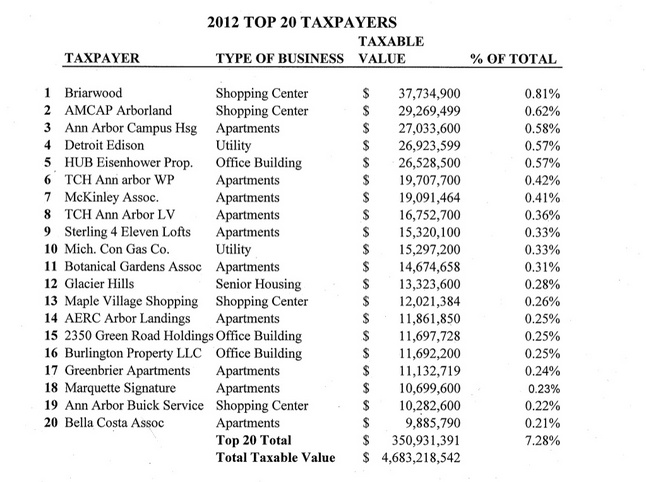

Top 20 Ann Arbor taxpayers in 2012

Two of Ann Arbor’s largest shopping centers and a student housing complex on the north side were the city’s top taxpayers in 2012, according to data released this month.

Last year, the city had a taxable value of $4.68 billion and collected $76.5 million in property taxes. That’s down from 2011 property tax revenue of $78.6 million and the $82.1 million collected in 2010.

Arborland Center on Washtenaw Avenue was one of Ann Arbor's top taxpayers in 2012.

The city’s list of top 20 taxpayers in 2012 consists mostly of large apartment complexes, shopping centers and office buildings. It comes as the city’s assessor’s office is working on 2013 assessments and preparing to mail property owners notices in early March.

The data shows that the top 20 taxpayers accounted for $350,931,391, or 7.28 percent, of the city’s roughly $4.68 billion in taxable value. In 2011, the top 20 accounted for $365,457,198, or 7.88 percent, of the city’s overall $4.63 billion in taxable value.

The top 5 taxpayers include: Briarwood Mall, Arborland Center, Ann Arbor Campus Housing - or the Courtyards, Detroit Edison and the Eisenhower Plaza office building - or the 777 Building.

Of those properties, all show value drops in 2012 ranging from 1 percent to 19 percent.

One of the largest drops in value on the 2012 Top 20 was at the Maple Village retail center, at 155 N. Maple Rd., which lost more than $4.3 million in taxable value. Real estate listings with Centro are marketing more than 40,000 square feet of available space in the center, meaning it’s more than 13 percent vacant. The center also lost $2.8 million in taxable value in 2011.

Ann Arbor Buick Service, or the Huron Village shopping center off Washtenaw Avenue, saw a .27 percent gain after losing $400,000 in taxable value in 2011.

Other notable changes from the top 20 taxpayers list shows housing, which accounts for half of the top 20, is gaining some value. The Windemere and Lake Village apartment complexes both jumped in value after the properties were sold in record-setting deals early last year. McKinley experienced a small jump following several acquisitions and Sterling 411 Lofts also gained value. Glacier Hills senior living community stayed the same with $13,323,600 in taxable value.

Office buildings in the top 20 taxpayers include: Eisenhower Plaza, 2350 Green Road Holdings - or the Northeast Corporate Center, and Burlington Property, which saw a small drop in value.

Falling off the list of top office building taxpayers was McMullen Properties and the former Borders headquarters on Phoenix Drive, which was left vacant following the bookstore’s bankruptcy. However, that building sold recently and interest among potential tenants could bring the value up for next year.

Check out the list of the largest taxpayers in 2012 below, and see the historical list dating back to 2001 on the city’s website.

The city's top taxpayers in 2012

City of Ann Arbor

Lizzy Alfs is a business reporter for AnnArbor.com. Reach her at 734-623-2584 or email her at lizzyalfs@annarbor.com. Follow her on Twitter at http://twitter.com/lizzyalfs.

Comments

15crown00

Tue, Feb 19, 2013 : 2:47 p.m.

And the largest landholder of all Uni M pays no taxes at all.all the while gobbling up parcel after parcel of taxable land.Doesn't seem quite fair does it/

Radlib2

Tue, Feb 19, 2013 : 6:10 p.m.

Yes it does.

codgerbill

Tue, Feb 19, 2013 : 12:40 p.m.

