Ann Arbor officials: Proposal 3 on Tuesday's ballot improves pension board composition

Ann Arbor officials have released an information sheet on a Proposal 3 on Tuesday's ballot, which asks city voters to approve changes to the makeup of the city's pension board.

Governance of the city's retirement system is defined by the city charter and changing its composition requires voter approval of a city charter amendment.

The current nine-member board includes the city administrator, chief financial officer, three trustees appointed by the Ann Arbor City Council, two trustees elected by general city members, one trustee elected by fire members and one trustee elected by police members.

In an effort to increase accountability and reduce the potential for conflicts of interest, a council-appointed blue ribbon committee recommended several years ago that the city administrator be removed and other changes be made to the makeup of the board.

At the heart of the concern is the independence of the board members. Of the nine current members, a majority are direct beneficiaries of the retirement system.

If Proposal 3 is approved on Tuesday, the board's makeup would be changed to include five appointed citizen trustees, one elected trustee each for general city members, fire members and police members, and the continued membership of the chief financial officer.

The agenda packet for Thursday's City Council meeting includes a copy of the new actuarial valuation report for the city's retirement system. The report shows the city had 798 retirees and 135 beneficiaries receiving benefits as of June 30.

The average age of persons receiving benefits is 67.2 and the average annual benefit payments equal $31,258.

The number of retired members and beneficiaries increased by 6.1 percent in the past year, while the average age of the retired members remained the same. The total annual benefit payments for those members increased by 7.3 percent in the past year.

As of June 30, there also were 664 city employees in active service covered under the provisions of the city's retirement plan.

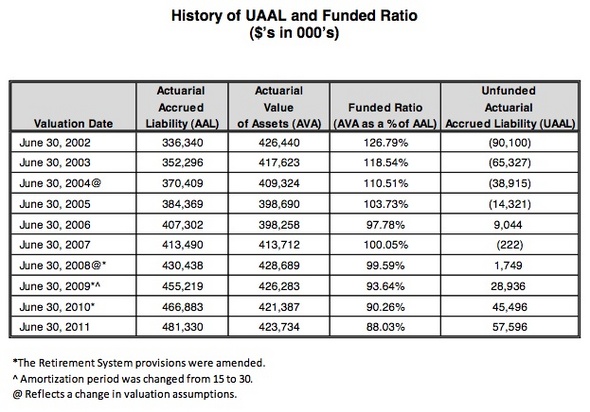

The report shows the city's pension system 88 percent funded, compared to being 90.3 percent funded the year before and 126.8 percent funded in 2002.

The city's unfunded pension liability has grown to $57.6 million, up from $45.5 million a year ago — and significantly up from $1.7 million in 2008. City officials are hoping recent changes to retiree benefits will help the city chip away at that obligation.

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's e-mail newsletters.

Comments

Sarcastic1

Tue, Nov 8, 2011 : 3:23 p.m.

When I read an article that pronounces a ballot proposal will improve the pension board, I expect to read the article and come away with the same opinion. Not in this case. The Ann Arbor Pension Board has had the same make up for 40 years, and I see no need to make any changes. The fund is in better financial shape than most other funds in the state. The independence of the board members is what makes it work. Stanton is just regurgitating information fed to him.

Nerak

Tue, Nov 8, 2011 : 2:08 p.m.

Please vote no on this proposal. I find it interesting that there was no information about this proposal included on the postcard sent out by the City Clerk (who gave me a really inadequate explanation as to why), while there was about the other two city proposals. And an information sheet suddenly becomes available the day of the election, after most retirees who still live in the city have likely voted absentee. Please pay attention to the comment from City Retiree, who hit the nail on the head. This is a bad idea and another example of the Mayor pushing to stack the deck on another board. Don't you think people who care about the board and the pension system (that is, those who DO benefit from it) are best-suited to participate on the board?

AstroJetson

Tue, Nov 8, 2011 : 3:58 a.m.

I strongly object to the title of this article.To state that Proposal 3 improves the pension board composition is totally subjective (the reporter's/AnnArbor.com's opinion) and not necessarily true. Proposal 3 merely CHANGES the the pension board composition. At this time no improvement can be determined.

Ryan J. Stanton

Tue, Nov 8, 2011 : 5:18 a.m.

It's actually the opinion of city officials, hence the attribution.

Let me be Frank

Tue, Nov 8, 2011 : 12:21 a.m.

A BIG NO FOR #3! A political ruse for the City Council and their cronies to further mismanage City financial matters. Why is the City just popping this one on the ballot without providing much public information before hand? This proposal smells funny.

J. A. Pieper

Mon, Nov 7, 2011 : 11:51 p.m.

Why is this coming out the evening before we vote? How can we find out enough information to know exactly which way we want to vote? This is ridiculous, and now we know one reason why our city is a fiasco financially. So much for leadership... They know how to confuse voters to get what they want, so they can pad their pensions off our back.

City Retiree

Mon, Nov 7, 2011 : 8:32 p.m.

