Washtenaw County residential home values appear poised to level off, according to 2011 data

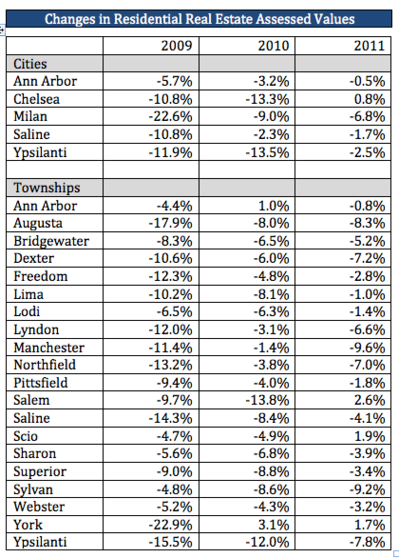

The 2011 residential property assessments for Washtenaw County’s municipalities paint a picture of still-falling home values that appear to be stabilizing in many communities after two years of double-digits drops.

No community in Washtenaw County lost more than 10 percent of its residential value, according to data released by the county’s equalization department. In 2009, 14 of the county’s 25 communities recorded double-digit value losses.

“I think our (housing) market is leveling off,” said Raman Patel, the county’s equalization director.

Three areas show increases in residential property values: Chelsea (0.8), Salem Township (2.6) and York Township (1.7), while two communities recorded minor drops in value: Ann Arbor (-0.5 percent) and Ann Arbor Township (-0.8 percent).

Hardest hit were three outlying townships: Augusta (-8.3), Manchester (-9.6) and Sylvan (-9.2). All three also posted steeper declines in 2011 than in 2010.

Even with those declines, Washtenaw County’s changes in residential value — which overall averaged a 4-percent drop — compare favorably to Metro Detroit.

Steeper value drops were recorded in Wayne County (8.73 percent), Oakland County (7.5 percent) and Macomb County (9 percent).

“We still have a very good market compared to surrounding areas,” Patel said.

The assessment changes reflect overall community trends based on home sales figures from 2010.

They offer a guide for homeowners and also set the taxable values for communities, so they directly impact tax collections. Homeowners will receive the new assessments this month and then have the opportunity to appeal them through Board of Review meetings in March.

However, since the assessment changes reflect community averages, they are not indicators on individual homes or neighborhood trends, local appraisers caution.

The county data also excludes foreclosure and short sales, as well as any sale determined not to be “at arms’ length,” said Kurt Schmerberg of Affinity Valuation in Ann Arbor.

That means that homeowners in neighborhoods particularly affected by foreclosures would find more intense pricing pressures if listing a home for sale.

“There are pockets that are pretty heavily impacted by a tremendous amount of foreclosures,” said Peter Hendershot, also of Affinity.

More pricing pressure will come this year as banks reactivate foreclosure proceedings, he added.

“There’s a whole wave of foreclosures that have been pretty much mothballed” by banks, Hendershot said. “They’re in the shadows. When they’re going to hit, we don’t know.”

Hendershot said other market trends also point to local real estate stabilization in many communities. He’s seeing high-end homes starting to sell, and the most active part of Ann Arbor is the west side.

He said he’s watching three-year sales trends — including foreclosures and short sales — because the first-time homebuyer credit in 2009 and early 2010 yielded many sales at the lower end of the market.

In Washtenaw County, the average price per home in 2008 was $232,426. That fell to $201,264 in 2009. Then in 2010 it climbed to $209,353. That data represents 6,775 sales.

Meanwhile, last year’s data from the Ann Arbor Area Board of Realtors show a median home sales price of $150,000, equal to the 2009 overall data. The median condo price in 2010 was $112,000, down from $115,000 in 2009.

Vance Shutes, a Realtor at Real Estate One, said he’s seeing the overall stabilization in the market.

“There are some local regions that are doing better than others,” he said. “And some neighborhoods that are flourishing and some that are languishing.

“But we seem to have arrested the slide of the last couple of years.”

