Top 5 investments University of Michigan missed out on before deciding to fund its own startups

It took several years for Ann Arbor venture capitalists and economic development officials to convince the University of Michigan to pry open its endowment and invest in its own entrepreneurial companies.

U-M announced last Wednesday that it would set aside $25 million of its $7.8 billion endowment to invest in its own spinoff companies. They'll be eligible for up to $500,000 apiece after they've secured investment from an outside venture capital source. Investors applauded the move.

HandyLab, led by CEO Jeff Williams, was sold to Becton, Dickinson and Co. for $275 million in late 2009. Although HandyLab was a U-M spinoff, the university's endowment did not invest in the company.

File photo | AnnArbor.com

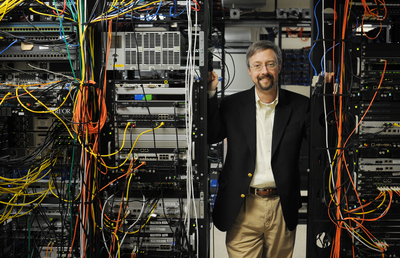

University of Michigan startup Arbor Networks, founded more than a decade ago, was sold to Tektronix Communications in 2010. Co-founder Rob Malan is seen here.

Melanie Maxwell | AnnArbor.com

In fact, President Mary Sue Coleman said the endowment's financial analysis indicated that if the university had invested in its own startup companies over the last 30 years, it would have achieved financial returns comparable to its broader venture capital fund portfolio.

In other words, local venture capitalists were right all along — U-M startups can compete with the best in the world.

Startups created by U-M have typically licensed IP from the university, which often gets an equity stake or royalty deals in return. U-M's Technology Transfer Office reaps revenues when U-M startups are sold, but the university's equity stake is typically diluted over time as outside investors step in and take on more risk in the startup's development.

Here are the Top 5 investments U-M missed out on:

1. IntraLase. This company — arguably the university's most successful spinoff — commercialized a groundbreaking blade-free laser technology that is now used in LASIK eye surgery. The Irvine, Calif.-based firm, founded in 1998, went public in 2004 on NASDAQ.

The student-led Wolverine Venture Fund, part of U-M's Ross School of Business, quadrupled its $250,000 investment in IntraLase. The Wolverine Venture Fund liquidated its equity in IntraLase during the IPO, making more than $1 million. We can assume that, had the university's endowment invested at an early stage of IntraLase's development, it would have achieved a fantastic return as well.

In addition, if the endowment had held onto its shares, it might have reaped even bigger rewards in 2007, when IntraLase was sold to Advanced Medical Optics Inc. for $808 million in cash.

2. HandyLab. The Pittsfield Township-based medical device startup, which commercialized a device to expedite infection detection in hospital patients, was sold to New Jersey-based Becton, Dickinson and Co. for $275 million in 2009. The Wolverine Venture Fund reaped a windfall from its $350,000 investment in HandyLab, landing $2 million as a result of the deal.

Other local venture capital firms, including Ann Arbor-based Arboretum Ventures and now-Gov. Rick Snyder's Ardesta, also got millions from the deal.

3. Accuri Cytometers. The Scio Township-based medical device startup was sold for $205 million to BD in early 2011. The company's cell flow analysis device is considered a market leader and attracted a number of suitors. Local investors, including Arboretum and Ann Arbor-based Plymouth Venture Partners, won big with investments in this company.

4. HealthMedia. The Ann Arbor-based health care software firm was sold to Johnson & Johnson in late 2008 for a sum believed to be close to $200 million, although the official price was never revealed. The firm, co-founded by Snyder and U-M professor Victor Strecher, is still based in downtown Ann Arbor. Arboretum, Snyder's Avalon Investments and Snyder himself had invested in the company and received a big payback.

5. Arbor Networks. The Ann Arbor-based information technology firm was sold to Plano, Texas-based Tektronix Communications, a division of Danaher Corp., in 2010. The price was never revealed, but local investors said they achieved a very lucrative return.

Contact AnnArbor.com's Nathan Bomey at (734) 623-2587 or nathanbomey@annarbor.com. You can also follow him on Twitter or subscribe to AnnArbor.com's newsletters.

Comments

xmo

Mon, Oct 10, 2011 : 4:41 p.m.

Thank Goodness somebody gets it. More jobs, More Taxes and More Money for the Ann Arbor Area.

Dug Song

Mon, Oct 10, 2011 : 2:21 p.m.

Even just one-tenth of one percent (0.01%) in equity across these companies, as we've proposed doing for the Entrepreneurs Foundation of Ann Arbor, would have reaped roughly a million dollar return: <a href="http://www.slideshare.net/dugsong/entrepreneurs-foundation-of-ann-arbor" rel='nofollow'>http://www.slideshare.net/dugsong/entrepreneurs-foundation-of-ann-arbor</a> @BartonHills: Less than half of UM Tech Transfer's companies have received any venture investment - just 42, according to a quick grep of <a href="http://www.techtransfer.umich.edu/about/startups.php" rel='nofollow'>http://www.techtransfer.umich.edu/about/startups.php</a> . Without knowing the deal terms behind them, it's hard to extrapolate what IRR these investments represent (over the course of a typical 10-year fund's lifetime) - but easy to see how Ann Arbor has immediately benefited (in jobs, talent, experience, and culture). VC is a risky business, with outsized rewards (when they happen). Optimizing to reduce the downside risk of a tiny sliver of UM's endowment allocated to this asset class is literally penny-wise and pound-foolish. The alternative is to continue to be the world's most prolific IP engine whose output gathers dust on a shelf. In terms of R&D, our equation simply doesn't balance - $1.5 billion a year in R, and pretty much nothing (relatively speaking) in D.

say it plain

Tue, Oct 11, 2011 : 1:24 a.m.

