Ann Arbor is a major stakeholder in Borders' future

BREAKING NEWS: Borders announces 164 layoffs Thursday morning; 124 corporate positions

Ann Arbor watched Borders Group Inc. grow into the second largest book retailer in the nation, remaining the home of its corporate headquarters even as the chain formed the core of a company that grew to hundreds of stores generating over $1 billion in sales.

Today, the community remains a stakeholder as the bookseller sorts out its future amid industry turmoil, leadership changes and falling investor confidence.

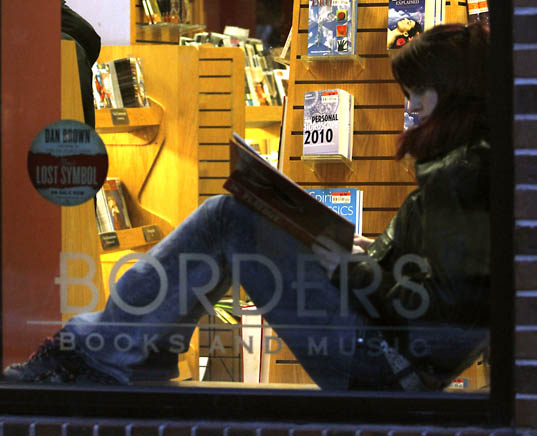

Allison Schim, 17, of Saline, reads a book in the window of Borders' downtown Ann Arbor store on Wednesday evening. She said the flagship store on East Liberty Street is her favorite bookstore.

Steve Pepple | AnnArbor.com

News this week that Borders will soon be under the leadership of its third CEO since January 2009 sent the company’s stock falling to less than $1 per share. Its overall value, based on the stock price, fell to $56 million by Wednesday afternoon.

That news follows reports of lower-than-expected holiday sales and store closings, and ongoing concern - even as Borders is positioned to sell on Apple’s new iPad tablet - about its electronic reader strategy.

Amid uncertainty about the company’s direction, the economic impact of Borders on Washtenaw County can be felt in tax revenue, employment and real estate:

|

Borders’ tax impact

|

• The company employs nearly 900 in Washtenaw County, with about 800 of those people at the headquarters at 100 Phoenix Dr. and the rest spread among the three retail locations.

• The combined tax revenue generated by both personal and real property taxes based on Borders’ presence in Washtenaw County is an estimated $1.6 million, according to data compiled by AnnArbor.com.

• The chain’s flagship location is downtown’s largest anchor retailer.

• The chain’s other two stores in the county - in Arborland Center on the east side of Ann Arbor and Waters Place, near Ann Arbor-Saline Road in Pittsfield Township - are in highly visible, high-rent retail centers, both of which have uncharacteristic large vacancies due to the bankruptcies of Circuit City and Linens ‘n Things, respectively.

• In Ann Arbor, the tax bill for 100 Phoenix Dr. - which is no longer owned by the company - made its owner the 12th largest taxpayer in the city in 2009, according to assessment records.

“Borders is a very important piece of the local employment base,” said Dave Lutton, CEO of the Charles Reinhart Co. “… What they’re facing is obviously a huge set of challenges given the changes in publishing and for book retailers.”

Beyond the numbers, the chain also counts in the region’s civic pride. That’s reflected in the region’s branding, which often mentions Ann Arbor as home to Borders, and also in the affinity for the store that started soon after the original Borders opened in the early 1970s.

“A lot of people have memories of Borders,” said Joan Lowenstein, an Ann Arbor attorney, member of the Downtown Development Authority and former City Council member.

Many of those memories stem from the years the store, founded by brother Tom and Louis Borders, operated on South State Street.

Lowenstein recalled how unique it was to find a quality book store in a town the size of Ann Arbor. The store was known for its selection, its knowledgeable staff and for being a great place to simply browse.

“Most small towns didn’t have really good book stores,” she said. “… The fact that it’s become global adds to that civic … ownership in Borders.”

The company moved into corporate control with its sale to Kmart Corp. in 1992, followed by the formation of Borders Group Inc. in 1994, along with Waldenbooks.

And growth continued even through recent years as the company expanded its superstore concept and opened international stores.

But the news since 2008 has illuminated both the changes in the book retailing industry and concerns about Borders’ ability to remain viable.

The most-cited examples include its inability to develop a successful online sales strategy and its behind-market pace to affiliate with an e-reader.