Shutes cited the example of Saline, where the average sales price is up 1.3 percent — following 2006-2009, when it dropped 25 percent.

He also said that homes priced to the market are selling, even with the foreclosure pricing pressures — yet he cautioned that homeowners can’t yet expect to see overall prices climb.

The economy and jobs outlook will have to improve further before that happens, he said.

“There’s steady demand and reduced supply, which economics say mean the price will go up,” Shutes said. “But the wages (in the county) aren’t there to support that.”

Paula Gardner is Business News Director of AnnArbor.com. Contact her at 734-623-2586 or by e-mail. Sign up for the weekly Business Review newsletter, distributed every Thursday, here.

Comments

CynicA2

Fri, Feb 25, 2011 : 2 a.m.

Nice to see that A2.com is still in the business of putting pearls on pigs... if you pile enough of them on no one will notice the pig! Just wait until the politicians in Washington start finding ways to reduce the mortgage-interest deduction in the name of deficit reduction - sellers will have to pay buyers take the boat-anchor known as the single family home, off their hands. So much for the so-called "American Dream". I can't wait to see all the gnashing of teeth!

John B.

Fri, Feb 25, 2011 : 2:39 a.m.

I predict that the mortgage-interest deduction will be gone sometime in the next 20 years - maybe sooner rather than later.... I have been recommending for some time that everyone should get to debt-free status ASAP for that and many other reasons....

Basic Bob

Thu, Feb 24, 2011 : 8:21 p.m.

Just curious, do townships and villages have to follow the county assessment, or do they pick their own property values? I have a hard time believing township assessors want to reduce taxable value 3 years in a row.

Dilbert

Fri, Feb 25, 2011 : 5:47 a.m.

Assessors have rather intricate procedures to determine assessed value; this can result in a multi-year lag (both up and down) from market prices.

ChunkyPastaSauce

Thu, Feb 24, 2011 : 11:14 p.m.

Basic Bob: The city is required by state law to set the assessed value at 1/2 of the fair market value of the property. However, I have heard that Ann Arbors housing assessed values are inflated by the city to keep tax revenues up (makes up 50% revenue for the city) and my own experience with that tax assessment board supports this. I had asked the city for an assessed value reduction for my property last year during the annual board of appeals. The city did reduce it a bit but did not come anywhere close to the fair market value. (I had the house assessed by a licensed assessor for fair market value. In addition, the house was recently purchased in the open market and the sale price is generally a good indicator of market value. I also had a list of recently sold similar housing prices). The property is still over assessed by quite a bit by the city (like tens of thousands over valued). It's illegal by state law but there isn't much one can do about it as the only other way to have the property set at the actually fair market value (that I am aware of) is by the state via a special court which is expense and apparently takes a very long time.

say it plain

Thu, Feb 24, 2011 : 7:45 p.m.

@JohnB, zillow.com is notoriously not good at providing real-world estimates since the bubble ended. And I don't know where you're getting your info about 'stability' in the lower-end housing market in Ann Arbor lol, the entry-level housing has lost lots of value since the bubble burst, totally clear to people who bought lots of little houses even in the allegedly still-'stable' and desirable west side of town...tiny capes and ranches there got up to close to 250K a piece, lord was that ridiculous, and now even non-foreclosure pricing has that down to where it was close to or before 2000, more like 150-180 for *asking* prices that I've seen. These kinds of homes have tended to see lower time-on-market stats than the high-end housing, because the bubble created a *waaay* too high supply of these, but they've surely not been immune in any sense of the word! The rhetoric you're using looks lots like the way realtors would talk before it became completely obvious to potential buyers that there was no way housing values were anywhere near sustainable, but that gig is up now! I think @kjmclark has it right about attending to the case-shiller people...

John B.

Fri, Feb 25, 2011 : 2:35 a.m.

Duly noted..... Our area has a bunch of fairly-similar homes, so Zillow's method of (primarily) looking at comps. and square footage seems to work pretty well, in general.

say it plain

Thu, Feb 24, 2011 : 8:12 p.m.