I don't mean to imply that the UM can be counted as *forfeiting* their educational mission, just that it is subject to compromise under certain conditions. I would worry that becoming too involved in the "D", or in the VC culture, might change the nature of the "R", and indeed affect the educational mission and atmosphere.

Dug Song

Tue, Oct 11, 2011 : 1:18 a.m.

Also, it is annoying that you cannot edit posts once submitted to this site. As an engineer, the 0.01% typo above really bothers me!

Dug Song

Tue, Oct 11, 2011 : 1:16 a.m.

@say it plain: The University making investments from its endowment does not mean it is forfeiting its mission as an educational institution (as you seem to imply, reductio ad absurdum). It is doing what you do with endowments - you grow them. The news that the fruit of UM's own research could represent some allocation of the high-growth/high-risk assets in their investment portfolio (as opposed to, say, Facebook private stock) should be something we can all celebrate. Whether they actually can (based on their constraints and culture, and a competitive market for capital) is another question entirely.

say it plain

Mon, Oct 10, 2011 : 3:38 p.m.

Somehow to me your points serve as an argument for keeping the University out of "D" as much as possible, hmm. I think it has something to do with the "R&D" rhetoric. They're occupying the old Pfizer site with their NCRC and their incubators, and that feels like as much as they need to do on the 'business' end of "D", at least to me. It absolutely brings home how UM is at least *supposed* to pretend that they are about being a university, a place for research and for education and for scholarship, not a business incubator or an R&D wing for Michigan businesses, as 'nice' as that may be for some who benefit from that. It makes me appreciate the reticence of the CFO to get all woohoo gungho about the 'local' aspect of the UM's VC portfolio.

Veracity

Mon, Oct 10, 2011 : 1:53 p.m.

Nathan Bomey's article refers to Governor Snyder's venture capital funds, including Ardesta, as being successful, being profitable for those who founded and administered the funds. According to a previous article by Nathan Bomey, Governor Snyder's venture capital firms "raised $100 million apiece for investments in high-tech companies in Michigan and elsewhere." <a href="http://www.annarbor.com/business-review/rick-snyders-venture-capital-companies-hit-with-liens-for-unpaid-taxes/">http://www.annarbor.com/business-review/rick-snyders-venture-capital-companies-hit-with-liens-for-unpaid-taxes/</a> Furthermore, the article went on to explain that "A recent Wall Street Journal analysis of Snyder's venture capital record found that 10 of the 36 startup firms that received funds from Snyder's firms were based in Michigan. Of all the investments, four companies went public, 13 were acquired or merged with other companies, 11 are still private companies and seven went out of business, WSJ reported, citing data from VentureSource." Two of Snyder's successes, HealthMedia and HandyLab, were sold respectively to Johnson & Johnson in 2008 and Becton, Dickinson and Co. in 2009. Together these companies created only 300 jobs in Michigan but how many of these jobs still exist is not known. Governor Snyder's venture capital efforts have produced few jobs in Michigan and more elsewhere. Furthermore, the nascent companies created by venture capital were mostly technology firms that produced few jobs and jobs requiring specialized education and skills unsuited for most unemployed citizens of Michigan. More attention needs to be directed towards creating jobs for the more than 500,000 out-of-work Michiganers and not so much on making more money for the established wealthy like Rick Snyder and the University of Michigan.

Dug Song

Mon, Oct 10, 2011 : 2:33 p.m.

The hundreds of millions in state and federal funding and tax breaks for companies like A123 Systems that are building factories here target this need. But we cannot survive as a region without innovation, even if it requires new skills and specialized education. The perverse situation we suffer in Ann Arbor is that we have a well-oiled machine of innovation in the University - but a slow path to commercialization, where anyone would actually see its benefit.

say it plain

Mon, Oct 10, 2011 : 11:30 a.m.

I am not very savvy about all this VC stuff, but you bring up another interesting point relevant to the U's decisions here. Do guidelines for acceptable losses look different for an entity like UM, where tax write-offs, for instance, do not apply? I guess the UM's analysis would have had to consider all the firms that would have qualified for their investment under the proposed guidelines and determined that they wouldn't have suffered if they'd invested in only these? Or maybe it's some sort of gamble even so, and tied to ...hmmm... how a venture capitalist (and one who did pretty well himself investing in these firms!) is currently governor?! That might be an interesting further investigation; not that it would get done around these parts ;-)

BartonHills

Mon, Oct 10, 2011 : 10:47 a.m.

The big question is what would have happened with the other 107 startups that UM spun off, according to UM press releases. Would the U have lost its shirt on the overall portfolio if it had invested in all 112 firms? A typical VC firm likes to have a Grand Slam on 2 out of 10 of its investments. At this ratio, UM should have had 20 Grand Slams, but only 5 are mentioned in this article.