It’s also announced at least 1,400 job cuts in the past two years - over 500 at its corporate headquarters - and the shuttering of two-thirds of its Waldenbooks chain, including the Borders Express store at Briarwood Mall in Ann Arbor.

Meanwhile, sales continue to fall, including a reported 13.7 percent drop over the 11-week 2009 holiday period.

And the industry itself is undergoing transformation as online retailer Amazon.com gains market share and price wars among retailers like Walmart and Target put Borders at a disadvantage.

Even Forbes Magazine’s online edition included Borders in a recent report titled “Where you might not shop in 2010,” detailing some national chains with high-profile store closings.

And on Monday, Borders announced that CEO Ron Marshall - brought it as a turnaround expert in January 2009 - was leaving; reports said he would become CEO of Montvale, N.J.-based Great Atlantic & Pacific Tea Co.

Taking his place is Michael Edwards, executive vice president and chief merchandising officer.

In a glimmer of good news for the retailers, Borders did get relief on the e-reader front in the form of Apple’s announcements Wednesday about its iPad. Apple did not confirm rumors that it would strike an exclusive deal with bricks-and-mortar rival Barnes & Noble to sell B&N digital books through the iPad.

For its part, Borders plans to sell digital books through a new application under development by Toronto-based Kobo Inc., a division of Indigo Books & Music. Those apps can be used with the iPad.

Borders officials say they continue to strategize to drive more traffic into stores, like by boosting its customer loyalty program, and to shed debt. Both are key to any corporate rebound, local business leaders said.

“There’s no question they’ll need to reinvent themselves,” said Ed Shaffran, a downtown Ann Arbor developer and landlord.

But while the chain redefines itself, many hope that its retail position as a downtown anchor doesn’t change. It still attracts customers as part of a retail mix that increasingly is dominated by bars and restaurants.

“The downtown has always had some sort of anchor,” said Shaffran. “… Borders, as it stands today, is a big-time anchor.”

Tom Crawford, Ann Arbor’s finance director, said Borders-related tax payments generate at least $350,000 for the city.

”Borders is clearly one of our major (companies),” Crawford said. “They’re valued members of our community.”

Crawford noted that the city’s seen the corporate downsizing over time.

“They’ve been reducing employees for a number of years,” he said. The loss of jobs is enough to prompt the company to sublease about 37,000 square feet it the 317,000 square foot headquarters on Phoenix drive, according to real estate listings.

One area where many in the community focus on when asked about the store and its impact on Ann Arbor is the remaining employees - and how the uncertainty is affecting them.

“It’s hard to see the company struggling, but they have talented people here,” Crawford said.

A lot of people in this community have their fingers crossed that Borders will survive its latest repositioning.

“If they were not to exist, there would be a big hole to fill,” Shaffran said.

The hole, he said, would be literal in the real estate sense.

But it’s also about considering the impact of the uncertainty and ultimate turnaround performance on hundreds of Ann Arbor employees and the 25,000 in the chain’s other locations.

“One of the things getting tangled up in all of this,” Shaffran said, “is the faces. The employees.”

Paula Gardner is Business Director of AnnArbor.com. Follow her on Twitter. Sign up here to receive AnnArbor.com's weekly Business Review newsletter.

Comments

notanative

Mon, Mar 22, 2010 : 1:13 p.m.

