSEF board works with a balanced budget. In the current fiscal year, we have allocated funds for marketing including paid advertising on AnnArbor.com that is already paying off. Without adequate funding in our budget, we could not have launched the One Million Reasons campaign which has raised $250,000 to date. No more than 18% of the funds from the One Million Reasons campaign will be allocated to administrative expenses. When AAPSEFs new iteration reaches maturity in 2012 or 2013, funding percentages for programs will follow Charity Navigators best practice guidelines and exceed 65% of our budget. If we cant meet that goal before that time, the board will reevaluate the purpose of the organization. Every donor ought to investigate nonprofits they are going to invest in or volunteer with. If they have questions about the organization, they should contact the organization and seek answers. I have talked with several community members recently about our financials. After understanding the goals, all seemed satisfied that AAPSEF was a good investment.