Can 'spring market' continue Ann Arbor's real estate price rebound?

The spring housing market: What will it mean in Washtenaw County?

That’s a driving question for home sellers, home buyers and the average resident, who saw - based on countywide averages - at least a 20 percent drop in home values since 2005, with some areas still reeling from a 65 percent (or higher) value drop.

File photo

Attempts to gauge the market are particularly active at the start of the annual “spring selling season,” roughly the next 30 days, when a wave of new listings is expected in the market

Data from the local market shows that 2011 represented a rebound in home values in five of eight school districts tracked through the Ann Arbor Area Board of Realtors.

Yet nationwide, prices have fallen 34 percent nationwide since the housing bust, back to 2002 levels, according a report released Tuesday by the Associated Press.

From that report:

A gauge of quarterly national prices, which covers 70 percent of U.S. homes, fell to its lowest point on records dating back to 1987 after being adjusted for inflation.

"The pick-up in the economy has simply not been strong enough to keep home prices stabilized," said David M. Blitzer, chairman of S&P's index committee. "If anything, it looks like we might have reentered a period of decline as we begin 2012."

Contrast that to Ann Arbor, where homes gained 3.57 percent in value last year based on sales prices per square foot. "Ann Arbor" is defined as homes in that public school district by the AAABOR.

Across Washtenaw County, the biggest gain during that time was in Chelsea, which posted a 6.87 percent gain, while the largest drop was in Willow Run, where prices dropped 7.66 percent in a single year - and 65.45 percent since 2005.

The value changes in other districts, with losses in parentheses, are:

- Saline 4.94 percent

- Milan 4.87 percent

- Dexter 4.12 percent

- Lincoln (2.95 percent)

- Ypsilanti (2.98 percent)

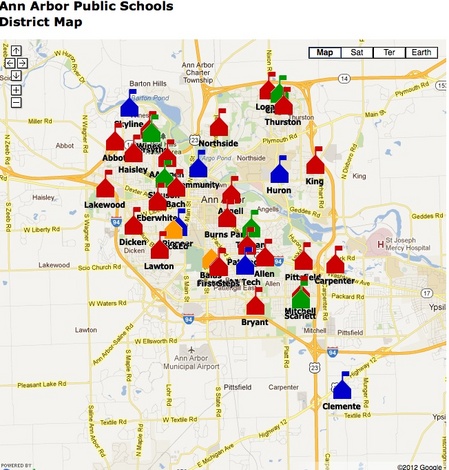

From AAPS

Three Ann Arbor elementary neighborhoods showed a drop in value from 2010 to 2011. In addition to Allen, they were Northside (-6.06 percent) and Lawton (-0.48 percent). (A link to the full list of schools and average sale prices is at the end of this column).

The top Ann Arbor elementary neighborhoods in terms of one-year value gains besides Bach, were King (7.16 percent) , Pittsfield (6.8 percent), Burns Park (6.69 percent) and Mitchell (6.01 percent).

Homes in the Ann Arbor district, on average, also fared the best in terms of value since 2005: Their average sales price per foot dropped 19.06 percent by the end of 2011. That average price is $141.12 per square foot - or about $282,000 for a 2,000-square-foot home.

The elementary school area that comes closest to that average Ann Arbor price is Dicken, where homes on average are selling for $144.46 per square foot.

Second to Ann Arbor in regaining value is Saline, where homes dropped 25.03 percent since 2005, with a rebound of 4.94 percent charted last year. The average price per square foot there is now $116.25.

At the low end of pricing is Willow Run at $39.18 per square foot on average at the end of 2011 - or about $80,000 for a 2,000-square-foot house - and Ypsilanti, where the $51.38 square-foot average at the end of 2011 puts that same 2,000-square-foot house at just more than $100,000.

While the average sales price data tells us about the last several years, a few indicators offer hints about what this year’s sales trends will look like.

In Ann Arbor, the taxable value of residential property is climbing 2.1 percent this year, according to Tom Crawford, the city’s finance director.

That percentage is an overall average - so some properties will drop in taxable value - but it’s also contributing to an overall property tax revenue gain of $600,000 more than budgeted. That follows years of decline, such as the 4.2 percent drop in 2010.

Foreclosures still affect the market, but few of them are available in Ann Arbor. Eight single family homes were listed last week on Homepath.com, the Fannie Mae website. That compares to 10 that were found there today. In Ypsilanti, there were 11.

However, another foreclosure indicator - the monthly sheriff’s deed sales totals of the homes heading into redemption periods after a foreclosure - shows 91 in January, compared to 88 a year earlier and 113 in 2010.

