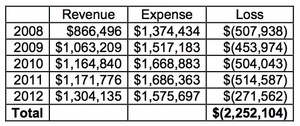

After losing $2.25M over 5 years, Ann Arbor's city-run golf courses being absorbed by general fund

Ann Arbor's two city-run golf courses have lost a combined $2.25 million over the past five years, requiring a sizable subsidy from the city's general fund.

It's due to that kind of financial performance that the city's golf course enterprise fund has been on a five-year deficit elimination plan with the state of Michigan.

City officials believe they've made strides operationally and financially at the Huron Hills and Leslie Park golf courses in recent years, but they still haven't completely eliminated the deficit.

After reimbursements from the city's general fund for prior year losses, the golf fund's net cumulative deficit as of June 30 was still $164,436.

The city of Ann Arbor's golf course enterprise fund has been losing money for years, requiring subsidies from the city's general fund.

Source: City of Ann Arbor

That means the golf budget will be included as part of the city's nearly $80 million general fund budget that pays for core services like police and fire protection.

The Ann Arbor City Council voted 10-1 Monday night to approve a new deficit elimination plan for the golf fund and the city's airport fund, which had an unrestricted net asset deficit of $595,250 as of June 30.

City Administrator Steve Powers said the plan is required by the state, but the City Council still could decide later to go in another direction if it wants. Its hands aren't tied by the plan.

"This is something we have to submit to the state because we are up against a deadline," he said of the approved plan. "It's very much a technical submission to the state treasurer that identifies how Ann Arbor as a local government is going to correct the deficit in two funds."

Karen Lancaster, the city's accounting services manager, said the deficit in the airport fund is due to categorization of an internal loan for hangar improvements as unrestricted, rather than restricted. She said the airport fund overall actually has a positive net asset balance of $1.4 million.

The city's plan to eliminate the airport deficit is to continue making payments toward the loan balance, which was $943,659 as of June 30. The airport will remain a separate enterprise fund.

Based on the latest projections, the golf course fund could lose about $272,000 in fiscal year 2012-13 and that will require an equivalent subsidy from the general fund.

If the golf course operations were accounted for in the general fund — using a different accounting standard, which eliminates certain charges and adds others — the loss would have been about $247,000, or $25,000 less, according to the city's administration.

Looking forward, city officials believe moving golf operations into the general fund will save $20,000 per year for the general fund on an accounting basis through fiscal year 2014-15. After that, the savings per year is expected to increase by $120,000 due to the golf fund's debt being paid off.

The Leslie Park Golf Course during sunnier weather.

Lon Horwedel | AnnArbor.com

Council Member Mike Anglin, D-5th Ward, was the only one to vote against the deficit elimination plan, expressing fears about moving the golf operations into the general fund.

"My fear is that when we move them back into the general fund, they become part of the parks system," Anglin said. "The parks system is stressed, to say the least. And what will happen is, in order to fund further items in the parks, we're going to have problems sustaining the golf courses."

Sumedh Bahl, the city's community services administrator, said golf courses are city parks and he doesn't see it as a burden for the general fund to absorb them.

Council Member Jane Lumm, an Independent who represents the 2nd Ward, said she's glad to see the bottom line financial performance of both golf courses improving.

"At Huron Hills, for example, the revenue for fiscal year '12 is about $370,000, which is an impressive increase of 62 percent compared with fiscal year '08," she said.

Moving the two courses to the general fund makes sense, Lumm said, since golf is a recreation activity. She said the city's other recreational facilities and activities are in the general fund and it never seemed logical that the city's two golf courses should be treated differently.

Without counting about $20,000 in what she called "central costs," Lumm said Huron Hills lost about $145,000 last year and Leslie Park lost about $105,000.

Mayor John Hieftje said he thought Lumm did a good job summing up the work the city has done to improve the golf courses both operationally and financially. He said he's hopeful there will be a day in the not-too-distant future when golf revenues and expenditures break even.

"The city's efforts in bringing the golf courses back up to a point where we can see them getting to a break-even point have been genuine and a lot of hard work has been done," he said.

Council Member Stephen Kunselman, D-3rd Ward, noted there are no operational impacts to the golf courses by accounting for them in the general fund.

"We're not going to be taking monies from the golf courses and providing it to the canoe liveries or other operations, so I think we're on the right track," he said.

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's email newsletters.

Comments

genetracy

Thu, Dec 6, 2012 : 10:39 p.m.

I thought govenrnment ownership of all business was the answer. Just ask Washington.

Woman in Ypsilanti

Thu, Dec 6, 2012 : 7:03 p.m.

I am not sure how many people use the golf courses but if they are well used, there is no reason the city shouldn't run them at a loss. Isn't the whole point of the parks dept to provide recreation opportunities to residents? If the issue is that they aren't fully used and that there isn't enough demand for two golf courses, by all means, close one of them and put the other one to some different use that will be more popular (like a dog park).

Napalm.Morning

Thu, Dec 6, 2012 : 7:50 p.m.