Please vote No on proposal 3. I'd like to clarify a few things. First, the pension board only administers Chapter 18 (the Pension Ordinance.) Ann Arbor City Council is the only body that can change, increase or decrease benefits because only Council can approve any ordianance changes. Changing the Charter is different from changing an ordinance. That is why changing the Charter requires a public vote. In 2001, the City wanted to reduce the work force by offering incentives to retire. The Pension Board disagreed but Council ( including the current mayor) put in an ordinance change to provide the incentives. Remember...you were not asked to vote on that because it didn't change the Charter. It only required Council majority. Therefore, changing the Charter will not give citizens 'more representation as a citizen on salary and benefit negotiations involving city employees.' Second, the Mayor seems to be having a hard time filling the current number of citizen trustees. Vacancies have remained unfilled for months. Third, THANK YOU, THANK YOU, THANK YOU to all the Citizen Trustee past, present and future. I appreciate all of your time, hard work and dedication to the Pension Fund. The stock market drops in 02, 08 and this year are reflected in Actuary Report. Unfortunely, the Actuary report does not reflect your (voluntary) hard work for the citizens of Ann Arbor and for those of us who served them (past and present.) Fourth, The Blue Ribbon Committe...don't get me started. Thank you.

dotdash

Mon, Nov 7, 2011 : 10:51 p.m.

Thank you, City Retiree, for your post. Can you explain further why the referendum is bad? I get why it might not change anything (your first paragraph), but why do you ask people to vote against it, exactly?

Stephen Lange Ranzini

Mon, Nov 7, 2011 : 8:24 p.m.

In case you didn't pay careful attention to the table above, what it means is that in 9 years, the pension fund lost $147.7 million on top of the $170 million deficit built up in the post retirement health care fund. The city's retirement system certainly needs a reform since according to the most recently completed city external audit, it is now $227.6 million in the red (last year's audit showed the deficit was $215.5 million - add to that last year's loss of $12.1 million). While the pension fund is $57.6 million underfunded ($45.5 million underfunded per last year's audit) the post retirement health care fund is $170 million underfunded. It's a shame that a deficit of $227.6 million was allowed to be built up before action was taken. For the details on how the retirement system deficit is calculated, see pages 77 to 79 of the city's audited financial report (called the CAFR) for June 30, 2010 (which is the most recent available) at <a href="http://www.a2gov.org/government/financeadminservices/accounting/Documents/AnnArbor%20CAFR2010.pdf" rel='nofollow'>http://www.a2gov.org/government/financeadminservices/accounting/Documents/AnnArbor%20CAFR2010.pdf</a> The unfunded amount is what is listed as "unfunded actuarial accrued liability" or "UAAL". Of course the future success of this proposed reform is entirely dependent upon the quality and skills of the five citizens the mayor appoints (who will have a majority of the votes on the new board) and city council's willingness to adopt and stick with fiscally prudent benefit policies.

Tony Livingston

Mon, Nov 7, 2011 : 8:22 p.m.

Pension systems like Ann Arbor's are bankrupting cities and states all over the country. If the average age of retirees is 67 that means there are a lot of young ones balancing out the retirees in their 70s and 80s. People have got to wake up to the fact that we are paying for people to begin taking retirement pensions when they are 50 years old. Why? That is not the purpose of retirement programs. This is a huge problem that will not go away with a few new rules to the pension board. We taxpayers need to speak up and say enough is enough. I would love to see a story from AnnArbor.com listing the ages of everyone recieving retirements pensions. We don't need names, but I think people would be surprised to know how many people in their 50s are on the public dole here.

Val

Mon, Nov 7, 2011 : 8:22 p.m.

Why is there no information on the millage? There are two millage requests on the ballot; 5 mills for street repair and .125 mills for sidewalk repair. These should be voted down since I as a home owner am not the only one using the streets and the sidewalk. Non-property owners will be able to vote on these requests, students, who will not pay for any of the cost and the apartment people will pay very little. Why cannot the City find another way to raise money to pay for the maintenance of our streets and sidewalks which is spread to the general public? Where is the gas tax that the City receives which is ment for the streets and sidewalks? Where is the money and how is it spent?

Dr. I. Emsayin

Tue, Nov 8, 2011 : 12:33 p.m.

The sidewalk repair vote is to ask citizens who paid for their own sidewalk repair to pay again for the people who refused to pay for their mandated sidewalk repair. Make them pay, not us!

alarictoo

Mon, Nov 7, 2011 : 7:36 p.m.

Looks like a bit of a "pig in a poke" if you download the information sheet and look at the actual language. * The City Administrator is removed from the pension board. * "Citizen Trustees" appointed by the City Council jumps from 3 to 5. * "Elected Trustees" for general city members (i.e., taxpayers) drops from 2 to 1. * Police and Fire appointed trustees remain the same. * The City Controller continues as a member. So, looking at that language it appears that the real change is we the taxpayers lose half of our influence on the pension board. That's a big "No" in my book. Unless you trust the City Council... ;^)

Ryan J. Stanton

Mon, Nov 7, 2011 : 7:48 p.m.

This increases citizen representation on the pension board. The general members are elected by a vote of the active employees who are not in either police or fire.

snapshot

Mon, Nov 7, 2011 : 7:20 p.m.

I'm voting yes......Folks should also know that 2 mils of property taxes go to funding city pensions......due to the shortage of 57 million I would suspect an increase in that milliage and I would like more representation as a citizen on salary and benefit negotiations involving city employees. I'm not sure why ANY board members directly benefiting from their decisions are allowed on the board to begin with. Isn't this the "fox watching the henhouse" syndrome? That fox is going to eat chicken every night.

Barb

Mon, Nov 7, 2011 : 6:49 p.m.

Now this I'd vote for - unless I'm missing something. But unless it get more press or word-or-mouth going (which is kind of late to start now), I doubt it will pass.