I think this story makes important points about the civic costs of losing businesses like Borders, beyond the job losses themselves, that are often invisible to the general public. Wystan Stevens, thanks for that detailed historical information. The link to the photo is a nice example of a traditional institution (the public library) embracing new media and making archived materials available online. Now, RonAnnArbor, I think your Christmas shopping examples are dead-on here, but your post (and this discussion overall) fails to point out the overarching fact driving all this: The Internet, combined with highly efficient delivery companies like UPS and FedEx, have fundamentally changed commerce. Natural selection plays out in all areas of life, not just in the biosphere, and brick-and-mortar merchandise models simply can't compete in a world where people have figured out they don't need to see and touch a product before buying it. Lets face it-- most things we buy are commodities once a handful of pertinent details are specified. Let's see... rent for 500+ local stores in prime locations costs much more than a giant warehouse in the middle of suburban Illinois... and... paying a handful of employees at each location to show you what to buy and ring it up costs much more than running a dozen servers in that warehouse with slick search and retail software to do all that electronically. Then, let's see... trucking products to all those stores, sorting, shelving, and then un-shelving and re-boxing product that doesn't sell in order to truck it away costs more than having one big set of shelves and putting exactly what I want on a truck that is driving by my house every day anyway. And the list goes on and on. Accurate storage and transmission of complex, precise, and nuanced information is expensive on many levels, and the Internet, after years of investment in its infrastructure, can do these things in spades. We are reaping big dividends in a storm of creative destruction, the depth of which we apparently did not foresee. So, we have examined *why* the price difference exists in the example you provided on Amazon vs. Borders (I'm personally not familiar with the differences in B&N's model you refer to-- maybe you could post more detail on that-- but they are clearly feeling the same pressures as Borders). Now, let's pay attention to a decision implicit in your purchasing from Amazon: You were not willing to pay $48 more for those books in order to pitch in to keep a Borders presence in Ann Arbor. In this $48 are the property taxes, wages, donations to community foundations, and yes, executive bonuses and yacht payments, which the presence of Borders provides in Washtenaw County. Of course, you aren't alone-- I've made this same decision many times myself-- but I think it's important to acknowledge that the decision to *always* choose the lowest-priced merchandise in the marketplace is actually a voluntary one. What we're being forced to realize is that local stores aren't really just selling merchandise; in fact, much of what we're providing with our payment at the cash register is a stream of economic nourishment that is spilled out into many different areas of our communities. When we shop online, the savings consists mostly of that nourishment that would have gone to folks and institutions (including governments) along the local supply chain. Instead we get to keep that cash our pockets. Since we don't really know most of those people, or comprehend their jobs, there is no movement of the ethical compass, and saving that money makes rational sense to us. Given that rational selfishness is a fundamental driving force of life (no connotations of evil here-- just that we all operate on a daily basis under the essentially subconscious assumption that we should conserve resources for us and ours, rather than cede them to people or institutions we dont know personally), transactions that can trim out financial inefficiency will beat out competition as long as we are unable to assign meaningful value to it. Amazon is capitalizing on this. Thus we will continue to see transition of retail spaces away from companies providing static, commodity merchandise (books, CDs, electronics, housewares, even food and clothing) and toward service and experience providers (bars, clubs, restaurants, day spas). Maybe Borders (or any other local retailer) could undertake an experiment for a month to make the public think about all this: Lower all your merchandise prices to match Amazon to the penny (don't forget sales tax), but then charge an admission fee at the door of $5 or $10 (or whatever it needs to be). Call it a cover charge, storefront cost-sharing fee, whatever-- make it clear this fee goes to pay rent, utilities, property taxes, and employee wages. Would this be sustainable? Maybe not, but it is bound to be educational.

Wystan Stevens

Fri, Jan 29, 2010 : 8:05 p.m.

"Gloriagirl" mistakenly says that the downtown Borders store used to be in the Crown House of Gifts building on State Street. Not so: the Crown House of Gifts was in that building, and Cosi is in there now. The Borders brothers -- Tom and Lou, originally from Louisville, Kentucky -- were next door at 303 S. State, in the former Wagner & Son men's clothing store, which is now the M-Den sports shirt outlet, and used to be Steve & Barry's. (For a few years, Borders and Crown House shared an escalator between them.) Incidentally, the brothers began business as purveyors of used books, in two upstairs rooms at 209 S. State. (Herb David's guitar studio was there too, across the hall.) Then they moved briefly to a William Street storefront, in the Maynard House apartment building -- lurching back to State Street to occupy the suddnly-available premises of the legendary Wahr's Book Store (where the Red Hawk grill now does a sizzling business). There they made the switch to new books, which continued to be their merchandise of choice a few years later, after the big leap across State Street to the newly-vacated Wagner store. Here's the original Borders shop sign, upstairs at 209 S. State (the Frieze Building visible in the background): http://www.aadl.org/gallery/pictureAnnArbor/a2signs/A2signs386.jpg.html

Somewhat Concerned

Thu, Jan 28, 2010 : 4:40 p.m.