Thank you for the reminding us that there is a middle ground (at least outside "the District"). Let's take yet another "step back" for some perspective. Per the Ann Arbor city web-site there are 157 parks under the City's jurisdiction. I dare say there is plenty of public "green-space" for all manner of activitie. Unfortunately, though, golfers can realistically only recreate their activity on an actual golf course. Ergo, two golf courses, each targetted to unique skill levels and interests, is certainly a reasonable allocatin of city resources for our population base.

Townspeak

Thu, Dec 6, 2012 : 4:31 p.m.

Ann Arbor needs to downsize the golf course to 9 holes and use the river side for other uses, nature trials, walking bridge to Gallup park...etc. We could put a skate rink there in winter to combine with sledding. even a tow rope to get up the hill would be nice. but, this town has a ton of golf and needs to keep our river front land for everyone. A smaller course, and connecting it to Gallup would do this.

Napalm.Morning

Thu, Dec 6, 2012 : 6:27 p.m.

Go back a re-read the details of the posts herein, particularly, those of Mr. Ranzini. Closing all or some element of courses does absolutely nothing about the drain on the city's financial state from legacy pension costs, and administrative overhead. Save for the poor investment decision making of past city leadership, the courses for all intents and purposes breakeven with as much, or more use, than much of the "green space" in town of which there is plenty for hiking, biking, and sledding. Your outlined suggestions of a skating rink and tow-rope enabled sledding hill will generally have a shorter "season" than golf. . .and yet will also require some elements of maintenance, and staffing. . . will there be a usage charge for the tow-rope enabled sledding hill, and skating rink? Under the city's budgetary accounting, the proposed functions will still be charged with the legacy pension costs. So what is accomplished other than satisfying some perception that golf is "elitist" and that golf facilities must be "redistributed" to fairly allocate city resources for the use of all.

snapshot

Thu, Dec 6, 2012 : 7:22 a.m.

Well I'm confused. So losing big bucks on a recreational loss leader frequented by the very few is a successful operation? I love the way our officials can justify their agendas and taxpayers actually swallow the swill.

Napalm.Morning

Thu, Dec 6, 2012 : 7:56 p.m.

And all 157 city parks are regularly frequented by numbers of patrons exceeding your highly scientific [sic] "very few" threshold? ? ?. . . Doubtful, LOL. Thanks for the insightful(cough) input.

Ann E.

Thu, Dec 6, 2012 : 4:38 a.m.

The golf courses offer constructive outdoor physical activity for young people learning a sport they can play throughout life. The courses are inside the city where people can get to them easily. Fees are within reach for teenagers working part-time jobs. I hope the city will be able to find a way to keep this resource for our community.

snapshot

Thu, Dec 6, 2012 : 7:23 a.m.

So lets take the operational cost out of the educational funding.

Roger Kuhlman

Wed, Dec 5, 2012 : 8:47 p.m.

Why is the city of Ann Arbor running golf courses? Governments do a terrible job of running businesses and almost always seem to be producing operational losses that have to be absorbed by taxpayers. Ann Arbor's public courses need to be closed. The Huron Hills course would be a nice place to have a lightly-managed Greenway instead.

Brian Kuehn

Thu, Dec 6, 2012 : 12:41 a.m.

@Roger Kuhlman: Turning Huron Hills into a greenway would generate how much revenue? I will go along with closing the course if we can re-purpose the land for a densely developed affordable housing project.

mrsbiddy

Wed, Dec 5, 2012 : 8:21 p.m.

I was born in Ann Arbor and have lived here most of my life. I have many very fond memories of Huron Hills for both golfing and sledding. If that isn't what is considered recreation then I don't know what is. Ann Arbor passed an open space bond to preserve areas around and IN town and the golf courses are prime examples of what the bond is looking to preserve. We already own these facilities and they are used daily when weather permits. As I drove by today there were lots of cars in the parking lot of HH and many golfers on the course. Putting these two areas in the general fund for accounting is the logical way to go.

Patricia Lesko

Wed, Dec 5, 2012 : 8:11 p.m.

The Dems for ALEC on City Council say that our public services must be profit centers are busting a move straight out of the Tea Party playbook. The golf courses were moved into an Enterprise Fund (out of the General Fund) prior to 2008 for the purpose of MAKING Huron Hills appear unprofitable. Shortly thereafter, Hieftje quietly tried to broker a sale of the "unprofitable" HH land in 2008, and lease the "unprofitable" park operations in 2012. It's classic ALEC-inspired government: downsize and outsource public-owned operations (often to our political friends) with claims of savings (that never appear): then, cut services and funding for services. Residents pay about $10M per year in taxes to support 2000+ acres of parkland. AADL Library millage supporters argued 600K visits to the downtown library justified a $110M new building. Our parks host well more than 600,000 visits/uses per year; 50K people rent canoes/kayaks each year. We need to ask why the city pays $4,000/acre to mow the parks. Why the IT Department has a multi-million dollar fund surplus, and charges $5,000 per year for the computers in police cruisers. Why the Fleet Department has a fund surplus, as well, and charges $50 to change a windshield wiper on a city-owned vehicle. Hieftje and his Council allies have skimmed millage money from our park system to death to pay for wildly inflated administrative and overhead charges levied internally. Thus far, Hieftje (and his Council allies) voted to spend $4M from the General Fund on a pretend "Interplanetary Train Station" while at the same time approving budgets that have sharply raised fees, hiked water and sewer rates, and cut police and fire services, among others. It's not the profitability of the parks that's the problem; it's the arrogance of pols who parade as Dems while pushing Tea Party-inspired government. (On Nov. 6th we said: NO on public money for art, and YES on public support of parks).

