Ann Arbor city administrator unveils status-quo budget plan for next two fiscal years

City Administrator Steve Powers received a round of applause for the second year in a row after presenting his annual budget plan to the Ann Arbor City Council Monday night.

The city administrator's mostly status-quo budget, which now goes to council for potential changes and final approval in May, shows the city's general fund revenues rising from $79.2 million to $82.6 million as the city heads into the 2013-14 fiscal year starting July 1.

"Your policy discipline over the past 10 years has really contributed to the city's sound financial position," Powers told council members.

City Administrator Steve Powers said his budget plan addresses some deferred maintenance items the city has put off over the past several years.

Ryan J. Stanton | AnnArbor.com

Powers pointed out that, just looking at the revenues and expenditures labeled as "recurring," there's a $1.35 million surplus shown in the budget for next year. But his budget also proposes $1.6 million in one-time costs, using up that surplus and then some.

"While the financial forecast for the city is improving, the recommended budget does urge spending restraint and prudent financial decisions," Powers said.

"Recurring expenditures are funded by recurring revenues, so the balanced budget is not creating difficulties for the city and difficulties for council in later years."

Powers said his budget plan addresses some deferred maintenance items the city has put off over the past several years.

Some of the budget notes he highlighted include $60,000 for increased costs of painting and replacing streetlight poles, $269,000 for regulatory-related items and capital improvements at Barton and Superior Dams, $138,000 in increased revenues based on building and planning activity, and $20,000 to do a citizen survey to measure public perception of services.

Powers' budget also includes putting $234,000 into the police department for increased overtime and funding for county animal control.

The administrator presented a two-year budget plan that shows the city digging deeper into its reserves to pay for more one-time costs in the 2014-15 fiscal year.

In the second year of the two-year plan, recurring revenues and expenditures are generally balanced at $84 million, but then another $1.6 million in one-time costs are shown.

Tapping the general fund reserves to pay for $3.2 million worth of non-recurring cost items over the next two years would reduce the fund balance to 14.4 percent of expenditures.

Tom Crawford, the city's chief financial officer, in the past has recommended the City Council maintain a fund balance equal to 15 to 20 percent of expenditures.

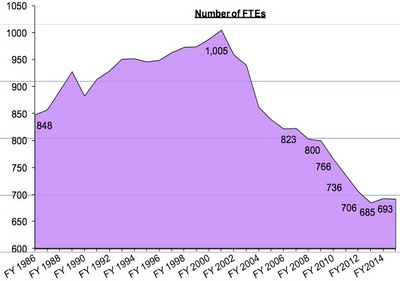

The city has slashed roughly a third of its workforce over the past decade or so.

City of Ann Arbor

"We are seeing some good news on the revenue side," Powers said. "The proposed budget is actually in a position where I am recommending that the total city millage actually decrease by 0.125 mills."

With the local and state economy improving, the city predicts property tax revenues will climb by 2.3 percent next year — even with the planned 0.125-mill decrease in the city's tax rate.

The reduction in the tax rate offsets the increase the city saw from the new 0.125-mill sidewalk millage approved by voters in 2011. That translates to about $13 a year for the average homeowner.

Water and sewer rates on average are projected to increase 3.7 percent to help pay for maintenance and upgrades at the water and wastewater treatment plants. There'll be separate public hearings on the utility rate increases and the overall city budget on May 6.

Powers said the policy direction council has established over the years is resulting in some significant containment of employee costs on health insurance and pensions, with employees contributing more than they had in the past. Employees now put 6 percent of their pay toward pension costs.

The 693 full-time employees Powers is recommending in the city budget for next year is up 7.67 FTEs from the approved 2012-13 budget, but six of those essentially already have been approved. Four are additional firefighters the city hired within the past year, and two are building development inspectors the city hired within the past year to reduce the wait time for construction projects.

One new position being created is in the IT department where the city has decided to hire a full-time employee to replace contracted services, and the remaining 0.67 FTE is in accounting.

The City Council is expected to deliberate on the budget, consider amendments and take a final vote at its May 20 meeting. It's expected council members will consider whether to increase police and fire staffing and restore some services like fall leaf pickup an holiday tree pickup.

Police Chief John Seto said at a budget work session last month Ann Arbor has inadequate police staffing resources to do proactive and consistent enforcement and community outreach. Similar concerns have been expressed about the fire department's ability to respond to fires.

Council members didn't comment on the administrator's budget plan Monday night, but Mayor John Hieftje offered his thanks to Powers for "that good message."