The number of sheriff’s deeds sold in Washtenaw County in 2011 were 1,128, the lowest since 2006. So this year’s number could at least signal that the 2012 foreclosures will at least remain stable when compared to 2011.

As for the spring market - the traditional season for residential listings and sales to start in earnest - area Realtors say signs point to continued price increases.

“Everything I have is selling,” said Martin Bouma of Keller Williams in Ann Arbor. “Inventory is very low, and there’s a lot of buyers.”

He’s seeing multiple offers above list price: “It’s creating an urgency in buyers,” he said.

The increase in prices isn’t across the market, he points out. In fact, a look at January sales data from across the county shows the first month of the year was flat in terms of residential sales and dollar volume, while listings were up from 418 homes to 433 homes.

In some markets, the price increases that started in 2011 could begin to help the people who want or need to sell but found themselves “under water” on mortgages.

“That’s still an issue out there,” Bouma said.

Alex Milshteyn of Edward Surovell Realtors agrees with Bouma that early market indicators bode well for continued price gains in 2012.

“I have not seen a market like this since probably 2004,” he said.

That year, the median sale price of homes sold through AABOR was $225,000, up from $220,000 in 2003, while the median condo sale price was $169,800, up from $169,000.

Seven years later, the median sale price through AAABOR was $159,000 - up from $155,000 at year-end 2010. For condos, the median sales price was $112,000 in December.

Another sign that the condo market is on a different track from houses: The condo market, based on average price per square foot, continued to decline last year. In 2011, the slide was 4.96 percent, totaling a loss of value of 24.49 percent since 2005.

Meanwhile, another residential real estate market dynamic that could finally play out this year is the number of unsold residential properties that were converted to rentals, Bouma said.

In the last two years, nearly 1,100 houses and condos were rented out - while 1,500 properties sold. For a seller-turned-reluctant-landlord, a rise in home prices may trigger a property being relisted - and, as Bouma points out, the numbers indicate a ¾-year’s worth of inventory that could come back onto the market.

The result of all of the moving pieces in the market, he adds, is that “it’s very difficult to price a house.”

Click real estate data 2011 by Elementary Schools-.xls to see a chart listing sales price per square foot trends for all of the Ann Arbor Public Schools elementary schools and district-wide data from other areas. It was compiled by Martin Bouma of Keller Williams Ann Arbor.

See more information on the AAPS attendance area.

Paula Gardner is News Director of AnnArbor.com. She can be contacted by email or followed on Twitter.

Comments

dotdash

Wed, Feb 29, 2012 : 3:23 p.m.

The banks are making lending very very difficult and I'm sure that that has kept a lid on home sales. I just refi'ed and the process was excruciating. The mortgage broker, processor and underwriter all apologized to me, saying that there were new rules in place that they could do nothing about. The banks have slammed the barn door shut after the horses have left, furthering the problems they contributed to by leaving those barn doors so wide open for so long.

dexterreader

Wed, Feb 29, 2012 : 2:41 p.m.

I live in Dexter Township and my assessment for 2012 went up over 11%. Someone in the township definitely thinks the recession is over and home values are rebounding. Of course, the taxable value did not rise that much but still.... I guess the combination of building a small pole barn in 2010 and the uptick in home "valuations" combined to give me a double whammy. But then, I guess the increase is a "good thing" overall.

chadfugate

Wed, Feb 29, 2012 : 10:26 a.m.

The market rates may have gone down, or remained the same. For the homeowner to get qualified for lower rates, there are certain prerequisites but I would recommend you search online for 123 Refinance before you decide because they can find the 3% refinance rates.

BobbyJohn

Tue, Feb 28, 2012 : 11:13 p.m.

Please, Paula and others, realize that the real estate market is still very much in the doldrums. The bleeding has been stanched, but we are a L-O-N-G way from 2005. Just saw a nice 1 bedroom condo on Packard near Stadium. Sold for $87K ~ 2004, now it just sold for $32K. And outside of the city limits is worse than in town. Most realtors in 2006 will saying about how good of an invesytment real estate is; and they are still saying it.

say it plain

Wed, Feb 29, 2012 : 2:17 a.m.

Nice to encourage us to look at the facts, but jeez, do you think then that your headline and selected quotes (most of them, anyway, you do include some hedging from Bouma) and general tone of the article might lead people to think that there must have been a clear 'rebound', wow, maybe even like that Misheltyn guy says (and I recall him being quite the 'optimist' back in 2004/2005 ;-) ), hasn't been this good since 2004 or so? "Urgency", "rebound", "continue".... paints a certain picture I think...

Paula Gardner

Tue, Feb 28, 2012 : 11:55 p.m.