Alan Benard

Wed, Dec 5, 2012 : 8:07 p.m.

Close them or sell them.

dexterologist

Wed, Dec 5, 2012 : 7:29 p.m.

How about the city sells the development rights for the land to the Green Belt and then creates an endowment with this money to help fund the operating costs of the two golf courses.

J K

Wed, Dec 5, 2012 : 6:55 p.m.

How about forming a non profit to operate the golf courses and removing the tax burden from the City's general fund? To roll the operation of the golf courses back into the general funds hide the cost of operations and the actual losses they are incurring. If so many golf courses are being successfully run for profit, why can't the City manage to operate theirs at net zero?

Stephen Lange Ranzini

Wed, Dec 5, 2012 : 6:51 p.m.

@A Voice of Reason: Excellent point about the retirement pension and retirement healthcare costs. Last I checked, the city had a $210 million deficit in those retirement funds and each activity of the city, each separate bucket and the general fund too, is charged their pro rata shared portion for that accumulated deficit. How those charges are apportioned could easily turn any marginally profitable activity of the city into a loss making activity. If you shut such an activity down, the remaining activities would have to shoulder higher costs and would incur greater "losses". If the city had no fire, police, road repair, gold courses, whatever, it would still have to pay the roughly $600 million of accumulated retirement and regular debt of the city.

GoNavy

Wed, Dec 5, 2012 : 6:48 p.m.

Why is the city in the business of running a golf course again?

A Voice of Reason

Wed, Dec 5, 2012 : 6:10 p.m.

Well, Huron golf course is an important course for the kids in this town. Schools use it for their golf programs and young kids learn to golf. It is a great golf course for girls/young women because it is somewhat shorter and Huron and Gabriel Richard High Schools use it as their home course. I assure you Mr. Hann that these kids are not upper class kids. I also see many retirees using this course because it is affordable. I am saddened that a company like Miles of Golf, has the city council members in their back pocket, and is trying to take this away from our citizens. Secondly, the Huron Hills is doing great at attracting golfers with rounds of golf being up. I am guessing if it did have to account for the over-priced retiree healthcare benefits of the city, IT charges and municipal services, mandated by the city (unlike other recreation services) it would run a profit. And finally, I would rather look at a golf course than a fancy commercial entity. Here is low cost green space, being put to good use. Preserve our course and history.

Peter Eckstein

Wed, Dec 5, 2012 : 5:45 p.m.

Why isn't there equal attention to the dollars that such activities as tennis, hockey, and swimming have "lost" over the past five years. These things are all subsidized, I am sure, as part of a general support for nearby recreational facilities. As far as I can tell, there are no fees at all for use of the tennis courts, so that every nickel paid for maintenance is a "loss". This is a good move and will make it easier to see the two courses as just parts of the parks system, which we have all recently agreed to continue subsidizing though the millage renewal.

DAN

Wed, Dec 5, 2012 : 5:43 p.m.

There are better solutions than lumping them into the general fund and obscuring the costs. The city could: 1. Lease their mangement to a private company similar to what was done with city parking lots. 2. Raise the golf fees to reflect the annual costs of maintaining and operating them and let the users, not the city as a whole shoulder the burden OR 3. Close one of them until the city can afford two golf courses and maintain that land as a city park-both arenearcurrent parkland

Paul Bancel

Wed, Dec 5, 2012 : 5:27 p.m.

Ryan -I think you got the lead in wrong. Didn't you mean to write - Over the past five years, 2,500,000 people who golfed during their lives have died and studies show that in spite of increased medical advances and new medical cures, all people who will have golfed at Leslie Park and Huron Hills after it is put into the General Fund are going to die.

LXIX

Wed, Dec 5, 2012 : 4:17 p.m.

Don't forgot the other three sports that tiny 3% of the parks budget will be supporting besides golf - Skiing, trail hiking, fireworks (we don't know about those), and fine liquor tasting. Add in the grass carbon sequestration benefit and calming vistas while steaming away in traffic on the Huron Pkwy caused by poor city planning for dense over-development and this is a pretty darn good deal for the local bucks

Roger Kuhlman

Wed, Dec 5, 2012 : 9:27 p.m.

Dense over-development in Ann Arbor? What? Ann Arbor is suburban with plenty of suburban sprawl but densely developed it is not. If we are going to have more businesses and people in Washtenaw County--something I am very much opposed to--it is far better environmentally to have them densely clustered in a few select spots like Ann Arbor than spread out all over the county in suburban and exurban sprawl.

leaguebus

Wed, Dec 5, 2012 : 4:14 p.m.

No one will buy these courses unless they can control the land and if they control the land, they will eventually become apartments or condos.