Actually the top taxpayer is not Briarwood Mall. It is DTE Energy. Mich Con and Detroit Edison are both part of DTE Energy

JRW

Tue, Feb 19, 2013 : 3:21 a.m.

I was curious about the Botanical Gardens Association listed as an apartment complex. The only Botanical Gardens I know of are part of UM (not taxed), and they are not apartments. Can anyone clarify?

notnecessary

Tue, Feb 19, 2013 : 12:03 a.m.

I'm always amazed at the comments on articles that discuss property taxes and how so many people go on and on about how the University doesn't pay property taxes. Why do you think that Ann Arbor has such a rich tax base? Why do you think there are all these apartment buildings, shopping complexes, etc to tax? Why do you live here and pay taxes? (hint: its probably something to do with the university in one way or another). Without the University, Ann Arbor would be another Jackson MI or Adrian MI without anything to tax. So yes, Ann Arbor would have more tax revenue if the University would pay taxes but it'd have WAY WAY less tax revenue without the University.

Doug

Thu, Feb 21, 2013 : 7:12 p.m.

How many people outside of our state would have heard of Ann Arbor if it wasn't for the U of M? Ann Arbor is the University of Michigan. Wouldn't it be nice to have a national poll that asks, "What do you think of when you hear of Ann Arbor, Michigan?"

Honest Abe

Mon, Feb 18, 2013 : 11:38 p.m.

This is too bad that the greedy, money grubbing UM is not on the list, since they are exempt. Although, that school realistically is the most valuable and the biggest 'account receivable'.

mr_annarbor

Mon, Feb 18, 2013 : 9:05 p.m.

Why is there nothing in this article about why the property values have dropped?

Basic Bob

Tue, Feb 19, 2013 : 3:22 a.m.

There was a real estate bubble followed by a recession. Businesses failed and their properties were foreclosed. As a consequence, market value went down for both those and similar properties - pretty much everyone. State law requires that assessed values also decrease to roughly 50% of market value.

mightywombat

Mon, Feb 18, 2013 : 8:39 p.m.

I expected to see First Martin on the list... They seem to own every other building in Ann Arbor.

moveover2012

Mon, Feb 18, 2013 : 5:33 p.m.

Maybe U of M should call themself A CITY/Villages and food there own bill /like road constrution .water sewer, busses ..with 85 000 student it is there own City within a City..time to pay UP..

notnecessary

Tue, Feb 19, 2013 : 12:06 a.m.

They have their own police force, their own buses (plus they pay a lot towards AATA), they do maintain their own roads, they have their own power plant....I'm not sure about water and sewer ... but they are pretty independent. Let's be real there is no Ann Arbor without the University so everyone should stop blasting U-M....

moveover2012

Mon, Feb 18, 2013 : 5:30 p.m.

Since U of M doesnot pay any property tax ..no more School funding .....taken from the K-12 schools.. set them FREE..

cibachrome

Mon, Feb 18, 2013 : 3:50 p.m.

Is there a way to determine how much revenue would be generated if church properties would be taxed? It would help to answer the question about how they impact the tax base.

a2grateful

Mon, Feb 18, 2013 : 3:48 p.m.

They can't fix the clock because they have no money after taxes. . .

FabioFulci

Mon, Feb 18, 2013 : 3:33 p.m.

Funny, you'd think that would mean the folks who run Arborland Center could actually afford to get the clock changed so it finally reads the correct time.

Kyle Mattson

Mon, Feb 18, 2013 : 3:42 p.m.

Considering DST is only a few weeks away I think we may have to live with the incorrect time for now Fabio...

Buckybeaver

Mon, Feb 18, 2013 : 2:59 p.m.

The additional problem with the UM, is that they are quite comfortable purchasing products and services from outside the city and in fact outside the state which further erodes taxable incomes here. MSC says they are committed to supporting the local community but that isn't what's been happening.

SonnyDog09

Mon, Feb 18, 2013 : 7:36 p.m.

What products are actually manufactured in Oz? How can you criticize the UM for not purchasing products that are not made here? We are pretty much a service economy in the Glorious People's Democratic Republic of Ann Arbor. Most of the services are outsourced, too. Gardeners and waitstaff can't afford to live here. So, even if the UM contracts with a company that is based in the city, most of the employees live outside. What services could be provided to UM by companies that are based in the Republic?

Ben Freed

Mon, Feb 18, 2013 : 2:55 p.m.

It will be interesting to see where Arbor Hills falls on this list once it's completed.

JimmyD

Mon, Feb 18, 2013 : 2:41 p.m.

