Exclusive interview with Borders CEO Mike Edwards: 'We are here fighting to the end'

Borders Inc. CEO Mike Edwards said the company needs to convince publishers to agree to new terms for product shipments.

Melanie Maxwell | AnnArbor.com

But he also acknowledged that the company’s future is dependent on the willingness of publishers to agree to new terms under which they would continue to ship books to the company’s remaining stores.

“All I can tell you is that we are here fighting to the end,” Borders Inc. CEO Mike Edwards said in a rare interview. “We know we have a business plan that works, but it requires a lot of support to get it there, and our publishers are going to make or break our ability to transform this company at the end of the day.”

Borders bankruptcy coverage

- Borders files for bankruptcy protection

- Timeline of Borders' rise and fall

- Judge approves bonus plan with strings attached

- Borders says it may leave Ann Arbor

- Borders must change business model if it is to survive bankruptcy

- Borders store-closing sale draws overwhelming response at Ann Arbor's Arborland

- Borders plans store closings in addition to locations identified in original filing

Edwards, sitting in his third-floor office overlooking the parking lot of the company’s headquarters on Phoenix Drive, said it’s likely Borders will know by the end of June whether publishers “are going to support us or not.”

He said Borders is presenting an 80-page business plan with a new terms proposal to publishers this week and next week. He described the proposed new terms as a “shared risk scenario" but said negotiations are progressing slowly.

Meanwhile, Edwards said the company is close to finalizing a reorganization plan that it would need to be approved by a judge before the company could exit bankruptcy. It’s unlikely that plan would be approved unless the publishers sign off on it.

There’s not much time to lose. Borders, which filed for Chapter 11 bankruptcy Feb. 16 and is closing nearly 230 stores, continues to bleed cash. In papers filed last week with the U.S. Bankruptcy Court's Southern District of New York, Borders reported a loss of $52.6 million from Jan. 1 to March 26.

The risk remains that the company will be forced to liquidate its assets inside bankruptcy.

But Edwards said he’s convinced the company will be on firm financial ground once it finishes closing unprofitable stores, getting better lease terms at its remaining locations, securing improved terms with vendors and boosting its online sales, e-book offerings and in-store product mix.

Edwards also:

--Said he’s been surprised by the lack of “outreach from the community to save Borders here.”

--Suggested that Borders’ biggest mistakes were opening too many stores and making them too big, expanding internationally, buying back stock and failing to get the Internet right.

--Said the company would’ve closed 110 stores, instead of nearly 230, if publishers had agreed to concessions in January.

--Insisted that the company would be able to compete in the emerging electronic books segment without its own e-reader.

--Said the company wants to emerge from bankruptcy by September.

Borders Inc. CEO Mike Edwards in his office at the company's headquarters in Ann Arbor.

Melanie Maxwell | AnnArbor.com

--Defended the Borders’ executive bonus plan and said it’s unlikely that the bonuses will actually be paid out.

--Said Borders has fewer than 400 workers at its corporate headquarters in Ann Arbor and that workers are quitting every week.

--Said the company might move its headquarters out of Ann Arbor and that it would focus its office search on a 10- to 15-mile radius.

He spoke Monday with AnnArbor.com’s Nathan Bomey. Excerpts:

AnnArbor.com: How close are you to identifying a reorganization plan?

Mike Edwards: We’re very close. We have all the components of the plan done. What has to be shored up at this point is a financial sponsor and getting clarity on what the go-forward publishing terms will be.

AnnArbor.com: Can give us a preview into what it will look like?

Edwards: There’s a pretty dramatic turnaround in terms of profitability. That’s mainly driven by store closures of unprofitable stores and expense reductions. The other aspects of it are (an) enhanced merchandise mix for our stores and significant growth online.

We don’t really, from a retail perspective, plan growth for many years. But clearly online and in the e-book segment there will be a shift and migration that’s already occurred. That’s in the business plan.

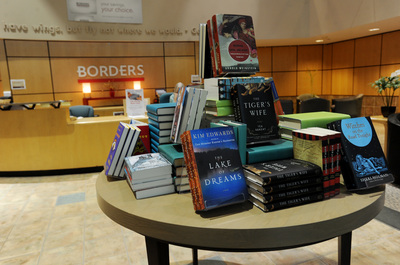

A view of the lobby at Borders' Ann Arbor headquarters. Edwards said the company fills only about 25 percent of the building.