Mike

Wed, Dec 5, 2012 : 3:46 p.m.

Just raise the price to what it actually costs to play golf..................then see if people still want the course.

a2cents

Wed, Dec 5, 2012 : 3:45 p.m.

I would rather have art !!

Roger Kuhlman

Wed, Dec 5, 2012 : 9:20 p.m.

Then how about you a2cents along with other lovers of public art paying for it themselves through donations.

et-tu-brute

Wed, Dec 5, 2012 : 3:55 p.m.

These courses are Mother Nature's Art

grye

Wed, Dec 5, 2012 : 3:22 p.m.

I would question more of the expenditures of public art that bring in absolutely zero funds and therefore is a complete money drain. At least some funds are generated for the golf courses. The golf course operations needs to be re-vamped to determine how to at least break even.

Jim

Wed, Dec 5, 2012 : 3:21 p.m.

They aren't marketed well. Leslie park is a great course.

Brad

Wed, Dec 5, 2012 : 3:59 p.m.

They've recently started to market Huron Hills toward its strengths which probably explains the huge gains being made there.

Stephen Lange Ranzini

Wed, Dec 5, 2012 : 3:14 p.m.

@Youwhine: You are correct, the multiplicity of separate fund accounts ("buckets"), enable a lack of transparency and shell games to move money around to favor a specific activity (e.g. 1% For Art) or to assert "poverty" for a specific unflavored activity (e.g. Fire Protection in the general fund). If this activity is not in the general fund, the overhead charges against the golf course activity don't exist anymore. That might be the $20,000 number. However the debt service on the golf course, which is $120,000 annually ends in two years, so the losses will drop by that amount, too, soon, and the debt must be paid regardless, being a sunk cost.

Rod Johnson

Sun, Dec 9, 2012 : 5:04 a.m.

Kyle--while I appreciate the response, it doesn't seem very germane to my comment. I was reacting to Mr. Ranzini's suggestion that "AnnArbor.com's spelling autocorrect is sometimes overly aggressive."

Stephen Lange Ranzini

Wed, Dec 5, 2012 : 9:57 p.m.

@Youwhine: I am informed by someone who actually knows the answer to your first question, the following: "The 20k difference is due to two expenses not hitting the general fund once golf is moved there. There is a depreciation charge of 165k and loan repayment of 145k (will not hit the general fund as it will go through debt payment account). The difference between the two is 20k."

Stephen Lange Ranzini

Wed, Dec 5, 2012 : 9:25 p.m.

@Roger Kuhlman: Please read @A Voice of Reason's excellent post about the retirement pension and retirement healthcare costs. Last I checked, the city had a $210 million deficit in those retirement funds and each activity of the city, each separate bucket and the general fund too, is charged their pro rata shared portion for that accumulated deficit. How those charges are apportioned could easily turn any marginally profitable activity of the city into a loss making activity. If you shut such an activity down, the remaining activities would have to shoulder higher costs and would incur greater "losses". If the city had no fire, police, road repair, gold courses, whatever, it would still have to pay the roughly $600 million of accumulated retirement and regular debt of the city. The key question is what is the marginal contribution (profit or loss) of the activity before past sunk costs are charged to it. You might be surprised to find that the losses of the golf courses are manufactured to hide the sins of past decisions regarding retirement fund benefits. Also the debt payments of $120,000 a year are sunk costs that end in two years. If it were a business the key question is what is the EBITDA (earnings before income tax, depreciation, amortization), but since it's a government entity in Ann Arbor, you have to ask, what is the marginal contribution before unrelated costs are charged to the "business".

Roger Kuhlman

Wed, Dec 5, 2012 : 9:17 p.m.

If operating revenues annually are running less than operating expenses as Ryan Stanton's article suggests City golfing is running deficits and should go. That is pretty clear.

Stephen Lange Ranzini

Wed, Dec 5, 2012 : 6:41 p.m.

@Youwhine: It is my understanding that there are charges per employee for email, IT support & etc. and maybe other charges too, charged to each non-general fund account to compensate the general fund for administrative support. What makes up that $20,000 I don't know precisely, but this is likely what it is. Think of the general fund like a holding company and each daughter fund of the city like a subsidiary company. The subsidiaries have to reimburse the parent company for the resources they use. Why Ann Arbor needs 59 companies instead of simple budget line items in a comprehensive budget that covers all activities is really the question and why the liquid funds needed elsewhere get trapped in the "buckets".

Youwhine

Wed, Dec 5, 2012 : 6:08 p.m.

Thanks for the response. I guess I still do not understand what the $20k overhead cost goes owards if nothing is going to change in how the courses are run/managed. Is it literally a $20k cost simply to do the accounting for the courses if they are their own budget entity?

Kyle Mattson

Wed, Dec 5, 2012 : 5:44 p.m.

Rod- Comment editing is no a feature we offer at this time due. It is being considered for future updates. Please feel free to email me directly with any other suggestions or feedback you may have. Thanks.

Rod Johnson

Wed, Dec 5, 2012 : 3:44 p.m.

Does annarbor.com have spell correction? I would guess you're thinking of your own browser/phone, but who knows? This site's technology is pretty cryptic sometimes.