Very true. I really do encourage readers to check out the chart (link is at the bottom of the story). The one year gains are encouraging in the areas that actually saw them - but they didn't occur everywhere, and we're still looking at double-digit declines from 2005.

smokeblwr

Tue, Feb 28, 2012 : 9:46 p.m.

Realt"or"s will always say the market is great and you should BUY! Never trust what they are saying as in truth, they just want a piece of your pie.

say it plain

Wed, Feb 29, 2012 : 2:11 a.m.

Caveat emptor big big time...I've had some amazing experiences being straight-out lied to by realtors, it's worse than car sales. "Overly optimistic" is overly generous imo. The last couple years have caused some in this profession to re-think their habits regarding, um, "interpreting data" and "advising clients", because maybe the bad karma of telling everyone buy buy buy don't worry about it you can always sell in a couple years at a profit finally got them thinking?! The real-estate press and their presentation of 'data' should also think hard about their role in the mess that the housing bubble has been...

BobbyJohn

Tue, Feb 28, 2012 : 10:52 p.m.

I appreciate the honesty from the realtor, My2bits. Unfortunately, many home buyer's don't realize that most realtors, even though they are nice people, are Salesmen(women) first and last. Caveat Emptor!

My2bits

Tue, Feb 28, 2012 : 10:23 p.m.

I am a Realtor. I always tell people that Realtor projections are overly optimistic. Part of it is that they want your business. Part of it is that as professional salespeople the successful ones do tend to have a naturally optimistic outlook. It is just a data point and has its bias. Always know where your information comes from.

Al Swa

Tue, Feb 28, 2012 : 9:39 p.m.

As a recent college grad who will hopefully be purchasing my first condo in the Ann Arbor within the next six months, I'd prefer the prices stay low until I've made my purchase. Then they can rise all they want. ;)

cinnabar7071

Tue, Feb 28, 2012 : 10:10 p.m.

As someone who owns a home the lower values are nice when the tax bill comes, but it would be nice if the price sky rockets just before I sell, if I ever sell.

michiganexpats.com

Tue, Feb 28, 2012 : 9:14 p.m.

Washtenaw County is the only county in Michigan that has grown in the last 10 years. To me, that means the real estate market is bound to keep growing as well. Good news!

a2phiggy

Tue, Feb 28, 2012 : 9:11 p.m.

While the average price per square foot is helpful, a range of price per square foot would be more meaningful. Neighborhoods in Ann Arbor are highly variable in home condition, level of renovation, lot size, curb appeal, outdoor amenities, etc., all of which will affect the price. Add in the uneven burden of foreclosures and short sales and the average price per square foot becomes less meaningful. Is that data available?

Ray

Tue, Feb 28, 2012 : 8:49 p.m.

The one very clear thing that this article shows is that Real Estate is a hyper local market and as a buyer or a seller you should have a trained professional help you navigate the market. Using national data to show how the Ann arbor Market is doing holds no logical weight. That would be exactly like me saying that two identical homes have the same value even though one is in Ann Arbor and one is in Detroit. Ann Arbor, Saline, and Dexter market are doing incredibly well and many of the other markets in Washtenaw are starting to show some turnaround. Some extra information that could help homeowners and buyers is: <a href="http://a2realestate.kwrealty.com/" rel='nofollow'>http://a2realestate.kwrealty.com/</a> <a href="http://blog.kw.com/2010/11/11/how-rising-interest-rates-will-impact-affordability/" rel='nofollow'>http://blog.kw.com/2010/11/11/how-rising-interest-rates-will-impact-affordability/</a> <a href="http://blog.kw.com/2012/02/12/powerful-perspective-on-today%E2%80%99s-biggest-opportunities/" rel='nofollow'>http://blog.kw.com/2012/02/12/powerful-perspective-on-today%E2%80%99s-biggest-opportunities/</a> <a href="http://www.realtor.com/blogs/2011/11/17/top-ten-turnaround-towns-midwestwest-edition/" rel='nofollow'>http://www.realtor.com/blogs/2011/11/17/top-ten-turnaround-towns-midwestwest-edition/</a> If anyone would like more information on their local market please contact me.

smokeblwr

Wed, Feb 29, 2012 : 3:26 a.m.

Word!

cinnabar7071

Tue, Feb 28, 2012 : 10:07 p.m.

I've bought and sold using a agent and not using a agent. I dont feel in the least the agent was worth the money, but that has a lot to do with the research I put in before hand. If your willing to do the research you can save thousands of dollars, but if you're not willing to do the research you could lose thousands. I did have a lawyer draw up the paper work when I didn't have a agent tho, and that cost was only a few hundren dollars.

smokeblwr

Tue, Feb 28, 2012 : 9:45 p.m.

Is this where we place classified ads for services?