Melanie Maxwell | AnnArbor.com

AnnArbor.com: What needs to be done to make your online sales competitive?

Edwards: It’s search engine optimization, it’s improving the checkout experience, it’s making the content searchable and being relatively priced to the competition.

We get 150 million hits a year on our website. And our conversion rate right now is 2 percent. Amazon is eight times (better).

So, improving the conversion aspect of the website dramatically improves the sales potential. Our Web business has been triple digit growth since the beginning of the year. It’s an area that the company historically has not put a lot of resources in.

AnnArbor.com: What role would you say mismanagement played in driving Borders into bankruptcy?

Edwards: Hindsight is 20/20. In a multi-billion-dollar company, with major strategy decisions you don’t really see the impact — good or bad — for two or three years.

Not just Borders, but many super store concepts in the '90s (opened too many locations). Borders was at a clip of opening up 20 to 25 stores a year. It hides a lot of sins.

Consequently those new stores weren’t really developing the profit curve that the core stores were for a long period of time. Once you get a large portion of your store base that’s not performing, there’s very little you can do other than cut expenses to offset those decisions, and those are long leases.

A stack of books — like those in Borders stores — greets visitors in the lobby of the company's Ann Arbor headquarters.

Melanie Maxwell | AnnArbor.com

Going international, doing stock buybacks and not investing in the online experience were strategic errors relative to the competitive landscape, which really remained very relentless and committed to their core customer.

Amazon has been investing in technology, creating a great online book experience for years and they haven’t really changed their strategy. They continue to invest aggressively in it. B&N — they never looked at international, they never took on more than they could, they kept their balance sheet healthy and they ultimately resonated with the core reader customer.

AnnArbor.com: When it really gets down to it, though, isn’t price the baseline problem that Borders has? You simply can’t compete on price?

Edwards: It’s not a problem that’s different for us versus B&N or Walmart or Costco. … Pricing has put pressure on the industry, (but) the e-book effect is far more destructive than pricing, which has been out there for years.

AnnArbor.com: With e-books, how fast do you see the transition occurring? Are you surprised by how fast it’s occurring already?

Edwards: Yes. I joined the company just a little over a year and a half ago. When I joined, e-books were less than 1 percent of the market. The Kindle was out but it didn’t have the traction. The Nook had just been released. The Apple product wasn’t even on the market.

Edwards said the company wants to emerge from bankruptcy by September.

Melanie Maxwell | AnnArbor.com

Within a year it went from 1 percent to almost 10 to 11 percent of the total publishing sales. That is a radical transformation. And that comes at the expense of physical books.

That profound impact on the retail traffic puts a lot of pressure on not just our bookstore, but all bookstores. So I was surprised to see it move that fast. I don’t anticipate it slowing down any time soon.

AnnArbor.com: Are you convinced that Borders can survive bankruptcy?

Edwards: Absolutely. … We’ve done the consolidation ahead of the (steep rise in e-book sales). Our stores will remain profitable even with a downward trend for the next three to four years with significant leasehold reductions and flexibility.

So, yeah, I know we can come out. I know that we can move back to profitability significantly. In fact, it could be the turnaround of the century if you just look at our historic performance.

Our competitors — right, wrong or indifferent — don’t have the protection of Chapter 11 to negotiate across the board.

AnnArbor.com: Are you surprised the publishers haven’t been as cooperative as you would have hoped?

Edwards: It’s been a little disappointing. … Today we are slowly getting terms, but not meaningful.

If all the pieces have to come together, the terms commitment then drives the financial sponsorship. If so, then we have a business model that we can create a plan of reorganization around, get approval from the courts and emerge.

And our goal has been to emerge in the September time frame, because it’s critical to be back on normalized terms and have a bank behind us going into the holidays because of the inventory build.

AnnArbor.com: We’ve been told that morale at this office is pretty low. Is that affecting your ability to do business?

Edwards: Managing through Chapter 11 has been devastating for a lot of people and creates a lot of fear and uncertainty. The company has gone through a pretty significant amount of reductions over the last four years, not just in the office but in the field. At one point the office had 1,400 people. Today we’re under 400.

Once we weather the storm, people will be more encouraged with the business plan. But we still have a significant amount of attrition. Every week. And understandably.

Borders has fewer than 400 employees left at its corporate headquarters on Phoenix Drive.

Melanie Maxwell | AnnArbor.com

If you don’t have that risk tolerance, then you’ve gotta do what you’ve gotta do for yourself and your family. We make no bones about it — we’re very transparent about the issues we face.