Stephen Lange Ranzini

Wed, Dec 5, 2012 : 3:16 p.m.

Sorry, "unflavored" should read "unfavored"... AnnArbor.com's spelling autocorrect is sometimes overly aggressive...

Youwhine

Wed, Dec 5, 2012 : 3:09 p.m.

Also, when I drive around southeast Michigan, I see golf courses EVERYWHERE. I have to assume that most of them are MAKING money or else they would not be open. What are they doing differently than the city? I agree with the poster who stated that if they can't figure out the business, get out of the game.

a2citizen

Wed, Dec 5, 2012 : 3:07 p.m.

Sell the swimming pools, too!!! I mean, I drive by Fuller Park twice a day and I haven't seen anyone use that pool in over three months.

Brian Kuehn

Wed, Dec 5, 2012 : 5:34 p.m.

Ha ha! Well said!

Youwhine

Wed, Dec 5, 2012 : 3:06 p.m.

I will be the first to admit that math and budgets are not my strongest suit. Howver, this confused me: "city officials believe moving golf operations into the general fund will save $20,000 per year for the general fund on an accounting basis through fiscal year 2014-15." Am I to understand that simply by placing the budget for the golf course under a different heading, there will be a $20k cost savings seen somewhere else in the budget? It sounds like, if that is the case, then this is all simply a shell game wherein numbers are shuffled. Further, it creates the impression that none of the numbers in the budget are 'real' in that they don't accurately reflect what is going in and coming out of city coffers. This doesn't create a very positive sense of transparency. Can somebody help explain what I am missing?

LXIX

Wed, Dec 5, 2012 : 3:02 p.m.

"Ann Arbor parks millage renewal wins big with 68.8% voter approval" ..."Voter approval was required to keep the $5 million in annual revenue from the tax flowing to the city's parks department through 2018". [Nov. 6th - A2.com] "Lumm said Huron Hills lost about $145,000 last year and Leslie Park lost about $105,000." That is $250,000. So the $5M parks will have to share 5% off their budget to support two of the largest green properties. After 2015 another $100k is wiped from the golf course deficit. So the $5M partks will then only have to share 3% of their budget to add two huge parks with a popular sport.

Brad

Wed, Dec 5, 2012 : 2:47 p.m.

The city has two great courses. Leslie Park is recognized as one of the best municipal courses in the state, and Huron Hills' unique traits and natural beauty make it a YEAR ROUND attraction.

Ron Granger

Wed, Dec 5, 2012 : 2:40 p.m.

The people who work 2, 3 jobs to support their kids? They don't have the time or money to golf. And yet they are forced to subsidize these golf courses. Wealth is relative.

A Voice of Reason

Wed, Dec 5, 2012 : 6:13 p.m.

I guess they do not have to use the parks either, so we should shut the 232 of them down too.

Ronald K. Dankert

Wed, Dec 5, 2012 : 2:19 p.m.

It didn't take long for that old red herring "upper class few" to show up. Being a regular Huron Hills player for many years, I do confess often marveling at the limo's and other assorted luxury cars lining up to disgorge the countless upper-class seniors and children for their tee times. (Glad they're not rampaging the City streets.) Perhaps the Ann Arbor Greenbelt Program could buy the golf courses from the Ann Arbor Parks Department someday, ensuring that Whitmore Lake and Canton are less likely to encroach on our city limits.

Linda Peck

Wed, Dec 5, 2012 : 2:09 p.m.

Even though I am not a golfer, I do appreciate both golf courses as part of our community. They look beautiful and in the winter are used for sledding and cross-country skiing. It is part of our cultural heritage to have beautiful open spaces such as this. These spaces are higher on the list of priorities than art, in my opinion. Also, isn't it lovely that we have public golf courses for people who do love the sport and are not in the "upper classes" as someone put it here. I am happy that Huron Hills has increased its revenue by 62% in the last year. That is huge.

hiker1546

Wed, Dec 5, 2012 : 2:01 p.m.

This article is inflammatory because it does not properly reflect the true facts of the golf course operations. The general fund requires that the golf course pay an assessment to reflect overhead from the city (i.e. a portion of the mayor's time, the city administrator's time, the recreation supervisor's time, the cost of running city hall, etc., etc.). The people commenting could have a better sense of the situation if the reporter reported the facts about (1) money that the golfers pay and (2) money that the city actually pays out for golf staff, golf supplies and any other actual costs of running the courses My understanding is that if only the actual money paid in and paid out was considered (and not the allocations from general operations and the general recreation department that the golf course must absorb that have nothing to do with the actual running of the golf course) that there is more money taken in than is paid out. So, closing the golf course will NOT reduce costs for the city.

Stephen Lange Ranzini

Wed, Dec 5, 2012 : 2:43 p.m.

@hiker1546: You are correct. Last I looked into it, the city charges (for example) each separate fund account ("bucket"), over $1,000 per employee for email access and PC computer support, whether or not they have or even use a computer for their job. I doubt that many of the workers maintaining the golf courses have them, yet the overhead charge magically turns the golf course into a cash losing operation, when the core business itself may actually be profitable.

et-tu-brute

Wed, Dec 5, 2012 : 1:50 p.m.