"Now the hard choices are yours," Powers told council members.

The administrator's budget plan cautions early projections show the city could face deficits in future years. Recurring expenditures are projected to be $859,822 higher than revenues in 2015-16, and $1.6 million higher than revenues in 2016-17 — before thinking about any one-time costs.

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's email newsletters.

Comments

RUKiddingMe

Wed, Apr 17, 2013 : 11:36 a.m.

In addition to what someone already posted about rhe SPARK items I see this: "The FY2014 budget reflects an increase primarily attributable to a planned expansion of Ann Arbor SPARK's downtown incubator facilities." WHAT HAS SPARK DONE TO JUSTIFY THIS? Why is SPARK getting our tax money and increasing their office space and staff? What are the deliverabes that can be directly and provably a result of SPARK working? We need answers to this!!!!

RUKiddingMe

Wed, Apr 17, 2013 : 11:34 a.m.

From the budget, what does this mean: "RESOLVED, That Art in Public Places Fund budget be appropriated without regard to fiscal year" And why is there $340,464 for art in public places for 2014? And why is that amount listed as revenue rather than expense? Is that left over from previous balance? Is that program still going on? Is it from the Percent For Art (which I thought had been frozen until they decided what do about the vote on the millage, which is taking kind of a long time, BTW), or an additional program that was running before that was even established?

RUKiddingMe

Wed, Apr 17, 2013 : 11:12 a.m.

If I recall correctly, the last water/sewer rate increase was for the wastewater treatment rebuild. So was this new increase planned back then, or did the cost of that project go up, or ???

Stephen Lange Ranzini

Wed, Apr 17, 2013 : 10:25 a.m.

Overall the budget is a fine document. However, I do have concerns: 1) Many city roads are stil in bad shape. Why is it necessary to retain a minimum fund balance of $9 million in the Road Millage Fund? Wouldn't it be better to use these funds more rapidly for much needed projects, especially since deferring maintenance on roads can rapidly increase the expenses of later fixing the roads? What are we saving the $9 million for? 2) I would encourage the city to post a list of all past city council resolutions that bind funds into a special account. The list should also have links to the text of the related city resolutions. If this were posted citizens might be able to analyze the body of resolutions to find ways to shift funds into the General Fund away from special purpose funds (a/k/a "buckets") which have less urgent priorities. 3) What is the purpose of the Facilities (capital projects) $875,000 non-recurring expenditure and the Building Settlement Funding $100,000 non-recurring expenditure? 4) I would encourage city council to refund back to the General Fund the $50,000 taken from it and given to the Art in Public Places Fund in past years. 5) I would encourage city council to approve the resolution diverting some of the DDA's increase in TIF money to the General Fund to facilitate the hiring of 2 additional fire fighters, taking staffing up to the minimum level of 88 required to provide sufficient personnel to staff a minimally acceptable level to meet national standards for fire and emergency medical services response times. Alternatively, get the DDA board to agree to fund the 2 extra fire fighters. It would cost $150,000 a year to pay for this. 6) Other than the TIF capture for the Ann Arbor-Ypsilanti SmartZone LDFA, there appears to be no effort towards economic development , even though economic development was listed as the fourth highest city council priority.

Kai Petainen

Wed, Apr 17, 2013 : 4:19 a.m.

Page 253 of report. SPARK LDFA breakdown. From 2012 to 2015 estimates: Revenues: Tax revenue +20%, Investment Income -33% Expenses: Staffing +38%, Due Dilligence +46%, Intensive Service +16%, Accelerating Opportunities +432% Micro Loan for Entrepreneurs: $275,000 to $0 Bootcamp costs: up 127% Internship: from $0 to $100,000 Business Software: from $0 to $20,000

Ryan J. Stanton

Tue, Apr 16, 2013 : 11:31 p.m.

If the recommended 0.125-mill decrease is approved by council, the city's tax rate will have gone down 0.3355 mills since it was at 16.7825 mills in fiscal year 2007-08. Here's a breakdown of how it looks in the administrator's budget: 1. GENERAL OPERATING (6.1682) 2. EMPLOYEE BENEFITS (2.0560) 3. SOLID WASTE (2.4670) 4. AATA (2.0560) 5. STREET/SIDEWALK (2.1250) 6. PARK MAINTENANCE/CAPITAL (1.0969) 7. OPEN SPACE/PARKLAND PRESERVATION (0.4779) 8. DEBT SERVICE (zeroing out - down from 0.1250) TOTAL (16.4470) According to the city, about 27.3% of the overall property tax dollars paid by property owners in Ann Arbor goes toward city government services; 52.8% goes to education; 10.8% goes to the county; 2.9% goes to the library; 3.9% goes to AATA, and smaller amounts to other entities.