Fair enough on that point--zillow's ability to 'zestimate' the market value of a condo in a populous area is probably lots better than its accuracy in anything like the conditions of most of ann arbor, i.e., neighborhoods with varied-housing-stock in close proximity and very low recent sales activity. The current reports, for instance, show that y-o-y things are up in double-digit percentages, woohoo, I wonder how many local realtors are using that to somehow do the press-tactics they use so often! Really, even this article with the implication that somehow from the first 2 months of 2011 we can conclude that "home values appear poised to level off" is misleading in that way business reporting helped fuel the housing bubble so irresponsibly. I realize official reps of the real estate industry "need" to do this, but I do wish the business reporting community didn't so love to work as shills for them. Used to be very important when the newspaper business model depended on the RE advertising, would love to think that is finished, but probably not totally.

John B.

Thu, Feb 24, 2011 : 8:05 p.m.

... and I didn't say a thing about the prices of starter homes being stable in the past, during the bubble-popping - I'm talking about recently (the last six months, say).

John B.

Thu, Feb 24, 2011 : 8:02 p.m.

I would agree that Zillow had a 'period of adjustment' where they were out of line while prices were plunging, but I don't agree that is still the case. Like I said, they are in the ballpark. Yes, it depends on the number of recent sales, what those comps. were, what your house is actually like compared to others in the area, etc., etc, but they are a starting point. I'm not a realtor, nor do I play one on TV, but in my neighborhood their estimates have proven to be pretty good overall. I can also tell you that my parents just sold their condo in the Chicago suburbs for within $5K of Zillow's estimate.

Atticus F.

Thu, Feb 24, 2011 : 6:21 p.m.

Get ready for another global reccesion due to high gas prices...Be prepared for any holdings in the stock market to decrease in value, as well as home values, and commercial properties.

Buster W.

Thu, Feb 24, 2011 : 5:33 p.m.

@John B. I check <a href="http://www.zillow.com" rel='nofollow'>www.zillow.com</a> periodically (usually for entertainment purposes only). My current "zestimate" is $299K (purchased for $310K in 2003)...the problem is I don't think a home has sold in my sub for over $250K in the last two years. The comparables are very sketchy, mostly due to lack of comparables is my guess.

John B.

Thu, Feb 24, 2011 : 7:58 p.m.

Like I said, they are in the ballpark. Yes, it depends on the number of recent sales, what those comps. were, what your house is actually like compared to others in the area, etc., etc, but they are a starting point. I'm not a realtor, nor do I play one on TV, but in my neighborhood their estimates have proven to be pretty good overall. I can tell you that my parents just sold their condo in the Chicago suburbs for within $5K of Zillow's estimate.

John B.

Thu, Feb 24, 2011 : 5:31 p.m.

KJMC: How many new mcmansions are being built in Washtenaw County currently? I would guess zero, or at least statistically close to zero. The ONLY new homes I see being built are entry-level, with a few exceptions, and not even many of those 'starter homes' are going up. I think that you have to look at smaller segments of the market to see what prices are doing. Some segments are stable, some are still falling, some have bottomed and are slowly climbing. Entry-level single-family homes have always sold well in the Ann Arbor area, for example, as demand is typically higher than supply. For the past couple years, it has generally only been existing ones, but they have continued to sell, even when almost nothing else could.

say it plain

Thu, Feb 24, 2011 : 8:20 p.m.

No, so far as I can tell, @JohnB, you absolutely referred to how "entry level home have always sold well in the AA area" and implied that this segment of the market has "continued to sell"....sorry, but that surely doesn't imply what the reality has been, i.e. that the lower-end has taken longer to sell since the bubble burst and has also required way longer selling-time windows than pre-bursting... the *last six months* was what you were referring to?! Oh, okay, yeah, the first-time home buyer credit that accounts for a lot of sales in the last year really did help with selling those homes lol, albeit at 20% off their peak prices. I'm guessing that just like nationally, where the great hope was that the recent apparent leveling off of prices and increase in sales activity wasn't "just" due to the coupon incentive the government provided, but the realization that it likely was only that driving sales is setting in now.