Here we go again. Same debate as a couple years ago with Huron Hills golf course, so let's review: 1. The golf courses are a park. 2. They are prime parkland in the city, that can never be sold. 3. Even if you could sell them, why would you, when the City is spending hundreds of thousands of dollars each year buying new land outside the city limits? 4. I don't know the facts, but I have a good guess that the golf courses are no different than any other park facility and would be curious to what they all do financially. Long long ago, I worked at a rink in the Livonia area and saw first hand the losses that facility had - but it was a service. 5. What looks most promising about this article is the fact that in two years when the golf course debt is paid off (Ryan what was this debt for? Past losses? I have lived here since 2002 and don't remember any major debts for the courses). But when this debt is paid off in two years and they save another $120,000 that will put both courses around $130,000 in losses. This is nothing. This then could be easily eliminated with slight fee increases or budget cuts. 6. I am biased. I live near Huron Hills and love that course. When the city looked at going into a partnership with someone else &/or closing it a few years ago, I became even more interested in it. It would cost more to operate them as a park only than it would a golf course. The city has since done a great job with the courses. 7. According to the Chronicle's story on the same subject, in 2007, the golf courses had a combined 35, 876 rounds. This year they had 55, 135 rounds. That in any business is HUGE! Take into consideration a down market and down golf economy I thinks this shows the city is doing something right. (Ryan, can you post these # of rounds?) 8. The light at the end of the tunnel - with doing a combined 55,135 rounds and a "looming" $130,000 debt in two years, simple math would show a $2.36 increase to each golfer would be these courses making mo

discgolfgeek

Wed, Dec 5, 2012 : 1:42 p.m.

As a golfer, allow me to address one of the suggestions which is to raise the rates for play. That is a bad idea as the rates are barely competitive now and it would likely reduce, not raise, revenue. As for the other suggestion to sell them, that is a truly short-sighted idea. Sell these properties and you will never get this beautiful land back. Ten years from now, they'll likely be sold & developed as any private owner would have trouble competing given the taxes they would have to pay on the land. So, close one or both golf courses if you keep the land as a park .

Rose Garden

Wed, Dec 5, 2012 : 1:41 p.m.

For everyone who thinks the City should get rid of the golf course because it is not generating a profit, would you rather that the City sells the property to developers for condominiums and strip malls? No, no. I drive along there twice a day at the minimum. I enjoy the golf course immensely, but have never golfed. Generate a one-half percent City increase in sales tax--whatever it takes to keep that beautiful piece of rolling, grassy hills.

Roger Kuhlman

Wed, Dec 5, 2012 : 9:01 p.m.

Both Ron and Sonny Dog make very good points on this discussion of city golf courses and what to do with them.

SonnyDog09

Wed, Dec 5, 2012 : 5:37 p.m.

"whatever it takes to keep that beautiful piece of rolling, grassy hills." So, Rose, get out your checkbook. Oh, of course, what you meant is whatever it takes to get other people to pay for what you want, didn't you?

Ron Granger

Wed, Dec 5, 2012 : 2:41 p.m.

They could be made into parks. The idea that it is golf courses or condos and strip malls is absurd.

Urban Sombrero

Wed, Dec 5, 2012 : 1:23 p.m.

Could the city sell the courses to a private entity/corporation with the stipulation that they have to remain golf courses? I see no reason for the city to keep losing money on them, but I'd hate to see the land sold off and turned into housing or retail or something like that.

Mike

Wed, Dec 5, 2012 : 3:45 p.m.

We have lots of green belt areas alll around the city that we are buying with tax dollars. I would assume that is so we can develop the cities into bustling hubs of activity and avoid urban sprawl. So what is it you want? Bigger cities or urban sprawl? Or do you just want people to live at places live "camp take notice" and stay away from you? One of those NIMBY's?

nickcarraweigh

Wed, Dec 5, 2012 : 1:21 p.m.

I played golf once, in the mid-70s, too, but I gave it up when Reagan got elected in 1980.

walker101

Wed, Dec 5, 2012 : 4:55 p.m.

Just to think Obama plays more golf than I do.

Lolly

Wed, Dec 5, 2012 : 12:40 p.m.

We aren't thinking about getting rid of any other city parks just because they don't make money or don't break even. That's not why we have them. To talk about letting go some of the prettiest pieces of property in the city, that are enjoyed by everyone who drives pastt as well as those who golf, sled, and cross country ski there, seems really short-sighted to me.

Roger Kuhlman

Wed, Dec 5, 2012 : 8:58 p.m.

A golf course is not a city park. Sorry. City parks and natural areas are funded by a special parks millage that people can vote on regularly and reject if they do not like them anymore. That is not true of Ann Arbor public golfing and golf courses.

RUKiddingMe

Wed, Dec 5, 2012 : 6:13 p.m.

Exactly, Ron (and Brad)

Brad

Wed, Dec 5, 2012 : 2:51 p.m.

That voice of reason thing sure didn't last long.

Ron Granger

Wed, Dec 5, 2012 : 2:40 p.m.

