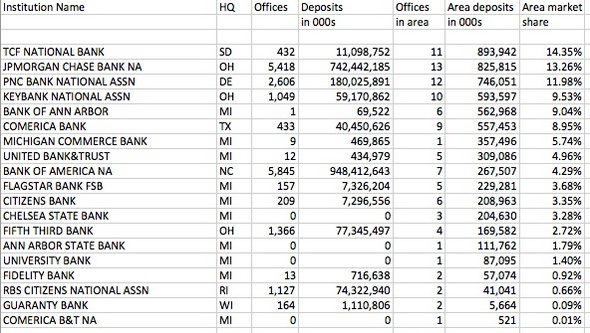

Market share: Ann Arbor area banks' FDIC rankings

Recent news that Bank of Ann Arbor will close, expand and open offices in Washtenaw County this year was only one sign of change among local banks.

Chelsea State Bank remains the 12th largest bank in the county, based on FDIC market share data.

File photo | AnnArbor.com

A look at FDIC reports of bank market share among the 19 institutions in the Washtenaw County market also shows that rankings changed in 2011 - the last year data is available - for 10 of them.

Bank of Ann Arbor is now ranked No. 5 in the market, up from 7 a year earlier. It's now the largest local bank, with 9.04 percent of the market, based on deposits in the county. And it leapfrogged over both Comerica (6) and Michigan Commerce Bank (7).

Other changes in 2011 include:

The No. 2 and 3 banks in the market switched positions: JPMorgan Chase Bank is now the second-largest, with 13.26 percent of deposits, while PNC Bank fell to third place, with 11.98 percent of deposits.

Bank of America (9) and Flagstar (10) swapped positions from 2010.

Fifth Third went from No. 14 to 13, while Ann Arbor State Bank went from 15 to 14, as University Bank dropped from 13 to 15.

Fidelity Bank, ranked No. 16 in 2011, was just acquired by Huntington Bank as part of a regulatory move to sell the assets of the failing Dearborn-based bank.

Here's a look at the information from the FDIC:

From the FDIC

Comments

dextermom

Sat, Apr 14, 2012 : 12:44 p.m.

Like trespass asked - how can banks (Chelsea, A2 State, University, Commerica) rank with 0 offices? Did anyone read the figures and try to present "news", not just copy something?

bbb

Sun, Apr 15, 2012 : 12:28 p.m.

@johnnya2: I think it's more like a story saying that a team scored 2 touchdowns to win the game, but the box score only shows 9 points for the team. True, the story may have a correct conclusion, but the accompanying graphic doesn't make sense. When there's an obvious issue with the numbers, you would hope there would be some follow-up instead of the reporter just copying and pasting and saying "oh well".

johnnya2

Sat, Apr 14, 2012 : 12:55 p.m.

Or if it means that much to you, YOU can do some research as to how the FDIC comes up with its numbers. It really is not that important to the story. The STORY is the rankings of the bank. If you need to know the background of how those numbers are derived, that is YOUR issue. The FDIC is the scorekeeper. It would be like asking why does a touchdown in football count as 6 points.

trespass

Sat, Apr 14, 2012 : 11:07 a.m.

HOw can Bank of Ann Arbor have more in area depositis than it does in total deposits?

Snarf Oscar Boondoggle

Sun, Apr 15, 2012 : 9:58 p.m.

geography might com into play here ... just thnking..

Michigan Reader

Sat, Apr 14, 2012 : 8:24 p.m.

Some accountant's calculator was malfunctioning.