But the people left are extraordinarily committed and loyal to Borders. The best we can do is keep people as informed as possible. But certainly it’s tough to lead through this, because you’re leading on a lot of assumptions.

I can’t definitively tell you one thing or another. I can only tell you what we’re working on and what we hope to achieve.

AnnArbor.com: You took a lot of heat for the bonus proposal. Why was that appropriate?

Edwards: Well, the term ‘bonus’ is inappropriate. It’s an incentive program that translates all the way down to the store managers in the company. Not really radically different than anything we’ve had in place.

What’s different is there’s no guarantees embedded in it. So either you perform and have a successful reemergence or there’s nothing.

We’re trying to do everything we can to stabilize the talent we have in the company, give them some hope and incentive and some upside for committing to a very turbulent environment.

It also gives, frankly, great comfort to the creditors committee and the banks that don’t want to invest a lot of time and money to offer us transition plans if they think our management team is walking out the door.

Everyone thinks that we’ve already cashed the checks. Our ability to achieve these (benchmarks) is so remote.

AnnArbor.com: So you think the terms are pretty strict? This has to go very well for you to get the bonuses.

Edwards: This is a ‘Hail Mary’ pass, yeah.

AnnArbor.com: Was that because the U.S. Trustee pushed you into something like that? Do you blame it on that?

Edwards: No, not at all. There’s always a dynamic tension when you have the trustee (and) you have the creditors committee, which actually really drove it. We actually had very little influence on it at the end of the day. It was really driven by the courts and the creditors.

It’s certainly not motivating the senior management team. We don’t believe it. What we believe is we want this company to survive.

AnnArbor.com: When do you hope to decide where your corporate headquarters will be?

Edwards: Early fall would be a good time frame. We want to be reasonably close. Within 10 to 15 miles. We’re not averse to moving in Ann Arbor or moving anywhere else. We just need far less space than we have today. And there’s far more economic deals than there were when this building was constructed.

AnnArbor.com: How much of this building would you say occupy?

Edwards: If we pulled everyone together, maybe 25 percent of the building.

AnnArbor.com: A lot of people in this community still have that emotional connection to Borders and it means a lot to them. Some people believe, though, that this company has lost its Ann Arbor roots. Where do you come out on that?

Edwards: Well, I think that’s partially true. When the company was founded here by the Borders brothers, it was a very different environment. Very connected to the cause, very connected to downtown.

When it became a multi-billion-dollar global brand, I don’t think the thinking was about Ann Arbor anymore. The thinking was, we’re running this big company that was based in Michigan.

AnnArbor.com: It was different.

Edwards: For us, it’s really about sustainability. I wouldn’t say there’s been huge outreach from the community to save Borders here. I’ve done business in a lot of cities and I have not experienced this, which is a less than positive approach with a company that’s in trouble.

No one running a company really wants to screw it up. Like we show up for work every day and say, how do we run this company into the ground?

There’s been so much turnover at the company over the last four or five years. And a lot of those people still live in Ann Arbor. They don’t have warm and loving feelings about an employer that laid them off. And that’s understandable.

Personally, I love downtown Ann Arbor. I live downtown. I would like to be located down there. It’s the right environment for us.

But at the end of the day, all the decisions we’re making now are economic based and how do we best keep the company surviving in a very turbulent industry.

AnnArbor.com: What about the store downtown? Do you still think you can keep that there long term?

Edwards: We’re still working through that. But that’s our intention. It’s a kind of iconic aspect of our history. … I, for one, feel that bookstores will never go away. They’re too important to the American culture and our communities. It’s like the last safe social escape for retail. I don’t think people want to hang out or relax in a Target.

AnnArbor.com: Anything else you want to add?

Edwards: People are really focused on Borders right now, but I think we should be expanding our view in terms of what’s happening in the book industry.

The real story is all these amazing writers out there — where are they really going to be able to show their books in a way that continues to inspire society? That’s what the bookstore is about.

AnnArbor.com: It’s a culture change.

Edwards: It’s a huge culture change.

Contact AnnArbor.com's Nathan Bomey at (734) 623-2587 or nathanbomey@annarbor.com. You can also follow him on Twitter or subscribe to AnnArbor.com's newsletters.

Comments

lovetoread

Fri, Jul 22, 2011 : 3:43 p.m.