KJMClark

Thu, Feb 24, 2011 : 7:53 p.m.

John, new sales are *clearly* not a problem right now. Those sales skew the median in good times. However, what part of the market is selling now will still tend to alter the median, which is pretty much the point you're making in your second paragraph.

Buster W.

Thu, Feb 24, 2011 : 4:18 p.m.

In Washtenaw County, the average price per home in 2008 was $232,426. That fell to $201,264 in 2009. Then in 2010 it climbed to $209,353. That data represents 6,775 sales. Meanwhile, last year's data from the Ann Arbor Area Board of Realtors show a median home sales price of $150,000, equal to the 2009 overall data. The median condo price in 2010 was $112,000, down from $115,000 in 2009. @Ms. Gardner, Why the disparity in these numbers reported by AAABR (last year, $150K vs. $209K? Is this a mean-median difference?

John B.

Thu, Feb 24, 2011 : 5:23 p.m.

I would guess yes, but Paula can answer this autoritatively. More lower-priced homes sold, which skewed the median lower than the mean. That sounds very likely to me, based on what I've seen locally. BTW, for anyone that wants a rough idea of the current market value of their home, go to <a href="http://www.zillow.com" rel='nofollow'>www.zillow.com</a>

mbill

Thu, Feb 24, 2011 : 4:10 p.m.

In Sharon Township the majority of sales around me have been foreclosures and short sales. It still took a couple of years to sell them for half what the county - township said they are worth. There is no way my home is any where near the value the township placed on it. Any one that bought a house in the last 15 years owes more than they can sell it for. Unless you can come up with the difference you can't sell. I filed with the state tax tribunal 2 years ago but they are so backed up that it maybe a few more years before I am ever heard. How many homes were sold last year in Washtenaw county? How many were short sales, foreclosures and at arms length? What is the percentage of sales that are being excluded?

John B.

Thu, Feb 24, 2011 : 5:25 p.m.

Have you checked your home's estimated market value at <a href="http://www.zillow.com" rel='nofollow'>www.zillow.com</a> ? They are generally in the ballpark, sometimes scary-close.

KJMClark

Thu, Feb 24, 2011 : 1:31 p.m.

The mish-mash of different ways, all somewhat inaccurate, of measuring house sale prices doesn't really tell you how prices are doing. Median is easily skewed by changes in the housing mix and new mcmansion sales. That's why the Case-Shiller index uses repeat sales of individual houses. Nationally, and for metropolitan Detroit, the Case-Shiller index is falling again. Detroit set a new low and is continuing to drop. A recent NYTimes article (<a href="http://www.nytimes.com/2011/02/23/business/economy/23housing.html)" rel='nofollow'>http://www.nytimes.com/2011/02/23/business/economy/23housing.html)</a> had Prof. Shiller's thoughts on this: "Mr. Shiller, noting the unrest in the Middle East, a large backlog of foreclosed houses, the uncertain future of the mortgage holding companies Fannie Mae and Freddie Mac, and proposals to reduce the mortgage tax deduction, saw "a substantial risk" of declines of "15 percent, 20 percent, 25 percent." Let's recall that Prof. Shiller (Yale) was right about the Dotcom bubble (he's the one that planted the phrase "irrational exuberance" in Alan Greenspan's ear) and was right about the housing bubble. Any realistic assessment should start with his opinions. And what's with "The county data also excludes foreclosure and short sales," ?!? Then what good are they? That's like saying, "ignoring the low scores, test scores have risen." I can understand ignoring non-"arms-length" transactions, but the foreclosure and short sales are still open-market sales. Is it a common practice of assessors to ignore foreclosure and short sales?

Ypsi-Booster

Thu, Feb 24, 2011 : 1:28 p.m.

I just want to comment that it's distracting and annoying for a useful article to be interrupted by "Hey Ann Arbor!" or "Stay Connected!".