Ryan J. Stanton

Tue, Apr 16, 2013 : 11:09 p.m.

Some of the detail from the budget on safety services: -- Police - increase to recognize realistic levels of overtime and excess compensatory time payments (+$275k) -- Police - Provide funding to county for animal control services to maintain existing service delivery structure and services (+$28k) -- Police – maintain staffing levels -- Fire – Maintains three grant-funded positions after FY 2014. Maintains one General Fund supported FTE added in FY 2013 (+$381k) -- Fire – increased cost due to position changes and step increases and a decrease in excess compensatory time (+$68k) -- Fire – supplies and capital such as self-contained breathing apparatus, radio 800 MHZ batteries, thermal imaging cameras (+$32k)

craig stolefield

Tue, Apr 16, 2013 : 10:45 p.m.

West: Most of the reason taxes are high is the rate we pay for schools. I think if you look you will see the city's millage has gone down over the years even during the recession. Down a little bit this year too. Then again, none of the surrounding communities have 3,000 acres of parks to take care of. Cities everywhere have higher taxes than townships.

ordmad

Tue, Apr 16, 2013 : 10:39 p.m.

It's all the Mayor's fault. Him and his cabal of yes men and women on Council. What a horrible job ...... Oh, wait a minute, this is great news. Never mind. Thank you John Hieftje and Council of the recent past for your leadership and good stewardship. Despite a lot of what you read in the comments section, most of this town is truly appreciative of all the good work you all do.

Usual Suspect

Thu, Apr 18, 2013 : 12:51 p.m.

That's "He ans his cabal". Seems like you didn't need tuition.

yohan

Wed, Apr 17, 2013 : 6:32 a.m.

I disagree. I think Heiftje is the worst mayor Ann Arbor has had in the last 40 years. He is totally self serving and not only ignores the concerns, wants, desires and interests of the citizens of Ann Arbor but he continually attacks and degrades anyone who dares disagree with him. He and his wife are employed by the university and for that he continually puts the interest of the university over the interest of the citizens. I don't know of anyone who likes him and the only reason he keeps getting elected is the lack of decent opposition.

Westfringe

Tue, Apr 16, 2013 : 10:30 p.m.

" It's expected council members will consider with whether to increase police and fire staffing and restore some services like fall leaf pickup an holiday tree pickup." I hope they do so. We pay some of the highest taxes in the state, yet have less basic services than surrounding communities. This should be the first priority of the council.

John Q

Wed, Apr 17, 2013 : 3:11 a.m.

What services would those be?

craig stolefield

Tue, Apr 16, 2013 : 10:21 p.m.

Good work Powers, mayor and council. . A2 seems to be well positioned to come out of the deep, deep downturn while most cities are still raising taxes or making cuts.

Larry Ryan

Tue, Apr 16, 2013 : 9:51 p.m.

Oops, sorry... as I was about to say: This is another in a string of good budgets for the city. No tax increases, no deep cuts. Kind of amazing given the times we are in and hopefully coming out of. Congrats.

Larry Ryan

Tue, Apr 16, 2013 : 9:47 p.m.

This is another in a string of good budgets for A

dotdash

Tue, Apr 16, 2013 : 6:52 p.m.

What is the $1.6 million one-time expenditure related to? (It's hard to tell from the way the budget is broken down). Nice to have the whole budget document available though. Thanks.

dotdash

Tue, Apr 16, 2013 : 10:12 p.m.

Thanks, Ryan Stanton. I misunderstood and thought it was one item...

Ryan J. Stanton

Tue, Apr 16, 2013 : 7:05 p.m.

I've mentioned some of the items in the story. There's a summary of all the recurring and non-recurring budget items on pages 5 and 6 of the digital version of the PDF linked to in the story. Here's the non-recurring expenditures: Attorney (succession plan) $18,449 Financial Services (succession plan/process improvements) $135,000 Hydropower (regulatory and capital improvements) $307,500 Facilities (capital projects) $875,000 Systems Planning (State street corridor study) $150,000 Building Settlement Funding $100,000 Non-Departmental (ICMA citizen survey) $20,000