Interesting interview, thank you. This is not Mike Edwards fault, you don't drive a cruise ship like a wave runner and he does not have enough time on the clock to own the scars. An unenviable role to be the clean up guy. Hind sight is 20/20, but there were cracks in the hull early on. By the time the cracks got attention, I'm not sure anyone could have saved the ship. So go get some great deals in the liquidation and let's learn from the experience. What an interesting post-mortem for B-schools. The company evolved through some very interesting economic years - late 80's to early 90's recession, fast cash millenium followed by the WSbubble followed by the easy money borrowing in the early to mid-Decade 1 and M&A crazy hazy daze. Add the advent of all kinds of game changing rapid adoption consumer technology (which they dismissed while taking on liabilities like big long term leases). Buyer behavior changes have affected ALL retailers (it's a big grave yard they share and a siren to all retailers). Technology and the speed of cash are affecting the seas of change - and boy are waters choppy. Everyone is riding these waves and some respectable firms have sunk; we'll lose more. Plan B and a good weather person have never been more important. But there's opportunity in chaos. I suspect they under estimated their long-term real estate risks - with a whopping 1200+ stores and their costs to run international operations (some profitable some toxic to the bottom line); and clearly they missed recent term technology choices. But cut them a break - the economic environment clouded choices (cash flowed like water in 2003-2006) and without the roller coaster of their eco graph, choices might have been more obvious. Their story feels like one big corporate bouncy house - and it's hard to know where you're going to land - some people don't like it, so they leave. Hang in there Mike. At least now we know how this chapter ends, look forward to your book.

snapshot

Mon, May 9, 2011 : 6:19 a.m.

Since Ann Arbor has a preponderance of "public" employees who seem to have, not only a complete lack of real business knowledge, but an arrogant resentment towards the "private" sector that funds their employment. Maybe we should increase the taxes Border's pays, that'll fix them.

Anwar Shere

Fri, May 6, 2011 : 7:40 p.m.

A few notes here- not mentioned by Mr. Edwards- first, this is the same management team charged wiht getting Borders out of bankruptcy ( and it does NOT sound like Mr Edwards believes they can do so- nor so many of his creditors have that faith in him)- that signed a new financing arrangement then broke its terms based upon his managed results in what, 90 days? This is the same leadership that watched gross margins tank to new lows, while sales continued to tank. The same leadership that delivered their first plans to the court and were rebuked for its lack of detail or viable business plan. If the bonuses were not an issue, why then did Edwards lead his lawyers to battle for it? And if those bonuses are 'unlikely' or not to be paid, then how does that sum up the overall viability of his 'fight to the end' plan? So much more of the same old from this management group- focused on 'the brand' as they pillaged it into oblivion. And to be disapointed wiht Ann Arbor's support? What , when, was the last time Borders management, or Mr Edwards, did anything , anything locally to support this community? Does he think paying rent, eating out downtown, etc. is supporting AA? And it is interesting to note that , somehow, this hero of business is presenting a plan based upon his creditors- who have already been fleexed to the tune of millions, before and after his filing- that is based upon some socialistic , all chip in for us, scenario that frankly, I would doubt a single creditor can - or should- agree with based upon the perfromance of this group to date. If the plan is, give us charity and we can make it work, it is obvious these folks have no plan at all. Creditors have shareholders who actually want a return for their investment, not puff and dodge about 'the cause' or the 'brand'. Had the brand been managed , it would probably have a fighting chance to get out of chapter 11. I dare say, based upon both results and this interview, does not appear that is likely.

CynicA2

Fri, May 6, 2011 : 1:27 a.m.

'We are here fighting to the end'... would seem to imply, in and of itself, that the end is near. Certainly not an optimistic assessment. Not that there is all that much to be optimistic about... !

WWBoDo

Thu, May 5, 2011 : 8:33 p.m.

I would like to give Mike Edwards the benefit of doubt. As a a life long, born and raised, Ann Arborite, I would love to see Borders survive. Problem is, when Edwards let Tom Carney slip away, I recognized that both Edwards and Border's don't have a chance. Too bad. Tom was one of Border's brightest, high integrity, hardest working individuals with more business acumen than all of the CEO's before him, combined and multiplied by 10! At any point during the struggle, it is my opinion that Tom could have left for any number of companies and enjoyed half the stress and twice the compensation. It is an opinion shared by many in the local business community. But he remained committed to Borders' and its ultimate success. When you are in the trouble that Borders is in and let someone like that slip away--the writing on the wall is very clear. Frankly, I doubt Mike is calling the shots anyway--likely was not his decision to make or reverse. Nevertheless, it is emblematic of Borders incompetency and ultimate demise. Sorry.