The Borders website is way behind the sites at Barnes & Noble and Amazon. They won't match Amazon's prices because, as I was told at a Borders store here in Ann Arbor: "We can't compete with Amazon." No explanation of why they won't match B & N's prices. The selection of books, even at the flagship store, has gotten thinner and thinner, with more empty space and more space devoted to calendars, stuffed animals, cutesy notebooks and gadgets. The staff in the Ann Arbor stores tend to be pleasant and helpful, but not so elsewhere. It's an Ann Arbor company, but it's just not a company that knows how to compete. Pfizer was consolidating and had insufficient reason to stay in a state that is anti-business and anti-pharma. Domino's hopefully will continue to compete in its tough sector. For everyone who hates the U, just keep your fingers crossed that it can continue to compete despite budget cuts from Lansing. Borders' demise will hurt Ann Arbor, but nobody can blame it on anything other than the decisions Borders has made and is making.

Val Losse

Thu, Jan 28, 2010 : 3:53 p.m.

How can a land based company compete with computer based companies i.e. Ebay? Ebay has a very low overhead (guess on my part). I bet Ebay pays very little in property taxes while Borders must pay millions in propety taxes every year even when they are having several years of low income or negative income. People are loosing their jobs so they cannot pay their property taxes and so on. Does Ann Arbor take seriously their stake in the company? Then cut or eliminate their property tax and base their tax on income. It is probably too late especially with a city administration unwilling to face facts, if Borders goes under so will the property tax and so will hundreds of jobs and they will probably also stop paying property taxes. It is a cascade affect once started hard to stop. The affect of foreclosures lower property values thus less propety tax to collect. And so it goes. Income tax is the answer because it is based on ability to pay. Income tax is spread through the working population while property tax is on home owners abiltiy to pay and it is a tax that does not go away if one looses their job.

John Galt

Thu, Jan 28, 2010 : 2:44 p.m.

First Pfizer. Now Borders. And Dominoes is having troubles, too. There are not many private companies left around here. Soon, we will be entirely dependant upon the Government (and government supported universities) for jobs. Only problem is, the taxes to pay for all those government jobs will simply crush the little that remains.

Boy Scout

Thu, Jan 28, 2010 : 1:56 p.m.

Thank you for the statistics on Borders property taxes and employment. One other measure of impact on the community not cited, however, was the generous financial contributions made by their foundation to many area non-profits, particularly in areas of education, literacy, and the arts. Though not as large as Pfizer's, these contributions made significant impacts in our community, and have sadly and necessarily come to a complete stop in the last two years.

Unemployed Electrician

Thu, Jan 28, 2010 : 11:17 a.m.

What does Borders expect when they want us to shop locally in their stores but think it's ok to hire construction trades on their new or remodeled stores from outside their community and deny jobs to their local customers they expect to support them.

UofM_Fan

Thu, Jan 28, 2010 : 10:48 a.m.

Borders is done. It's just a matter of time now. For years they've been late to the game and always playing catchup to Amazon and B&N. At $0.96 a share (and most likely lower today), it's a waiting game for B&N. Do they drop $54 million and just buy Borders, wait for the price to fall a bit lower, or just sit back and watch Borders fold on its own?

Andy Piper

Thu, Jan 28, 2010 : 9:51 a.m.

Borders needs a REAL turn around expert, like Mulally at Ford. Borders has a great franchise and can make it with the right people running the business. Come on!

clownfish

Thu, Jan 28, 2010 : 9:41 a.m.

How many employees could have kept their jobs if $4.3 million was not paid out to one guy leaving? Or, why not use that 4.3 to pay down corporate debt instead of a new boat for the Jersey Shore?

Gloriagirl

Thu, Jan 28, 2010 : 8:29 a.m.

In my travels it has always been a warm reminder of home when I come across a Borders especially in a big town like San Francisco. I share those fond memories when Borders was originally next to the State theater in the old Crown House of Gifts. Surprising, when I go to Canada and visit the Indigo Book stores, they are an assimilation of Borders.

UofM_Fan

Thu, Jan 28, 2010 : 7:32 a.m.

I hate to say it, but Borders is doomed. As a former employee I have mixed emotions about it. On the one hand this has been a long time coming, caused by greed and mistakes made for years in the company. Borders derailed a number of years ago, none of these problems have just now popped up out of nowhere. On the other hand, the article talks about the 800 people working at the headquarters on 100 Phoenix Dr. When I left the company, there were more than 2000 employees in that building. Many of my friends from there have lost their jobs. Part of me thinks Borders should just fold and stop dragging out the inevitable. The other part worries about all the people that would lose their jobs. I only hope that those whose greed over the years have brought Borders to this can sleep well at night in their luxury condos and lavish homes.