Parks are vastly less expensive to maintain than golf courses.

Brian Kuehn

Wed, Dec 5, 2012 : 1:27 p.m.

A voice of reason. Thank you.

countrycat

Wed, Dec 5, 2012 : 12:17 p.m.

Budget deficit - raise the fees to increase revenue, cut expenses - do it or sell it off! Simple.

Stephen Lange Ranzini

Wed, Dec 5, 2012 : 11:53 a.m.

Last time I checked, the city had something like 59 separate fund accounts or "buckets", a labyrinth of complexity! Compare this to Livonia, a similar sized and well managed city where a city councilman (my father in-law) informed me it has *every* city activity (except the public schools) in the general fund. Closing down this funding bucket for the golf courses is progress, we should close them all down! Then, city council can make decisions based on where actual needs for the money on hand are, not based on whether or not money is sitting in the funding bucket or not. Some funds are overstuffed with cash (for example the 1% for art fund), overall the city has over $100 million of cash trapped in various buckets not restricted by millage or the source of the funds but "restricted" *only* by vote of city council, while the mayor and city manager assert that the general fund *only* has $15 million in cash and therefore doesn't have enough funds to properly staff the fire fighters and to keep all five fire stations open. Overall the city's many funding buckets earned over $30 million last year, but we have "no money" to find basic priorities like fire, police and roads! Drain the buckets!

Russ Miller

Thu, Dec 6, 2012 : 3:55 p.m.

Livonia has enterprise funds including one for their golf system which lost $290K in 2011 page 20 http://www.michigan.gov/documents/treasury/822190LivoniaCity20120531_387861_7.pdf

gretta1

Thu, Dec 6, 2012 : 3:47 p.m.

Thank you for your comments, Mr. Lanzini. I think you are correct; however, I would hate to see the general fund used as a veil for hiding the actual costs of each of the programs that are paid from the fund. I want to know EXACTLY how much is used to fund various programs AND - if push came to shove - I'd rather have good police and fire coverage than two city run golf courses. That does seem like a luxury to me. This is a small town, frankly.

Simon Green

Thu, Dec 6, 2012 : 1:48 p.m.

Thank you for this explanation, and lending some clear thinking to an issue which drives me crazy... these funding "buckets" inhibit rational city spending. (Of course, who thinks the city council is wholly rational?)

Chip Reed

Wed, Dec 5, 2012 : 3:13 p.m.

I like Livonia, but they have had a whole different kind of politics there (you say, in the past). A lot of people know how Dearborn used to be run, but let's not burden the readers of annarbor.com with Wayne County history...

Stephen Lange Ranzini

Wed, Dec 5, 2012 : 2:39 p.m.

@nickcarraweigh: Of course you are correct, however you are speaking of events and people who ran that city 30 years ago. Livonia has the merit of not having cut fire, police or road maintenance throughout the current depression, despite being closer to the epicenter of the auto industry neutron bomb impact than Ann Arbor.

nickcarraweigh

Wed, Dec 5, 2012 : 1:23 p.m.

Good old Livonia, where Ed McNamara and Bob Ficano learned how to run airports and Wayne County and stuff.

Bob W

Wed, Dec 5, 2012 : 1:12 p.m.

Yes, thanks for explaining, but this shouldn't be a shield for common sense and logic. My wife and I maintain mult accounts for various budget items, our buckets if you will. Just because one has become over -funded it is not an excuse to allow another to fall short, such as our property taxes and expect the city to accept that as a reason to not pay them. As you say, empty the buckets, they should still be able to make logical financial decisions within the current framework. Just sounds like hiding behind foggy finances.

cindy1

Wed, Dec 5, 2012 : 12:52 p.m.

Thank you for this explanation, Mr. Ranzini!

Mike

Wed, Dec 5, 2012 : 11:47 a.m.

How about keeping one of courses public and privatizing the other. The public one would be run with unionized workers with $50,000 salaries and pensions and the private one with whatever the private sector determines is cost effective and profitable in order to keep the course open. Or we can just hide the loss and mismanagement from the public in the general budget and then close fire stations and lay off police. Once that loss is buried we can ask the taxpayers for a city income tax (to create "revenue") to further support the mismanagement.....................

Arieswoman

Wed, Dec 5, 2012 : 11:40 a.m.

Anyone heard of just selling them? Only a few make use of these golf courses!

Brian Kuehn

Thu, Dec 6, 2012 : 12:18 a.m.

@RUKiddingMe: Based on your apparent definition, the entire Parks & Recreation Department is a nonessential service. I, and possibly a majority of Ann Arbor residents, consider a healthy park system to be essential. I support natural areas, tennis courts, playgrounds, swimming pools, dog parks and other recreation facilities, yes, including golf courses, because I think these are essential elements to a healthy and desirable community. The golf courses, according to the arcane formula developed by the City, lose money. So does every other recreational endeavor of the City, if put through the same financial paces.

RUKiddingMe

Wed, Dec 5, 2012 : 6:10 p.m.

A valid point, Brad, but I would say that in this instance, with 5 years of continuous loss on a pay-to-play nonessential service, it's the CITY that doesn't know anything about it.