CynicA2

Thu, May 5, 2011 : 7:11 p.m.

Blub... Blub... Blub... ! Buh Bye!

Larry Eiler

Thu, May 5, 2011 : 7:10 p.m.

This piece just implies -- by the CEO -- that Borders is done

M. Stephen Lukac

Thu, May 5, 2011 : 4:25 p.m.

Mr. Edwards said: "That's mainly driven by store closures of unprofitable stores and expense reductions," which may be true for the latest round of closures, but he chooses not to mention the decimation of the Waldenbooks brand a year earlier. Many, if not most, of these stores were profitable and had major ties to their communities. If you're going to recount history, make sure to tell it all. . .

mlivesaline

Thu, May 5, 2011 : 4:20 p.m.

I'm not surprised by the lack of outreach to save the company. All we've seen is a revolving door of CEO's come and go. They come and take a boat load of cash and then they go.

John B.

Thu, May 5, 2011 : 11 p.m.

...and now he blames the publishers ands the 'lack of outreach' for his current situation? Telling, indeed....

Townie

Thu, May 5, 2011 : 2:29 p.m.

He can now run for Governor on the Republican ticket! Will he walk away with enough cash to create the next rebranded 'Smart Nerd' campaign? Otherwise he has all the right attributes for a Republican governor and the theme: 'Shared Risk', pay the highest level people huge salaries, dump the little people, etc.

Use Logic

Sat, May 7, 2011 : 3:11 a.m.

It's pretty obvious, from past interviews and quotes, that Mike Edwards isn't a Republican. Quite the opposite.

Kai Petainen

Thu, May 5, 2011 : 2:12 p.m.

great interview. the interview sounds like a down-to-earth honest discussion.

andi lobdell

Thu, May 5, 2011 : 2:08 p.m.

Rooting for Borders! Thanks to the hardworking people there fighting the good fight!

Brian M.

Thu, May 5, 2011 : 2:08 p.m.

I'm sure the publishers are making tons of money hand over fist and are just being jerks about this whole negotiations thing.... Not an interview to inspire confidence. At all.

javajolt1

Thu, May 5, 2011 : 1:51 p.m.

Not sure what the publishers incentive would be to agree to new terms. In an industry with razor-sharp margins, cut-throat competition and new technology, it seems all but the most desperate would have already written off Borders as a dinosaur that failed to innovate when they had the chance. That horse has long left the barn. The risk/reward of taking this type of a chance would only be palatable to those with the strongest stomach.

townie1

Thu, May 5, 2011 : 1:46 p.m.

He's right, there's some bitterness among former employees. But he's wrong that it's because the company laid them off. It's because it was so blatantly obviously avoidable!! Management made one bad decision after another, ignoring or ostracizing those in the organization who saw that it was losing its soul. And the problem wasn't opening too many stores; the problem was that the company lost focus on its core business: a great selection of books, and a delightful store experience. We all hope some version of Borders can survive. But the Borders we love has been gone for more than a decade. And that's what makes us less-than-enthusiastic, and less-than-happy about being blamed, even implicitly.

A2Realilty

Thu, May 5, 2011 : 1:37 p.m.

Good article and interview Nathan. I'm struck by how much Borders doesn't seem to want to take accountability for its past actions and future opportunity. If Border's opinion is that their ability to be viable rests upon publishers making significant concessions for them... well, I don't know why a publisher would extend such terms to an organization that is currently in bankruptcy. The problem with Borders, in my opinion, isn't that certain stores are unproductive; it's that the entire model is outdated. They misjudged disruptive technology in several instances (Amazon, eReaders, Napster, online music, internet streaming, Netflix, etc.) and now have a business model that probably won't be profitable.

mw

Thu, May 5, 2011 : 6:46 p.m.

"The problem with Borders, in my opinion, isn't that certain stores are unproductive; it's that the entire model is outdated." Well, yes. But short of having the incredible foresight to close *all* their stores and adopt Amazon's business model before Amazon did, I'm not sure there was a solution. They could have avoided foreign expansion and never farmed out their web site (in short, made the decisions Barnes & Noble did) and be in better shape now. But all that inventory and all those lease obligations would still be a millstone, which is why I think B&N is doomed too (just like Blockbuster). It certainly appears that book superstores are going away. In a few years, I expect we're going to end up with a few little indies selling mostly used books (just like records stores).