It is strange to me why a city with a massive non-property tax segment would rely solely on property taxes. Wouldn't a revenue neutral combination of property tax reductions and a new income tax finally pull funding from the UofM and all the road-clogging township commuters? Wouldn't that reduce the total tax bill on Ann Arbor residents (voters)?

Clay Moore

Mon, Feb 18, 2013 : 2:40 p.m.

The invisible elephant in the Tax Payer's room is none other than: The University of Michigan! Universities have multi billion dollar endowments which go untaxed and often these universities do not pay property taxes. U.S. universities do not pay federal, state and municipal taxes. Why not? In theory, at least, universities are considered non-profit organizations by the IRS and their state-level tax codes, hence are tax exempt. As reported by David Jesse of the Detroit Free Press "More than $4B in unrestricted funds are being held by Michigan universities for projects, not tuition cuts". The money -- down from the $4.2 billion listed at the end the 2010-11 school year -- is noted in university financial statements as "unrestricted." That means there are no external conditions, either from donors or grant givers, on how it can be spent; it can be transferred from budget line to budget line by administrators or a board vote. The money is separate from endowments, which are made up mostly of gifts from people, businesses and foundations and mandated for specific expenditures, such as building a certain laboratory or paying for a faculty position. The buildup in unrestricted funds comes in an era of public universities raising tuition while complaining about state aid cuts. It fuels critics who say universities should use some of that money to hold down costs for students.

Sparty

Mon, Feb 18, 2013 : 6:57 p.m.

The new National UofM Scorecard shows that the State has low State financial support, high graduation rates, and medium/average tuition & fees. It seems your analysis is partially flawed.

JBK

Mon, Feb 18, 2013 : 5:51 p.m.

How about a Hotel/Restaurant tax? This way you would tax the people actually using a service. NY, LA, Boston, Detroit all do it. Just a thought!

belboz

Mon, Feb 18, 2013 : 2:39 p.m.

The city needs an income tax since U of M will never pay taxes and keeps absorbing property. Then, the city can help support AAPS infrastructure and maintenance to help with the crippling deficit. How about 0.5%. U of M would be a big contributor then. The biggest.

B2Pilot

Mon, Feb 18, 2013 : 7:39 p.m.

UofM does help AAPS with mentorship and student teachers at no charge. Not to mention access to research labs, hospitals, museums, sport facilities and equipment etc. Something other districts would love. Here is a concept; City council could try to attract business here isn't that what the DDA is supposed to be doing?? As pointed out UofM contributes way more in secondary income to the city than being a primary income source. 10 of 20 top employers in A2 are apartment complexs

SonnyDog09

Mon, Feb 18, 2013 : 4:35 p.m.

Every Michigan city that has an income tax has a higher rate for residents and a lower rate for non-residents. The idea that taxing non-residents of Oz will have us all rollin' in dough, is non-sense. The city would just find more inventive ways to waste any additional funding that an income tax raises. Don't believe any of the nonsense about making the income tax "revenue neutral." http://www.michigan.gov/taxes/0,4676,7-238-43715-153955--F,00.html

belboz

Mon, Feb 18, 2013 : 4:21 p.m.

Well, there is about $4 billion paid out in compensation and benefits at the U of M. If $3 billion of that happens in Ann Arbor, then %0.5 of that is $15 million, and I don't think it includes all of the Hospitals. McKinley might take some salaries out of the area, but they can't move the rental properties. That is an empty threat. And the U of M isn't moving.

notnecessary

Mon, Feb 18, 2013 : 3:28 p.m.

Great way to cause an exedous of people (individuals and businesses) to leave Ann arbor. I know as someone who works outside of the city but lives here id be on the run. I know previously when this has been brought up businesses like McKinley have threatened to move their HQ to township land.

JimmyD

Mon, Feb 18, 2013 : 3:14 p.m.

JBK, I'd read that as "half a percent".

JBK

Mon, Feb 18, 2013 : 2:48 p.m.

I hope you meant 0.05% and not .50%! :)

Tesla

Mon, Feb 18, 2013 : 2:20 p.m.

I had no idea that AA Campus Housing was such a big outfit.

notnecessary

Mon, Feb 18, 2013 : 2:13 p.m.

I'm curious how "McKinley" ranks below say The Courtyard apartments. I believe McKinley owns 6 complexes inside the city of Ann Arbor city limits now. Combined these properties would have a taxable base much higher than the other properties listed. My guess is that the value given to McKinley here is for one of their properties even though the article seems to suggest it is for their combined AA portfolio.