Brad

Wed, Dec 5, 2012 : 1:36 p.m.

You could say the same for all parks as they are all revenue negative. Can we sell them all? Or just the ones where they do things that you know nothing about?

Brian Kuehn

Wed, Dec 5, 2012 : 1:23 p.m.

I use Bird Hills Park and Leslie Park Golf Course. If you are going to make the criteria for selling off park land the number of users, then Bird Hills Park should be sold.

Carole

Wed, Dec 5, 2012 : 11:40 a.m.

Have they even thought about raising the cost for playing a round of golf at both of the courses. And, exactly what is going on at Leslie Golf Course -- I drive past it every day and it does not even begin to resemble a golf course at all. Art and golfing expenses when the city can not take care of the real needs of the citizens of Ann Arbor. Sorry, until all of the necessities and real needs of the city are taken care of -- no golf, no art.

Napalm.Morning

Wed, Dec 5, 2012 : 1:25 p.m.

Raising the cost? (pretty standard knee-jerk response from the left side of the aisle) . . back to our economics basics. ..in a free market economy businesses have to balance what they charge against what the public will pay (while also covering their costs) Raising the price doesn't automatically raise revenue--usage often goes down as consumers are priced out of the market. There was a study on this very aspect of running the courses several years ago and the pricing was established--I believe lowered @ Huron Hills which was most likely a factor in the revenue growth @ Huron. The only issue here is the bloated city overhead and legacy costs bourne by the courses which have little if any relation to their true operating costs

Brian Kuehn

Wed, Dec 5, 2012 : 1:20 p.m.

Carole, as to your question about what is going on at Leslie, the work is a joint undertaking between the Washtenaw County Water Resources Commision, The City of Ann Arbor and the Michigan Department of Environmental Quality. The main point of the project is to reduce phosphorus and sediment flowing into the Huron River and to minimize stream fluctuations after large rain events. This is not designed to improve the golf course - it just happened to be in the way. Funding for the project will come from the City of Ann Arbor Stormwater maintenance fund, with up to 50% loan forgiveness from the State of Michigan because of environmental improvements to the storm drain (Traver Creek). Circling back to golfing expenses, can we assume you want to eliminate the entire Park & Recreation Department and sell off the City parks? The entire park operation nets approximately -0- revenue versus millions of tax dollars to maintain the system. A few actvities generate some revenue (swimming, skating) but even those revenue generating activities are losers if one allocated expenses against the small amount of money collected. It the City set-up a Playground Enterprise Fund the headlines would read "Playground Fund Loses Big Dollars - City Must Kick in $3,000,000 Annual Subsidy" and there would be a new set of people complaining about all the wealthy people that can afford to have kids having a park system and that most of the rest of us never use the swings and slides.

Susie Q

Wed, Dec 5, 2012 : 11:38 a.m.

Sell the golf courses. Why is this better of tax dollars than "public art"?

Roger Kuhlman

Wed, Dec 5, 2012 : 8:48 p.m.

Both practices are examples of fiscally irresponsible spending and governing. Both should go.

RUKiddingMe

Wed, Dec 5, 2012 : 11:33 a.m.

1) This seems like accounting card tricks, just shuffling an accounting loss into a big pile of city operational budget. Seems the only REAL outcome will be more difficulty in getting straight numbers for citizens to look at. 2) I really don't get why the city is continuously operating golf courses that lose money. I understand the view that services like buses and trash pickup don't need to turn a profit, since they could be considered services critical to the continued operation of the city. But golf? C'mon. If the city can't run those to turn some kind of profit after 5 years, it's time to get OUT of the golf game. The city operating these places at a loss makes NO SENSE. The idea of tax money going to a poorly performing golf course is enraging.

RUKiddingMe

Wed, Dec 5, 2012 : 6:08 p.m.

Ponycar, are you saying there's a set of city-paid sports leaugues that cost tens of thousands of dollars? Are these like "City of Ann Arbor" teams that compete against other city's teams? Or just groups of average Ann Arbor citizens that decide to start a leauge and apply to the city to have all their uniforms/equipment paid for with tax money? Maybe I'm hazy on the Rec & Ed part of things, but as a general rule, I would say that if the city is spending hundreds of thousands of dollars on sports leaugues, then yes, I want them to stop that too. I am personally aware of multiple softball leagues in Ann Arbor, and none of them get tax money. In fact, sometimes THEY pay the CITY to use the fields. Some soccer leaugues too.

Ponycar

Wed, Dec 5, 2012 : 3:35 p.m.

Do the city softball leagues turn a profit? How about kids soccer? Rec and Ed as a whole? Maybe they do, I don't know. If not, I guess we should scrap the Rec and Ed Department, huh?

Youwhine

Wed, Dec 5, 2012 : 2:53 p.m.

@Rose You mean sell it to developers who would then have to pay property taxes? So the city would no longer SPEND money on the courses, but would MAKE money on taxing the land? Sounds like a great idea to me.

Rose Garden

Wed, Dec 5, 2012 : 1:34 p.m.

Would you prefer the City to sell the non-profit golf course to developers?