Linda Peck

Thu, May 5, 2011 : 1:23 p.m.

Give it up. If you can't pay the rent and you are not qualified to stay in business. You are right, little comfortable bookstores are the way of the now and always.

Huron74

Thu, May 5, 2011 : 12:50 p.m.

Sounds to me like he just wants to hang in there long enough to sell Borders to somebody else and/or collect those bonus dollars. Borders as an enterprise has failed and it's best to just let it go and let the people involved move on and allow the remaining resources to pay off creditors. No one is gonna gain anything from a "fight until the last dog dies" scheme except the bankruptcy lawyers.

Wolf's Bane

Thu, May 5, 2011 : 11:54 a.m.

Here is the quote from CEO Mike Edwards that sums up their ultimate demise: "...e-book effect is far more destructive than pricing." That fact that he considers eBooks destructive in the light of the great technological progress is tantamount to believing that television was only meant to be a fad back in the 50s or the automobile hybrid technology will never evolve.

mw

Thu, May 5, 2011 : 6:39 p.m.

Ya think? Really. You couldn't infer this from my post(s). Um, no, I couldn't. I don't think Edwards was putting his head in the sand or was claiming that ebooks are a fad or meant to die, he only meant that they're the most 'destructive' competitor they have (much more than discount book retailers like Walmart).

Wolf's Bane

Thu, May 5, 2011 : 5:14 p.m.

Ya think? Really. You couldn't infer this from my post(s).

mw

Thu, May 5, 2011 : 4:52 p.m.

I think he meant only that eBooks are destructive to Borders business model -- not to society. We've reached a point where print book sales are falling off a cliff: <a href="http://activitypress.com/2011/04/19/us-publisher-upheaval-ahead-as-print-book-sales-see-sharp-decline/" rel='nofollow'>http://activitypress.com/2011/04/19/us-publisher-upheaval-ahead-as-print-book-sales-see-sharp-decline/</a> Ebooks are great for readers, but they're huge trouble for book printers and brick-and-mortar book stores. And selling ereaders in the stores isn't really going to help. Once you have an eBook reader, you certainly aren't going back to the store to buy books to read on it.

Wolf's Bane

Thu, May 5, 2011 : 11:49 a.m.

CEO Mike Edwards doesn't look like the tenacious CEO that the article makes him out to be. He looks defeated and tired. Talking about missing the Internet and iPad ship. Geez.

Susan Montgomery

Thu, May 5, 2011 : 11 a.m.

Great interview, Nathan! Thanks for the in-depth questions.

Newbster

Thu, May 5, 2011 : 10:48 a.m.

The "book biz"is the only business I know that for the most part gives booksellers 40% off retail prices PLUS they are able to return unsold books to the publisher! I'm sure other business owners would like to be able to do that. The "decision makers" of Borders needs to take the hit for this trouble. Unfortunately most likely the people that made the worst decisions have most likely moved on to the next company to destroy/lives to ruin.

Use Logic

Sat, May 7, 2011 : 3:08 a.m.

"Keystone" margin for a retailer is 50%. Most big retailers get discounts well above 50%, especially on non-food items. So at 40%, Borders is buying the returnability of its merchandise with significantly lower margins.

John B.

Thu, May 5, 2011 : 10:56 p.m.

40-50% is true in many other retail businesses, as well. For many small businesses, it is still extremely difficult to net any profit, after expenses (and before income taxes), even at those gross margins. Restaurants have higher gross margins, but even a lot of them don't make it, long-term, as they have lots of costs that can be difficult to forecast and control. Borders had reached the point where just their rent obligations were almost 50% of gross sales, if I recall correctly! Very unsustainable, to say the least....

greenstriper

Thu, May 5, 2011 : 12:03 p.m.

40% is the typical wholesale markdown for retailers in the hobby supply business, too.

A2comments

Thu, May 5, 2011 : 10:36 a.m.

2% is normal for conversion. Amazon is not 8 times that or likely 8. Amazon is also more Walmart than a bookstore. I bought Burlap to wrap my bushes and OTC items. Has Borders reached out to the community? It's a two way street. With 300 employees, should A2 offer incentives to keep them? Not from my perspective. I don't believe that in 5 or 10 years we will have giant bookstores or video stores. Maybe small specialized bookstores. Why wasn't he asked if he or the rest of senior mgmt accept any blame?