Brad

Mon, Feb 18, 2013 : 1:21 p.m.

So what is the approximate taxable value owned by Ann Arbor's #1 non-taxpayer, UofM?

Kellie Woodhouse

Mon, Feb 18, 2013 : 6:38 p.m.

@Eep-- indeed! I meant property taxes, but as you know the income tax debate has floated to the surface in recent days and was on my mind.

Dorchester

Mon, Feb 18, 2013 : 4:36 p.m.

In some cities, big non profits like Yale, MIT, UVA, Nortre Dame, and so on contribute voluntarily thru the Pilot program (Payments in lieu of taxes).

Eep

Mon, Feb 18, 2013 : 3:32 p.m.

@Kellie - You say that "if U-M were to suddenly pay taxes that would more than double the city's revenue from income taxes." I guess this is technically true, since the city currently doesn't collect income taxes, and multiplying zero times two would still be zero - but I don't think this is what you meant to say.

John

Mon, Feb 18, 2013 : 2:17 p.m.

Yes, but how much does having the University here help with the value of all the other taxable land? I don't disagree that the University should be paying something, especially when they acquire formerly-taxed land. However, the University does play a major role in attracting all the other businesses and home owners, which helps keep property values high, which keeps the taxable base in good shape.

notnecessary

Mon, Feb 18, 2013 : 2:14 p.m.

Without the university there would be no Ann arbor in any form like we know it

Kellie Woodhouse

Mon, Feb 18, 2013 : 2:11 p.m.

Yes, if U-M were to suddenly pay taxes that would more than double the city's revenue from income taxes, though it does appear that the number of student apartment housing on this list lends additional credence to Jim Kosteva's argument that the university's presence in A2 strengthens the city's tax base in other ways.

Brad

Mon, Feb 18, 2013 : 1:44 p.m.

Thanks. Per that article UM's land ($5.1B) is worth more than all the taxable land. That's pretty significant.

Paula Gardner

Mon, Feb 18, 2013 : 1:41 p.m.

Here's some info on what UM owns in Ann Arbor: http://www.annarbor.com/news/university-of-michigan-land-acquisition-means-less-money-for-the-city-of-ann-arbor/

Ricardo Queso

Mon, Feb 18, 2013 : 1:18 p.m.

Glaring is the loss of the Pfizer property tax base. AAPS if facing another round of painful budget cuts. Someway must be found to replace the lost Pfizer tax base.

Doug

Thu, Feb 21, 2013 : 7 p.m.

Kellie. Do you know what their taxable value was?

Kellie Woodhouse

Mon, Feb 18, 2013 : 2:05 p.m.

To put a figure to it-- Ann Arbor lost 4.8 percent of its tax base when Pfizer went of the city's rolls. In 2008, Pfizer paid $4.1M to the city.

jackson72

Mon, Feb 18, 2013 : 1:16 p.m.

Can we assume there's a "1" missing off the front of the Greenbriar Apartments taxable value (#17)?

Lizzy Alfs

Mon, Feb 18, 2013 : 1:27 p.m.

Yes! Thanks for pointing that out. There was an error in the city's chart. I have a new one and I will put it in the story.

G-Man

Mon, Feb 18, 2013 : 1:13 p.m.

Are all these properties pretty safe as far as fire protection is concerned? Who is checking on them?

notnecessary

Mon, Feb 18, 2013 : 3:31 p.m.

This comment is rather off topic. Fire protection/ prevention is important for properties big and small. This conversation is about tax revenues etc, not fire

RuralMom

Mon, Feb 18, 2013 : 3:19 p.m.

I can say at least one of them is, because my Hubby works for them! Ann Arbor does have rental property inspectors, they do perform inspections and enforce the rules and regulations.

a2roots

Mon, Feb 18, 2013 : 2:37 p.m.

The city has an ongoing inspection program which has been in place for years.

Kellie Woodhouse

Mon, Feb 18, 2013 : 12:59 p.m.

Very interesting. Of the top 20, 10 are apartment housing, with many of those targeted toward students.

Lizzy Alfs

Mon, Feb 18, 2013 : 12:59 p.m.

In case anyone is interested, here's a story I wrote a few weeks ago about residential property value trends: http://www.annarbor.com/business-review/washtenaw-county-residential-property-values-stabilizing-and-improving-in-2013/ And here's a story by Kellie Woodhouse on U-M expansion and what it means for the city's tax base: http://annarbor.com/news/university-of-michigan-land-acquisition-means-less-money-for-the-city-of-ann-arbor/